All Posts in "Editor"

The Overlooked Pharma Sector You Need To Know About, And The Company We Think Needs A Serious Look

One of the best kept secrets among most seasoned biopharma investors is the lucrative and enticing potential for treating rare diseases with orphan drugs.

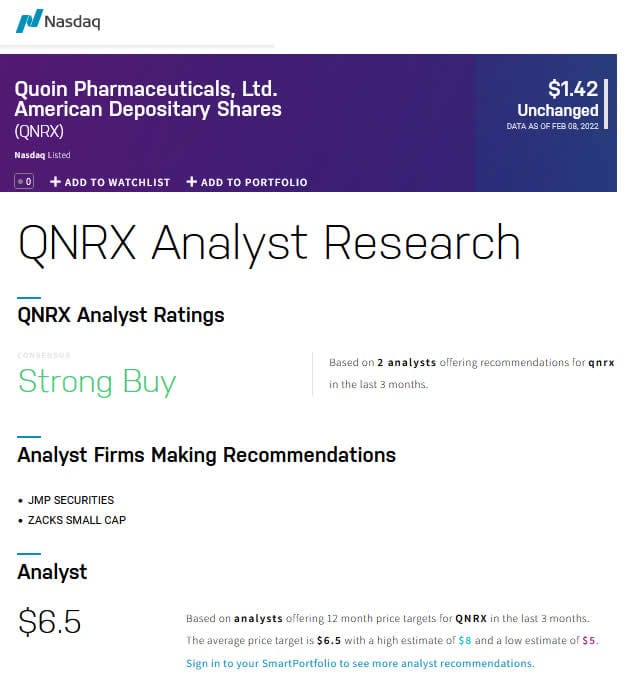

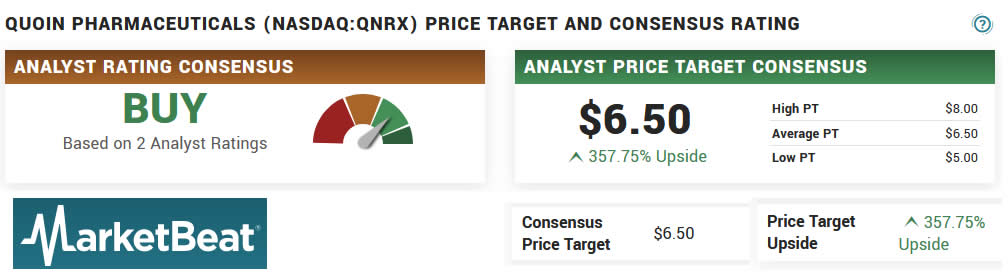

PAY ATTENTION: We’ve identified a rare-disease, orphan-drug company declared by multiple analysts as a STRONG BUY* with price targets in excess of 350%—and that company is Quoin Pharmaceuticals Ltd. (NASDAQ:QNRX). – This company is extremely undervalued, analysts agree as you will see below, and we personally think it is a huge bargain at this price point with major upside potential in the very near future.

Market research firm EvaluatePharma projects that worldwide orphan-drug sales will DOUBLE by 2026 to hit US$268 billion[1], and Prophecy Market Insights projects it will be more than DOUBLE of that, hitting US$547.5 billion by 2030, growing at a RAPID 13.1% CAGR.[2]

What is an Orphan Drug?

Orphan drugs are medicines developed to help treat, prevent or diagnose rare “orphan” diseases, which are conditions that each affect fewer than 200,000 people in the U.S. Today, about 600 orphan drugs are approved by the U.S. Food and Drug Administration (FDA) to treat these difficult and rare diseases. In order to spur pharmaceutical companies to develop more Orphan Drugs, Congress passed the Orphan Drug Act in 1983. This law encourages drug makers to research and manufacture orphan drugs by giving them tax incentives, subsidies for clinical research. This program has been very successful and very lucrative.

* Sources: [3],[4],[5],[6],[7]

Source: NASDAQ.COM

Source: https://www.marketbeat.com/stocks/NASDAQ/QNRX/price-target/

Analysts are bullish on QNRX and the sector as you can see by the above average price target of $6.50, with a low target of $5.00 and and a high target of $8.00.

So, let’s look at some of the major factors behind this rare disease market that has been incentivized from what was once a barren land into totally fertile ground.

Roughly 30 million Americans suffer from 7,000 or so rare diseases.[8]

And to address these patients, the US FDA funds research in rare diseases through programs like the Orphan Products Grants Program, by implementing the Orphan Drug Act, and reviewing and granting designations to Rare Disease Drugs, Rare Pediatric Diseases, and Devices. To sweeten the pot, the FDA also offers seven years for Orphan Drug Exclusivity (ODE), giving two whole years more of market exclusivity than New Chemical Entity Exclusivity (NCE).[9]

Because of this, biopharma companies are VERY attracted to the orphan-drug market. After decades since the passage of the Orphan Drug Act, the FDA has given orphan status to over 500 drugs[10], while the EU has given orphan designation to over 2,200 medicines.[11]

As of 2020, the FDA had approved drugs and biologics for over 800 rare disease indications.[12] Rare-disease drugmakers are BIG business, and even mean a lot to BIG Pharma. In 2021, AstraZeneca both acquired rare disease drug makers (Alexion) for US$39 billion[13], and agreed to pay up to $3.6 billion for the rights to a promising drug for another rare disease.[14]

UCB recently bought rare disease Zogenix for up to US$1.9 billion,[15] Italian pharma group Recordati closed out 2021 by signing an agreement to buy UK-based EUSA Pharma for an enterprised value of nearly US$850 million.[16]

“Orphans are wicked hot.”

– Dr. Tim Coté,

Former FDA official, and CEO of Only Orphans Cote LLC [17]

30-Second Intro: A Special Specialty Pharma Co.

- Tightly-held share structure, and currently valued at less than $11.5M

- Trading at less than $1.35.

- Multiple analysts have given QNRX a ‘BUY’ or ‘STRONG BUY’ Rating.

- Publicly shared analyst price targets avg $6.50 per share and as high as $8 per share.[18]

- Rare and Orphan Disease Focused specialty pharmaceutical company.

- Innovative Pipeline with three products targeting a broad number of rare and orphan diseases, including Rare Pediatric Designations.

- Plans in placeto establish a sales infrastructure to commercialize its products in both the USA and Europe.

- Targeting US/EU Approvals in 2024, 2025, and 2026.

- Established Strategic licensing partnerships for entry into multiple markets.

- Strong Key Opinion Leader (KOL) support.

- Experienced Management Team.

Capital Structure Statistics

Total Shares Outstanding — 8,350,000

Average Volume — 2.47 Million

Market Cap — $11.2 Million

Institution Ownership — 10.57%

QUICK RUNDOWN: THE PIPELINE

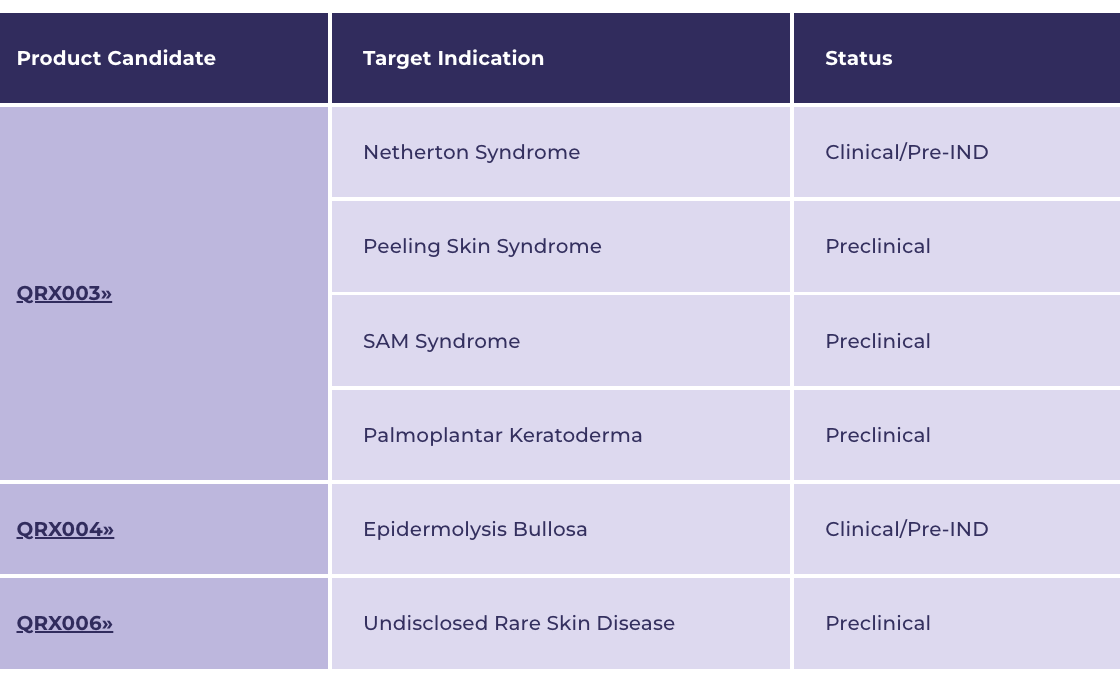

Quoin Pharmaceuticals Ltd. (NASDAQ:QNRX) is focused on developing innovative treatments for rare and orphan diseases, and has a pipeline that comprises three unique products (including QRX003, QRX004, and QRX006) that collectively have the potential to target a broad number of indications.

**FLAGSHIP** QRX003: Netherton Syndrome

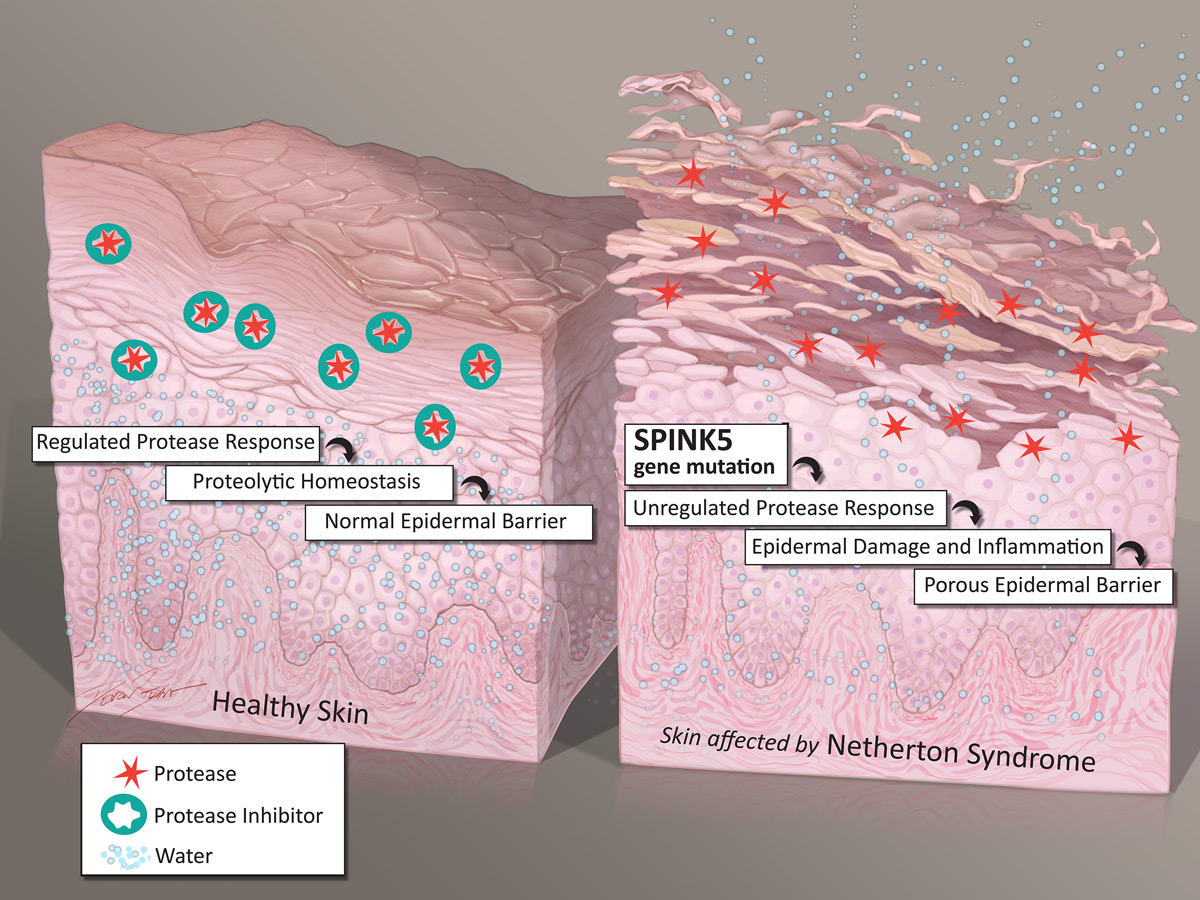

QRX003 is under development as a potential therapy for the treatment of Netherton Syndrome (NS)— a rare, hereditary skin disorder leading to severe skin barrier defects and recurring infections, as well as a pronounced predisposition to allergies, asthma and eczema.

Patients also often suffer from severe dehydration, chronic skin inflammation and stunted growth.

People with Netherton Syndrome have too few layers of their outer skin (stratum corneum) so the skin does not perform its primary function as a protective barrier.

Currently, there is no cure for Netherton Syndrome, nor are there any approved therapeutic treatments.

QRX003 is a once-daily topical lotion that offers a combination of a broad-spectrum serine protease inhibitor, and is formulated with Quoin Pharmaceuticals’ (NASDAQ:QNRX) proprietary Invisicare® technology.

When applied daily to the skin, the active ingredient in QRX003 leads to a more normalized skin shedding process and the formation of a stronger and more effective skin barrier, while also acting as a potent anti-inflammatory and antioxidant.

QRX003 is also being developed to target Peeling Skin Syndrome, SAM Syndrome, and Palmoplantar Keratoderma.

QRX004: Epidermolysis Bullosa

QRX004 is also a topical lotion made with Quoin Pharmaceuticals’ (NASDAQ:QNRX) proprietary Invisicare® technology, initially under development as a potential treatment for a group of rare and genetic skin disorders, in which the skin is so trauma or friction, which can have devastating results, cause severe pain, blistering, scarring, infection and immobility.

Known as Recessive Dystrophic Epidermolysis Bullosa (RDEB), it’s diagnosed at infancy and accompanied by a high mortality rate – 76% do not live beyond their 30s.

The cost of bandaging alone can exceed $10,000 per month.

Quoin Pharmaceuticals’ (NASDAQ:QNRX) QRX004 is designed for the creation of robust and sustained type VII collagen, and for improved wound closure, reduced blistering and stronger skin.

QRX006: Undisclosed Rare Skin Disease

QRX006 is another a topical lotion that Quoin Pharmaceuticals (NASDAQ:QNRX) is developing for an, as of yet, undisclosed rare skin disease.

It contains two separate active ingredients and is designed to be applied directly to the affected site over a prescribed period.

Currently available treatment involves the daily systemic administration (oral and IV) of the same two active ingredients that are in QRX006 over a period of several weeks.

This treatment is both cumbersome and costly for patients and healthcare providers and can lead to significant unpleasant side effects, often resulting in patients discontinuing treatment.

QRX006 is designed to reduce the side effects associated with systemic treatment and enable patients to apply the product directly themselves without the need for daily visits to a hospital or clinic.

Quoin Pharmaceuticals (NASDAQ:QNRX) applied for a patent for QRX006 in mid-2021.

AT THIS POINT we have identified a publicly-traded company with multiple assets in the pipeline and in planning stages of establishing sales infrastructure for the USA and Europe… and that company is

Quoin Pharmaceuticals (NASDAQ:QNRX)

Strategic Partnerships

Quoin Pharmaceuticals (NASDAQ:QNRX) has established partnerships with other companies and advocacy organizations.

FIRST was established to help individuals and families affected by ichthyosis.

The organization educates, inspires, and connects families and individuals affected by Ichthyosis and related skin types. Services include biennial national family conferences, regional meetings, a regional support network, publications, advocacy and a research program.

Quoin Pharmaceuticals (NASDAQ:QNRX) has in-licensed a bi-functional biologic from QUT for the treatment of Netherton Syndrome.

Quoin Pharmaceuticals (NASDAQ:QNRX) has entered into a licensing and distribution agreement with GenPharm for the Middle East.

AFT is Quoin’s licensing and distribution partner for Australia and New Zealand.

Feature Company:

Quoin Pharmaceuticals

Trade Symbol – NASDAQ:QNRX

Market Cap – ~$11.3 Million

Shares Outstanding: 8.35M

Leaders With Experience

Quoin Pharmaceuticals (NASDAQ:QNRX) is led by a group of seasoned management, board & advisors with particular skill sets and significant wins in the pharmaceutical sector.

Co-Founder, Chairman, CEO & Director Dr. Michael Myers brings more than 30 years of experience in the drug delivery and specialty pharmaceutical sectors. He’s served as CEO of Innocoll, Inc., where he was responsible for taking that company public in 2014, and also served in presidential roles for West Pharmaceutical Services, Fuisz Technologies (Biovai), and executive positions in Flamel Technologies and Elan Corporation. Dr. Myers also serves on the Board of Directors for Sonoran Biosciences as well as on the Advisory Boards for two Penn State startup companies, Cranial Devices and Gradient T.

Co-Founder, COO & Director Denise Carter also has over 30 years of experience in the drug delivery and specialty pharmaceutical industries. Carter and Myers have both worked at Innocoll, Inc., where she served as executive vice president of business development of the drug delivery division. Ms. Carter also held executive positions at Eurand and Fuisz Technologies (Biovail).

Among the members of the Board is Director Dr. Dennis H. Langer, MD, JD, whose spent over 35 years in the pharmaceutical industry at Eli Lilly, Abbott, Searle, GSK, and served as President at Dr. Reddy’s, NA. He’s also served as Director at Sirna Therapeutics (acquired by Merck), Ception Therapeutics (acquired by Cephalon), Transkaryotic Therapies (acquired by Shire), Pharmacopeia (acquired by Ligand), Cytogen (acquired by EUSA Pharma) and Delcath Systems. He currently serves as a Director at Myriad Genetics, Dicerna Pharmaceuticals and Pernix Therapeutics.

Before You Go…

REMEMBER THESE 5 POINTS

- Quoin Pharmaceuticals (NASDAQ:QNRX) and its proprietary Invisicare® technology are well- positioned to succeed in 2022.

- Analysts currently covering the company are unanimous in their BUY recommendations.

- QNRX is a VERY tightly held stock, with only 8.35M shares outstanding, and 10.57% institutional ownership.

- It currently trades at less than $1.30 per share, but has an average price forecast of $6.50, with estimates between $5-$8 for 2022.

- Big Pharma is spending BILLIONS to acquire, retain, and develop rare disease/orphan drug treatments.

So putQuoin Pharmaceuticals (NASDAQ:QNRX) on your radar, and do your own research to see why we felt it so necessary to bring it to your attention TODAY.

SOURCES CITED:

[1] https://www.pharmaceuticalcommerce.com/view/evaluate-pharma-predicts-a-981-billion-global-pharma-market-for-2021-up-14-3-

[2] https://www.globenewswire.com/news-release/2021/02/24/2181634/0/en/Global-Rare-Disease-Market-is-estimated-to-be-US-547-5-billion-by-2030-with-a-CAGR-of-13-1-during-the-forecast-period-by-PMI.html

[3] https://www.nasdaq.com/market-activity/stocks/qnrx/analyst-research

[4] https://www.wsj.com/market-data/quotes/QNRX/research-ratings

[5] https://www.marketwatch.com/investing/stock/qnrx/analystestimates

[6] https://www.investorsobserver.com/news/stock-update/analyst-rating-will-quoin-pharmaceuticals-ltd-adr-qnrx-stock-do-better-than-the-market

[7] https://biotuesdays.com/2022/01/07/maxim-starts-quoin-pharma-at-buy-pt-5/

[8] https://rarediseases.info.nih.gov/diseases/pages/31/faqs-about-rare-diseases

[9] https://www.fda.gov/drugs/development-approval-process-drugs/frequently-asked-questions-patents-and-exclusivity

[10] https://rarediseases.info.nih.gov/diseases/fda-orphan-drugs

[11] https://www.ema.europa.eu/en/documents/leaflet/leaflet-orphan-medicines-eu_en.pdf

[12] https://www.fda.gov/news-events/fda-voices/rare-disease-day-2020-fda-continues-important-work-treatments-rare-diseases

[13] https://www.fiercepharma.com/pharma/astrazeneca-fresh-from-alexion-deal-repelled-7-6b-buyout-rare-disease-specialist-sobi-report

[14] https://www.standard.co.uk/business/pharmaceuticals/astrazeneca-covid19-ionis-liver-rare-diseases-alexion-soriot-b970433.html

[15] https://www.fiercepharma.com/pharma/ucb-buys-rare-disease-drugmaker-zogenix-for-up-to-1-9b-bolsters-epilepsy-position

[16] https://www.reuters.com/markets/deals/recordati-buy-eusa-pharma-847-mln-boost-rare-disease-offering-2021-12-03/

[17] https://www.npr.org/sections/health-shots/2017/01/17/509506836/drugs-for-rare-diseases-have-become-uncommonly-rich-monopolies

[18] https://www.nasdaq.com/market-activity/stocks/qnrx/analyst-research

DISCLAIMER:

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is NOT a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report is not provided to any individual with a view toward their individual circumstances. Equity Insider is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has not been paid a fee for profiling Quoin Pharmaceuticals on this website or in other market publications, but . There we doo own shares of Quoin Pharmaceuticals which were purchased in the open market, which we plan to sell immediately and will sell in the immediate future. There may also be 3rd parties who may have purchased shares of Quoin Pharmaceuticals, and may liquidate their shares which could have a negative effect on the price of the stock. The simple fact that we own shares of Quoin Pharmaceuticals constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. MIQ, our associates, employees and friends also reserve the right to buy and sell, and will buy and sell shares of Quoin Pharmaceuticals at any time hereafter without any further notice. Let this disclaimer serve as notice that all material disseminated by MIQ has not been approved by Quoin Pharmaceuticals; this is not a paid advertisement, but we own shares of the Quoin Pharmaceuticals which were purchased in the open market that we will sell commencing immediately, and we also reserve the right to buy and sell shares of the company in the open market and we will buy and sell shares in the open market commencing immedaitely.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

Protected: Content Creators Have THIS New Media Tech Company to Thank for Huge Growth in Revenues and Audiences

Protected: The 21st Century Digital ‘Gold Rush’ is Here, and Decentralized Crypto Wallet Exchange Tech is at the Center of it All

Protected: Digital Health Giant in the Making: Highly Strategic and Disciplined M&A Driving Dramatic Growth and Profitability for This Healthtech Juggernaut

Upcoming $3 Trillion Spending Bill Set to Cause Copper Mining Boom

US Economic Advisers are pushing a massive spending package, with a giant infrastructure plan that should blast copper demand into orbit.

Under the moniker of “Build Back Better”, economic advisers for the current US administration are championing a sweeping $3 trillion package to boost the economy, beginning with a massive infrastructure plan.

Once news of the new planned US spending hit the market, demand for metals rose. There was one critical metal in particular that seriously took off hitting a nearly 10 year high… COPPER.[1]

We believe we’ve identified a company that’s perfectly positioned to capitalize on the days ahead, with a pair of enviable properties in a country about to see a major MINING BOOM.

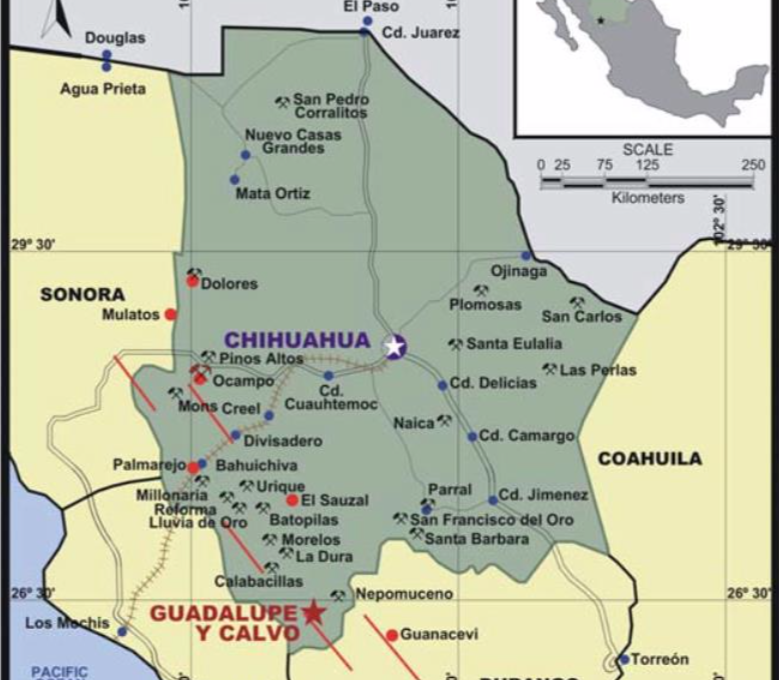

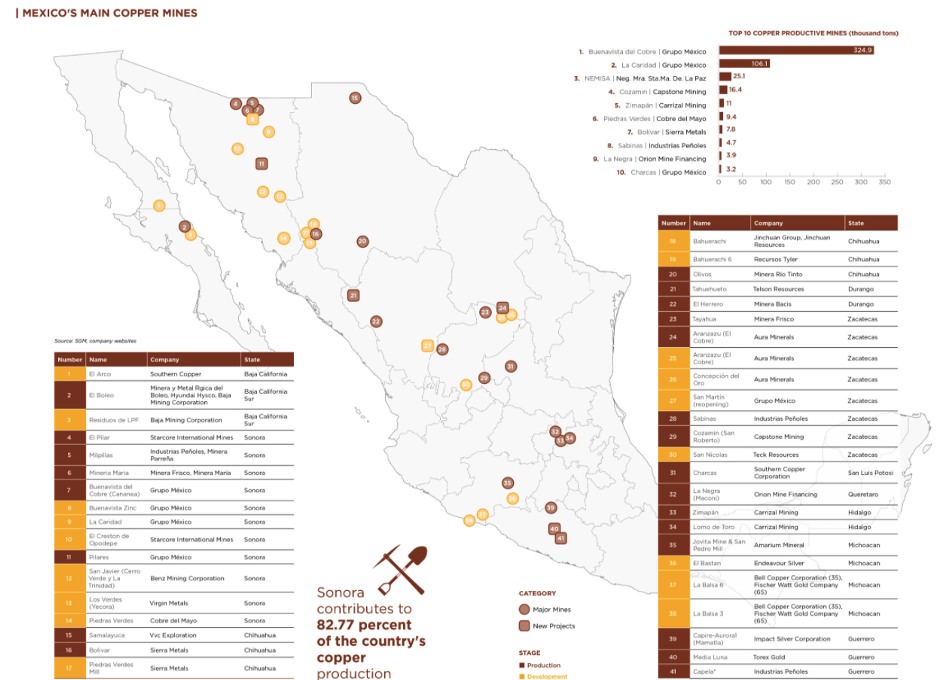

Emerging copper & gold mining developer Ridgestone Mining Inc. (OTC:RIGMF, TSXV:RMI) is poised for a breakout in TWO of Mexico’s top producing mining districts—including the country’s top producing copper region, Sonora.

Mexico’s mining output has already rebounded above pre-pandemic levels, despite ongoing challenges presented by the global health crisis.[2]

But will it be enough?

There’s a SERIOUS global shortage of copper on the horizon—a gap projected to reach 10 million tons in the next decade.[3]

Goldman Sachs has warned of this historic shortage, stating: “the market now on the cusp of the tightest phase in what we expect to be the largest deficit in a decade.”[4]

Among the top producers of copper in the world is Peru, where their central bank just cut projections, due to COVID-related challenges to production.[5] Neighboring Chile is ramping up what it can, with BHP’s Spence Mine expected to hit peak production later this year.[6]

And don’t think that those massive supplies in Chile and Peru will be headed towards the USA to meet this infrastructure boom. Most of those large, copper-loaded ships are headed for Chinese ports.[7]

It’s beginning to look like North American demand will need to be met by North American supply.

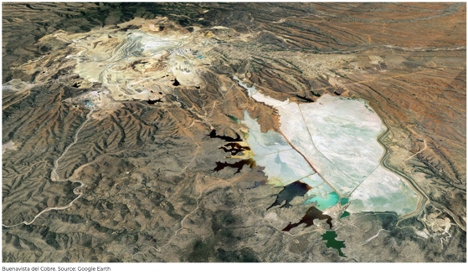

Much more will be expected out of one of the largest copper mines in the world by reserve, Buenavista (aka Cananea) Mine.

Currently the 5th largest copper mine in the world[8], the Buenavista Mine is located in Sonora State. It’s owned and operated by Group Mexico, which trades in the USA under the name Southern Copper Corporation (NYSE:SCCO).

It’s also one of the oldest open-pit mines in North America. The importance of the Buenavista Mine is heightened for Southern Copper, especially because the company recently had to cancel its Tia Maria copper project in southern Peru because of “anti-mining terrorism” in the area.[9]

So the focus back on Mexico appears to be even more warranted than before.

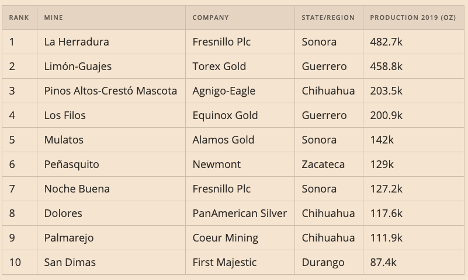

Among the Top 10 producing mines in Mexico, 6 are located within the mining districts of either Chihuahua or Sonora.

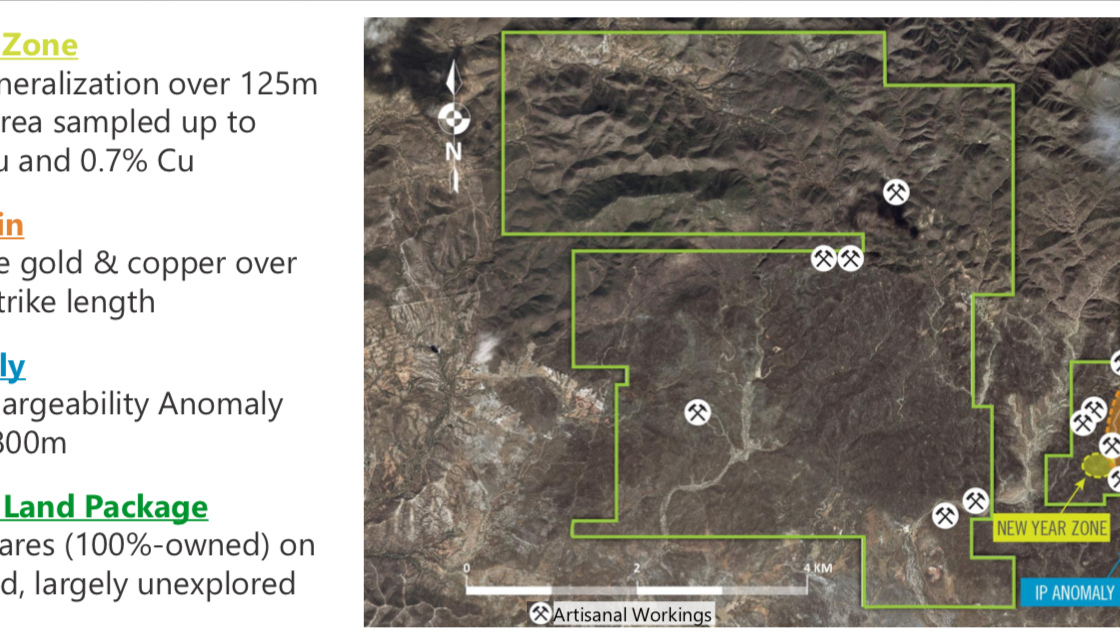

Ridgestone Mining Inc. (OTC:RIGMF, TSXV:RMI) has established its properties within both of those districts, they’re surrounded by bigger players that will (as will we) be paying very close attention to their developments in the months to come.

In 2021, Ridgestone Mining Inc. (OTC:RIGMF, TSXV:RMI) is looking to advance both its copper-gold Rebeico project and gold-silver Guadalupe y Calvo projects.

After successfully closing TWO over-subscribed private placements, raising $2.32 million earlier this year, Ridgestone Mining is well capitalized and good to go.

We expect BIG results from a still-very-small company, which is primed for a growth spurt in 2021…

5 Key Highlights Pointing at Ridgestone Mining as a Perfect Mining Opportunity in Mexico

- TWO high-grade mining projects located within Mexico’s prolific Sierra Madre gold belt

- Exploration-stage Rebeico copper-gold project in Sonora

- Resource-stage Guadalupe y Calvo gold-silver project in Chihuahua

- Rebeico copper-gold project encompasses 3,459 hectares of private land with numerous artisanal gold and copper workings.

- Multiple mineralized zones identified: the Alaska Vein, the New Year Zone, the IP Anomaly, and a number of historic mines including the El Cobre copper mine.

- Past exploration highlights include:

- Alaska Vein

- 1.5 metres grading 1.2% copper plus 36.1 g/t gold

- 1.0 metre grading 5.95% copper plus 17.70 g/t gold

- New Year Zone

- 16.25 metres grading 1.79% copper plus 2.13 g/t gold

- Waste Dumps (from surface waste dumps/waste material from mining in the 1960s)

- 111 samples with an average grade of 0.8% copper plus 2.5 g/t gold

- El Cobre Mine (underground mine operated during the 1960s, samples taken from waste material)

- Samples grading over 2.4% copper

- IP Anomaly

- A potential copper-gold porphyry highlighted by a target spanning 1,400 metres by 800 metres

- Alaska Vein

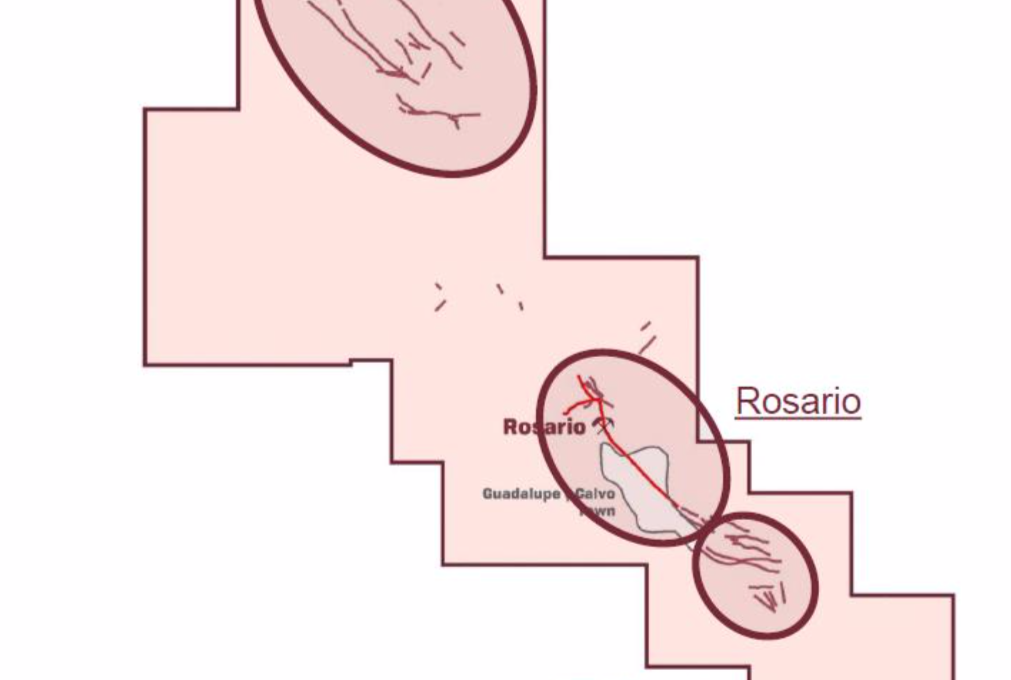

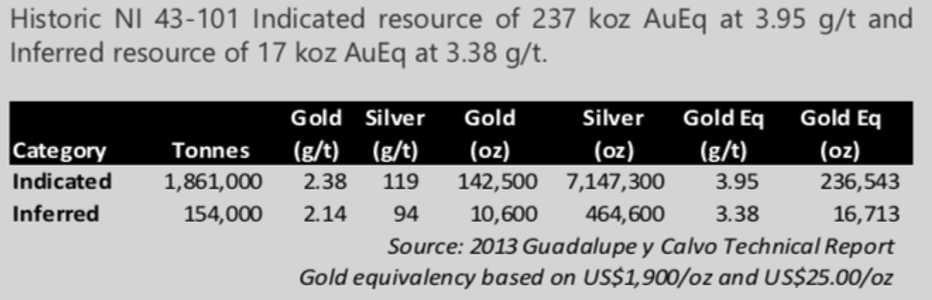

- Guadalupe y Calvo (GyC) gold-silver project is located within a mining district with historic production of over 2 million ounces of gold and 28 million ounces of silver.

- Mineralization is characterized by low-sulfidation epithermal veins with multiple vein structures identified over a 3km strike.

- GyC hosts a historical estimate NI 43-101 Indicated resource of 237,000 oz AuEq at a grade of 3.95 g/t AuEq and Inferred resource of 17,000 oz AuEq.

- Resource remains open for expansion along strike and at depth.

- Proven management team with a track record of discovery and monetization in Sonora State.

- Past successes include:

- Sale of the largest moly deposit in Mexico for $195 million

- Discovery of three gold deposits and one copper deposit which have become significant mines (two of which are still active in Sonora)

- Past successes include:

Copper-Gold Asset: Rebeico Project

Rebeico is located 115km east of Hermosillo, a main operations support hub for the Sonora mining district.

Comprised of 16 concessions totaling 3,459 hectares on private land(no ejido), the Rebeico is accessible by highway and a network of all-weather roads.

Infrastructure is great, as there are grid electrical power lines within 6.5 km of the property.

Historic exploration on the property focused on the Alaska Vein and New Year Zone.

Alaska Vein drilling highlights included:

- 1.2% Cu and 36.1 g/t Au over 1.5 m

- 2.4% Cu and 8.3 g/t Au over 3.25 m

- Including 5.95% Cu and 17.7 g/t Au over 1 m

- 2.8% Cu and 8.7 g/t Au over 2m

New Year Zone drilling highlights includes:

- 1.79% Cu and 2.13 g/t Au over 16.25m

- 0.54% Cu over 29.15 m

On top of the two primary zones are additional prospective signs of copper potential. These include samples from historic mines, and waste by-products.

Waste Dumps (waste material from mining in the 1960’s) data includes:

- 111 samples with an average grade of 2.5 g/t gold plus 0.8% copper from surface waste dumps (waste material from mining in the 1960’s)

El Cobre Mine (historic mine that operated into the 1960s) data includes:

- Waste material grading over 2.4% copper

IP Anomaly:

- Potential copper-gold porphyry highlighted by a target spanning 1,400 metres by 800 metres

Case Study 1: Southern Copper’s Buenavista Mine

Roughly 125 miles separate RMI’s Rebeico Project and Southern Copper’s Buenavista mine, which are both along the same trend in the prolific Sonora Mining district.

The Buenavista Mine is the oldest operating copper mine in North America, dating back to 1899.

In 2019, the mine produced 965 million pounds (Mlbs) of copper, which accounted for approximately 44% of the company’s total production for that year. The mine also produces silver and molybdenum as by-products. The contained copper at the mine is estimated to be 22.1Mt.[10]

According to the CFO of Southern Copper Corp., Raul Jacob, the company wants to almost double output by 2028, and possibly become the world’s largest producer.[11]

Jacob stated: “If this [copper] price level holds, we should see announcements of new projects coming in the market.”

It’s important to note that in order for Southern Copper to get there, the company has stated it will look at acquisition opportunities that come along, with asset quality being a top priority.

Given that the Rebeico Project is in the same mining district, and comes with full control given the private ownership of the rights, this could potentially make Ridgestone Mining a serious candidate in the years to come, with a very healthy valuation due to a better price environment.

“We feel comfortable in Latin America and very comfortable and positive about copper,” Jacob added, in an interview with Mining.com.

Between March 2020 and March 2021, shares of Southern Copper Corporation (NYSE:SCCO) has seen its shares rise from $26.57 on March 24, 2020 to a high of $81.53 in February 2021—for a rise of +200% in one year.

Gold-Silver Asset: Guadalupe y Calvo (GyC) Project

Located in the town of Guadalupe y Calvo, in SW Chihuahua State (~300km south of Chihuahua City) with excellent road access and strong local infrastructure.

Comprised of 2,750 hectares of contiguous claims covering numerous historical workings, including the Rosario Mine.

Dating back to the 1930s, the Rosario Mine produced over 2 million ounces of gold, and 28 million ounces of silver.

Due to water-handling capabilities of the time, this historic production was limited… NOT because of the mineralization.

That means, that with today’s technology, it’s game on to get this project back up and running!

Management recognized this, as there are EXCELLENT near-term opportunities for resource growth in place, through additional drilling—Mineralization remains OPEN along strike and at depth.

Already there’s been significant exploration (over 200 drill holes) done in the past by companies that are now part of Goldcorp, Aurico Gold, and Endeavour Silver totaling over 50,000 metres.

Included within those drilling results were 4.1 g/t Au and 281 g/t Ag over 2.5 metres with NUMEROUS targets identified for follow-up exploration.

The Northwest striking Rosario fault complex is the project’s main structural feature, with a total width of the mineralized zone up to 80 metres.

Underground historic mining had widths of high-grade gold-silver mineralization up to 10 metres.

Case Study 2: Coeur Mining’s Palmajero Mine

Ridgestone Mining’s (OTC:RIGMF, TSXV:RMI) y Calvo Project is located near the city of the same name, which is just over 100 miles along trend to the southeast of the Palmajero Mine, owned and operated by Coeur Mining, Inc. (NYSE:CDE).

The property consists of a land position that totals approximately 27,233 hectares.

In 2020, the mine produced 6.3 million ounces of silver and 110,608 ounces of gold.

The Palmarejo silver-gold complex consists of:

- the Palmarejo mine and processing facility;

- the Guadalupe underground mine, located about 8 kilometers southeast of the Palmarejo mine;

- the Independencia underground mine, located approximately 800 meters northeast of the Guadalupe underground mine;

- other nearby deposits and exploration targets.

Between March 2020 and March 2021, shares of Coeur Mining, Inc. (NYSE:CDE) has seen its shares rise from $2.88 on March 18, 2020 to a high of $11.14 in February 2021—for a rise of 287% within one year.

Peer Groups in the Mexico Mining World

Ridgestone Mining Inc. (OTC:RIGMF, TSXV:RMI) is surrounded by successful mining operations in both the Chihuahua (GyC) and Sonora (Rebeico) regions.

Together, these regions are both within the Sierra Madre corridor, which has been known for its mineral endowment for a very long time.

This is one of the most mining friendly regions of the country.[12]

In particular, the Sonora region is Mexico’s most active mining region for both copper and gold[13]—Sonora contributes to 82.77% of the country’s copper production.[14]

The output and copper extracted from Sonora, in particular, is considered top notch quality, which is why the demand for this metal in the area is growing on a daily basis.[15]

Beyond the copper production, according to Mexico´s Mining Chamber CAMIMEX, more than half (6) of Mexico´s ten largest operational gold mines are in those two regions.

| Company | Symbol | Share Price Today | Mkt Cap | State/Region |

| Ridgestone Mining Inc. | OTC:RIGMF TSXV:RMI | $0.165 | $12.44M | Chihuahua / Sonora |

| Fresnillo PLC | OTC:FNLPF | $13.25 | $9.63B | Sonora |

| Southern Copper | NYSE:SCCO | $67.48 | $52.17B | Sonora |

| Starcore International Mines | OTC:SHVLF TSX:SAM | $0.21 | $10.1M | Sonora |

| Minera Frisco | OTC:MSNFY | $0.49 | $1.67B | Sonora |

| Sierra Metals Inc. | NYSE:SMTS TSX:SMT | $3.06 | $500M | Chihuahua |

| Agnico Eagle Mines Limited | NYSE:AEM TSX:AEM | $60.46 | $14.66B | Chihuahua |

| Alamos Gold Inc. | NYSE:AGI TSX:AGI | $8.18 | $3.21B | Sonora |

| First Majestic Silver Corp. | NYSE:AG TSX:FR | $17 | $3.77B | Sonora/Durango |

| Argonaut Gold Inc. | OTC:ARNGF TSX:AR | $1.76 | $541.3M | Sonora |

* All price in USD

** Latest share price taken from Yahoo! Finance on April 13, 2021

Ridgestone Mining’s Management Team

Before it had even acquired its properties, perhaps the #1 asset that Ridgestone Mining had in place was its leadership team. Each member brings a proven track record of discovery and monetization, with expertise specific to Sonora State.

Past successes include the sale of the largest moly deposit in Mexico for $195 million, and the discovery of three gold deposits that have gone on to become significant mines—two of which are still active in Sonora to this day.

Among the talented team, here are some members we felt were necessary to highlight:

CEO & Director – Jonathan George

George is a geologist and mining entrepreneur with over 35 years of experience in exploration, development and financing. Previously President, CEO and co-founder of Creston Moly. Successfully raised $40 million in equity to acquire, develop, and de-risk the El Creston project before selling it to Mercator Minerals for $195 million. Other notable highlights include President and CEO of ESO Uranium, the predecessor to Alpha Minerals which was acquired by Fission Uranium for $185 million.

CFO & Director – Erwin Wong

Wong has over 26 years of experience having served in senior management and board level positions for numerous Chinese and Canadian based enterprises, both public and private, which were involved in various sectors including transport, real estate, mining, life sciences and investment banking. He had also founded a corporate advisory firm which assisted a number of companies with the complexities of initial public offerings, corporate governance and regulatory compliance in various jurisdictions. Erwin Wong is a Chartered Accountant and holds a Bachelor of Commerce from the University of British Columbia.

VP Exploration – Noris Del Bel Belluz

Belluz has over 35 years of experience in operations, exploration, geology and technical evaluations of both underground and open pit mines. Most recently, he was Operations Manager & Acting General Manager for Nevsun Resource’s Bisha mine, which was acquired for $1.8 billion by Zijin Mining Group Co. Previously, he was Manager of Mine Geology for Eldorado Gold’s China operations and with Freeport-McMoRan as Manager of Mine Geology at the Grasberg mine in Indonesia which included a key role in the discovery of the Kucing Liar skarn deposit. Belluz’s technical experience also includes holding senior roles with Stantec Engineering and Wardrop Engineering, overseeing various technical studies from NI 43-101 resource estimates to feasibility studies and detailed engineering. He holds a Bachelor of Science Degree in Geology from the University of Toronto and is a Qualified Person (QP) under NI 43-101.

Advisor – Dr. Andrew J. Ramcharan

Dr. Ramcharan has over 20 years’ experience in operations, project evaluation, mergers and acquisitions, corporate development, project finance and investor relations. Mr. Ramcharan has worked for a number of companies including IAMGOLD Corporation, Sprott Resources and Resource Capital Funds. He holds a Master’s and Ph.D Degree in Mining and Minerals Economics. Andrew is a Registered Member of The Society for Mining, Metallurgy and Exploration (SME) in USA, Licensed Professional Engineer in Ontario, Canada and Fellow of The Australasian Institute of Mining and Metallurgy. A graduate of the Colorado School of Mines, University of Leoben, and Harvard University’s Continuing Education program.

SOURCES:

[1] https://www.reuters.com/article/global-metals-idUSL1N2LA0K9

[2] https://www.bnamericas.com/en/news/mexico-mining-output-rebounds-to-pre-pandemic-levels

[3] https://news.metal.com/newscontent/101425386/Supply-falls-short-of-demand-A-global-shortage-of-10-million-tons-of-copper-in-the-next-decade/

[4] https://oilprice.com/Metals/Commodities/Goldman-Sachs-Historic-Copper-Shortage-Loom-As-Prices-Rocket.html

[5] https://www.mining.com/web/peru-central-bank-cuts-growth-forecast-for-2021-sees-tailwinds-from-rising-copper-price/

[6] https://cn.reuters.com/article/chile-copper-bhp-idCNL1N2KM001

[7] https://www.bloomberg.com/news/articles/2021-02-26/copper-crunch-is-set-to-ease-as-more-concentrate-heads-to-china

[8] https://www.kitco.com/news/2021-03-18/The-world-s-top-10-largest-copper-mines-in-2020-report.html

[9] http://www.laht.com/article.asp?CategoryId=14095&ArticleId=2381146

[10] https://www.nsenergybusiness.com/projects/buenavista-copper-mine-expansion/

[11] https://www.mining.com/web/copper-to-stay-tight-on-long-path-to-new-supply-top-miner-says/

[12] https://gambusinoprospector.com/mineral-resources-in-mexico/mining-regions/

[13] https://www.lexology.com/library/detail.aspx?g=e4db032c-8d2e-4360-a9c8-df86b0f6be59

[14] https://mexicobusiness.news/sites/default/files/2019-10/Map-Copper-mines_110-111.jpg

[15] https://electroheatinduction.com/copper-mined-mexico/

DISCLAIMER:

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Equity Insider is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Ridgestone Mining Inc. advertising and digital media from the company directly (“the Company”). There may be 3rd parties who may have shares of Ridgestone Mining Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Ridgestone Mining Inc. which were purchased as a part of a private placement. MIQ will not buy or sell shares of Ridgestone Mining Inc. for a minimum of 72 hours from the publication date on this website March 31, 2021, but reserve the right to buy and sell, and will buy and sell shares of Ridgestone Mining Inc. at any time thereafter without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, and we own shares of the mentioned company that we will sell, and we also reserve the right to buy shares of the company in the open market, or through further private placements and/or investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

Protected: The Smart Investor’s Way to Add PPE and Tech Solutions to Your Portfolio

Red-Hot Battery Technology Space Poised for Great Disruption with New AI-Based Tech

How EV Battery Technologies (OTC:CRYBF) (CSE: ACDC) Aims to Solve the World’s Greatest Battery Problem and Revolutionize Batteries Forever

There’s a radical shift underway in energy, taking place in most developed countries towards renewable resources.

Lawmakers are incentivizing major energy overhauls through grants and mandates, in order to shift from traditional power generation to largescale smart power grids, and energy storage.[1],[2],[3],[4]

We’re already seeing major projects coming online right now, including a pair of giant battery storage projects in California and Florida.[5]

In the USA alone, energy storage capacity is expected to grow a whopping 12x by 2024.[6]

Over that same period, the US energy storage market is projected to grow into a $5.4 billion in 2024.[7]

By 2025, the global battery technology market is projected to be worth $152.3 billion.[8]

By 2030, both the BNEF and IEA are forecasting global energy storage will double 6 times.[9]

This is BIG business!

However, in order to get there, there are still some major technological advances are still needed to pull this off.

Completely changing over power sources isn’t easy, and at times can even be dangerous… as seen in Arizona where at one of the state’s first battery installations resulted in a fire and explosion that injured several first responders.[10]

As we scale up our capabilities for utility-scale energy storage and smart power grids, battery technology will need to assure the public of its SAFETY, EFFICIENCY, and LONGEVITY.

This is not going to be easy.

But for those who can develop the technology to handle this major transition, there is a MAJOR breakthrough investment opportunity at stake.

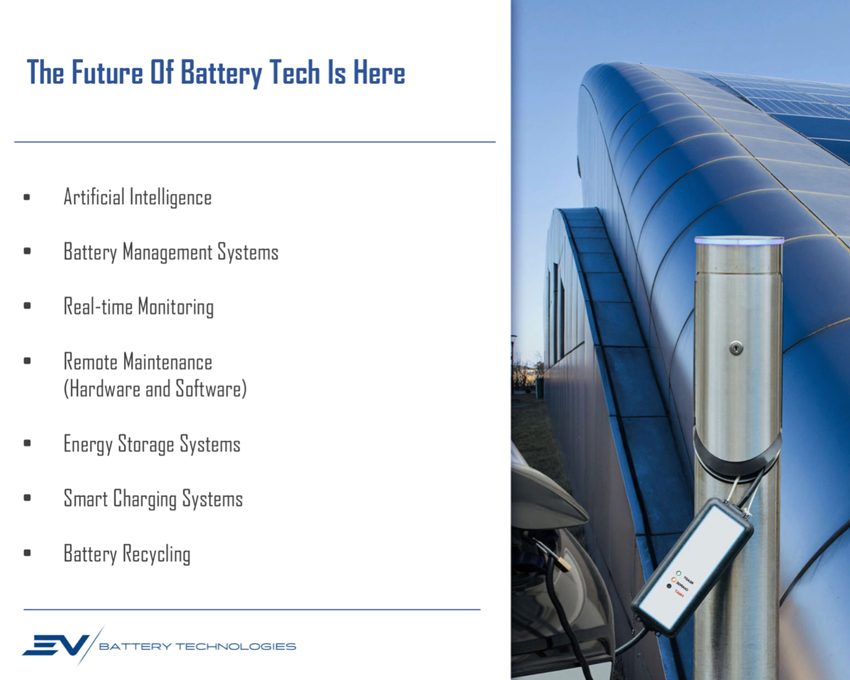

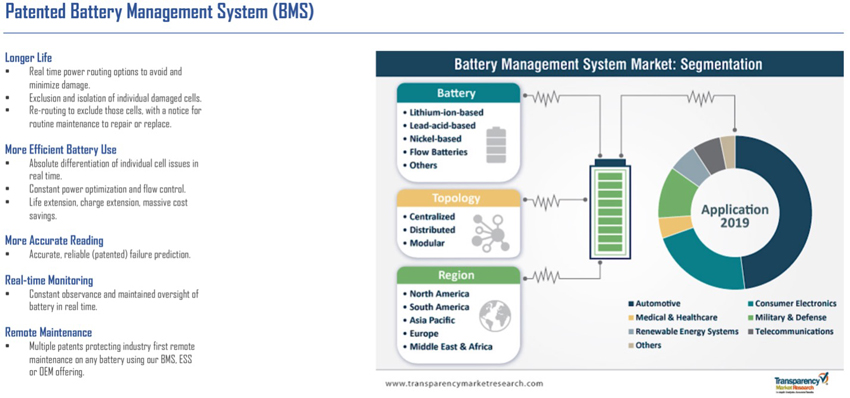

The field is known simply as Battery Management Systems (BMS)—an industry projected to be worth $12.6 billion by 2024,[11] and later $22.3 billion by 2030.[12]

Today, we’ve identified an incredibly overlooked BMS stock, with a plethora of battery disruptive technologies that could soon become the backbone of the energy revolution…

No, we’re not talking about Tesla Inc. (NASDAQ:TSLA).

Although, we ARE talking about one of Tesla’s most innovative competitors to date.

In their journey to launch, we believe this company has the best chance of challenging Tesla as a household within the household itself.

Just recently, they announced the specs for the launch of their Home Smart Wall technology built with state-of-the art patented AI-driven technology, that’s designed to compete with, and potentially outperform Tesla’s Powerwall.

The Home Smart Wall’s system is the “only product in the market that is able to remotely analyze and repair your battery system.”

The launch of this ground-breaking technology is set for the coming weeks, while this company hopes to be able to deliver the Home Smart Wall series to customers’ homes within 2021.

However, investors looking to capitalize on this company’s innovation don’t have to wait, as it’s not only trading publicly now, but it’s at an early-enough stage that the rest of the market has yet to take notice of the revolutionary potential of their technology before it takes off.

Bringing the Home Smart Wall and other fascinating battery breakthroughs to market is the up-and-coming stock:

Extreme Vehicle Battery Technologies Corp. (OTC:CRYBF) (CSE: ACDC).

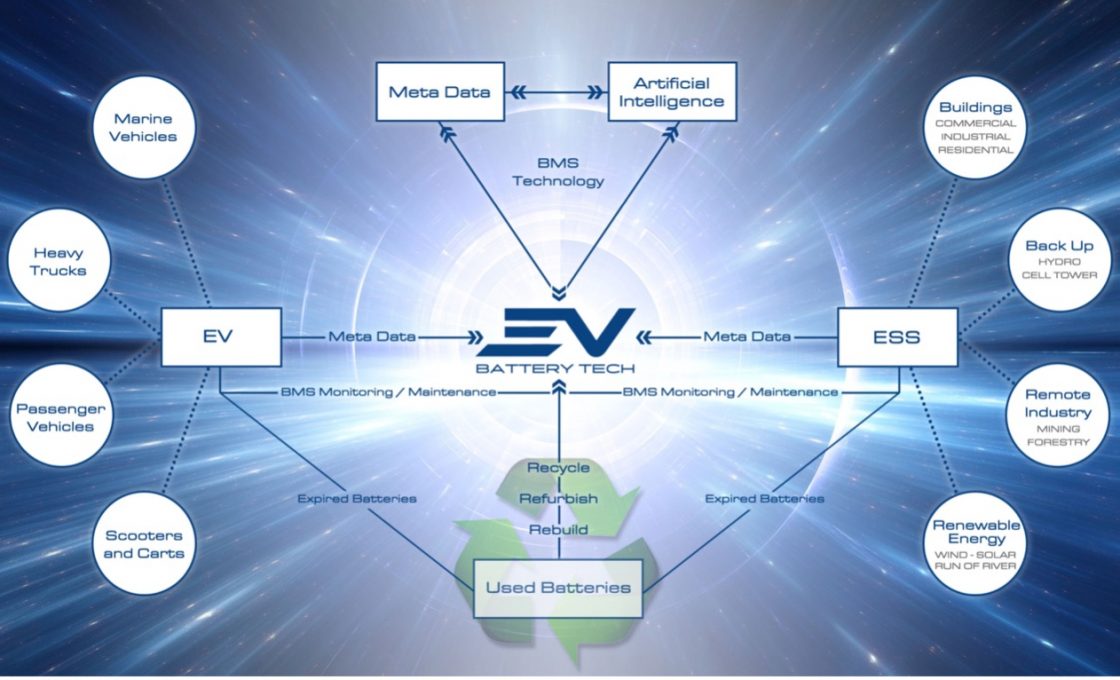

With a growing library of BMS technology patents designed to meet the growing demand for scalable, smart solutions for both the rapidly growing Electric Vehicle (EV) and Energy Storage Solution (ESS) markets, EV Battery Tech is perfectly positioned to make 2021 an electric year for their investors.

—

Meet EV Battery Technologies

and the

5 Advantages That Position this Company

for a MAJOR Disruption in the Space

- AI-Integrated Smart BMS Technology

One of the ONLY current battery management system platforms today that offers two-way communication between the grid, the energy storage system, and the energy generation sites—providing the solutions of tomorrow TODAY. - Strategic Partnership with Established Battery Leader

EV Battery Technologies has secured a crucial partnership with Chinese preeminent battery technologies developer Jiangsu RichPower New Energy Co. Ltd, which is already supplier for Tesla and has established its own commercial market in Asia. The agreement gives EV Battery Tech exclusive rights to distribute and implement these systems in North and South America, Europe, and Africa. - MAJOR Efficiency Upgrades

EV Battery Tech’s offerings provide an improvement over the existing in multiple ways, including: Individual cell replacement within battery pack (instead of full replacement)

Repairs and real-time monitoring of each cell within the entire battery pack Remote monitoring and maintenance

AI-driven system improvements

Real-time collection of Meta Data

Life extension due to smart BMS which works and repairs cells - Ecologically Responsible and Active

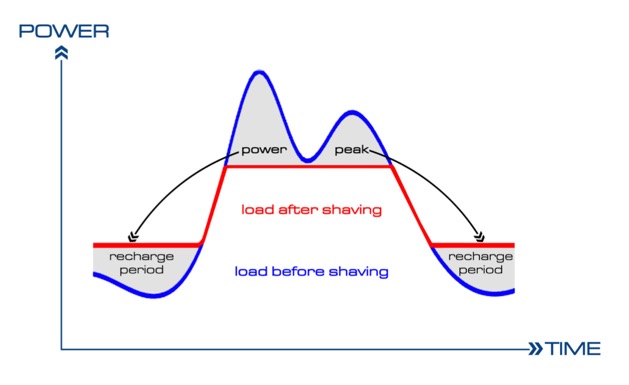

EV Battery Tech (OTC:CRYBF) (CSE: ACDC) uses used/recycled batteries in all of their solutions. By doing this, their reliance upon new sources of raw materials is diminished, while also doing their part to reduce and eliminate e-waste, which in 2020 alone reached over 53 million tonnes.[13] - Dynamic Peak Shaving

By incorporating a BMS of EV Battery Tech’s calibre, utility providers, large buildings, smart charging stations and remote industrial operations can all benefit from what’s called Dynamic Peak Shaving which means energy can be purchased outside of the grid’s peak use times to recharge the ESS, and handle large portions of the load through smart battery management during the times of greatest consumption. This provides not only better grid security, but also could represent massive savings for users who would be purchasing less energy during the times of its most expensive rates.

INTERMITTENT POWER DELIVERY, SIMPLIFIED

We’re entering an age where renewable energy is starting to dominate the discussion over where our power needs to come from.

Unfortunately, in many cases, these power sources (ie. wind, solar, wave etc.) come with challenges that need to be overcome before they can be fully relied upon.

When power is generated in those forms, the timing doesn’t always correlate with the heavier demand periods that the grid and its huge amount of consumers want it.

So whenever a utility provider talks about these types of power sources, inevitably that discussion will include what’s known as an Energy Storage Solution (ESS).

Typically when they do this, they’re referring to a lithium-ion grid-integrated solution—ie. a giant battery location.

But you can’t safely and efficiently have that without a Battery Management System (BMS).

Currently, the world is operating these projects with only basic BMS capabilities.

What Extreme Vehicle Battery Technologies Corp. (CSE:ACDC) (FSE:EVBT) offers to enhance this solution is an AI-integrated smart BMS.

As the world transitions to smart grids, this will be an absolute requirement to handle the load.

By implementing a smart BMS system, such as EV Battery Tech’s, the end-users benefit greatly from more sustainable power consumption that’s balanced out by what’s called Dynamic Peak Shaving.

This allows the system to recharge and store energy during the periods of lower consumption, and deliver energy to help carry the load during those peak times of need.

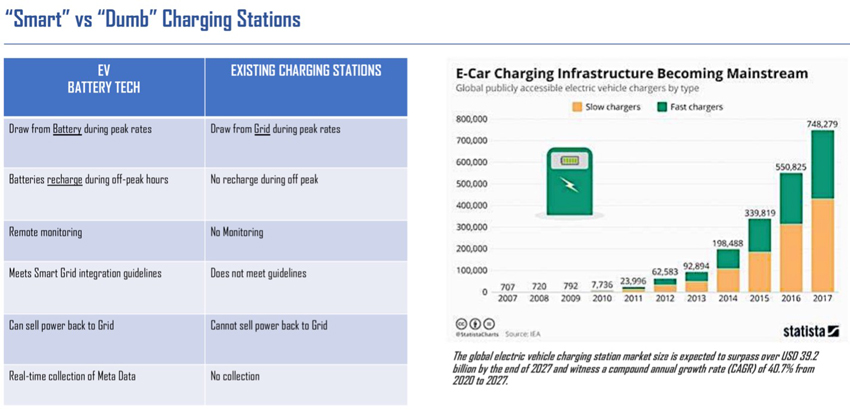

As well, this can (and should) significantly help usher in the electric vehicles revolution, which today is being hampered by inefficient charging station technology.

In the case of what EV Battery Tech (OTC:CRYBF) (CSE: ACDC) is offering, it breaks down to a “smart” vs “dumb” charging station debate.

Essentially, if a grand rollout of new infrastructure is coming to accommodate the wave of EVs hitting the roads in the years to come—it would be extremely wise if they were done “smartly”.

This means, incorporating peak dynamic shaving, remote monitoring, meeting smart grid guidelines, and collecting real-time meta data to improve efficiency.

PROVIDING THE RIGHT SOLUTIONS TO TRANSITION TO RENEWABLE ENERGY… TODAY

While there is still quite a bit of planning underway to move major population centres and energy demands over to renewables, the reality is it’s going to take some major technological advancements before we can safely make the jump.

Thankfully, EV Battery Technologies (CSE:ACDC) (FSE:EVBT) is offering one of the best solutions for this transition TODAY.

In order to get to where we need to be, there needs to be big technological shifts in everything from delivery of power to storage of power to maintenance of power… and ultimately how we consume power.

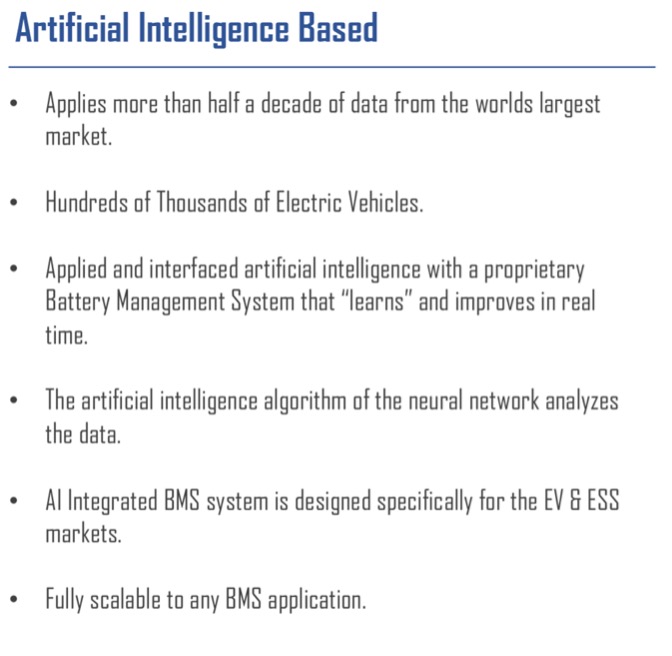

And all that requires smart Artificial Intelligence (AI) learning, which is central to EV Battery’s offerings.

However, in order to have proper AI, you’re going to need roughly 10+ years of data points gathered—all of which need to be all encompassing to be valuable.

Hence, this is where the partnership with RichPower is so crucial.

Despite the fact that EV Battery Technologies has only been trading publicly since late last year, they come fully loaded with the expertise of RichPower, which has been developing this technology for quite some time now.

In this field, RichPower’s expertise is respected and drawn upon for several new battery tech platforms. Even Tesla sources some of their materials from RichPower.

Therefore, the relationship with RichPower and its over 70 globally recognized patents give EV Battery Technologies a huge running head start.

Through the partnership agreement, EV Battery Technologies has exclusive rights to these patents in a wide variety of markets, as they launch their products into North and South America, Europe, and Africa.

—

“We are very happy to be bringing our technology to the global markets through our partner EV Battery Technologies. We are extremely proud of our technology and the market share we have captured in Asia and we are now excited to partner with EV Battery Tech to become a disruptive force in the global markets.”

– Jingke (Jack) Han, President and CEO of RichPower

—

CHINA’S COMMERCIALIZED ENERGY SOLUTIONS, NOW FOR THE WORLD’S BENEFIT

The patented technologies exclusively offered through EV Battery Technologies (OTC:CRYBF) (CSE: ACDC) provide significant improvements to the basic BMS options currently in place, including: Longer Life, Heightened Battery Use Efficiency, More Accurate Reading, Real-Time Monitoring, and Remote Maintenance.

Longer Life comes from real-time power routing options to avoid and minimize damage. This includes the innovation of exclusion and isolation of individual damaged cells. The system re-routes power by excluding these damaged cells, while delivering a notice for routine maintenance to repair or replace the problematic source.

Overall this leads to heightened battery use efficiency. By differentiating between individual cell issues in real time, the system can continue to deliver constant power optimization and flow control, while also extending the life of the battery and delivering massive cost savings.

System administrators are given the tools to accurately read the system as it is running, and make adjustments (ie. repairs, re-routings, replacements and schedule maintenance) on the fly.

“We are very fortunate to be bringing proven technology to the North American market. RichPower has not only commercialized these technologies but made a name for themselves in China. We now have the opportunity to work with them to become an early mover in the North American market.”

– Bryson Goodwin, President and CEO of EV Battery Tech

THE INVESTMENT OPPORTUNITY

While the latest release for EV Battery Technologies (OTC:CRYBF) (CSE: ACDC) targets the home through the Ionix Home Smart Wall product, the company is very much focused on targeting the even larger markets of utility-scale operations—ie. large-scale ESS sites.

Even should they capture a small percentage of those BMS contracts, and EV Battery Tech instantly becomes a very successful company.

As it stands now, the general public is likely more aware of the battery manufacturers themselves, such as Tesla, Panasonic, and Energizer, to name a few.

But the BMS space itself is lesser known, and involves a very small number of players.

So for EV Battery Tech to enter this portion of the market with a smart solution, doesn’t come with the kinds of barriers to entry as some might expect at this stage in the game.

We’re talking about an EARLY play here. This is a NEW industry unfolding before our very eyes.

And it’s growing quite rapidly, as the Global Battery Management System Market is expected to rise at an incredible CAGR of around 18.5% until 2025.[14]

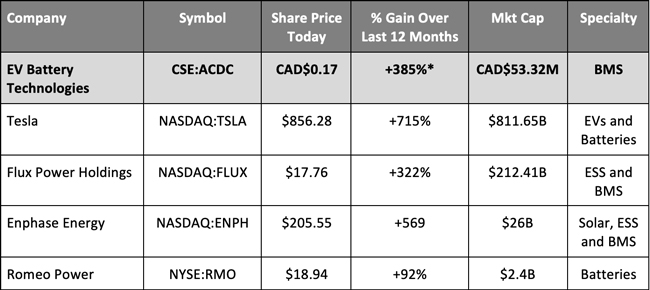

*EV Battery Technologies only began trading in October 2020.

**All prices (unless marked) in USD, and taken from Yahoo! Finance on January 12, 2021

HOW IT WORKS

For any renewable energy revolution to take place, the tw o aspects of storage and management are absolutely fundamental to the success of the operation.

Right now, the newly generated energy is stored in large ESS sites, and the grid draws upon them as needed.

It’s a one-way transaction.

Where the future is going, is a two-way transaction.

The grid and the ESS need to communicate back and forth to work at peak efficiency levels.

More importantly, the BMS system—provided by EV Battery Technologies (OTC:CRYBF) (CSE: ACDC)—needs to work in a cohesive way, communicating not only with the grid itself, but also with the energy provider (ie. solar or wind generation sites).

Bringing these two entities together in harmony is key to this working out well for us.

EDITOR’S NOTE: Current BMS systems don’t do this at all!

“Our solution is pretty much the only solution of today that will meet the requirements of tomorrow, on this market of grid integration.”

– Bryson Goodwin, President and CEO of EV Battery Tech

PROVIDING THE SOLUTION FOR LI-ION BATTERIES

As it’s been stressed throughout this report, in order to achieve any grand goals of moving to renewable energy sources, it’s clear that Energy Storage Systems (ESS) will need to be in place.

Many of those in use at the moment are based on lithium-ion batteries—which EV Battery Technologies (OTC:CRYBF) (CSE: ACDC) provides solutions for.

As we transition, this form of battery may change too. However, with over ten years of accumulated data at its disposal, EV Battery Tech is well equipped to handle today’s batteries, as well as to tomorrow’s.

This isn’t just simple data, either. It’s very complex data that’s been used to train the AI to work as efficiently as possible.

EV Battery Tech’s AI-integration allows for remote maintenance and monitoring, and even in some cases allows for repair.

For safety reasons, their system will even go in and re-route power around broken or defective cells. Because of the sheer enormity of these ESS platforms, and the energy levels they contain, this type of BMS presents an absolute gamechanger, that could give more confidence to markets that have witnessed accidents such as in Arizona, and allow them to more comfortably make the switch.

By integrating EV Battery Tech’s BMS, the power supply not only can continue to deliver, but to do it safely and securely.

The applications of such a technology are vast, moving beyond just utility-scale operations, but also into medical and healthcare, telecommunications, military and defense, consumer electronics, and also electric vehicles (EVs).

—

RECAP

Before we move into the age of renewable energy, some BIG changes are needed in terms of the technology required to maintain such a system.

Thankfully, there are solutions available TODAY—and they’re coming from Extreme Vehicle Battery Technologies Corp. (OTC:CRYBF) (CSE: ACDC).

SMART. EFFICIENT. SECURE.

They’re poised to deliver BATTERY MANAGEMENT SYSTEMS that no one else today is providing, with the expertise, data, and technology behind them to truly capitalize on a MAJOR investment opportunity only seen once per generation.

Staff Editor

Equity Insider

SOURCES:

[1] https://www.starcourier.com/story/news/2020/12/09/legislators-revisit-green-energy/3865854001/

[2] https://www.shropshirestar.com/news/business/2021/01/05/aceon-joins-call-for-vat-change-on-energy-storage-technology/

[3] https://www.tdworld.com/utility-business/article/21151118/us-senate-passes-american-energy-innovation-act

[4] https://www.theguardian.com/australia-news/2021/jan/05/australia-inching-closer-to-committing-to-net-zero-by-2050-top-energy-advisor-says

[5] https://insideclimatenews.org/news/07012021/inside-clean-energy-energy-battery-storage-boom/

[6] https://www.woodmac.com/press-releases/global-storage-market-to-grow-from-12-gwh-to-158-gwh-by-2024/

[7] https://cleantechnica.com/2020/01/17/us-energy-storage-market-may-grow-12x-by-end-of-2024-interview/

[8] https://www.bloomberg.com/press-releases/2020-02-25/battery-technology-market-worth-152-3-billion-by-2025-exclusive-report-by-marketsandmarkets

[9] https://www.greentechmedia.com/articles/read/global-energy-storage-double-six-times-by-2030-matching-solar-spectacular

[10] https://www.azcentral.com/story/money/business/energy/2020/12/14/aps-restarting-battery-installation-after-fire-explosion-2019/6543414002/

[11] https://www.bloomberg.com/press-releases/2019-11-11/battery-management-system-market-worth-12-6-billion-by-2024-exclusive-report-by-marketsandmarkets

[12] https://sg.finance.yahoo.com/news/battery-management-system-bms-market-140300506.html

[13] https://www.reuters.com/article/us-global-waste-un-report-idUSKBN243255

[14] https://www.marketwatch.com/press-release/battery-management-system-market-size-to-surpass-18-cagr-2020-to-2025-2021-01-07

DISCLAIMER:

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Equity Insider is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for EV Battery Technologies advertising and digital media from the company directly. There may be 3rd parties who may have shares of EV Battery Technologies, and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of EV Battery Technologies which were purchased as a part of a private placement. MIQ reserves the right to buy and sell shares of EV Battery Technologies, and will buy and sell shares of EV Battery Technologies at any time commencing immediately without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been reviewed and approved by EV Battery Technologies; this is a paid advertisement, and we own shares of EV Battery Technologies that we will sell, and we also reserve the right to buy shares of the company in the open market, or through further private placements and/or investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

Protected: Red-Hot Battery Technology Space Poised for Great Disruption with New AI-Based Tech

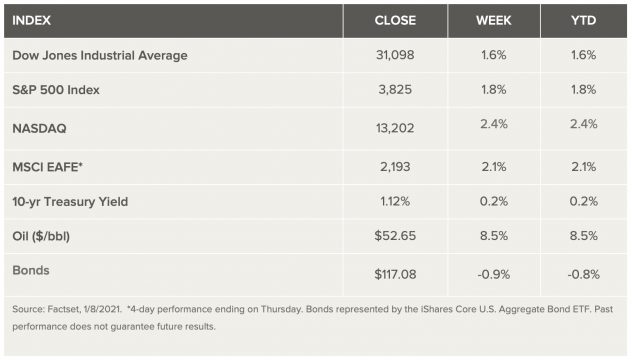

Weekly Market Review – January 9, 2021

Stock Markets

World stock markets saw strong gains as major indices broke records during the first week of trading for the year. Following the two runoff elections in Georgia, Democrats gained the majority in the Senate that may signal further fiscal stimulus later in the year to push economic recovery. An increase in corporate tax rates is a possibility as a result of Democrat control of the government, although this may not be a priority for 2021 due to the tenuous economic recovery and the party’s slim majority. For the first time in nine months, ten-year yields rose above 1%, and anticipation of strong performance in the post-vaccine phase caused small-cap and international stocks to outperform. The positive sentiment was bolstered by the return of WTI oil prices to February levels, rising above $50 in response to announcements of an expected production cut by Saudi Arabia.

U.S. Economy

Over the past week, economic data showed a combination of resiliency and lockdown stress. Political uncertainties dominated the news, and expectations of a policy stimulus and post-vaccine recovery pushed stock market activity. The optimism surrounding the economy’s strong underlying fundamentals, expectation of corporate profits, and stable interest rates fueled the stock gains and signaled investors’ bright outlook in the long-term.

- The market performed well over the past year, posting a 10% average return. Considering that this is a presidential election year, the market gains are encouraging.

- A Democratic White House and Congress are expected to push for fiscal stimulus through increased aid for households and increased government spending that may include an infrastructure bill. These measures are expected to boost the economy despite an increase in public debt.

- The 34% market plunge that occurred in 2020 as a result of the pandemic lockdowns is an aberration that quickly recovered with a 60% rally in the past five months. A new bull market has most likely begun, sustained by increasing corporate earnings and low interest rates that will continue to give rise to a strong domestic and global economy.

The bottom line is that we are likely seeing the early stage of a new economic expansion. Pressures from pandemic protocols and the resulting constraints on business activity may cause temporary stalls such as the loss of 140,000 jobs in December, the first monthly loss since April. However, these are expected to give way to a sustained new normal for the rest of the year and beyond.

Metals and Mining

The gold price corrected as of Friday, the 8th of January, closing below $1,900 per ounce after gaining for three consecutive weeks. The fall was caused by the strengthening of the US dollar and the 10-year Treasury yield. Ahead of the break-in at the Capitol building last Wednesday, gold reached a five-day peak of US$1,956; it was valued at $1,863.88 as of 11.01 a.m. EST on Friday. Downward pressure was also felt from the rising bitcoin value that set a record all-time high of US$41,000. Demand for bitcoin rose 39% from the 1st of January, causing a 2% decline in the price of gold. The corresponding movements in prices of these two investment vehicles appear to suggest that the market perceives them as competitors.

Silver likewise ended the week down after mid-week volatility. Values climbed to a five-day high of US$27.79 per ounce before the open of trading on Wednesday, the January 6th; a sharp decline followed thereafter. The downward momentum continued on Thursday, dipping below US$26 to settle at US$25.81 on Friday. Platinum rose to a 10-month high at $2,394 per ounce on Tuesday then corrected to a low of $2,226 then rebounded to end the week at US$2,247.

While the broad precious metals sector may experience further volatility, base metals were buoyed by a positive outlook over potential infrastructure development. Copper, zinc, nickel, and lead prices all made strong showings for the week due to strong forecasted demand.

Energy and Oil

The commitment by Saudi Arabia to further reduce production has fueled a solid rally that saw Brent topping $55 per barrel before the week’s close. Other developments were at play, such as the monetary stimulus package, potential for a deeper stimulus moving forward, and optimism on the effectiveness of the covid vaccine. The steady rise over the last two and a half months, with one slight interim correction, suggests an underlying market resiliency that is expected to remain bullish in the medium term. In the US., the near-term future of shale is bleak as the likelihood of an increase in supply will remain lackluster for the coming years. Aggressive drilling has been dismissed by shale producers as they project annual growth to remain capped at 5%.

In related developments, coal prices are rising as China’s demand for heat increases due to the prevailing cold winter in the northern hemisphere. Producers of lithium, which makes renewable energy possible, saw a severe drop in prices in anticipation of rising production costs, but there remain strong incentives to be bullish about this energy-linked sector. One reason is the full swing of automotive manufacturing from fossil fuels to renewable energy. The share price of Tesla, the leading electric vehicle (EV) manufacturer, rose more than 700% over the past year. Other stocks in the EV sector have shown similar gains.

Natural Gas

U.S. exports of liquefied natural gas (LNG) achieved a record high in the last month of 2020, continuing its November trend with an average of 9,8 billion cubic feet per day (Bcf/d). JKM benchmark prices for LNG continues to soar as spot prices for delivery in kay Asian LNG-consuming countries surged to a six-year high in large part due to the prevailing colder-than-normal winter. This compensates for the historically low prices encountered from April to July 2020 in Asia and Europe. The price slump began to reverse in August, and prices have now more than quadrupled. Since mid-October, prices for natural gas and LNG in the global spot and futures markets have exceeded the crude-oil indexed long-term LNG contracts despite the latter’s increase since September. The recent price increase in long-term contracts resulted from supply shortages caused by unplanned outages of several global export facilities. Fifty percent of U.S. exports since June went to Asian countries, 30% to Europe, and the remainder to the Middle East, Africa, and Latin America, according to reports by the U.S. Department of Energy and the U.S. Energy Information Administration (EIA) as of November 2020.

World Markets

Stricter lockdowns in Europe imposed in response to coronavirus resurgence have generally been shrugged off by the markets. Prices rose on hopes of renewed recovery resulting from a swift vaccine distribution and a potential massive U.S. stimulus package. The pan-European STOXX Europe 600 Index closed the week 3.04% higher. Gains were registered by Germany’s Xetra DAX Index (2.41%), Italy’s FTSE MIB (2.52%), and France’s CAC 40 (2.80%). UK’s banking and energy sectors led the 6.39% surge in the FTSE100 Index. Core eurozone government bond yields likewise ended higher, despite being tempered by weaker-than-expected eurozone inflation data and continued pandemic concerns. Peripheral eurozone bond yields fell for the week as it responded inversely to the core markets. Demand for high-quality government bonds fell while UK gilt yields rose. Germany’s economic data remained strong with better-than-expected trade and production figures together with robust factory orders data, suggesting a fourth-quarter expansion.

In Asia, Japan’s Nikkei 225 Stock Average advanced 2.5% to close the week at a multi-decade closing high of 28,139.03. The yen weakened against the U.S. dollar to close near JPY 104. A new spike in coronavirus cases has prompted Prime Minister Yoshihide Suga to declare a state of emergency in Tokyo and its surrounding prefectures effective Friday, January 9th. Measures to be implemented by the prime minister will be “limited and concentrated” to minimize the adverse economic impact. In China, the CSI 300 Index gained 5.5% and the Shanghai Composite Index rose 2.8% over their December 31 closing levels. Investor sentiment was shaken, however, over NYSE’s delisting of three Chinese telecommunication companies.

In other key markets, Saudi Arabia’s Tadawul All Share Index experienced a 5% correction from its strong close on December 31st. Earlier in the week, investors were greeted with the positive news of the resumption of normal trade and travel ties between Qatar and Saudi Arabia, the UAE, Bahrain, and Egypt. On January 5th, the five nations signed the reconciliation agreement that ended the three-and-a-half-year rift between them. On the same day, OPEC and non-OPEC oil-producing nations (aka Opec+) agreed to keep production flat. In Mexico, the IPC Index declined by 6% over the week. Inflation was reported at 3.15% year-over-year compared to 3.33% in November, which was generally in line with expectations.

The Week Ahead

The coming week signals the unofficial start to the earnings season during which time quarterly earnings reports are expected to be issued by national and regional banks. Important economic data to be released include industrial production, retail sales, and inflation figures.

Key Topics to Watch

- NFIB small-business index

- Job openings

- Consumer price index

- Core CPI

- Beige Book

- Federal budget

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Import price index

- Retail sales

- Retail sales ex-autos

- Producer price index

- Empire state index

- Industrial production

- Capacity utilization

- Consumer sentimental index (preliminary)

- Business inventories

Markets Index Wrap Up