Weekly Market Review – April 27, 2024

Stock Markets

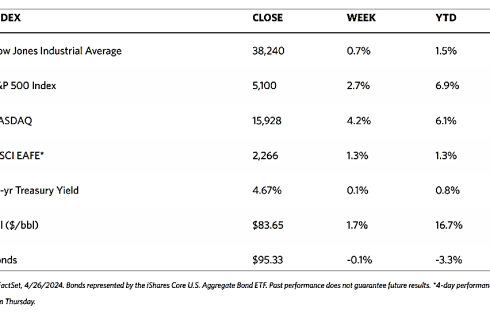

All major indexes are up this week. The Dow Jones Industrial Index (DJIA) inched up by 0.67% while the Dow Jones Total Stock Market Index climbed by 2.70% over last week, The S&P 500 Index also gained by 2.67% which mirrored the Total Stock Market Index; likewise, the S&P’ Small Cap 600, Mid Cap 400, and Super Composite 1500 components all recorded gains above 2%, indicating that the rally was across the board. The technology-heavy Nasdaq Stock Market Composite Index outperformed the broad indexes by registering a leap of 4.23%. The NYSE Composite rose by 1.74%, and the Russell 1000, 2000, and 3,000 Indexes all exceeded 2.60% gains. Risk perception among investors abated as indicated by the CBOE Volatility Index (VIX) which descended by 19.67%.

Most major equities benchmarks, including the S&P 500 Index, broke through a string of three consecutive weekly losses as investors became energized by the first-quarter earnings reporting season’s busiest week. Analysts were expecting overall earnings for the S&P 500 to have shot up by 3.7% in the first quarter year-on-year. According to FactSet, analysts anticipated as of the end of the week that “both the percentage of S&P 500 companies reporting positive earnings surprises and the magnitude of earnings surprises” would be “above their 10-year averages.” Nasdaq’s overperformance this week can be partly attributed to strength in Apple and a late rebound in chipmaker NVIDIA. Late in the week, Google parent Alphabet surged in reaction to the announcement that its first-quarter earnings were better than expected and the company’s first dividend payment. On the other hand, Facebook parent Meta Platforms plunged (at one point wiping out nearly USD 200 billion in market value) after its CEO Mark Zuckerberg announced plans to continue spending heavily on artificial intelligence and similar technologies.

U.S. Economy

The week began with strong buying interest pushed by some downside surprises in economic data. On Tuesday, some poorer-than-expected economic reports were received as good news because they could mean reduced pressure on inflation and interest rates. U.S. manufacturing activity fell back into contraction territory in April, reported at 49.9 by S&P Global’s gauge, which is well below the expected 52.0. S&P Global’s gauge of services sector activity came in at 50.9, lower than the expected 52.0, although it remains expansionary.

On Thursday, more negative economic news was released which, this time around, elicited pessimistic reactions among investors. According to the Commerce Department, their advanced estimate of economic performance showed that GDP was expanding at an annualized rate of 1.6% which is well below the consensus estimate of 2.5%. It is also the slowest economic growth rate in almost two years. The causes were traced to a sharp slowdown in government spending, a widening trade deficit, and consumers reining in spending particularly on goods. Other data released on Wednesday indicated that businesses continued to increase capital spending in March albeit at a slower pace (0.3%) than in February (revised lower to 0.4%).

Thursday’s inflation data also triggered concerns of “stagflation” (rising prices simultaneous with flagging growth) taking place in the U.S. The Commerce Department reported that core personal consumption expenditure (core PCE which is less food and energy expenses) index rose at an annualized 3.7% during the first quarter. This is more than expected and well above both the 1.7% increase in the fourth quarter and the 2% long-term inflation target of the Federal Reserve.

Metals and Mining

After chalking up months of impressive gains, it is somewhat expected for precious metals prices to give in to selling pressure and consolidate its gains, falling by more than 4% in the first two trading days of the week and giving up $100. While some are alarmed that gold saw its worst decline in nearly two years on Monday, a general assessment will point to the fact that despite falling by more than 4%, gold prices are still up by more than 17% from their highs in mid-February. The price action may look somewhat extreme, but it is still a healthy correction in a bullish uptrend. It is sensible for some profit-taking to take place as investors await the Federal Reserve’s guidance on monetary policy in the coming week, although it is safe to assume that the Fed will remain on hold through the summer and avoid adopting sudden changes until after the 2024 U.S. general elections in November.

This week, the spot prices of precious metals were generally down. Gold fell by 2.26% from last week’s close of $2,391.93 to end this week at $2,337.96 per troy ounce. Silver declined by 5.36% from its closing price of $28.69 last week to settle at $27.21 per troy ounce. Platinum, which ended last week at $935.54, closed this week at $917.04 per troy ounce for a loss of 1.98%. Palladium descended by 7.10% from last week’s ending price of $1,031.38 to this week’s close at $958.15 per troy ounce. The three-month LME prices of industrial metals ended mixed. Copper closed at $9,965.50 per metric ton, 0.91% above its last weekly close of $9,876.00. Aluminum closed this week at $2,569.50 per metric ton, lower by 3.73% from its last weekly close of $2,669.00. Zinc ended this week at $2,844.00 per metric ton, down by 0.28% from last week’s closing price of $2,852.00. Tin, which closed last week at $35,582.00, ended this week at $32,411.00 per metric ton, for a loss of 8.91%.

Energy and Oil

Oil prices have thus far failed to gain sufficient momentum to break out above the psychological resistance level of $90 per barrel, even if it is headed towards the first weekly gain since early April. Several factors have added some upside in the trading range, such as a higher-than-expected draw in U.S. crude inventories, a notable slowdown in U.S. manufacturing that triggered hopes of a June interest rate cut, and continuing tensions in the Middle East. Brent may be expected to continue trading around the $89 per barrel mark. In the meantime, Iraq promised to commit to OPEC+ limits following months of overproduction when the country overshot its quota by 200,000 barrels per day (b/d) during the first quarter. Regardless of the OPEC+ meeting outcome in early June, Iraq now pledges to cap its oil exports at 3.3 million b/d until the end of the year,

Natural Gas

For the report week from Wednesday, April 17 to Wednesday, April 24, 2024, the Henry Hub spot price rose by $0.09 from $1.50 per million British thermal units (MMBtu) to $1.59/MMBtu. Regarding Henry Hub futures, the price of the May 2024 NYMEX contract decreased by $0.059, from $1,712/MMBtu at the start of the report week to $1.653/MMBtu by the week’s end. The price of the 12-month strip averaging May 2024 through April 2025 futures contracts rose by $0.033 to $2.802/MMBtu.

International natural gas futures price changes were mixed this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia ascended by $0.32 to a weekly average of $10.51/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, declined by $0.35 to a weekly average of $9.38/MMBtu. For comparison, on the week last year corresponding to this week (beginning April 19 and ending April 26, 2023) the prices were $11.90/MMBtu in East Asia and $12.84 at the TTF.

World Markets

In tandem with U.S. equities markets, the pan-European STOXX Europe 600 Index broke a three-week losing streak and gained 1.74% for the week, as sentiment was boosted by an easing of Middle East tensions and some encouraging corporate earnings results. Most major stock indexes likewise advanced. France’s CAC 40 Index climbed by 0.82%, Italy’s FTSE MIB added 0.97%, and Germany’s DAX surged by 2.39%. Climbing to fresh all-time highs was the UK’s FTSE 100 Index, ascending by 3.09%. European government bond yields shot up to their highest levels this year. Stronger than expected U.S. economic data suggested that inflation may prove sticky, raising expectations that the Federal Reserve would maintain interest rates higher for longer and force other major central banks to follow suit. The yield on the benchmark 10-year German government bond spiked briefly above the 2.6% level. Due to hawkish comments from some policymakers, it has become doubtful that the expected lowering of interest rates in June will materialize.

Japan’s stock markets gained over the week. The Nikkei 225 Index as well as the broader TOPIX Index both gained by 2.3%. The Bank of Japan, (BoJ) at its April meeting kept its monetary policy unchanged, a dovish signal to most investors. However, the BoJ governor, Kazuo Ueda, suggested that in the second semester of this year, confidence to raise interest rates further is set to increase. In the fixed-income markets, the yield on the 10-year Japanese government bond rose to 0.91% from 0.84% in the previous week. The yen continues to weaken, and authorities have refrained from intervening despite intense speculation favoring such intervention. The yen weakened to about JPY 156.8 versus the U.S. dollar, from approximately 154.6 at the end of the previous week. On the other hand, the Tokyo-area core consumer price index (CPI) rose 1.6% year-on-year in April, down from 2.4% in March and lower than consensus expectations, suggesting that inflationary pressures are easing. Business confidence remains positive as the pace of hiring rose across the private sector, and expansion in activity may likely be sustained at least in the short term.

In China, as investors grew more optimistic about the economy, equities rose over the week. The Shanghai Composite Index moved up by 0.76% and the blue-chip CSI 300 gained by 1.2%. Hong Kong’s benchmark Hang Seng Index shot up by 8.8%. According to 15 economists polled by Bloomberg, China’s economy is poised to grow by 4.8% this year, higher than a median forecast of 4.6% last month. The country’s gross domestic product (GDP) grew by 5.3% in the first quarter year-over-year, which is above the consensus estimates and slightly faster than the 5.2% year-over-year expansion in the final quarter of 2023. Economists downgraded their inflation forecasts, however, as the economy continues to be dragged down by declining producer prices and a persistent property market slump.

The Week Ahead

The FOMC meeting, the nonfarm payrolls report, and consumer confidence data are among the important economic releases scheduled for the coming week.

Key Topics to Watch

- Employment cost index for the First Quarter

- S&P Case-Shiller home price index (20 cities) for February

- Chicago Business Barometer (PMI) for April

- Consumer confidence for April

- ADP employment for April

- Construction spending for March

- ISM manufacturing for April

- Job openings for March

- FOMC interest-rate decision

- Fed Chair Powell press conference

- Auto sales for April

- Initial jobless claims for April 27

- U.S. trade deficit for March

- U.S. productivity for the First Quarter

- U.S. unit-labor costs for the First Quarter

- Factory order for March

- U.S. employment report for April

- U.S. unemployment rate for April

- U.S. hourly wages for April

- Hourly wages year-over-year

- ISM services for April

- Chicago Fed President Austan Goolsbee speech

- New York Fed President John Williams speech

Markets Index Wrap-Up