Data from Vanda Research shows demand from retail buyers slumped by more than expected

Retail investors went on a tax-season buyers strike that helped exacerbate the stock-market selloff in early April, according to data from Vanda Research.

The magnitude of the drop in demand came as a surprise to the team at Vanda, who had expected only some mild weakness. They described it as one of the two main catalysts behind this month’s equity-market weakness, with the other being selling by systematic funds like commodity-trading advisers.

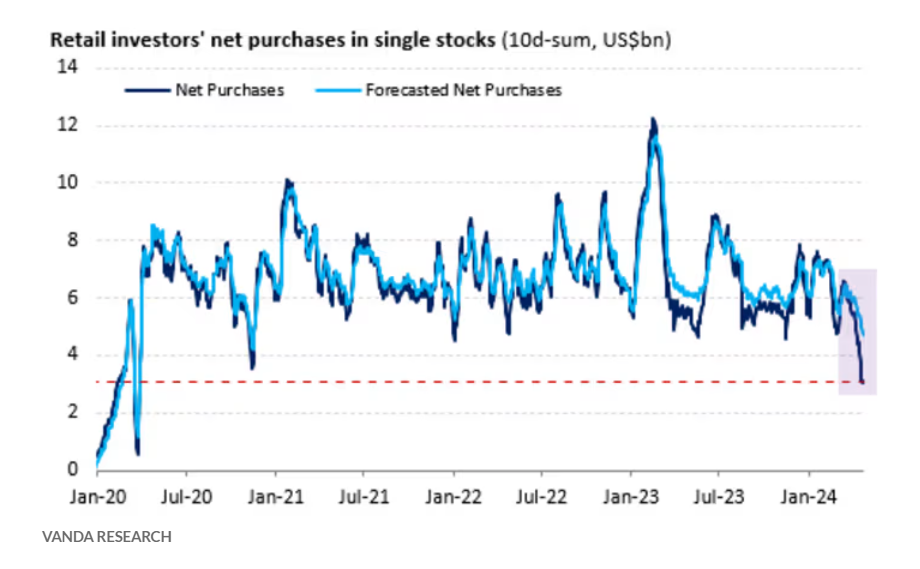

Based on a rolling 10-day sum of net purchases by this cohort, demand for single stocks touched the lowest level since late 2020, as the chart below shows.

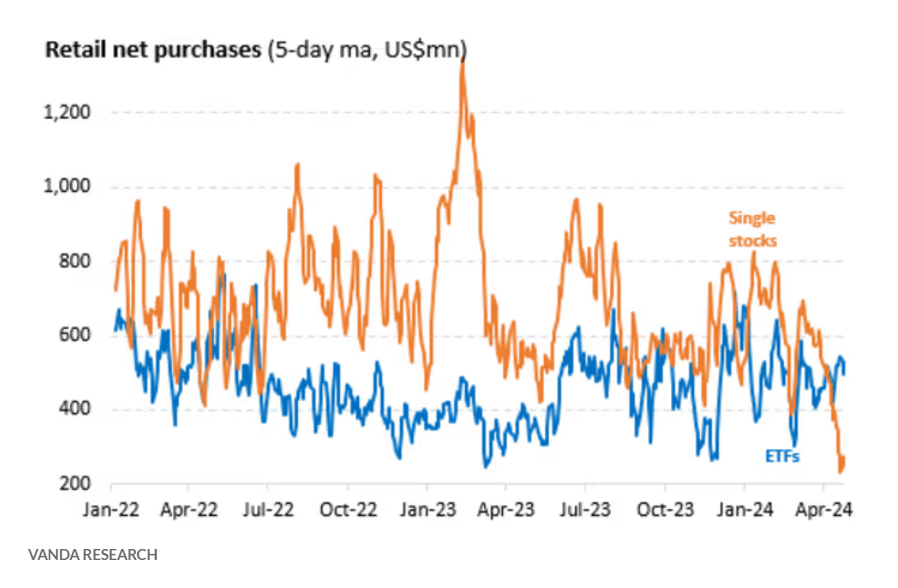

Indeed, investors seemed particularly uninterested in buying shares of individual stocks. Although some demand shifted to exchange-traded funds, ultimately, it wasn’t enough to offset this decline.

“While we expected tax seasonality to weigh on retail demand, the extent of the weakness surprised us,” the Vanda team said in a report shared with MarketWatch on Wednesday. “The buying slump can be largely attributed to a lack of demand for single stocks. Indeed, retail buying of single names severely undershot even our most-bearish forecast since late 2020.”

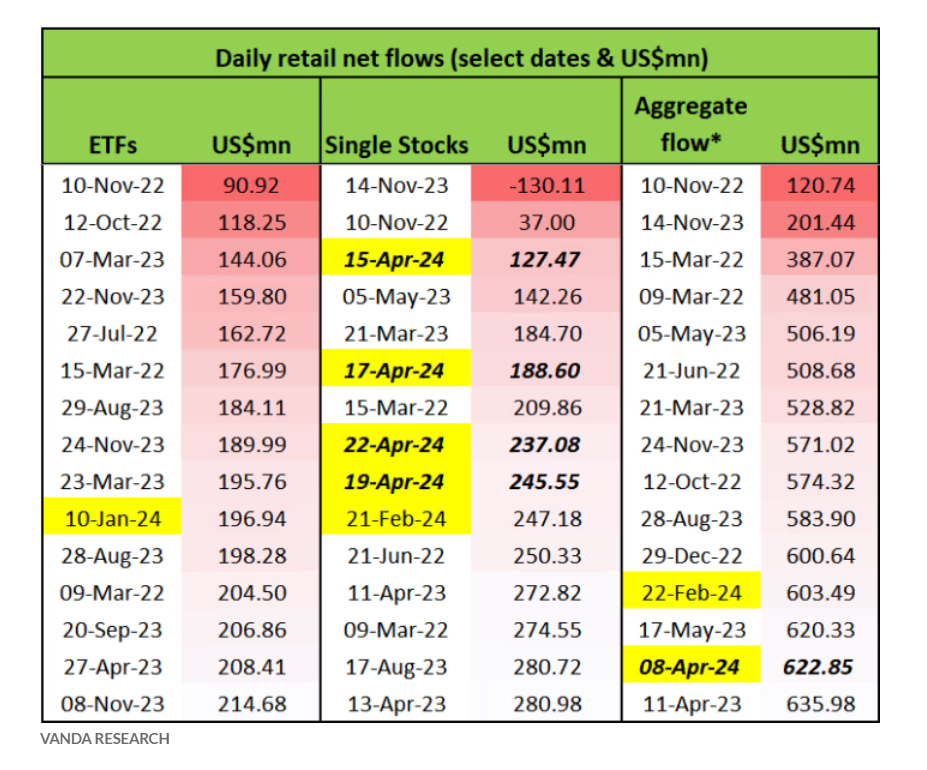

So far, April has seen some of the weakest demand for individual stocks since 2022, according to researchers at Vanda. Four of the 15 weakest days in that period have occurred this month.

Demand from the retail crowd was notably subdued last week, helping contribute to a more than 3% drop in the S&P 500, the index’s worst weekly performance in more than a year, according to FactSet data.

As the chart below shows, retail buying fell by two standard deviations relative to its long-term average. Based on a five-day moving average, demand for stocks hit the lowest point at any time in the past two years.

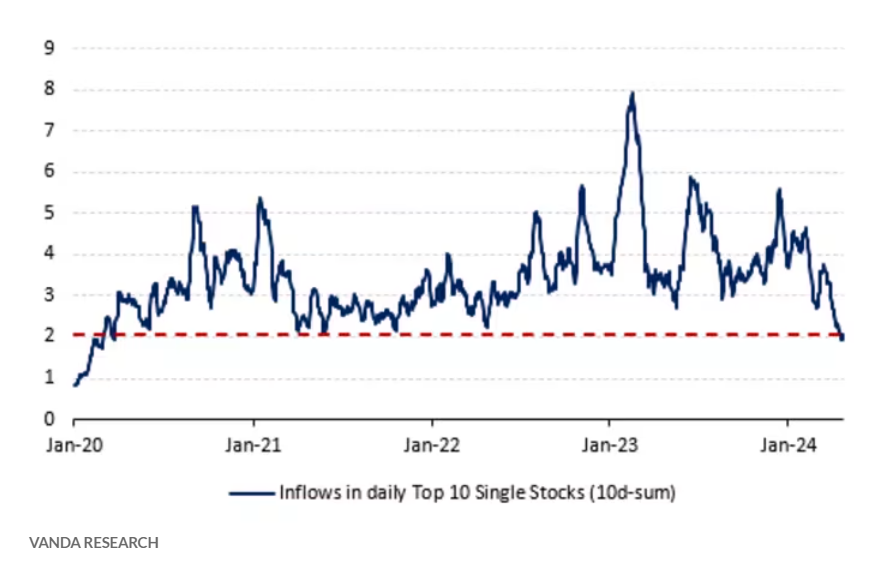

Much of the decline in demand was seen in shares of large-cap technology and semiconductor names that have been some of the U.S. market’s top performers over the past year, including Nvidia Corp. NVDA, -3.33% and Advanced Micro Devices Inc. AMD, -0.35%.

Vanda expects that retail investors will soon start pouring money into stocks again, now that they have taken profits and settled their tax bills.

Researchers have already started to see signs of a pickup in retail investors’ risk appetite, including a spike in demand for shares of Tesla Inc. TSLA, +12.06% earlier this week. Shares of the electric-vehicle maker logged their biggest daily advance since January 2022 following the company’s latest quarterly earnings report, according to FactSet data, although the company’s shares are still down 34.8% year to date, at $162.13.