AI Needs Nuclear: 117% Demand Increase Positions Domestic Uranium for Surge

ISSUED ON BEHALF OF HOMELAND URANIUM CORP.

ISSUED ON BEHALF OF HOMELAND URANIUM CORP.

Discover a glitch in the Matrix where two very large historical resource estimates of US uranium are being massively overlooked by the market while tech giants scramble for nuclear power.

The Shocking Disconnect

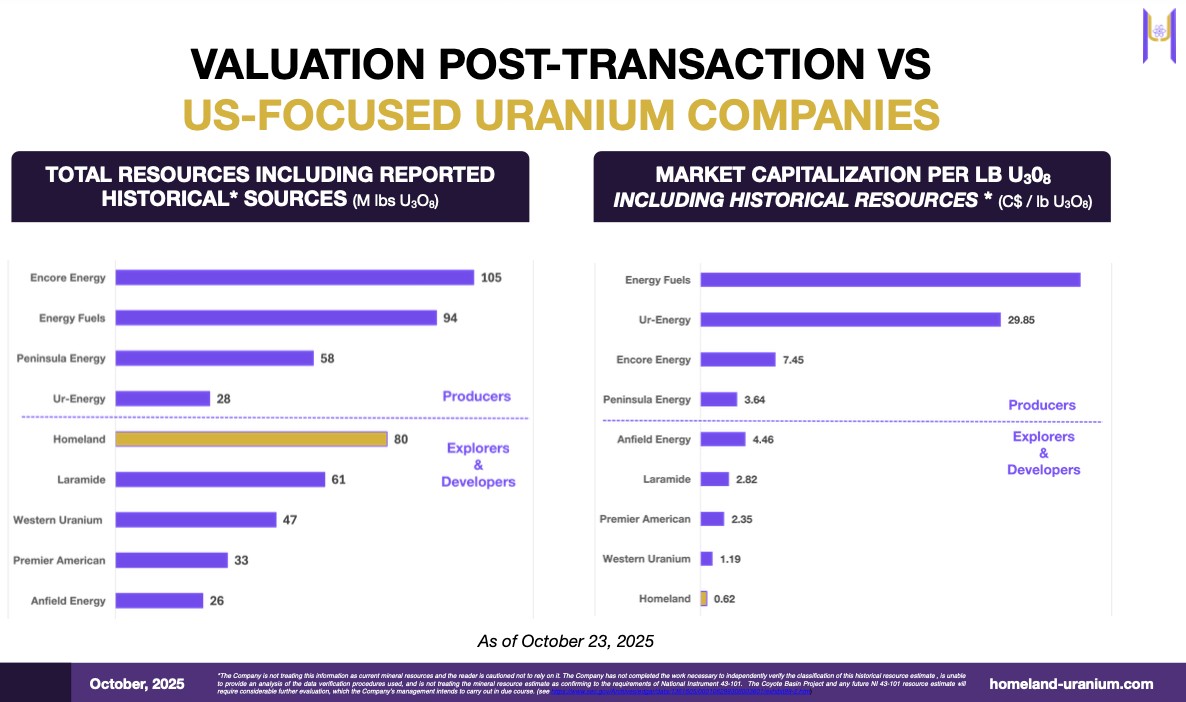

Right now, Homeland Uranium (TSXV: HLU) (OTCQB: HLUCF) controls a 35.4-million-pound historical resource estimate at its Coyote Basin asset, and another 44.2-million-pound historical resource estimate at its Skull Creek asset—which when put together, gives HLU one of the largest potential undeveloped uranium asset bases in the United States.

That’s enough fuel to power New York City for over 25 years[1],[2]. Or supply a major nuclear plant for decades.

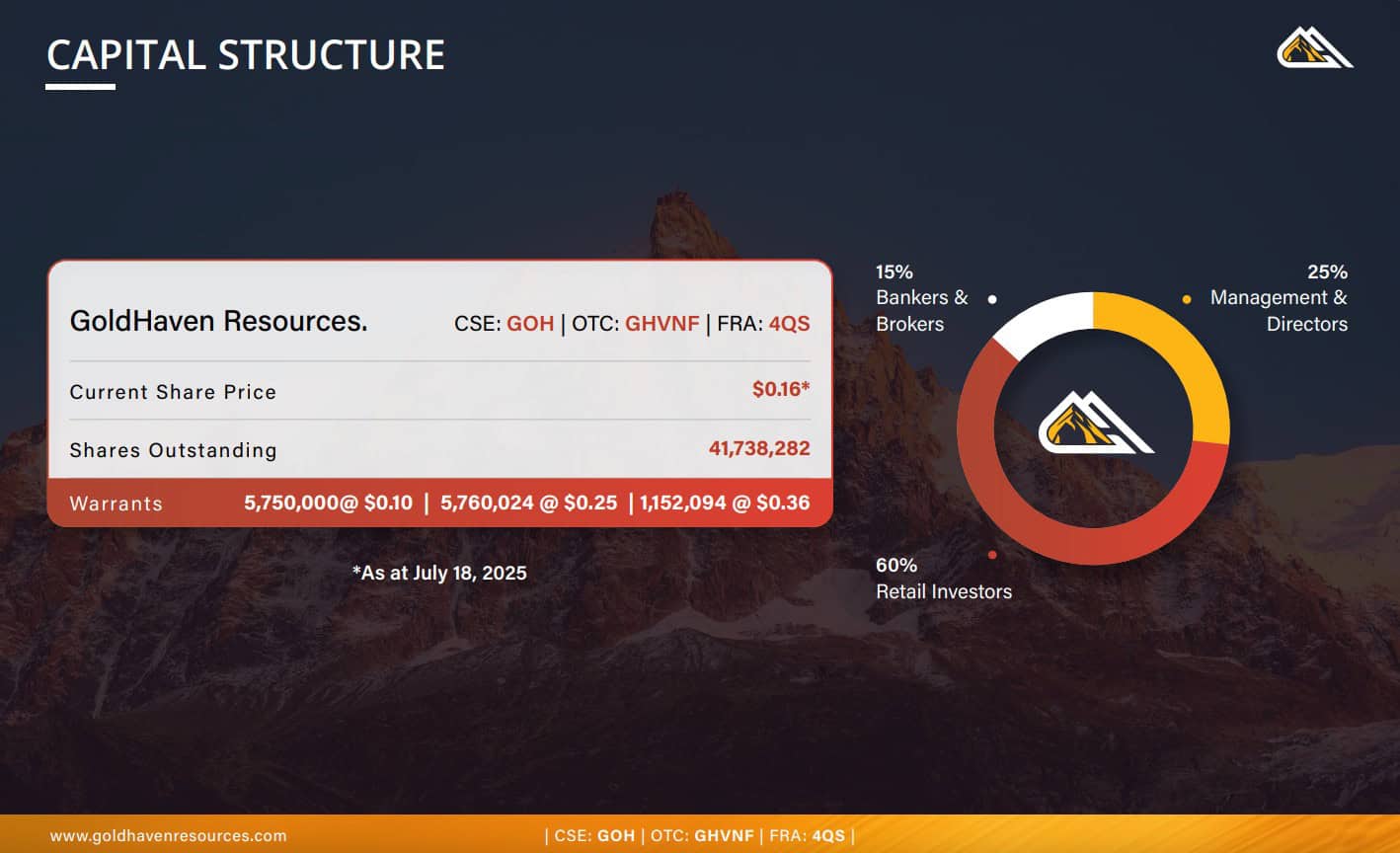

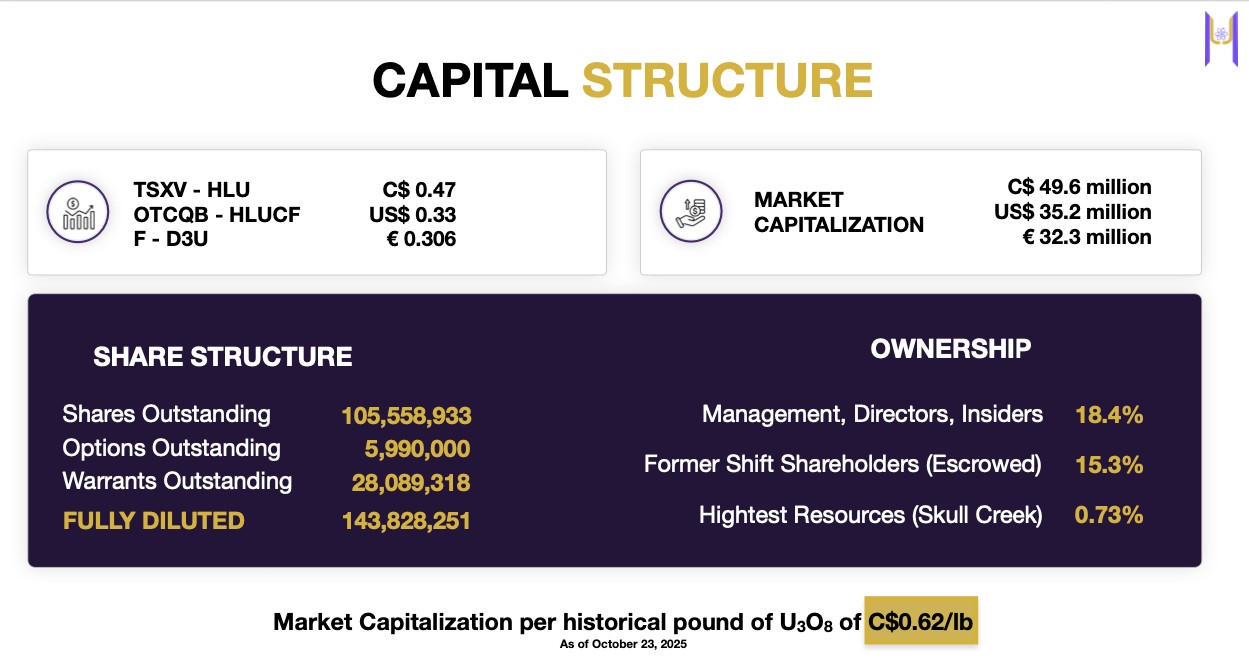

While Homeland Uranium (HLU.V) (OTCQB: HLUCF) sits at a C$49.6M market cap, the asset base and team quality suggest an unquestionable pricing error—the kind of massive disconnect the smartest money exploits immediately.

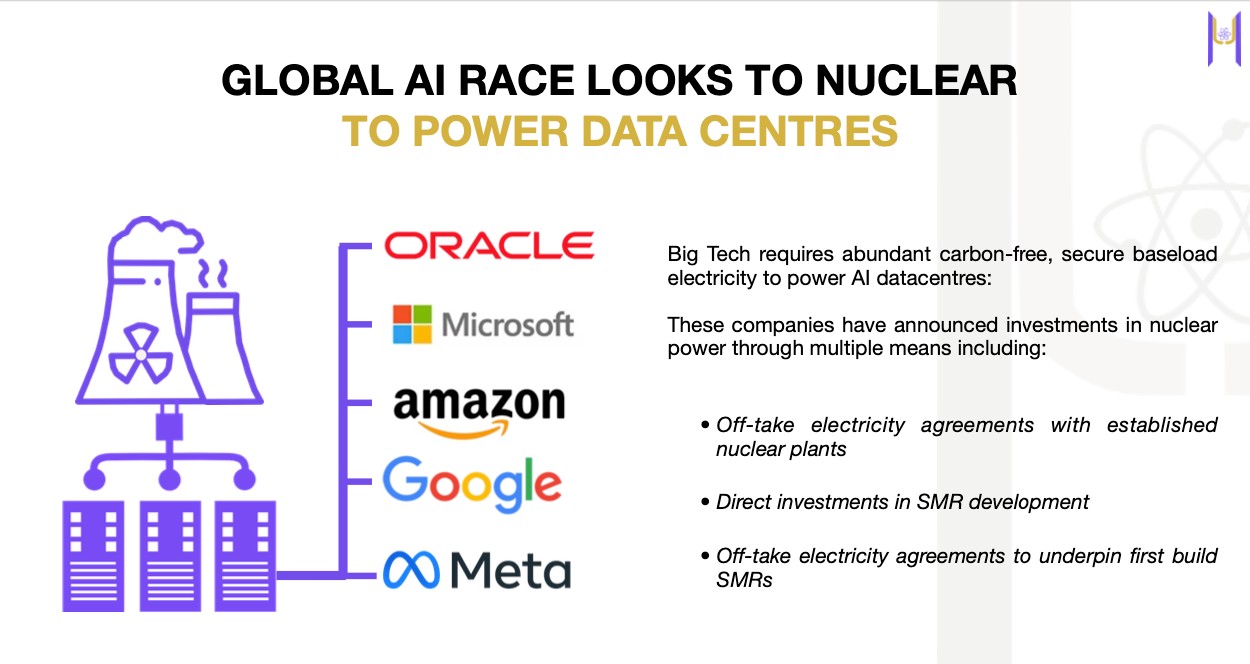

The AI Energy Crisis Nobody’s Talking About

Microsoft’s $100 billion AI infrastructure plan needs nuclear[3]. Oracle’s 1-gigawatt data center needs three reactors[4]. This isn’t speculation. It’s happening NOW.

In September 2024, Microsoft signed a 20-year deal with Constellation Energy to restart Pennsylvania’s Three Mile Island reactor[5]. Both Google and Amazon have also announced plans to purchase their own small modular reactors[6].

AI data centers need always-on energy. Renewables just can’t deliver.

Uranium demand is set to rise from 68,920 to 150,000 metric tons by 2040[7]. The US produces 1M lbs… but needs 50M lbs[8]. That’s a massive domestic shortage.

Current spot price (November 7, 2025): $78.20/lb[9], and experts expect it to keep climbing[10].

The $310 Million Track Record

This isn’t this team’s first rodeo. It’s their next billion-dollar exit.

Roger Lemaitre led UEX Corporation[11] from C$75M to C$310M market cap before selling at a 72% premium in late 2022[12].

Paul Matysek has sold six companies for over $2.5B in exits[13]:

- Energy Metals Corp: $10M → $1.8B (180x return)

- Lithium X Energy: Sold for $265M

- Potash One: Sold for $434M

- Goldrock Mines: Sold to Fortuna Silver

- Lithium One: Merged with Galaxy Resources

- Gold X Mining: Sold for $250M

This Homeland Uranium (HLU.V) (OTCQB: HLUCF) team specializes in nine-figure exits.

Insiders own 18.4% of shares.

Management is betting their own money.

Recently raised C$16.1M to fund aggressive exploration.

The Timeline That Changes Everything

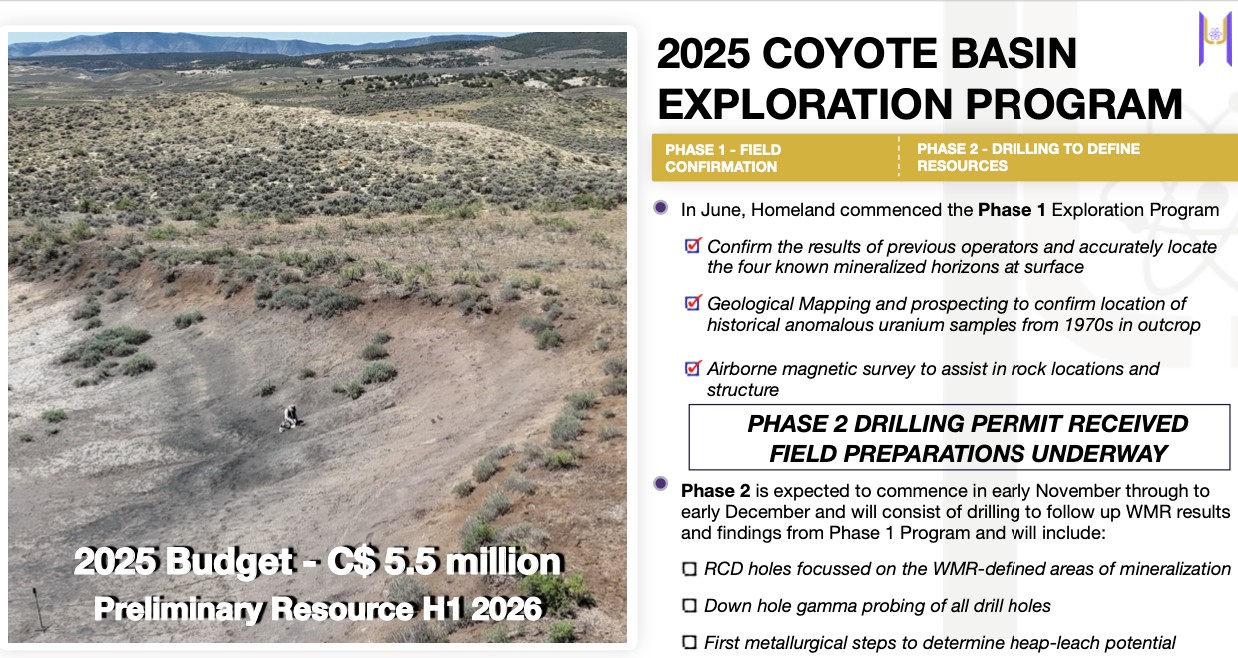

While others speculate, Homeland executes. Fully permitted and drilling NOW (not someday).

✓ September: Permits secured[14]

✓ October: Drilling commenced (reported to be expected around Oct 15)[15]

✓ Early November – Early December 2025: Phase 2 drilling commenced (per corporate deck)[16]

→ H1 2026: The Deadline for the market’s attention. First results expected, and potentially a Preliminary Resource Report (The ultimate rerating catalyst) (per corporate deck). [17]

→ 2026: Upgrading historical resource estimates to modern NI 43-101 standards

A clear path to profit most juniors don’t offer.

U.S. Security & Operational Control

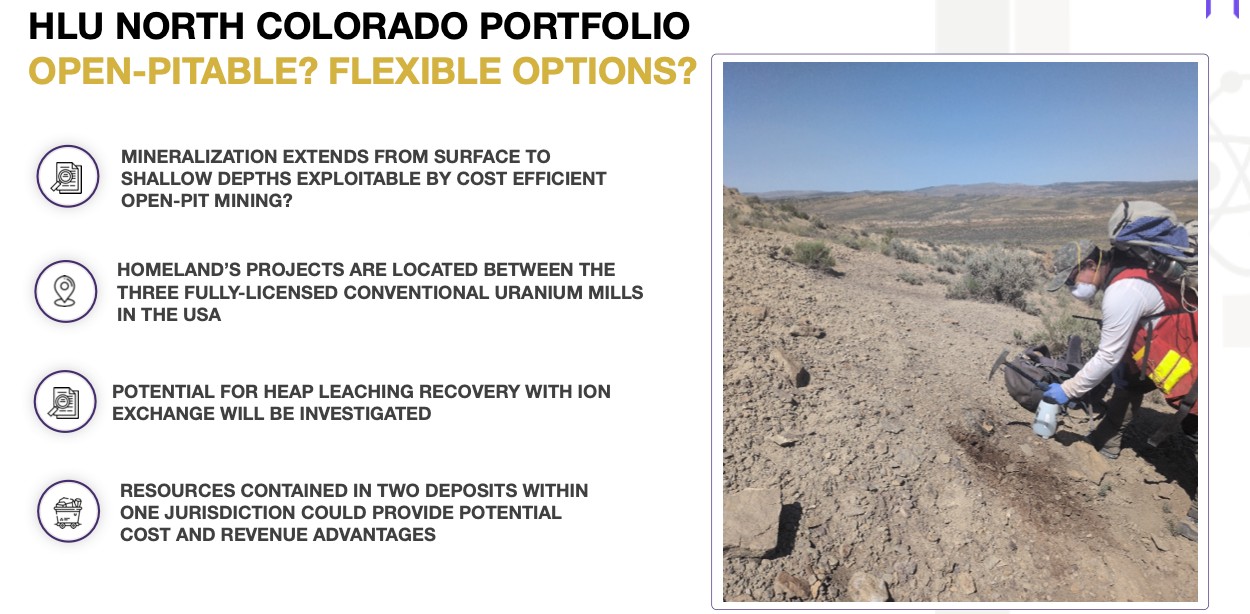

Unlike speculative plays in Africa or Kazakhstan, this is in mining-friendly Colorado, USA.

Located between the only three operational uranium mills in America. Three fully-licensed mills within trucking distance. Surface mineralization equals open-pit economics.

Homeland’s Coyote Basin and Red Wash projects sit in proven uranium territory with existing infrastructure. 37,252 acres spanning the historic Maybell Uranium District.

Why Should You Trust This?

Insiders own 18.4% of shares. Management is betting their own money.

Fully permitted and drilling NOW (not someday). Recent corporate updates show active field programs underway.

Recently raised C$16.1M to fund aggressive exploration. Cash in the bank to execute the plan.

The Profit Insurance

Adding another potential 17.7M lbs of vanadium* to the bigger picture isn’t just a bonus. It’s profit insurance.

(* Note this was part of the Coyote Basin historical resource estimate that was estimated in 1970 by Western Mining Resources, and reported in 2006 by Energy Metals Corporation)

This critical battery metal adds a crucial hedge against market volatility and secures a stake in next-gen U.S. clean energy storage. Four mineralized horizons create multiple, independent pathways to accelerated value creation.

The Next 90 Days

November: Drill core analysis begins

December: Expansion drilling at Cross Bones

January: First assay results expected

With drilling results expected Q1 2026, the window to enter at ground-floor prices is measured in weeks, not months.

Why NOW

The compressed window of opportunity.

Spot uranium at $78.20/lb[18] and climbing toward $100+[19]. Bank of America forecasts an imminent move to $100+ and $135/lb by 2026[20].

Drill results imminent equals rerating catalyst. The greater risk is the quiet certainty of regret.

The Bottom Line

Both the historical resource estimates from Coyote Basin (35.4M lbs U3O8) and from Skull Creek (44.2M lbs U3O8) represent together one of the most significant undeveloped uranium asset bases in the United States.

Current market cap: C$49.6M

The market always corrects massive disconnects between asset scale and valuation.

The Market Always Discovers Value.

The Only Question Is Who Will Be Holding

TSX-V: HLU/ OTCQB: HLUCF

when it does.

Educational purposes only. Conduct thorough due diligence and consult qualified financial advisors before making investment decisions.

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. This article is being distributed by Equity Insider on behalf of Market IQ Media Group Inc. (“MIQ”). MIQ has been paid a fee for Homeland Uranium Corp. advertising and digital media from Creative Digital Media Group (“CDMG”). There may be 3rd parties who may have shares of Homeland Uranium Corp., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ/BAY does not own any shares of Homeland Uranium Corp. but reserve the right to buy and sell, and will buy and sell shares of Homeland Uranium Corp. at any time without any further notice commencing immediately and ongoing. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material, including this article, which is disseminated by MIQ has been approved on behalf of Homeland Uranium Corp. by CDMG; this is a paid advertisement, we currently own shares of Homeland Uranium Corp. and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

SOURCES CITED:

[1] https://climate.cityofnewyork.us/subtopics/systems/

[2] https://world-nuclear.org/information-library/nuclear-fuel-cycle/introduction/nuclear-fuel-cycle-overview

[3] https://www.datacenterfrontier.com/energy/article/55252205/how-2024-the-year-that-re-energized-nuclear-power-foretells-ongoing-new-nuclear-developments-for-data-centers-in-2025

[4] https://www.power-eng.com/nuclear/smrs/oracle-designing-data-center-to-be-powered-by-trio-of-small-modular-reactors/

[5] https://penncapital-star.com/economy/microsoft-describes-three-mile-island-plant-as-a-once-in-a-lifetime-opportunity/

[6] https://spectrum.ieee.org/nuclear-powered-data-center

[7] https://www.mining.com/uranium-demand-for-nuclear-power-set-to-surge-nearly-30-by-2030-world-nuclear-association

[8] https://investingnews.com/uranium-forecast/

[9] https://tradingeconomics.com/commodity/uranium

[10] https://www.ans.org/news/article-7425/uranium-prices-up-could-demand-more-than-double/

[11] https://www.tipranks.com/news/press-releases/jourdan-hires-roger-lemaitre-as-vice-president-and-head-of-mining

[12] https://consolidatedlithium.com/jourdan-hires-roger-lemaitre-as-vice-president-and-head-of-mining/

[13] https://www.minenportal.de/artikel/445739–Freeman-Gold-Appoints-Paul-Matysek-as-Executive-Chairman-and-Announces-3-Million-Strategic-Placement.html

[14] https://www.homeland-uranium.com/news-releases/2025/homeland-receives-permit-to-commence-coyote-drill-program2025-09-24-010502

[15] https://www.homeland-uranium.com/news-releases/2025/homeland-receives-permit-to-commence-coyote-drill-program2025-09-24-010502

[16] https://www.homeland-uranium.com/images/PDF/Presentations/2025/Homeland_U_-_Corporate_Deck-Oct_2025.pdf

[17] https://www.homeland-uranium.com/images/PDF/Presentations/2025/Homeland_U_-_Corporate_Deck-Oct_2025.pdf

[18] https://tradingeconomics.com/commodity/uranium

[19] https://www.ans.org/news/article-7425/uranium-prices-up-could-demand-more-than-double/

[20] https://www.nucnet.org/news/price-could-hit-usd135-in-2026-says-bank-of-america-analysts-10-1-2024

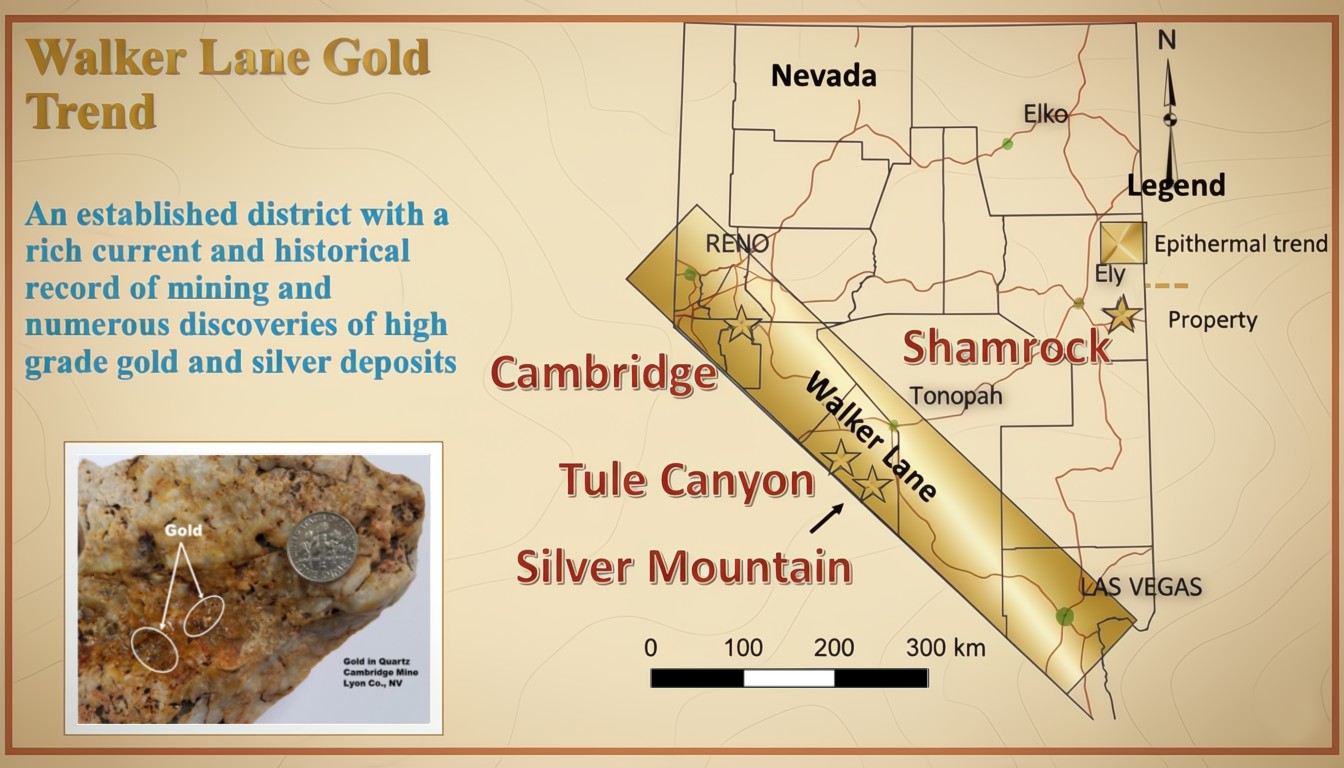

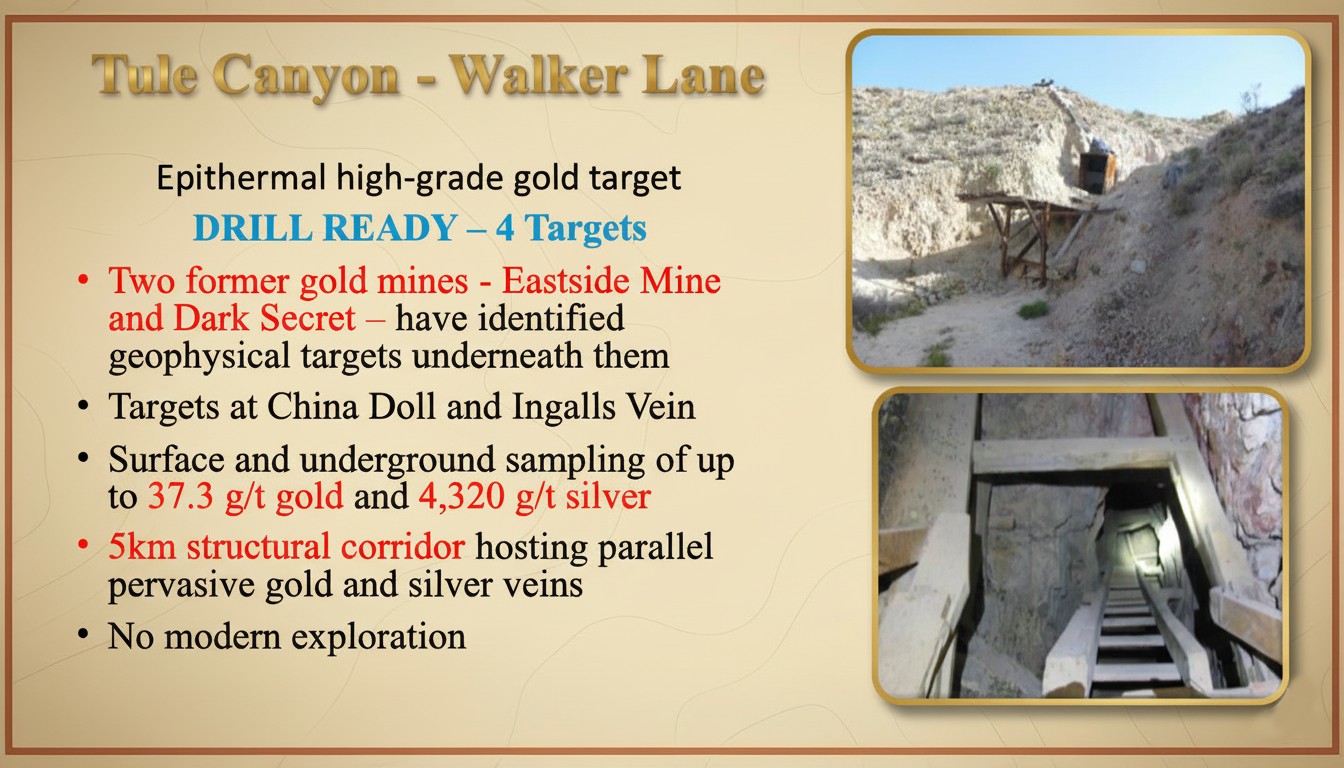

This is where Mexican placer miners worked the ground before 1848. Mills operated here in the 1920s. Historical workings produced high-grade gold and silver. Then everyone stopped, and no company has applied modern exploration techniques to test what lies beneath.

This is where Mexican placer miners worked the ground before 1848. Mills operated here in the 1920s. Historical workings produced high-grade gold and silver. Then everyone stopped, and no company has applied modern exploration techniques to test what lies beneath.

Every major mining district has its quiet period, typically after historical mining ends but before modern exploration begins.

Every major mining district has its quiet period, typically after historical mining ends but before modern exploration begins.

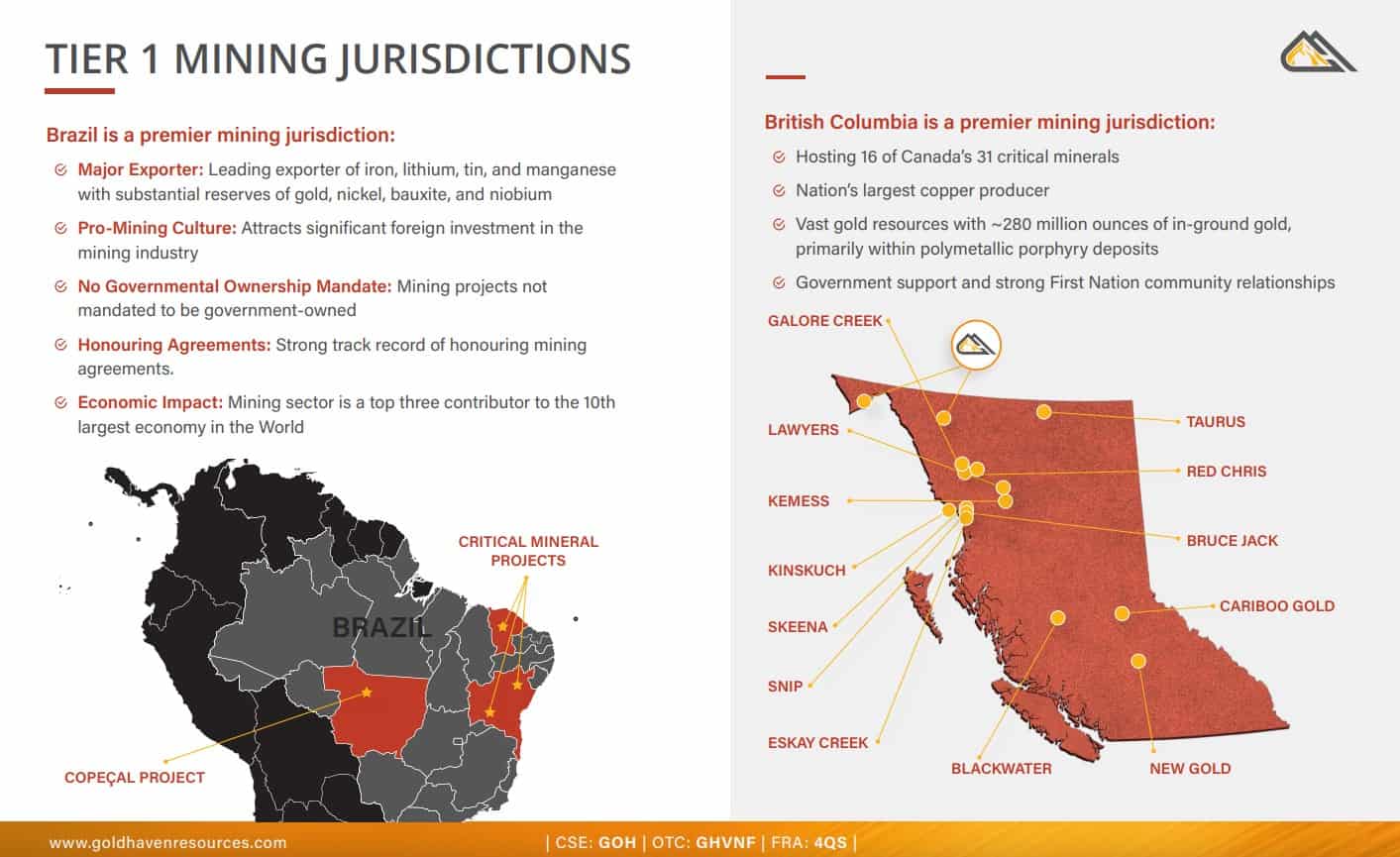

GoldHaven’s flagship Copeçal Gold Project sits in Brazil’s Juruena Gold Province – a belt that’s been producing gold since the 1980s and continues to attract major mining companies today.

GoldHaven’s flagship Copeçal Gold Project sits in Brazil’s Juruena Gold Province – a belt that’s been producing gold since the 1980s and continues to attract major mining companies today.

Picture this: It’s 1905 in the Nevada desert. A prospector named Lew Cirac strikes it rich, pulling high-grade silver out of the ground in what becomes known as the Republic Mining District.

Picture this: It’s 1905 in the Nevada desert. A prospector named Lew Cirac strikes it rich, pulling high-grade silver out of the ground in what becomes known as the Republic Mining District.

Issued on behalf of VisionWave Holdings, Inc.

Issued on behalf of VisionWave Holdings, Inc.

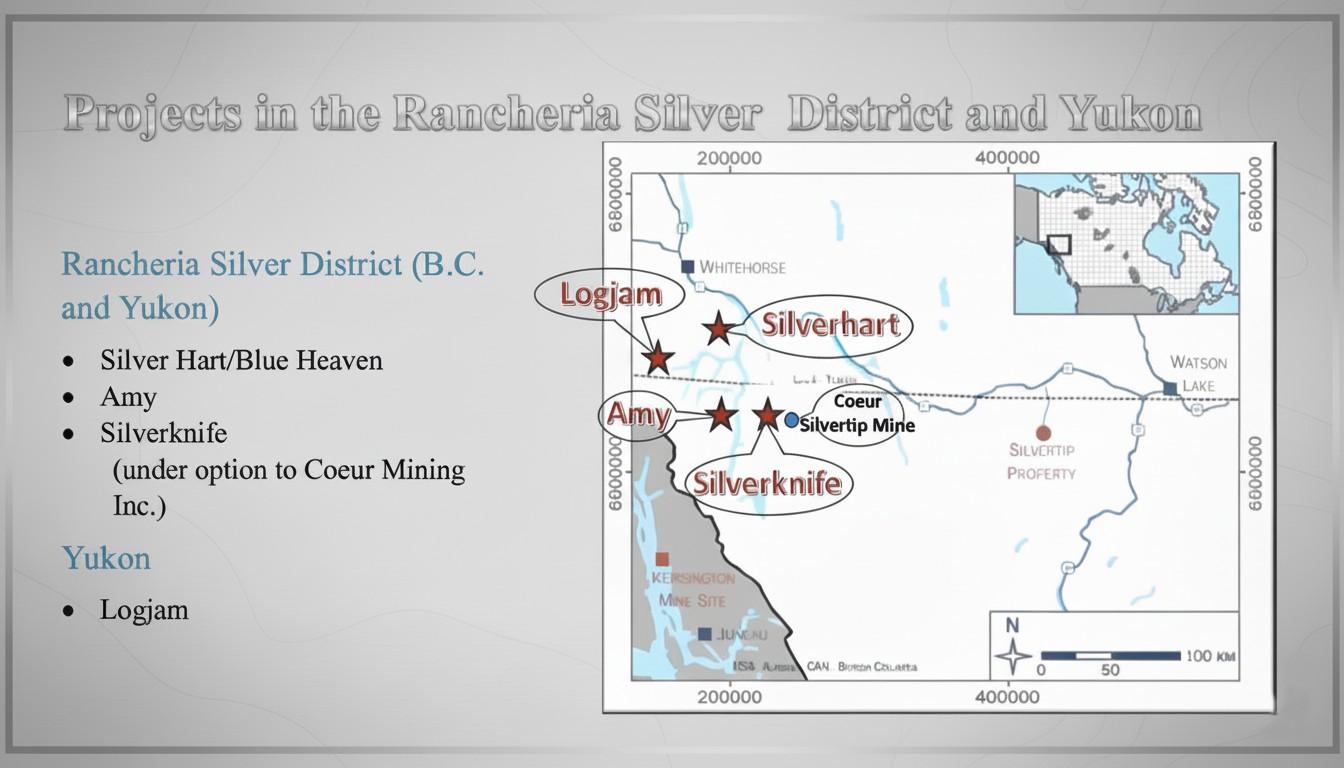

Picture northern British Columbia. A mining town that produced millions of ounces of gold. Real gold. Pulled from real rocks. Shipped to real banks.

Picture northern British Columbia. A mining town that produced millions of ounces of gold. Real gold. Pulled from real rocks. Shipped to real banks. But Canada is only half the story.

But Canada is only half the story.