TSX up on energy stocks

The energy and industrials sectors helped Canada’s main stock index edge higher in late-morning trading.

The energy and industrials sectors helped Canada’s main stock index edge higher in late-morning trading.

The $1,100 price tag on Apple’s latest iPhone turned heads when the company announced it last week. But for less than half as much, you can still get a good camera, a decent-sized screen and other popular features.

Opinion: Some factors could be pointing to either a downturn or a brief blip

Micron Technology Inc. has skyrocketed in the past two years as price hikes in memory chips have helped its business soar to new heights, but its latest forecast created fears that the party is coming to an end.

A credit freeze is free at all three major bureaus starting Sept. 21

If you haven’t frozen your credit reports yet, this could be your moment.

Under the Economic Growth, Regulatory Relief, and Consumer Protection Act, freezing your credit at all three major credit bureaus — Equifax EFX, -0.59% Experian EXPN, +0.75% and TransUnion TRU, +1.82% — will be free from Sept. 21. Previously, states set prices for credit freezes, which typically cost about $10.

China already shows ‘signs of reducing their level of [oil] imports’: analyst

There are still several weeks before U.S. sanctions on Iranian oil actually kick in, but expectations of tight crude inventories already have contributed to much of this year’s gain in global prices. The rise has come despite concerns over potentially lower energy demand and plans by two of the world’s biggest producers to boost output.

Market at Close A largely volatile day has come to a close and indices have ended on a negative note. But they are off the day’s low points. The Nifty has managed to give up 11,200 in today’s trade. The Sensex has closed over 200 points lower.

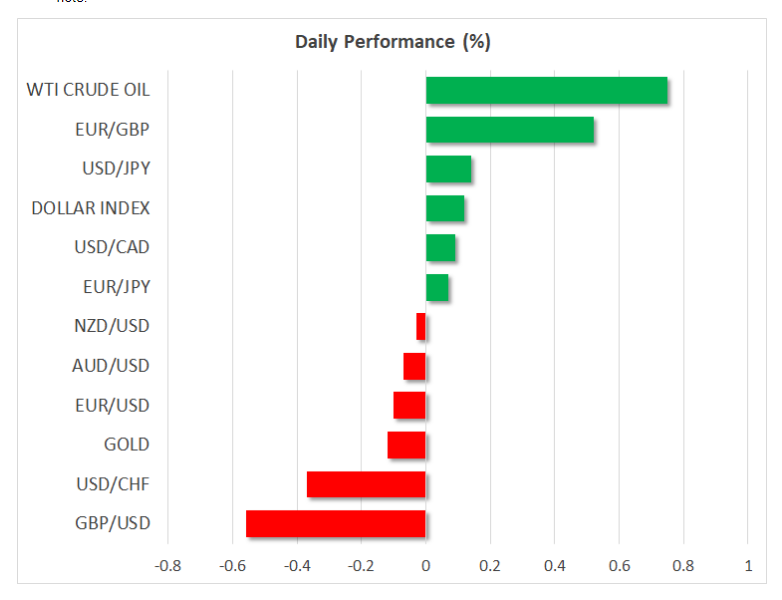

Here are the latest developments in global markets:

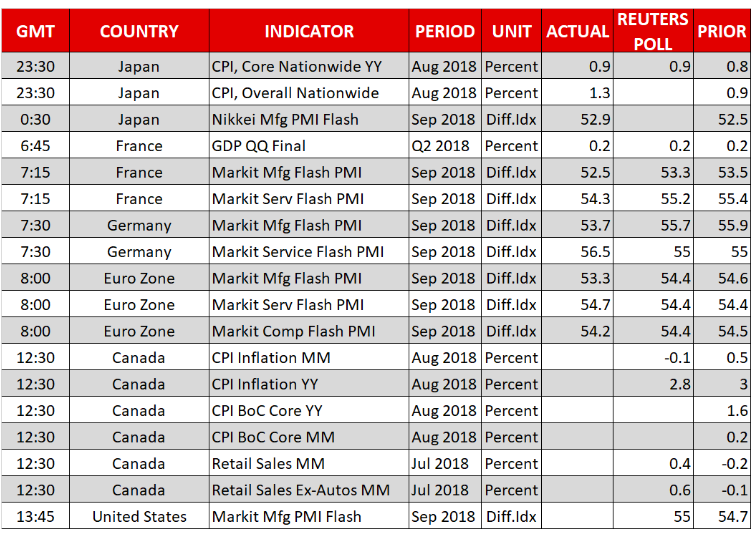

Day ahead: Canadian data due, with trade developments also in focus

Inflation and retail sales figures out of Canada at 1230 GMT will be the highlight in terms of data releases in the remainder of Friday’s session. Meanwhile, any potential updates regarding the US-China trade skirmish, the NAFTA negotiations, and the Brexit talks are also likely to attract attention.

In Canada, CPI inflation is forecast to have cooled to 2.8% in annual terms during August, from 3.0% in the previous month. The core figure – which excludes volatile items such as energy – will also be in focus, though no forecast is available. As for retail sales, projections point to a 0.4% growth in July on a monthly basis, a rebound following a 0.2% decline previously. The core print, which strips out automobile sales, is also expected to bounce to 0.6%, after falling by 0.1% in June.

Overall, these seem like very decent prints that – if confirmed – could stoke even further market expectations for a BoC rate increase in October. Although inflation is expected to slow, it’s still anticipated to remain far above the midpoint of the BoC’s target of 2% +/- 1%, hence allowing the Bank to proceed with normalizing policy uninterrupted. The market-implied probability for an October hike currently rests at 86% (Canada’s OIS), and in case of strong data prints that push it even higher, the loonie could extend its latest gains.

Besides data, any updates in the US-China trade spat could also prove crucial for market sentiment. Investors breathed a sigh of relief recently that the latest tariffs were not as aggressive as feared, leading to a widespread market rally. That said, it bears mention that neither side has actually shown concrete signs of backing off, suggesting that the recent melt-up in stocks may be more fragile than it seems, with a single alarming headline possible to “ruin the party” at any moment. In other words, have investors run ahead of themselves in discounting a less-aggressive scenario for trade?

Also stock-related, today is “quadruple witching” day in the US, a quarterly event when futures and options on indices and individual stocks expire. Trading volumes are generally higher than usual in such sessions, as investors rush to close, roll over, or rebalance some of their existing positions. This implies that market moves may be abrupt and perhaps larger in magnitude than average, without much in the way of fundamentals behind them.

In energy markets, the weekly Baker Hughes report on active oil rigs in the US is due out at 1700 GMT. Beyond that, a weekend meeting between OPEC and other allies taking place in Algeria may be of interest.

As for the speakers, UK PM Theresa May is anticipated to deliver remarks at 1245 GMT. Her tone regarding the Chequers plan, which was recently rejected by the EU, may be crucial for sterling’s forthcoming direction. If she sticks to her proposals, or appears generally unwilling to surrender some ground, that may spell trouble for the pound as speculation for a continued deadlock in the talks regains steam.

Markets have had a busy end to the week and that looks set to continue into Friday. US equities were one of the big stories of the yesterday as they all pushed their way back to record highs.

Analysts at ANZ Bank New Zealand explained that US equities continued to climb higher after a strong showing by European bourses.

Key Quotes:

“US treasury yields were little changed and the USD fell. The S&P 500 hit an all-time high of 2932, with solid gains in materials, consumer staples and technology. The DJIA and NASDAQ were up almost 1%. European shares were led higher by CAC 40’s 1.1% climb while other major indices were up 0.5-1.0%. USD was sold across the G10 and emerging markets on news China is planning to cut tariff rates on some imports (further details below). NZD and SEK led gains in the G10. The US treasury curve flattened a touch with 2-year up 1.3bps and 10-year up 0.6bp. Oil was biased lower, gold slightly higher.

Country rebuts charity’s accusations by inviting officials to see carcasses for themselves

Botswana has rebutted claims of a surge of elephant poaching by putting carcasses of animals that were allegedly slaughtered for ivory on display – some with tusks still intact.