All Posts in "Uncategorized"

A Healthcare Company With A Technological Advantage

While the announcement of a COVID-19 vaccine and its disbursement at the end of 2020 was certainly a light at the end of the tunnel for the public and the embattled health care industry, hospitals and health care systems know the journey to recovery is far from over. Communities continue to see virus surges and hospitals face capacity concerns. Health care organizations must take a realistic look toward the future and begin preparing for what could be several challenging months before the pandemic’s impact is behind us. From addressing patient care and pricing needs to understanding regulatory challenges and new investment and acquisition opportunities, 2021 could be a year of fits and starts. Those organizations that plan for change and remain nimble will lead the way.

Is there a light at the end of the tunnel?

The health care industry’s response to COVID 19 has been one of resilience, persistence and commitment, especially by front-line caregivers. The pandemic has significantly shifted industry trends and accelerated the pace of change. As a result, leadership is being forced to reevaluate strategic plans to determine and evaluate how best to deliver care going forward.

Kaufman Hall’s December 2020 National Hospital Flash Report indicates that operationally, and financially, November was a challenging month for hospitals and health systems nationwide. Margins and volumes fell, revenues flattened, and expenses rose as states moved to retighten social distancing guidelines. Margins have been down consistently since the start of the pandemic, but have fluctuated from month to month. Even with mass vaccine distribution on the horizon, the report predicts that “October’s downturn likely will continue as COVID-19 rates rise throughout the fall and winter. Hospital and health system leaders are bracing for difficult months ahead, as the combined forces of the pandemic and seasonal flu drive many individuals, and local and state governments to recommit to stricter preventive measures, causing many to delay nonurgent procedures and outpatient care. The result will exacerbate volume declines and could further destabilize hospitals financially, with a potential return to the significant losses seen in March and April.”

”

To date, Department of Health and Human Services (HHS) has distributed approximately $109 billion of the $175 billion allocated to the Provider Relief Fund (CARES Act) as of mid-November, according to data released by the department. In an effort to provide additional relief, Congress voted, in December, to appropriate additional dollars to the provider relief package and changed the rules (yet again) with respect to how lost revenue is recognized.

Understanding the financial reporting and compliance requirements associated with CARES funding will continue to be important in 2021.

While it is unclear what impact and lasting influence the pandemic will have on delivery of care from a financial perspective, one thing is certain, telemedicine is not going away and has arguably had the most profound impact to the health care industry in 2020. With claims up 3,000% year-to-date over the same period the prior year, it is clear that continued investment in telemedicine and related technology will be important.

Health Catalyst reports that with the shift to telehealth, providers are entering a new business landscape as COVID-19 has broken down barriers between traditional providers and more modern telehealth and disruptive care delivery companies. In the article titled, Six Strategies to Navigate COVID-19 Financial Recovery for Health Systems, Health Catalyst reports that health care’s new competitors fall into three main buckets:

- Telehealth-only providers: Companies like MDLive and Teladoc use real physicians and offer a variety of specialties and focus a significant portion of their business on working with insurance providers and self-funded health plans to provide subscriptions.

- Direct primary care: The direct primary care companies include Go Forward, Crossover Health and One Medical. Go Forward is similar to a modern subscription concierge practice. Crossover Health partners with employers like Apple, Microsoft and Amazon to deliver care directly to employees. One Medical is a modern concierge practice that charges an annual fee and bills fee for service.

- Large corporations: Amazon, Walmart and CVS Health are entering the health care space. Amazon offers a virtual care program for their employees as well as in-home deliveries and more. They announced a partnership with Crossover Health in July to pilot employee health clinics near large centers. Walmart has opened care clinics and a virtual care system and CVS continues to build their hubs.

“Teledoc, Doctor on Demand, Go Forward and Crossover Health have business models that overlook coding, CPT codes and modifiers, and other procedures traditional organizations must follow … Amazon, Walmart and CVS Health have traditional, straightforward pricing and are redirecting care away from the traditional system into their own care delivery system,” according to the article.

As large corporations and other providers increase competition for patients, they will compete with traditional provider organizations for patients. According to a survey, 79% of primary care physicians have experienced some form of burnout and four out of five employed physicians say their health systems employers are not doing anything to combat it. With a loss of clinicians, comes loss of revenue. The disruptive care delivery companies are introducing new models of care that appeals to clinicians because they “offer less hassle,” with no coding and documenting for quality measures and the like. There’s often less stress due to lower patient volumes, and with a lot of the concierge practices and even telehealth, clinicians can somewhat choose how much volume they want, as well as more flexibility.

The pandemic is not over, and no one can anticipate what the next 12 to 24 months will bring and how it will affect health care providers. Leadership and front-line caregivers will need to continue to be resilient, persistent and quick to respond.

PRICE TRANSPARENCY

Price transparency: Why this, why now?

On Nov. 15, 2019, Centers for Medicare and Medicaid Services finalized rules requiring all hospitals to make publicly available and produce annually a machine-readable file of standard charges that includes gross charges, negotiated charges, a self-pay walk-in rate, and minimum and maximum negotiated charge for all services. In addition, CMS defined a list of 300 services whose discounted cash prices, payer-specific negotiated charges, and de-identified minimum and maximum negotiated charges must be made publicly available in a searchable, consumer-friendly format.

CMS will be monitoring compliance with methods that include evaluation of complaints made by individuals or entities, review of analysis of noncompliance by individuals or entities, and audits of hospitals’ websites. If a hospital is noncompliant, CMS may take steps ranging from a written warning notice to imposition of penalties up to $300 per day and publicizing it.

In an era of rising health care costs and diverse consumer buying preferences, the need for price transparency has taken on increasing importance.

There are many factors driving this demand with expenditures being one of them. U.S. health care expenditures and rates of inflation continue to lead the world and dominate federal expenditures. U.S. health care spending grew 4% to $3.8 trillion in 2019, which equates to $11,582 per person, according to an analysis by CMS’ Office of the Actuary released Dec. 16, 2020. This compares to 4.7% growth in 2018 and is similar to industry averages of 4.5% annual rates. The Society for Human Resource Management (SHRM) reports that “large employers project that their health benefits costs will rise 5.3% in 2021, although COVID-19 expenses are fueling uncertainty about overall expenses. The group’s 2021 Large Employers’ Health Strategy and Plan Design Survey was conducted in May and June 2020, and it captured responses from 122 large employers offering coverage to more than 9.2 million employees and dependents. Seventy-seven percent of the respondents each has more than 10,000 employees.”

SHRM reports that premiums and employees’ out-of-pocket costs are estimated to reach $14,769 per employee, up $197 from 2019. Total costs are projected to rise to an average of just over $15,500 in 2021. The pricing transparency rules are meant to provide patients the information they need to make educated care decisions and reduce cost. President Donald Trump, whose administration proposed the rules, is quoted as saying, “We believe the American people have a right to know the price of services before they go to visit a doctor.”

The American Hospital Association, Association of American Medical Colleges, Children’s Hospital Association and Federation of American Hospitals have issued statements on behalf of hospital systems indicating that they believe these rules will increase confusion because they do not achieve the goal of providing patients with out-of-pocket cost information, accelerates anticompetitive behavior among health insurers, and stymies innovation in value-based care delivery models.

While the pricing transparency rules may be a step in the right direction, we remain skeptical that these rules alone will enable patients to know the prices of services before receiving treatment. Pricing in the health care ecosystem will likely remain opaque until we have greater data interoperability between payers, providers and patients.

According to an article published by Healthcare Financial Management Association (HFMA), written by Kevin Shears and Chris Sukenik, the new rules and general market trends have six important implications for providers:

- Increased pricing visibility will expose substantial price variations among providers. This creates a need for hospitals and health systems to focus on defining and communicating their consumer value proposition. News stories will likely present providers in a negative light across major metro markets. Health systems will need to focus on sharpening and delivering on their value propositions for consumers, including individuals and employers.

- Health systems will need to deploy strategic pricing to maintain and strengthen their market

position. Health systems will have to develop a more nuanced pricing strategy to address the issue of significant price variability among providers in their area and ensure continued success in an increasingly value-focused market. - Providers will experience unit rate compression, and most of this rate movement will be price

declines. With the veil of negotiated rates lifted, health plans will be able to show how their payment rates compare with those of competing health plans in the market. As a result, health systems with rates above the market average, will be under pressure to accept lower prices during negotiations and will likely experience unit rate compression. - Providers should prepare for expanded efforts to implement reference pricing. Given the impact of COVID-19 on the economy, employers will grow increasingly willing to pursue reference pricing strategies as part of business recovery plans to control health care costs.

- Highly profitable commercial volume and market share will shift, likely from higher-priced

organizations to lower-priced ones. With commercial lives shrinking as a share of population in most markets nationally, largely because of the COVID-19 crisis, the competition for commercial lives has become more intense. Market shifts in commercial volume from higher-priced to lower-priced health systems will deteriorate the financial performance of health systems on the wrong side of the volume shifts. - Centers of excellence strategies will become an important vector for volume growth. Publicly available pricing data will accelerate the development and adoption of COE programs. The organizations that win with COE strategies will likely do so by engaging clinical leadership to quickly gain experience in developing bundled payments, developing the foundational cost and quality analytics to demonstrate and communicate results, aligning benefit design with the COE program, and cultivating strong business relationships with leading employers and health plans.

These new rules have significant and far-reaching implications for all health care systems, and after initial implementation, ongoing monitoring and analysis of these six areas will continue to be critical as organizations evaluate and make decisions about their delivery models and related pricing.

DEAL FLOW

Solid health care provider deal flow will persist as healthtech grows

2020 has been a solid year for health care services investment from both financial buyers, e.g., private equity, and strategic or corporate buyers. Despite the global pandemic putting a halt to most deal flow during the summer, 2020 capped off a 10-year run, post-global financial crisis that saw $822 billion invested into health care service providers across 11,054 deals, according to PitchBook data. Private equity-backed deals accounted for 28% of dollars invested ($231 billion), and 48% of total deal volume (5,355 deals). Corporate deal activity, such as CVS acquiring Aetna, accounted for the balance.

Since the end of the global financial crisis, private equity’s deal activity within health care service providers has increased in total, and private equity’s proportion of deal flow relative to corporate activity has increased from approximately 40% to 60% over time.

We expect private equity investors will continue to show moderate growth in capital deployed and strong growth in deal count in the near term.

Consolidation has led many private equity investors to move downstream and evaluate smaller deals as they search for opportunities to bring synergies and value to more providers. Particularly in the aftermath of the COVID-19-related public health emergency, many independent providers experienced financially lean periods and have become motivated sellers.

The pandemic also pulled forward interest in health care technology as millions of patients and thousands of physicians used virtual health services for the first time. So while the opportunity for investment in physical service providers will eventually decline as the sector consolidates, the door will open to health care technology investment.

Historically, health care has underinvested in (nonmedical) innovation relative to other sectors, particularly financial services, which is also highly regulated. Health care venture capital and corporate mergers and acquisitions investment in health tech post-global financial crisis represented 6% of annual sector revenue compared to the 62% the financial services sector had similarly invested in fintech.

Patients are demanding the same customized, on-demand experience for their health care that they receive in most other aspects of their lives. Companies and investors that can deliver that experience will be positioned to capture significant long-term tailwinds.

As of this writing, we are uncertain how the regulatory environment may change with the Biden administration. Vice President Kamala Harris and incoming Health and Human Services Secretary Xavier Becerra have histories of health care mergers and acquisitions scrutiny during their separate tenures as attorneys general of California. Time will tell what effect the administration may have on the overall health care M&A environment.

REGULATORY

Legislative and regulatory outlook for health care

Health care has long been an industry heavily affected by legislation and regulation. As we look forward to the first quarter of 2021 and beyond, we continue to expect that to be true. In 2020, the industry saw nearly $200 billion in stimulus payments to help provide some relief from the financial effects of the pandemic. However, with the speed of the rollout, it did present challenges to many of our clients when determining how to meet the terms and conditions of the Provider Relief Fund grant. With the passage of the Consolidated Appropriations Act, 2021, some of those challenges subsided.

What did the Consolidated Appropriations Act, 2021 (the Act) do and how will it affect 2021 for the health care ecosystem? From a challenges perspective the Act mainly provided two things: one, the Act, yet again, changed the calculation of “lost revenue;” however, in this round the changes are largely beneficial to allow for an actual budget calculation rather than a strict year over year methodology. Two, it provided an opportunity for providers that are parent organizations with subsidiaries that received targeted distributions to allocate those distributions to other eligible health care providers within the organization. The Act also provided for many of what is referred to as the “Medicare extenders.” An example of this would be eliminating the Disproportionate Share Hospital cuts.

For many recipients of the Provider Relief Funds, the change to the determination of lost revenue and the flexibility to allocate targeted distributions as well as the Medicare extenders will allow for them to enter 2021 with a bit more financial certainty. Many providers found themselves in a predicament when the calculation of lost revenue was defined for calendar year 2019 versus calendar year 2020. As shown below, through November 2020, many providers had growth in revenues rather than reductions. Many factors contributed to growth in 2020 by providers. However, despite the growth, the providers were not growing as fast as they had budgeted, which then provided profitability concerns as the budgeted revenues drove decisions around expenditures, many of which were fixed.

As shown in the chart, while the average provider grew revenue year over year (adjusted for Provider Relief Funding), they experienced a shortfall relative to the budget of 2.3%. Given the operational leverage typically present in providers, which was exacerbated by prohibitions on nonemergent or elective procedures, this caused expenses per adjusted discharge to exceed budget by 15.9% on average.

In addition to the stability provided by the Provider Relief Fund, many health care providers with large investment balances saw a year of growth within their investment portfolios as well as increased philanthropic activities. With the stability and more financial certainty, we expect most health care providers to continue with the majority of their planned expenditures.

The $1.4 trillion government funding bill, which was passed alongside the Act, also included legislation aimed to protect patients from so-called “surprise billing” for emergency services and other instances in which a patient is unknowingly treated by an out-of-network provider. The “No Surprises Act” would cap patients’ out-of-pocket responsibility for emergency care to what they would pay for in-network services. Providers are also unable to bill out of network for planned procedures unless the patient gives explicit consent. Billing disputes for covered procedures would be handled in arbitration. One key change is the No Surprises Act forbids arbiters to consider Medicare and Medicaid rates or the provider’s billed charges when ruling for the amount the insurer should pay the provider. The patient cannot pay more than the in-network rate and is not involved in the arbitration process.

The No Surprises Act will likely reduce total patient responsibility for care and may reduce total revenues for certain providers. Payers will not be able to reference the generally low rates of Medicare or Medicaid in arbitration, but nor will they have to disclose pharmacy benefit manager relationships and rebate structures, which previously proposed bills called for. It remains to be seen whether this legislation will fundamentally change how care is provided and the viability of certain provider business models, or if it is simply step one of a much larger change to the regulatory and legislative environment. However, we also note the pandemic has caused some to consider their physical footprint versus their digital presence.

CYBERSECURITY

Reported breaches continue to rise

Cybersecurity and data protection continue to be a point of concern within the health care industry. Over the last few quarters in 2020, we have seen an increase in the number of hacking incidents as attackers continue to leverage the pandemic for their own benefit. Although many organizations claim to have a sophisticated cybersecurity program, attackers continue to gain access to patient financial and medical information. If proper protocols are in place, why do the attacks continue? RSM security and privacy risk professionals state two ways cybercriminals break into health care organizations:

- Remote workers exposing the organization to phishing emails, ransomware and vulnerable storage locations

- Third-party vendors and partners transferring the organization’s data insecurely from system to system

As a result, there has been a significant increase in the number of individuals affected by health care data breaches within the past five months. For example, in the month of September 2020, there were over 9 million individuals affected by 87 data breaches (an increase of 373% compared to September 2019) reported to the Office of Civil Rights. Further, 68% of the total breaches reported to the OCR during 2020 were related to a hacking/information technology incident affecting 23 million individuals.

The 2020 NetDiligence Cyber Claims Study indicates that attackers are shifting their preference to small and midsized organizations, which explains the increase in breach reports within the health care industry over the past five months.

This shift in focus leaves the health care industry vulnerable to exploitations during a time where most organizations are cutting their IT budgets and resources in response to the pandemic.

According to Black Book Research, 88% of providers revealed that lack of budget was the major obstacle to properly securing and protecting health information, up from 68% in 2019. Eighty-two percent of hospital chief information officers in inpatient facilities under 150 staffed beds and 90% of practice administrators collectively state they are not even close to spending an adequate amount on protecting patient records from a data breach.

According to the 2020 NetDiligence Cyber Claims Study, a data breach on average costs small to midsize organizations $276,000 (per claim) in lost business income and $26,000 in recovery expenses alone. It is important for health care organizations to evaluate their exposure to cyberrisks. Reduced IT budgets and resources are contributing to an increase in attacks and incident costs. While most large organizations would seem to be the prime target for attackers, small to midsize organizations have experienced the most attacks, contributing to over 98% of the study’s claims. It is no longer a matter of “if” but “when” health care organizations will be the target of a cyberattack, and to ignore such a risk will prove to be extremely costly.

In assessing the overall cost/benefit of investing in a robust cybersecurity program, health care organizations should evaluate the costs to address a breach, which includes the following:

- Cyber incident costs: costs associated with investigating the incident (averaging about $123,000 per claim)

- Service costs: costs associated with hiring breach counsel, forensics, notifications, credit monitoring and public relations (averaging about $78,000 per claim)

- Legal costs: costs associated with lawsuit defense, lawsuit settlement, regulatory action defense and regulatory fines (averaging about $401,000 per claim)

In the coming months, we expect these costs and the reported number of attacks to continue to rise. As a result, health care organizations must be diligent and increase their focus on data security over patient information and the systems they use to treat them.

Sources:

2021 Promises To Be A Banner Year For Healthcare Stocks – Investors Are Eyeing This Small Unknown Company

Maitri Health Technologies Corp. (OTC: MHTCF / CSE: MTEC) Innovates Full-Scale PPE and Tech Solutions for Businesses and Individuals Managing Outbreak Risk for the Future

A lot of lessons were learned in 2020, not the least of which is that we have some major systemic issues regarding preparedness. The most alarming issue at the beginning of the global health crisis was how woefully inept the system for the production of personal protective equipment (PPE) — a BIG problem between suppliers, and their buyers.

The COVID-19 crisis underscored a need, that looking forward requires a MAJOR shift of how we operate for the years ahead.

At the beginning of this, PPE suppliers faced a ‘wild west’ of procurement on the market. It was a complete mess of empty boxes, unfulfilled orders and cargo planes landing at foreign airports, greeted by no one.

Early on in the crisis, Canada served as a brutal example of ill-preparedness, as government officials had to admit that $300 million worth of PPE supplies in the country’s National Emergency Stockpile System (NESS) had expired and gone to waste[1]—it had to be thrown out.

In a world without COVID-19, maybe this shortfall could be easily and quickly replaced. But once that world-changing event kicked off, suddenly governments all over the planet were scrambling to secure whatever supplies they could—often finding themselves later throwing out MILLIONS of masks and other supplies that were badly made from producers in places like China.[2]

Pre-2020, PPE was an afterthought in most people’s daily lives. TODAY… almost every single business is being required to supply their employees with protection, and enforce upon their customers compliance. Even with a vaccine coming available, the effects the current pandemic is likely 3-5 years away. Over the course of the coming months and decade to come businesses will be required to maintain vigilance in case of a next pandemic.

Almost a full year into this thing, and PPE shortages is STILL an issue.[3]

In short: We’ve crossed a Rubicon, and there’s no turning back.

Billionaire investor Ray Dalio saw this playing out very early on in April, stating, “the world will look different”. Among these observations, Dalio specifically predicted “priorities are going to shift [towards] healthcare and building the basics.”[4]

How we deal with health crises moving forward will look completely different than life prior to the outbreak. In order to get a handle on these threats moving forward, people and businesses are looking for protection—both through PPE and through tracing and other new forms of technology designed to contain the spread.

Creating a reliable domestic supply chain for PPE will undoubtedly require a complete overhaul of the system that was in place before this all began.[5]

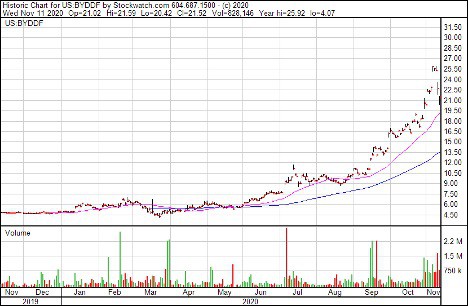

Famously anti-tech billionaire investor Warren Buffett probably didn’t envision making PPE when he took a 10% interest in Chinese electric vehicle maker BYD (OTC:BYDDF) in 2008. But by the end of May 2020, the company was set for certification by the National Institute for Occupational Safety and Health (NIOSH) and a capability to produce 50 million N95 respirator masks per day.[6]

The move paid off, as the BYDDF share price has exploded over the course of the year.

However, calls for DOMESTIC supplies of PPE are growing louder.

But to avoid the same egregious issues in terms of materials and supplies, SECURITY needs to be airtight.

Addressing these very serious needs for change, a team in Canada came together to build a NEW system from top to bottom—not only in producing state-of-the-art PPE for institutions and individuals, but also in creating an entire environment aimed at enhancing the safety of ALL individuals from those making the equipment, those transporting it, and those wearing it.

Proprietary Healthcare Tech and PPE

Made Onshore

Meet Maitri Health Technologies Corp. (OTC: MHTCF / CSE: MTEC)

Rising to the occasion, the seeds for the idea behind Maitri Health Technologies Corp. (OTC: MHTCF / CSE: MTEC) formed after a call to action in Vancouver was made by local business and community leaders to rapidly raise $150,000 to secure PPE supplies for an area hospital that was in dire need—within 12 business days those supplies landed.

That experience sparked a team of backers to form the company and assemble one of the most talented teams in the entire space.

The word “Maitri” comes from the Sanskrit word for “Compassion”.

After quickly discovering how bleak the situation was for healthcare institutions around the world in the early days of the crisis, a new mission was launched to form the ultimate team of healthcare specialists, tech innovators, and logistics experts to not only solve the issues of a broken system—but to completely disrupt it, revolutionize it, and perfect it.

Now thanks to their collective efforts and exceptional brain trust, Maitri Health Technologies Corp. (OTC: MHTCF / CSE: MTEC) has put together a full platform that will allow all users to breathe easier… and safer.

Maitri Health has emerged as an exceptional integrated platform for all things related to the handling of the crisis: Including masks, shields, antimicrobial solutions, and soon swabs, tests, tracing and health management technology.

This isn’t just manufacturing business, but a full-suite answer to the entire global health care supply chain crisis.

According to Maitri’s leadership, Technology and R&D is the future of global health protection.

The company has relationships with the intention of creating partnerships and M&A opportunities that help their products collectively work together to provide any and all health care data associated with this fight to defeat current and future pandemics.

Maitri Health addresses current needs and delivers a long-term solution for supply chains well into the future.

Unlike during the early months of the crisis, Maitri Health’s proposal for buyers is a completely secure process.

This means tracking and logging each contact point of every single employee along the supply chain that may or may not have come in contact with each item, to securing other businesses and entities of all sizes through PPE for employees to proprietary tracing and security software.

But that’s not where their technological advancements end.

For example, the common surgical mask hasn’t changed for roughly 50 years. Maitri Health has redesigned both surgical and non-surgical masks (all ASTM Level 1, 2, 3 certified and Made in Canada) both in shape, comfort, and in materials used.

From testing kits, to tracing software and hardware, to anti-viral surface cleaners and hand sanitizers, to masks (surgical, non-surgical, and N95) and face shields, Maitri Health Technologies Corp. (OTC: MHTCF / CSE: MTEC) has something to protect everyone.

BOTH GOVERNMENTS AND CORPORATIONS DRIVING DEMAND

As states and other communities brace for the impact of a possible predicted surge of positive COVID-19 test results, demand for PPE, test kits, and other materials is about to skyrocket.[7],[8],[9],[10]

Industry and governments are making major purchases, to ensure the economy can continue to operate without more widespread and substantial lockdowns.

This trend not projected to fizzle out any time soon. Analysts anticipate the US healthcare personal protective equipment market size to reach US$13.2 billion by 2027, expanding at a CAGR of 29.1% from 2020 to 2027[11]—and the Global market is set to grow to US$98.27 billion by the end of 2027[12].

5 Advantages That Position Maitri Health Technologies Corp. (OTC: MHTCF / CSE: MTEC) for a Break-Out in the Months to Come.

- Sourcing and Supply Chain

Focus on distributing and growing domestic supply chain for PPE, Anti-Viral Solutions and Test Kits, for reliable transactions with countries and corporations in need. - Technology Transfer and R&D

Closing the circle between hardware and technology through partnerships and licensing agreements to better support the collection, storage and transfer of information for a complete PPE ecosystem. - Universal Supply Chain Control – Global Distribution

Strategic partnerships and supply agreements to bring the production of basic PPE and medical products produced in the Americas and Europe for global consumption, with local manufacturing and assembly in preparation for future biomedical emergencies. - Highest quality & reliability + sustainability

Production and distribution of products that are compliant, reliable and easy to access, with a focus on sustainable manufacturing and recycling practices. - World-class management team

Comprised of industry leaders in health, government, technology, capital markets and high-growth companies, including a former Canadian Minister of Health and a world infectious disease expert at Yale who works with the WHO and the CDC.

FACE MASKS / FACE SHIELDS

Maitri Health currently offers a series of next generation medical-grade masks called the 3D Mask, including those with ear loops, head straps, and other options to provide comfort, style and lab certified protection.

Users are already reporting back that these are more comfortable than the standard fare, while from a quality of materials standpoint, Maitri Health products come with a domestic safety assurance that most foreign suppliers cannot match.

They’re made better, and designed for longer use, using multiple layers and a better fit around the face and on the nose.

These masks are made in Canada, and production can be smoothly set up in the USA and abroad. Domestic production is key in this era, especially given all of the cases of faulty PPE that was ordered from China and shipped to the USA[13] , Canada[14] and Europe[15].

While China has claimed to have fixed the issue, it’s a much more secure option to have domestically produced equipment with onshore quality assures. The fear that comes with foreign made medical assets is real, and is impacting the cause[16].

Supplies of PPE has become a hot commodity in other nations, including not just masks, but face shields as well[17]. Back in March, German Chancellor Angela Merkel’s government banned the export of ALL protective medical equipment, including goggles, gowns, face shields, gloves and surgical masks[18].

Securing a domestic supply is incredibly important, not just in North America, but abroad as well.

In Canada, the calls are coming to come to terms with a need to shift towards manufacturing all types of PPE, including face shields.[19]

Maitri Health Technologies Corp. (OTC: MHTCF / CSE: MTEC) is providing face shields along with its platform of face masks, and is taking orders at this time. Its Win-Shield is designed by healthcare and dental professionals to cover the face and head while adding a superior level of comfort.

The product is easy to assemble and comfortable for all day use, meant to change to perception of what it means to wear personal protective equipment.

TESTING SOLUTIONS

Maitri Health is providing a US made supplier of Saliva and Nasal Covid Test Kits called Diacarta. This biotech company has a test that ranks highly by the FDA for accuracy.

This solution to the need for high quality testing will be part Maitri Health Technologies’ broader vision of a full technology platform that tracks and provides intelligence to healthcare providers, government, corporations.

As part of Maitri’s digital strategy, testing provides a strong use case for data collection and eventual software driven predictive healthcare.

ANTIVIRAL SOLUTIONS

Maitri Health also currently offers a pair of antiviral solutions: Candid Clean Sanitizer and Clean Terra Antiviral Solution.

Certified as a safe product, Candid Clean Sanitizer is gentle on the hands, and non-greasy. With so many questionable hand sanitizers on the market made from alcohols that are rough on the hands and smell bad, Maitri’s team at Candid Clean designed a superior blend of quality ingredients and available fragrances.

CleanTerra Antiviral Solution is more effective than bleach and non-toxic, food safe non-corrosive and biodegradable. Envirocleanse, A Berkshire Hathaway Company, is a key partner that makes this effective daily disinfectant that can quickly and safely be used to eliminate pathogens on high touch surfaces such as counters, escalators, airplanes, buses, wheelchairs, site signage, gyms, desks, vehicle interiors, restrooms, hotel rooms, etc. CleanTerra is effective in the fight to keep areas safe without any risk of chemical poisoning to humans and does no damage to assets such as furniture or surfaces. This is unlike other cleaners on the market.

PRODUCTS IN DEVELOPMENT

On deck for Maitri Health Technologies Corp. (OTC: MHTCF / CSE: MTEC) are a stream of products in development that the company plans for release by the end of November, including N95 Clear Masks, Swabs, Antigen and Anti-Body Tests, as well as a Technology Platform that involves Track and Trace, Inventory Management and Workplace Management.

Perhaps a key breakout among this group is that of the test kits, which are still in extremely high demand across North America and abroad.

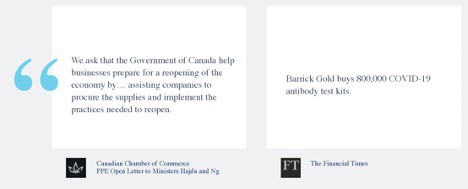

These are being snapped up in massive numbers not only by governments, but by major businesses as well, such as Barrick Gold which bought 800,000 antibody test kits for use on its operations.[20]

As we will see, combining test kits and other diagnostic equipment to the company’s offerings could be a major game changer for Maitri Health.

Evaluating Maitri Health Among its Peers

It’s slightly difficult to compare Maitri Health with other producers of equipment in this space, because there is such a variety of competitors in the market. Keep in mind, that shortages still remain across several markets, so there’s still plenty of room to join the fray.

However it’s wise to start by looking at the BIGGEST entities in the PPE space, and how much they’ve gained from their 2020 low points to present (as of November 11, 2020).

| Company | Symbol | Share Price Today | % Gain Within 2020 | Mkt Cap |

| Maitri Health | N/A | N/A | N/A | N/A |

| Honeywell International | NYSE:HON | $199.29 | 92% | $139.8B |

| 3M Company | NYSE:MMM | $169.21 | 44% | $97.6B |

| MSA Safety Incorporated | NYSE:MSA | $143.87 | 65% | $5.6B |

*Latest share price taken from Yahoo! Finance on November 11, 2020

**All prices in USD

As we can see, there have been several respectable gains in the double digits, among the biggest players.

However, it’s in the microcaps to mid-cap levels that the much bigger gains are being witnessed. In the table below, only one company has a market cap over a billion dollars.

What these companies do have in common is a primary focus on healthcare safety supplies and diagnostic equipment. This is a smoking gun that points towards where the biggest gains are truly being made.

FOUR of these companies, Allied Healthcare Products, Owens & Minor, Alpha Pro Tech and Co-Diagnostics, have made gains of +2.7x —with CODX gaining +14x.

| Company | Symbol | Share Price Today | % Gain Within 2020 | Mkt Cap |

| Maitri Health | N/A | N/A | N/A | N/A |

| Yunhong CTI | NASDAQ:CTIB | $1.77 | 124% | $8.44M |

| Lakeland Industries | NASDAQ:LAKE | $20.22 | 91% | $161.35M |

| Allied Healthcare Products | NASDAQ:AHPI | $4.70 | 273% | $18.86M |

| Owens & Minor | NYSE:OMI | $23.04 | 459% | $1.69B |

| Alpha Pro Tech | NYSE:APT | $12.89 | 273% | $175M |

| Co-Diagnostics | NASDAQ:CODX | $13.30 | 1,362% | $375.98M |

*Latest share price taken from Yahoo! Finance on November 11, 2020

**All price in USD

Maitri Health Technologies Corp. (OTC: MHTCF / CSE: MTEC) has positioned itself to be a perfect hybrid of both the PPE space, and the diagnostics and tracing space.

The company already has a platform that includes face masks, antimicrobial solutions, and face shields. But soon, they’re prepared to launch N95 clear masks, swabs, tests, and tracing and detection technology.

Maitri Health’s All-Star Team

“ We have assembled an all-star team of leaders and innovators. Our team brings integrity, invaluable skills and future-forward vision to help drive our mission of building a global platform. The quality of people we’ve attracted is also a testament to our business model and their confidence in our success.”

– Andrew Morton CEO and Director of Maitri Health

CEO and Director – Andrew Morton

Morton is a seasoned global technology executive with a track record of successfully building and running innovative companies. He was SVP Global Sales for Zodiac Interactive, a private equity held software company focused on advanced software for Tier 1 Cable and Telecom providers. He headed up Broadband TV for Entone where he launched successful operations on multiple continents. Entone was acquired by Amino Communications (LON: AMO) where he served for several years post transaction on the senior executive team. Earlier in his career, Morton co-launched global operations for Comtrend Corporation, a leader in telecom hardware and software.

Chief Commercial Officer and Corporate Secretary – Marliss Yassin

Yassin is a CPA, CA with +15 years’ experience working with publicly listed companies. She has held finance management positions at various public companies, including an international industrial products company and mid-tier mining companies. Yassin gained extensive experience through her client engagements at Deloitte providing reporting, advisory and assurance services to publicly traded companies, primarily in the natural resources sector.

Strategic Advisor – Jodi Butts

A lawyer by trade and an entrepreneur at heart, Butts is a healthcare executive with a strong track record in driving positive change and growth within leading organizations. Previously, she served as Chief Executive Officer of Rise Asset Development and Senior Vice-President of Operations and Redevelopment at Mount Sinai Hospital.

Butts brings significant governance experience as she currently serves as an independent director at Canada Goose Holdings and Aphria, is a member of Dot Health board of directors and has held the Chair role on several Boards. She also holds several Board Advisory roles including with Bayshore Home Healthcare and the World Health Innovation Network at the University of Windsor.

Strategic Advisor – Dr. James Shepherd

Dr. Shepherd is one of the world’s foremost experts in infectious diseases. An associate professor of medicine at Yale School of Medicine, Dr. Shepherd’s global experience include his work as a special advisor to the World Health Organization. His recent history includes advising the Government of India on tuberculosis control, directing a research program in TB and HIV for the Centers for Disease Control and Prevention in Botswana, and assisting the University of Maryland start a large AIDS treatment program in Nigeria.

Strategic Advisor – Dr. Anne Snowdon

Dr. Snowdon is a leader in health system innovation and transformation and global supply chain infrastructure in healthcare. She’s currently Professor of Strategy and Entrepreneurship and Chair of the World Health Innovation Network (WIN), at the University of Windsor, Odette School of Business.

She currently leads a global network, SCAN Health, to disseminate new knowledge and enable cross jurisdiction learning to accelerate supply chain transformation across global health systems. She has published more than 140 research articles, papers and cases, has received more than $22 million in research funding, holds patents, and has commercialized a highly successful booster seat product for children traveling in vehicles.

Strategic Advisor – Sashko Despotovski

Despotovski is a seasoned investment banker and an active investor in both private and public companies. He has held posts within several funds and hedge funds in the investment banking capacity in USA and Canadian markets, as well as on the operational side as management and as a director for a number of companies. Despotovski holds advisory board seats at several international companies and is currently managing director of Hinna Park Capital in Norway.

Director – Gavin Cooper

Cooper is a Chartered Accountant with extensive experience in all aspects of corporate and financial management. For the past 35 years, he’s been providing strategic and financial advice and corporate administration services. He’s held senior positions with a number of public and private companies with local and international operations.

Director – Dr. Solomon (Sam) Pillersdorf

Dr. Pillersdorf has been involved in the mining sector for +10 years, including funding start-up mining companies and sourcing and funding resource claims. Dr. Pillersdorf was Head of Rheumatology Outpatients and Head of Rheumatology training at the McMaster University Medical Center.

Director – Tony Clement

Clement is a former Canadian federal politician and former Member of Canadian Parliament. He served in senior roles in Prime Minister Stephen Harper’s Cabinet for nearly a decade, as Health Minister, Industry Minister and President of the Treasury Board. As a business entrepreneur, he has also led information technology companies, and served on the board of directors on information technology and health care companies, having provided strategic advice both nationally and internationally.

Board Chair – Sav DiPasquale

DiPasquale is a senior executive with +30 years of experience in the pharmaceutical, biotechnology and transportation industries, and is currently President of the Canadian Pharmaceutical Distribution Network (“CPDN”). At CPDN, DiPasquale is responsible for overall operations, including the development and implementation of strategies to grow the organization’s membership and extend its unique service offering.

Previously he spent nearly 17 years at Glaxo Smith Kline in various senior positions, including VP Business Development and CIO.

Staff Editors

Equity Insider Team

DISCLAIMER:

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor a recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Equity Insider is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Maitri Health advertising and digital media from the company directly. There may be 3rd parties who may have shares of Maitri Health and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Maitri Health which were purchased as a part of a private placement. MIQ will not buy or sell shares of Maitri Health for a minimum of 72 hours from the publication date on this website March 7, 2021, but reserve the right to buy and sell, and will buy and sell shares of Maitri Health at any time thereafter without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above-mentioned company; this is a paid advertisement, and we own shares of the mentioned company that we will sell, and we also reserve the right to buy shares of the company in the open market or through further private placements and/or investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

SOURCES:

[1] https://www.cmaj.ca/content/cmaj/early/2020/06/24/cmaj.200946.full.pdf

[2] https://www.vice.com/en/article/7kzae9/european-countries-are-throwing-out-rubbish-chinese-made-masks-and-coronavirus-tests

[3] https://www.bnnbloomberg.ca/fixing-the-ppe-shortage-should-top-biden-s-to-do-list-1.1520273

[4] https://markets.businessinsider.com/news/stocks/ray-dalio-bridgewater-associates-predicts-pandemic-boost-savings-self-sufficiency-2020-4-1029117199#

[5] https://www.supplychainbrain.com/articles/32170-qa-what-it-will-take-to-create-a-reliable-domestic-supply-chain-for-ppe

[6] https://www.fool.com/investing/2020/06/02/warren-buffett-backed-chinese-car-maker-turned-mas.aspx

[7] https://www.wgbh.org/news/local-news/2020/10/22/masks-gloves-and-other-protective-equipment-in-demand-as-mass-readies-for-possible-surge

[8] https://www.cbsnews.com/news/ppe-n95-mask-shortage-covid-19/

[9] https://www.citynews1130.com/2020/10/13/some-b-c-dentists-charging-covid-19-fee-to-cover-ppe-costs/

[10] https://news.ontario.ca/en/release/59065/ontarios-action-plan-protect-support-recover

[11] https://www.businesswire.com/news/home/20201019005365/en/United-States-Healthcare-Personal-Protective-Equipment-Market-Report-2020—ResearchAndMarkets.com

[12] https://www.allamadvisorygroup.com/ppeoutlook/

[13] https://www.latimes.com/world-nation/story/2020-04-10/china-beijing-supply-world-coronavirus-fight-quality-control

[14] https://globalnews.ca/news/6905351/coronavirus-china-canada-faulty-masks/

[15] https://www.aljazeera.com/news/2020/3/29/netherlands-recalls-defective-masks-imported-from-china

[16] https://www.propublica.org/article/foreign-masks-fear-and-a-fake-certification-staff-at-csl-plasma-say-conditions-at-donation-centers-arent-safe

[17] https://www.ft.com/content/efdadd97-aef5-47f1-91de-fe02c41a470a

[18] https://www.reuters.com/article/health-coronavirus-germany-exports-idUSL8N2AX3D9

[19] https://globalnews.ca/news/7406308/coronavirus-inside-supply-chain-crisis/

[20] https://www.ft.com/content/baf6f145-f2f9-42bd-ac75-9fd22f9b1091

Protected: Extracting Big Value by Developing and Commercializing Functional and Psychedelic Medicine Products (2)

Protected: Extracting Big Value by Developing and Commercializing Functional and Psychedelic Medicine Products

Protected: Canadian Gold Rush in Full Swing During Record Year for Precious Metal

Protected: We Think It’s Time To Look At Micro-Cap Stocks Again

Take a look at this undervalued Gold mining company

It’s official, we are now entering ‘BULL’ territory in the Gold sector! When this happens, and we love when it does, it presents a multitude of opportunities for us, so we wanted to outline one such opportunity for you to take a look at:

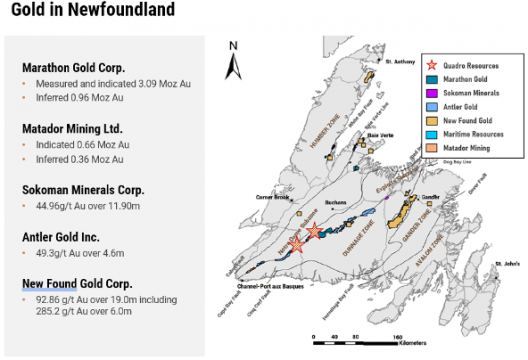

Quadro Resources Ltd. (TSXV: QRO / FSE: G4O2) is Developing TWO Potential Breakthrough Precious Metals Projects Targeting Gold, Palladium and Platinum in Safe, Prolific Canadian Mining Zones

Back in March of 2016, the stock of a relatively small Canadian junior mining company called Marathon Gold began a 4-year run on the road to a 10x valuation.

Excitement progressively grew around its Valentine Gold Project in the world leading mining jurisdiction of central Newfoundland.[1]

To date, four gold deposits at Valentine have been delineated, and a 2018 Preliminary Economic Assessment showed it could sustain open pit mining and conventional milling over a 12-year mine life.

In total, the mineral resource on the project comprises 3.09 million ounces Measured & Indicated at 1.75 g/t Au, and another 0.96 million ounces Inferred on a 20km trend.[2]

When Marathon announced step-out drilling in March 2016 that they’d successfully expanded the Valentine deposit’s mineralized corridor, the stock began to climb.

The stock’s run truly began on March 20th, 2016 at $0.17. By May 10th, 2020, Marathon had more than completed the ten-bagger journey.

Today in 2020, another journey beginning on the other side of the lake… at $0.17.

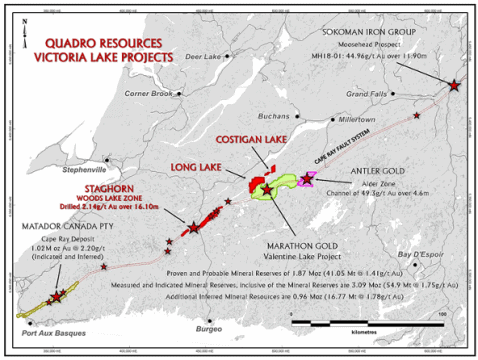

Just 30km across the lake from Marathon, are two projects located within the very same Cape Ray Fault Zone as the Valentine Lake project— both 100%-controlled by the same company.

The first project is a large package, covering 12 km of the Cape Ray Fault Zone directly between not only Marathon Gold’s Valentine Lake deposits, but also Australia-based Matador Mining’s Cape Ray deposits.

The other project is a 192-claim unit property located proximal to Marathon’s Valentine Lake deposits.

But those are only the company’s gold properties.

This company also has interests in a large land position in Ontario, targeting platinum-palladium.

Just last year platinum was being deemed by analysts as the “Most Precious Metal”.[3]

Now the company appears to be in the midst of a healthy 2020.

Over that period of time, this company has confirmed its approval to acquire the platinum-palladium property in Ontario, announced work on its two properties in Newfoundland, and also began trading on the Frankfurt Exchange.

It’s worth taking a deeper look into why this company is in a healthy position in two of Canada’s best mining jurisdictions, with a trio of projects they could build a legacy upon.

Meet Quadro Resources Ltd. (TSXV: QRO / FSE: G4O2)

Meet Quadro Resources Ltd. (TSXV: QRO / FSE: G4O2), a junior Canadian mining company targeting gold in Newfoundland and palladium/platinum group elements (PGE) in Northern Ontario.

In Newfoundland, Quadro is developing its Staghorn and Long Lake projects, both of which are gold-rich systems that have significant work planned for 2020—Staghorn in Q2, and Long Lake in Q3.

In Northern Ontario, Quadro just recently secured a 70% option on the Seagull Lake project, which comes with high-grade intercepts of PGE and targets already identified.

Quadro Resources Ltd. (TSXV: QRO / FSE: G4O2) is backed by an experienced team of mining veterans who have had successes in the junior resource sector.

By establishing its three projects (Staghorn, Long Lake, and Seagull Lake), Quadro is making a case to become a peer to its neighboring miner heavyweights, such as Marathon Gold, and Impala Platinum Holdings. Drilling and field testing to date have suggested results in line with Marathon grades and numbers.

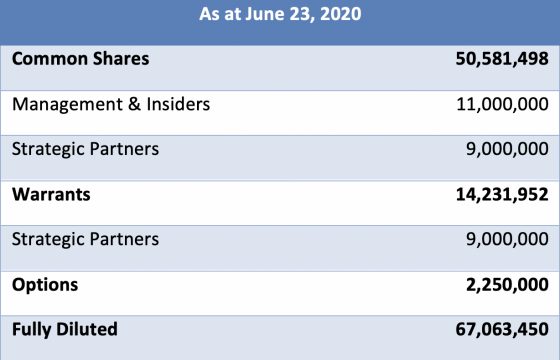

As a Canadian junior mining company, it’s also worth noting Quadro’s relatively tight capital structure:

- 50 million shares outstanding

- 11 million shares held by management and insiders, including two public companies which have a financial interest in the projects

- Combined with strategic partners, 40% of Quadro shares are spoken for

A COMPARISON OF NEWFOUNDLAND GOLD PROPERTIES

In terms of the Policy Perception Index (PPI) in 2019, Newfoundland and Labrador placed in the Top 10 jurisdictions in the world (and 2nd highest in Canada)—According to the most recent Annual Survey of Mining Companies put out by the Fraser Institute.[4]

The PPI is a composite index that measures the overall policy attractiveness of all the 76 jurisdictions in the study.

Policy-wise, the jurisdiction offers a clearer path forward as companies plan out their journey to production.

In the case of both Quadro Resources Ltd. (TSXV: QRO / FSE: G4O2) and Marathon Gold Corp., there is a lot to look forward to in terms of development in Newfoundland.

Both of the companies’ properties are on strike from each other, and are traversed by the auriferous Cape Ray Fault, and associated Rogerson Lake Conglomerate unit.

They’re separated by a 30 km expanse of water—Victoria Lake.

Marathon’s property hosts the multi-million ounce Valentine Lake gold trend, which terminates to the southwest at the short of Victoria Lake.

Whereas the northeast (Ryan’s Hammer) portion of Quadro’s Staghorn property extends to the opposite shore of Victoria Lake, where similar gold mineralization has been located in float and drill holes.

Marathon’s gold system consists of a series of stacked Quartz-Tourmaline-Pyrite-Gold veins hosted in a granodiorite unit, proximal to the overthrust Rogerson Lake Conglomerate.

Mineralization at Quadro’s Staghorn is generally hosted in Arseonpyrite-Pyrite-Quartz veins within a diorite/granodiorite unit proximal to the Rogerson Lake Conglomerate. Gold is also found in strongly sheared sediments associated with the Cape Ray structure.

Marathon has completed more than 275,000 meters of drilling.

Drilling on Quadro’s Staghorn at the Ryan’s Hammer, Ryan’s Hammer East and Mark’s Pond areas’ soil anomaly amounts to approximately 1,000 meters. Two new wide auriferous zones have been discovered from this drilling, and now requires step out drilling.

It was the timing of step-out drilling in 2016 on Marathon’s Valentine deposit that corresponded with the kickstart of that company’s exceptional run from $0.17 to $1.76 today.

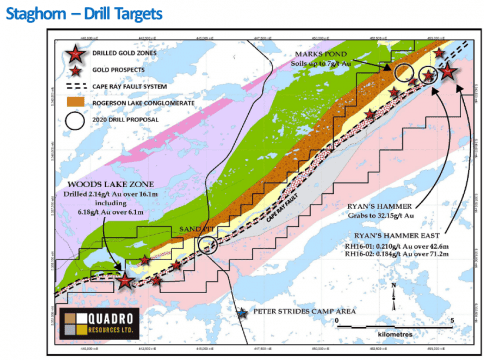

THE STAGHORN PROJECT

Quadro Resources Ltd. (TSXV: QRO / FSE: G4O2) owns a 100% interest in the large Staghorn Project land claim package that covers 12 km of the auriferous Cape Ray Fault Zone, located directly between Marathon Gold’s Valentine Lake deposits and Matador’s Cape Ray deposits.

To date it has completed two drill programs on the project:

- In 2017 — 1466m in 9 holes focused on the Woods Lake Zone.

- This program confirmed the widespread extent of an auriferous altered grandiorite within a flexure of the Cape Ray fault and will require additional drilling to better define higher grade zones within the package

- In 2018 — 887m in 5 holes focused on completing a fence of holes across the Cape Ray structure at Ryan’s Hammer.

- This drilling combined with previous drilling to the east has partially outlined two wide gold trends with only one drill cut in each trend.

Through compiling these drill results (along with other field work such as prospecting/geophysics and soil sampling), Quadro has outlined three high priority targets in the northeast end of the Staghorn property, 30 km on strike from the Marathon Gold deposits.

In 2020 Quadro is set to embark on a proposed 2500 m drill program focused on discovery and development of deposits in the same style as Marathon Gold’s.

The program includes:

- Ryan’s Hammer

- Initially a prospecting discovery consisting of numerous slabs of angular float of mineralization granodiorite with values up to 32.15 g/t Au.

- One hole drilled in 2018 as part of a fence across this area intersected 0.145 g/t Au across 50 meters.

- 100 meter step out holes are recommended.

- Ryan’s Hammer East

- Located 300 to 500 meters across strike from the high grade float, previous drilling intersected 0.184 g/t Au over 71.2 meters in a moderately veined and altered granodiorite.

- Additional drilling is required to further test the granodiorite.

- Mark’s Pond

- This target is outlined by a 800 m by 300 m gold-in-soil anomaly with values up to 7,000 ppb gold.

- The target is coincident with the northern edge of a diorite intrusive body and the regionally significant Rogerson Lake conglomerate.

- Four holes are planned to test this soil anomaly.

ANOTHER NEWFOUNDLAND GOLD CONTENDER

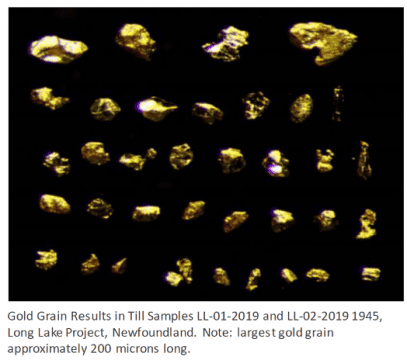

Further complimenting Staghorn is the Long Lake Property, which Quadro Resources Ltd. (TSXV: QRO / FSE: G4O2) has an option to earn a 100% interest in.

The 192 claim unit property is located proximal to Marathon Gold’s Valentine Lake deposits.

Long Lake’s property highlights include two areas of strong gold in soil and tills which to date have never been followed up.

Vendors took two till samples from a Tower gold-in-soil anomaly and processed them at Overburden Drilling Management Limited (ODM).

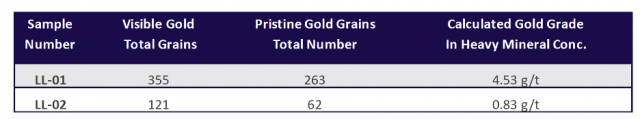

Both samples were highly anomalous as follows:

According to Don Holmes, P.Geo of ODM in late 2019, the No. 01 sample was collected at the site of a historical gold soil geochemical anomaly, and No. 02 was collected several meters adjacent.

A program of excavator trenching, prospecting and additional geochemistry is planned in 2020.

Quadro plans to drill high grade zones that have been identified by soil testing. With approximately 200 Sq. Kms over the two assets, there is more than enough running room to replicate the size and scope of Marathons Victoria Lake project.

CHASING PLATINUM-PALLADIUM IN ONTARIO

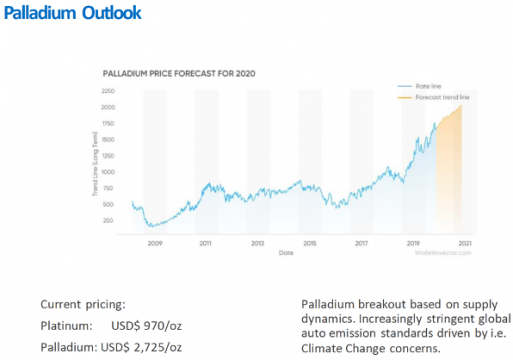

In 2019, the lesser talked about palladium took off to become the hottest precious metal in the world.

Among experts, it even opened this year being labeled as “more precious than gold”.[5]

Primarily mined in Russia and South Africa, 85% of palladium ends up in catalytic converters in car exhausts to reduce air pollution. However usage started increasing as governments (especially China’s) started raising standards on pollution from vehicles.[6]

Now there are supply concerns over the obscure metal as it traded above gold for most of the past year.

Earlier this year in February, Quadro Resources Ltd. (TSXV: QRO / FSE: G4O2) announced an option to acquire a 70% interest in the platinum-palladium prospective Seagull Lake Property from White Metal Resources Corp.

Located an hour north of the port city of Thunder By, and 50km south of Impala Canada’s Lac des Iles Mine (previously North American Palladium), the Seagull Lake property comes with excellent infrastructure—including paved and gravel roads, natural gas pipeline and power lines in the area.

Impala Canada recently paid $1.0 billion to acquire North American Palladium’s Lac des Ile Mine—Canada’s only primary PGE mine.

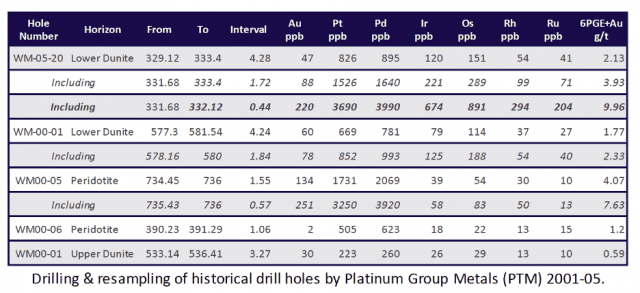

Quadro’s Seagull asset is comprised of 492 single cell mining claims totaling 10,390 hectares. Historic holes on the property targeted semi massive to massive sulphides at +800m depths.

Drill intersections include grades of up to 3.6 g/t PGE, 0 34% Cu, 0.21% Ni over 21 m, and 1.04 g/t PGE, 0.14% Cu, and 0.16% Ni over 16 m.

Three styles of PGE mineralization have been identified in the Seagull Intrusion: PGE rich detrital “black sands”, magnetite PGE rich layered “reef type”, and “Norilsk type” basal Cu Ni PGE rich sulphide bearing cumulates.

The company believes there is potential for the discovery of a Norilisk (Siberia) type PGE Cu Ni and contact type PGE sulphide mineralization.

Judging by other plays in the area this could be plausible.

The tremendous potential of the Thunder Bay North region is evidenced by Rio Tinto’s Escape Lake property (recently consolidated by Clean Air Metals Inc.), and Impala Canada’s Sunday Lake Property, which has had the following results:

- 35.8 m of 4.5 g/t Pt+Pd+Au (“3E”)

- 41.2 m of 3.22 g/t Pt, 2.08 g/t Pd, 0.21 g/t Au.

PGE zones at Seagull are wide open for expansion and drill permitting is underway.

Quadro’s work program will comprise of follow-up drilling on the high-grade intercepts identified by PTM and testing the PEM OFF HOLE geophysical anomaly that was never properly tested by PTM due to deviation of the previous drill holes.

The company will also test a magnetic anomaly considered to be the feeder zone for the Seagull Intrusion and a possible source of the copper, nickel, PGE mineralization.

Additional targets include the up-dip potential of the Lower Dunite Reef Zone PGE mineralization. Compilation of the existing data base accumulated by the previous operators is in progress and additional PGE targets have been defined from the 3D Mag inversion data.

VETERAN MINING MANAGEMENT TEAM AND BOARD

T. Barry Coughlan, BA – President & Chief Executive Officer, Chairman

Vancouver based businessman and financier Coughlan has been involved for more than 30 years in the financing of publicly traded companies. He’s presently a director of five publicly traded companies and was previously a director of Taseko Mines Ltd., Great Basin Gold Ltd., Farallon Mining Ltd., and Continental Minerals Corp. Over his career he has been involved in the financing of +30 private companies and their subsequent listings on North American Stock Markets. He is currently the Executive Chairman of Mineral Mountain Resources Ltd.

Wayne Reid, P.Geo – Vice-President Exploration

Spanning a variety of Canadian geological terrane, from Newfoundland to Northern B.C. and Alaska, Reid has +35 years of experience in exploration and mining geology, involving gold, base metal and uranium exploration in most geological environments in North America. He was part of the team in the discovery of the Brewery Creek Gold Deposit in the Yukon Territory and the Boundary Massive Sulphide Deposit / Duck Pond Mine in Central Newfoundland.

Tom Wilson, CPA-CA – Chief Financial Officer

Wilson has more than 35 years of corporate experience in all areas of financial management and administration including corporate governance, government and securities compliance and financial administration, for both public and private companies. Within the mining sector, he’s been CFO for the following companies: Quadro Corp., ICN Resources Ltd., Paragon Minerals Corporation. Previously, Mr. Wilson was the VP/Treasurer of Cellfor Inc.; the CFO for Quest University; Corporate Controller for MDSI; and Senior Manager at MacMillan Bloedel Limited.

Gordon Fretwell, B.Comm., LL.B. – Corporate Secretary

Formerly a partner in a large Vancouver law firm, Fretwell has, since 1991, been practicing primarily in the areas of corporate and securities law. He currently serves on the board of several public companies engaged in mineral exploration including: Asanko Gold Inc., Quartz Mountain Resources Ltd., Canada Rare Earth Corp, and Coro Mining Corp.

Brian Corrall, CA – Director

Corrall is the former President of CWA Consultants Inc. and Chief Financial Officer of GB Energy Holdings Inc. He’s held various financial positions at MacMillan Bloedel/Weyerhaeuser, BC Coastal Region for 30 years and served as a Director of Finance until November 2005. He’s been a Director of Quadro Resources Ltd. since January 2005 and served as an Independent Director of ICN Resources Ltd (formerly Icon Industries Ltd.) until September 2009. Corrall has been a Chartered Accountant and Financial Consultant since December 2005.

Trevor Thomas, LL.B. – Director

Thomas has practiced in the areas of corporate commercial, corporate finance, securities, and mining law since 1995, both in the private practice environment as well as in-house positions and is currently general counsel for Hunter Dickinson Inc. Prior to joining Hunter Dickinson Inc. he served as in-house legal counsel with Placer Dome Inc.

Nelson Baker, P.Eng. – Director

Baker has been active in the mineral exploration industry for over 50 years. He has been the President and CEO of Mineral Mountain Resources Ltd. since July 2010. Over the years he has served on several boards particularly in the junior resource sector. He was one of the founding principles of Rainy River Resources Ltd., and served as a director, President and CEO of Rainy River from March 2005 to June 2009. During that period, he and his team successfully expanded the Rainy River gold deposit from 450,000 ounces to 5 million ounces of gold.

Stephen Stares – Advisor to the Board

President and CEO of Benton Resources, Stephen Stares is a successful mining entrepreneur with +25 years’ experience in mineral exploration. With Noranda exploration he spent 7 years on projects including the Hemlo gold mines, Eagle River gold deposit and the Geco and Mattabi base metal camps. He also spent 10 years managing the operations of Stares Contracting Corp., a successful mineral exploration services company based in Thunder Bay, Ontario. In March 2007, Stephen and brother Michael, were the proud recipients of Prospectors and Developers Association (PDAC) Bill Dennis Prospector of the Year Award. This award was given to recognize the family’s contributions to the industry of the past 40 years.

Alexander “Sandy” Stares – Advisor to the Board

President and CEO of Metals Creek Resources, “Sandy” Stares has +18 years’ experience in mineral exploration, spanning a variety of Canadian geological terranes, from Newfoundland to Yukon. Prior to forming his own Contracting Company – Stares Prospecting Ltd. – he worked with IndoMetals, Rubicon Minerals Corporation, Freewest Resources of Canada, New Millenium, Lac Des Isle Mines and Noranda. He was instrumental in the discovery of the H-Pond Gold Prospect and the Lost Pond Uranium Prospect. He has discovered numerous major mineral occurrences in Canada and abroad which have been the subject of extensive exploration programs. He was also one of the recipients of the PDAC’s Bill Dennis Prospector of the Year Award” in March 2007, which was awarded to members of the Stares/Keats family.

5 Key Highlights to Remember for Quadro Resources Ltd. (TSXV: QRO / FSE: G4O2)

- Promising Newfoundland Real Estate over two propertiesincluding the Staghorn Gold project near Marathon Gold’s ~4.2 million oz Valentine Lake Deposits, and the Long Lake Gold property immediately north of Marathon Gold’s Valentine Lake property.

- Seagull Lake Property in Ontario within an hour of the city of Thunder Bay, and 28km north of new copper, nickel, platinum, palladium discoveries of Rio Tinto and Magma Metals, and 50km southeast of the North American Palladium mine.

- Extensive Exploration Programs planned in 2020 on all three projects, with the goal of step-out drilling to expand the deposits.

- Tight Share Structure with 50 million shares trading. Strategic partners and management have approximately 40% interest of the shares I/O.

- Proven Management Team and advisor board, with plenty of Canadian mining experience in a variety of terrane.

[1] https://www.gov.nl.ca/nr/files/pdf-wf-mining-2018.pdf

[2] https://www.marathon-gold.com/projects/flagship-project/valentine-lake/project-highlights/

[3] https://www.bloomberg.com/news/articles/2019-10-28/why-palladium-is-suddenly-a-more-precious-metal-quicktake-k2ap4ryc

[4] https://www.fraserinstitute.org/sites/default/files/annual-survey-of-mining-companies-2019.pdf

[5] https://www.bbc.com/news/business-51171391

[6] https://www.bloomberg.com/news/articles/2020-01-20/why-palladium-is-suddenly-a-more-precious-metal-quicktake-k5n00l9z

Disclaimer

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Equity Insider is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Quadro Resources Ltd. advertising and digital media from the company directly. There may be 3rd parties who may have shares of Quadro Resources Ltd., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own 1,090,476 restricted shares of Quadro Resources Ltd. and 545,238 restricted warrants exercisable at $0.25 which were purchased as a part of a private placement that was entered into on June 24, 2020. These shares and warrants will have their restriction lifted on October 24, 2020 at which point MIQ fully expects to sell/exercise them all. MIQ will not buy or sell shares of Quadro Resources Ltd. for a minimum of 72 hours from the date this report was posted (July 20, 2020), but reserve the right to buy and sell, and will buy and sell shares of Quadro Resources Ltd. at any time thereafter without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by Quadro Resources Ltd.; this is a paid advertisement, and we own shares of the mentioned company that we will sell, and we also reserve the right to buy shares of the company in the open market, or through further private placements.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

Investing In Gold 2020

Gold has long been regarded as a safe haven in times of market turmoil. Many investors have gained exposure to the precious metal by buying stocks of companies engaged in exploration and mining.

Now more than ever everyone is looking for “it”, yet most can’t find “it” & by “it” we’re referring to OPPORTUNITY IN THE STOCK MARKET!

When Presenting a True Wealth-Building Opportunity in Times of Uncertainty There is 1 Key Factor to Consider:

What are the “recession-proof” industries, meaning if the world continues to fall into uncertainty what industries will provide investors with the biggest opportunity to thrive?

The answer and PRIMARY EXAMPLE of a “recession-proof” industry is the GOLD & MINING SECTOR!

During the 2008 financial crisis companies like Barrick Gold Corporation saw massive gains. From January 1, 2007, to January 1, 2008 (NYSE: GOLD) saw its price per share increase over 73% when it went from $29.61 to $51.44

The above is just an example of what can happen, and we’ve got our eyes on a few emerging growth comapnies in this sector. If you’re interested in learning more, enter your email address in the box provided on this page and we will email you the information.

Editorial Team

Equity Insider