US Economic Advisers are pushing a massive spending package, with a giant infrastructure plan that should blast copper demand into orbit.

Under the moniker of “Build Back Better”, economic advisers for the current US administration are championing a sweeping $3 trillion package to boost the economy, beginning with a massive infrastructure plan.

Once news of the new planned US spending hit the market, demand for metals rose. There was one critical metal in particular that seriously took off hitting a nearly 10 year high… COPPER.[1]

We believe we’ve identified a company that’s perfectly positioned to capitalize on the days ahead, with a pair of enviable properties in a country about to see a major MINING BOOM.

Emerging copper & gold mining developer Ridgestone Mining Inc. (OTC:RIGMF, TSXV:RMI) is poised for a breakout in TWO of Mexico’s top producing mining districts—including the country’s top producing copper region, Sonora.

Mexico’s mining output has already rebounded above pre-pandemic levels, despite ongoing challenges presented by the global health crisis.[2]

But will it be enough?

There’s a SERIOUS global shortage of copper on the horizon—a gap projected to reach 10 million tons in the next decade.[3]

Goldman Sachs has warned of this historic shortage, stating: “the market now on the cusp of the tightest phase in what we expect to be the largest deficit in a decade.”[4]

Among the top producers of copper in the world is Peru, where their central bank just cut projections, due to COVID-related challenges to production.[5] Neighboring Chile is ramping up what it can, with BHP’s Spence Mine expected to hit peak production later this year.[6]

And don’t think that those massive supplies in Chile and Peru will be headed towards the USA to meet this infrastructure boom. Most of those large, copper-loaded ships are headed for Chinese ports.[7]

It’s beginning to look like North American demand will need to be met by North American supply.

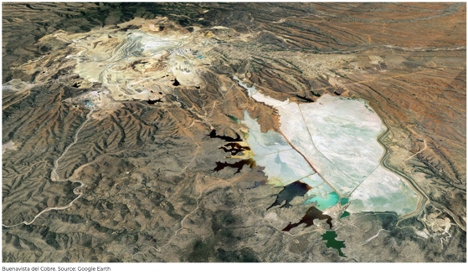

Much more will be expected out of one of the largest copper mines in the world by reserve, Buenavista (aka Cananea) Mine.

Currently the 5th largest copper mine in the world[8], the Buenavista Mine is located in Sonora State. It’s owned and operated by Group Mexico, which trades in the USA under the name Southern Copper Corporation (NYSE:SCCO).

It’s also one of the oldest open-pit mines in North America. The importance of the Buenavista Mine is heightened for Southern Copper, especially because the company recently had to cancel its Tia Maria copper project in southern Peru because of “anti-mining terrorism” in the area.[9]

So the focus back on Mexico appears to be even more warranted than before.

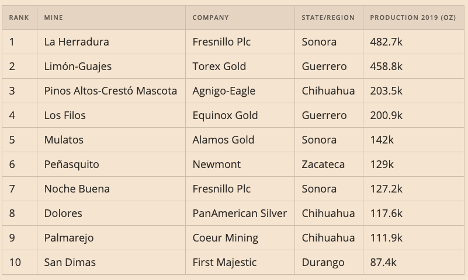

Among the Top 10 producing mines in Mexico, 6 are located within the mining districts of either Chihuahua or Sonora.

Ridgestone Mining Inc. (OTC:RIGMF, TSXV:RMI) has established its properties within both of those districts, they’re surrounded by bigger players that will (as will we) be paying very close attention to their developments in the months to come.

In 2021, Ridgestone Mining Inc. (OTC:RIGMF, TSXV:RMI) is looking to advance both its copper-gold Rebeico project and gold-silver Guadalupe y Calvo projects.

After successfully closing TWO over-subscribed private placements, raising $2.32 million earlier this year, Ridgestone Mining is well capitalized and good to go.

We expect BIG results from a still-very-small company, which is primed for a growth spurt in 2021…

5 Key Highlights Pointing at Ridgestone Mining as a Perfect Mining Opportunity in Mexico

- TWO high-grade mining projects located within Mexico’s prolific Sierra Madre gold belt

- Exploration-stage Rebeico copper-gold project in Sonora

- Resource-stage Guadalupe y Calvo gold-silver project in Chihuahua

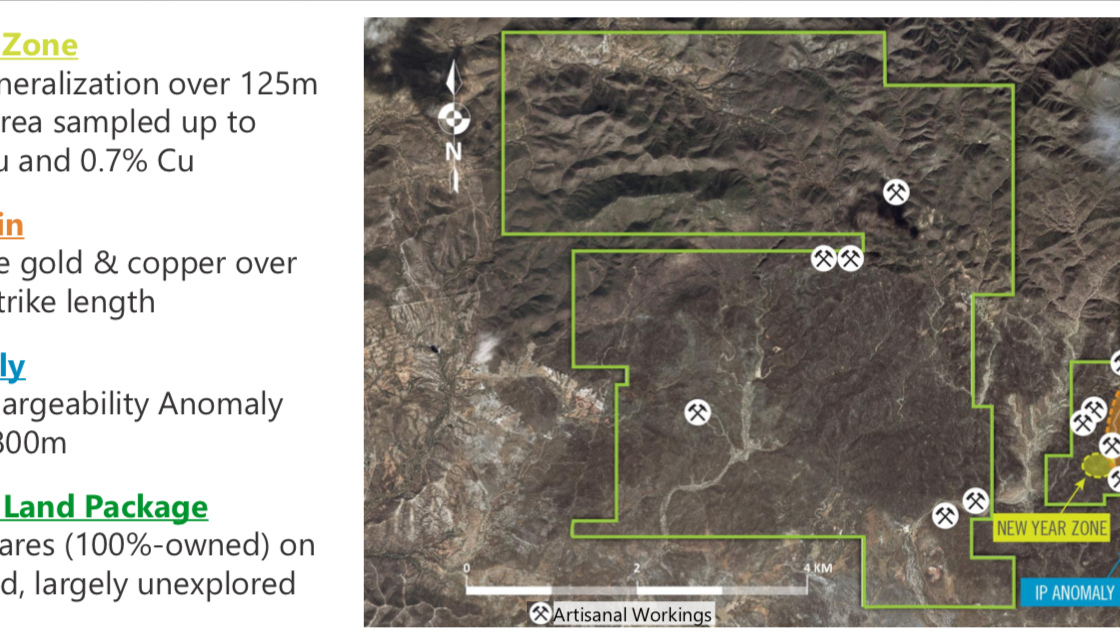

- Rebeico copper-gold project encompasses 3,459 hectares of private land with numerous artisanal gold and copper workings.

- Multiple mineralized zones identified: the Alaska Vein, the New Year Zone, the IP Anomaly, and a number of historic mines including the El Cobre copper mine.

- Past exploration highlights include:

- Alaska Vein

- 1.5 metres grading 1.2% copper plus 36.1 g/t gold

- 1.0 metre grading 5.95% copper plus 17.70 g/t gold

- New Year Zone

- 16.25 metres grading 1.79% copper plus 2.13 g/t gold

- Waste Dumps (from surface waste dumps/waste material from mining in the 1960s)

- 111 samples with an average grade of 0.8% copper plus 2.5 g/t gold

- El Cobre Mine (underground mine operated during the 1960s, samples taken from waste material)

- Samples grading over 2.4% copper

- IP Anomaly

- A potential copper-gold porphyry highlighted by a target spanning 1,400 metres by 800 metres

- Alaska Vein

- Guadalupe y Calvo (GyC) gold-silver project is located within a mining district with historic production of over 2 million ounces of gold and 28 million ounces of silver.

- Mineralization is characterized by low-sulfidation epithermal veins with multiple vein structures identified over a 3km strike.

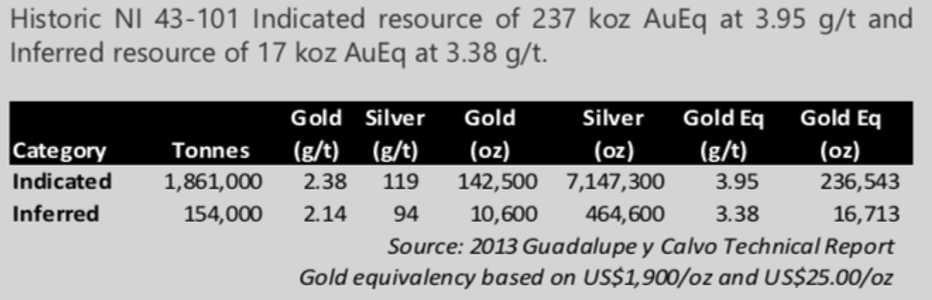

- GyC hosts a historical estimate NI 43-101 Indicated resource of 237,000 oz AuEq at a grade of 3.95 g/t AuEq and Inferred resource of 17,000 oz AuEq.

- Resource remains open for expansion along strike and at depth.

- Proven management team with a track record of discovery and monetization in Sonora State.

- Past successes include:

- Sale of the largest moly deposit in Mexico for $195 million

- Discovery of three gold deposits and one copper deposit which have become significant mines (two of which are still active in Sonora)

- Past successes include:

Copper-Gold Asset: Rebeico Project

Rebeico is located 115km east of Hermosillo, a main operations support hub for the Sonora mining district.

Comprised of 16 concessions totaling 3,459 hectares on private land(no ejido), the Rebeico is accessible by highway and a network of all-weather roads.

Infrastructure is great, as there are grid electrical power lines within 6.5 km of the property.

Historic exploration on the property focused on the Alaska Vein and New Year Zone.

Alaska Vein drilling highlights included:

- 1.2% Cu and 36.1 g/t Au over 1.5 m

- 2.4% Cu and 8.3 g/t Au over 3.25 m

- Including 5.95% Cu and 17.7 g/t Au over 1 m

- 2.8% Cu and 8.7 g/t Au over 2m

New Year Zone drilling highlights includes:

- 1.79% Cu and 2.13 g/t Au over 16.25m

- 0.54% Cu over 29.15 m

On top of the two primary zones are additional prospective signs of copper potential. These include samples from historic mines, and waste by-products.

Waste Dumps (waste material from mining in the 1960’s) data includes:

- 111 samples with an average grade of 2.5 g/t gold plus 0.8% copper from surface waste dumps (waste material from mining in the 1960’s)

El Cobre Mine (historic mine that operated into the 1960s) data includes:

- Waste material grading over 2.4% copper

IP Anomaly:

- Potential copper-gold porphyry highlighted by a target spanning 1,400 metres by 800 metres

Case Study 1: Southern Copper’s Buenavista Mine

Roughly 125 miles separate RMI’s Rebeico Project and Southern Copper’s Buenavista mine, which are both along the same trend in the prolific Sonora Mining district.

The Buenavista Mine is the oldest operating copper mine in North America, dating back to 1899.

In 2019, the mine produced 965 million pounds (Mlbs) of copper, which accounted for approximately 44% of the company’s total production for that year. The mine also produces silver and molybdenum as by-products. The contained copper at the mine is estimated to be 22.1Mt.[10]

According to the CFO of Southern Copper Corp., Raul Jacob, the company wants to almost double output by 2028, and possibly become the world’s largest producer.[11]

Jacob stated: “If this [copper] price level holds, we should see announcements of new projects coming in the market.”

It’s important to note that in order for Southern Copper to get there, the company has stated it will look at acquisition opportunities that come along, with asset quality being a top priority.

Given that the Rebeico Project is in the same mining district, and comes with full control given the private ownership of the rights, this could potentially make Ridgestone Mining a serious candidate in the years to come, with a very healthy valuation due to a better price environment.

“We feel comfortable in Latin America and very comfortable and positive about copper,” Jacob added, in an interview with Mining.com.

Between March 2020 and March 2021, shares of Southern Copper Corporation (NYSE:SCCO) has seen its shares rise from $26.57 on March 24, 2020 to a high of $81.53 in February 2021—for a rise of +200% in one year.

Gold-Silver Asset: Guadalupe y Calvo (GyC) Project

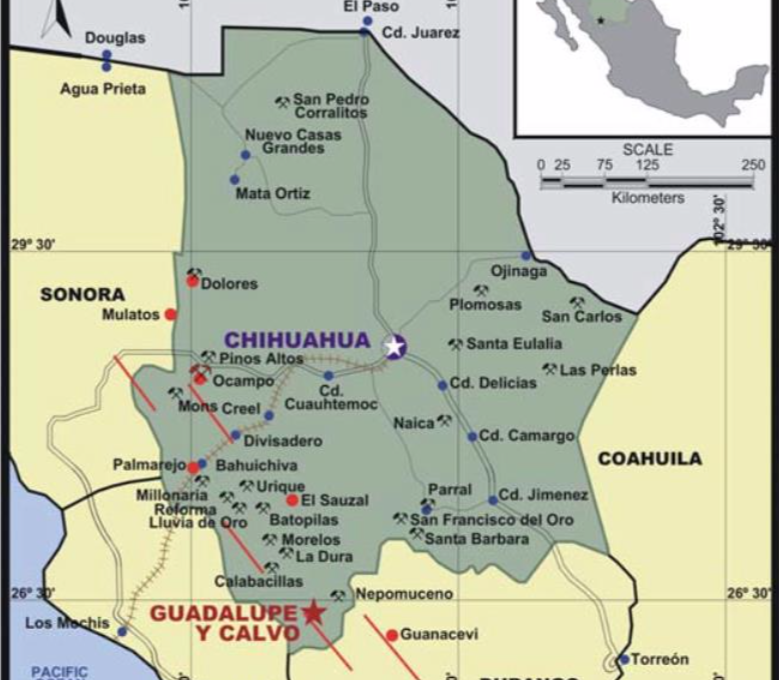

Located in the town of Guadalupe y Calvo, in SW Chihuahua State (~300km south of Chihuahua City) with excellent road access and strong local infrastructure.

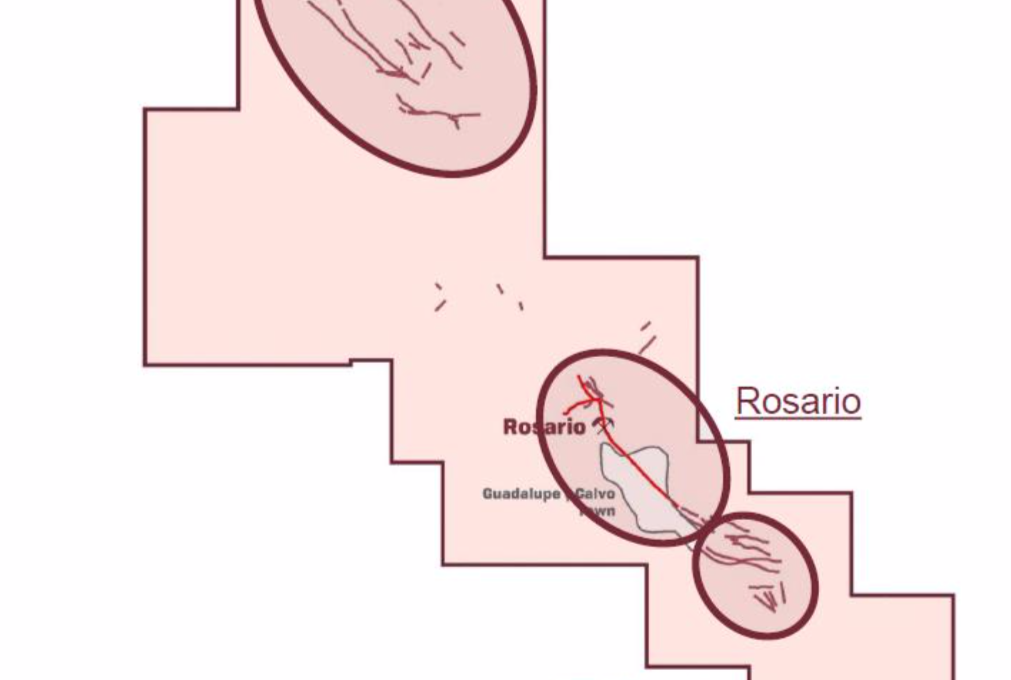

Comprised of 2,750 hectares of contiguous claims covering numerous historical workings, including the Rosario Mine.

Dating back to the 1930s, the Rosario Mine produced over 2 million ounces of gold, and 28 million ounces of silver.

Due to water-handling capabilities of the time, this historic production was limited… NOT because of the mineralization.

That means, that with today’s technology, it’s game on to get this project back up and running!

Management recognized this, as there are EXCELLENT near-term opportunities for resource growth in place, through additional drilling—Mineralization remains OPEN along strike and at depth.

Already there’s been significant exploration (over 200 drill holes) done in the past by companies that are now part of Goldcorp, Aurico Gold, and Endeavour Silver totaling over 50,000 metres.

Included within those drilling results were 4.1 g/t Au and 281 g/t Ag over 2.5 metres with NUMEROUS targets identified for follow-up exploration.

The Northwest striking Rosario fault complex is the project’s main structural feature, with a total width of the mineralized zone up to 80 metres.

Underground historic mining had widths of high-grade gold-silver mineralization up to 10 metres.

Case Study 2: Coeur Mining’s Palmajero Mine

Ridgestone Mining’s (OTC:RIGMF, TSXV:RMI) y Calvo Project is located near the city of the same name, which is just over 100 miles along trend to the southeast of the Palmajero Mine, owned and operated by Coeur Mining, Inc. (NYSE:CDE).

The property consists of a land position that totals approximately 27,233 hectares.

In 2020, the mine produced 6.3 million ounces of silver and 110,608 ounces of gold.

The Palmarejo silver-gold complex consists of:

- the Palmarejo mine and processing facility;

- the Guadalupe underground mine, located about 8 kilometers southeast of the Palmarejo mine;

- the Independencia underground mine, located approximately 800 meters northeast of the Guadalupe underground mine;

- other nearby deposits and exploration targets.

Between March 2020 and March 2021, shares of Coeur Mining, Inc. (NYSE:CDE) has seen its shares rise from $2.88 on March 18, 2020 to a high of $11.14 in February 2021—for a rise of 287% within one year.

Peer Groups in the Mexico Mining World

Ridgestone Mining Inc. (OTC:RIGMF, TSXV:RMI) is surrounded by successful mining operations in both the Chihuahua (GyC) and Sonora (Rebeico) regions.

Together, these regions are both within the Sierra Madre corridor, which has been known for its mineral endowment for a very long time.

This is one of the most mining friendly regions of the country.[12]

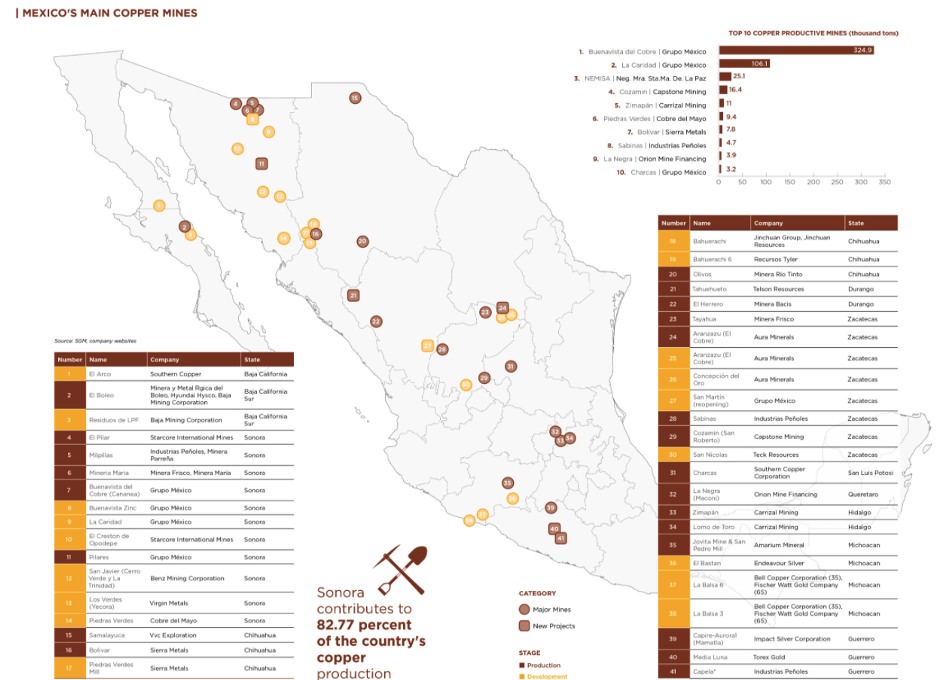

In particular, the Sonora region is Mexico’s most active mining region for both copper and gold[13]—Sonora contributes to 82.77% of the country’s copper production.[14]

The output and copper extracted from Sonora, in particular, is considered top notch quality, which is why the demand for this metal in the area is growing on a daily basis.[15]

Beyond the copper production, according to Mexico´s Mining Chamber CAMIMEX, more than half (6) of Mexico´s ten largest operational gold mines are in those two regions.

| Company | Symbol | Share Price Today | Mkt Cap | State/Region |

| Ridgestone Mining Inc. | OTC:RIGMF TSXV:RMI | $0.165 | $12.44M | Chihuahua / Sonora |

| Fresnillo PLC | OTC:FNLPF | $13.25 | $9.63B | Sonora |

| Southern Copper | NYSE:SCCO | $67.48 | $52.17B | Sonora |

| Starcore International Mines | OTC:SHVLF TSX:SAM | $0.21 | $10.1M | Sonora |

| Minera Frisco | OTC:MSNFY | $0.49 | $1.67B | Sonora |

| Sierra Metals Inc. | NYSE:SMTS TSX:SMT | $3.06 | $500M | Chihuahua |

| Agnico Eagle Mines Limited | NYSE:AEM TSX:AEM | $60.46 | $14.66B | Chihuahua |

| Alamos Gold Inc. | NYSE:AGI TSX:AGI | $8.18 | $3.21B | Sonora |

| First Majestic Silver Corp. | NYSE:AG TSX:FR | $17 | $3.77B | Sonora/Durango |

| Argonaut Gold Inc. | OTC:ARNGF TSX:AR | $1.76 | $541.3M | Sonora |

* All price in USD

** Latest share price taken from Yahoo! Finance on April 13, 2021

Ridgestone Mining’s Management Team

Before it had even acquired its properties, perhaps the #1 asset that Ridgestone Mining had in place was its leadership team. Each member brings a proven track record of discovery and monetization, with expertise specific to Sonora State.

Past successes include the sale of the largest moly deposit in Mexico for $195 million, and the discovery of three gold deposits that have gone on to become significant mines—two of which are still active in Sonora to this day.

Among the talented team, here are some members we felt were necessary to highlight:

CEO & Director – Jonathan George

George is a geologist and mining entrepreneur with over 35 years of experience in exploration, development and financing. Previously President, CEO and co-founder of Creston Moly. Successfully raised $40 million in equity to acquire, develop, and de-risk the El Creston project before selling it to Mercator Minerals for $195 million. Other notable highlights include President and CEO of ESO Uranium, the predecessor to Alpha Minerals which was acquired by Fission Uranium for $185 million.

CFO & Director – Erwin Wong

Wong has over 26 years of experience having served in senior management and board level positions for numerous Chinese and Canadian based enterprises, both public and private, which were involved in various sectors including transport, real estate, mining, life sciences and investment banking. He had also founded a corporate advisory firm which assisted a number of companies with the complexities of initial public offerings, corporate governance and regulatory compliance in various jurisdictions. Erwin Wong is a Chartered Accountant and holds a Bachelor of Commerce from the University of British Columbia.

VP Exploration – Noris Del Bel Belluz

Belluz has over 35 years of experience in operations, exploration, geology and technical evaluations of both underground and open pit mines. Most recently, he was Operations Manager & Acting General Manager for Nevsun Resource’s Bisha mine, which was acquired for $1.8 billion by Zijin Mining Group Co. Previously, he was Manager of Mine Geology for Eldorado Gold’s China operations and with Freeport-McMoRan as Manager of Mine Geology at the Grasberg mine in Indonesia which included a key role in the discovery of the Kucing Liar skarn deposit. Belluz’s technical experience also includes holding senior roles with Stantec Engineering and Wardrop Engineering, overseeing various technical studies from NI 43-101 resource estimates to feasibility studies and detailed engineering. He holds a Bachelor of Science Degree in Geology from the University of Toronto and is a Qualified Person (QP) under NI 43-101.

Advisor – Dr. Andrew J. Ramcharan

Dr. Ramcharan has over 20 years’ experience in operations, project evaluation, mergers and acquisitions, corporate development, project finance and investor relations. Mr. Ramcharan has worked for a number of companies including IAMGOLD Corporation, Sprott Resources and Resource Capital Funds. He holds a Master’s and Ph.D Degree in Mining and Minerals Economics. Andrew is a Registered Member of The Society for Mining, Metallurgy and Exploration (SME) in USA, Licensed Professional Engineer in Ontario, Canada and Fellow of The Australasian Institute of Mining and Metallurgy. A graduate of the Colorado School of Mines, University of Leoben, and Harvard University’s Continuing Education program.

SOURCES:

[1] https://www.reuters.com/article/global-metals-idUSL1N2LA0K9

[2] https://www.bnamericas.com/en/news/mexico-mining-output-rebounds-to-pre-pandemic-levels

[3] https://news.metal.com/newscontent/101425386/Supply-falls-short-of-demand-A-global-shortage-of-10-million-tons-of-copper-in-the-next-decade/

[4] https://oilprice.com/Metals/Commodities/Goldman-Sachs-Historic-Copper-Shortage-Loom-As-Prices-Rocket.html

[5] https://www.mining.com/web/peru-central-bank-cuts-growth-forecast-for-2021-sees-tailwinds-from-rising-copper-price/

[6] https://cn.reuters.com/article/chile-copper-bhp-idCNL1N2KM001

[7] https://www.bloomberg.com/news/articles/2021-02-26/copper-crunch-is-set-to-ease-as-more-concentrate-heads-to-china

[8] https://www.kitco.com/news/2021-03-18/The-world-s-top-10-largest-copper-mines-in-2020-report.html

[9] http://www.laht.com/article.asp?CategoryId=14095&ArticleId=2381146

[10] https://www.nsenergybusiness.com/projects/buenavista-copper-mine-expansion/

[11] https://www.mining.com/web/copper-to-stay-tight-on-long-path-to-new-supply-top-miner-says/

[12] https://gambusinoprospector.com/mineral-resources-in-mexico/mining-regions/

[13] https://www.lexology.com/library/detail.aspx?g=e4db032c-8d2e-4360-a9c8-df86b0f6be59

[14] https://mexicobusiness.news/sites/default/files/2019-10/Map-Copper-mines_110-111.jpg

[15] https://electroheatinduction.com/copper-mined-mexico/

DISCLAIMER:

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Equity Insider is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Ridgestone Mining Inc. advertising and digital media from the company directly (“the Company”). There may be 3rd parties who may have shares of Ridgestone Mining Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Ridgestone Mining Inc. which were purchased as a part of a private placement. MIQ will not buy or sell shares of Ridgestone Mining Inc. for a minimum of 72 hours from the publication date on this website March 31, 2021, but reserve the right to buy and sell, and will buy and sell shares of Ridgestone Mining Inc. at any time thereafter without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, and we own shares of the mentioned company that we will sell, and we also reserve the right to buy shares of the company in the open market, or through further private placements and/or investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.