All Posts in "Uncategorized"

This Healthcare Juggernaut Is Ready For Take Off

WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) – the “Berkshire Hathaway of Tech-Enabled Healthcare” – Could Be the Next Giant Healthtech Conglomerate

When Warren Buffett first bought Berkshire Hathaway in 1962, it was nothing more than a struggling textile mill.

Today, it is a $600+ billion conglomerate juggernaut,[1] owning businesses ranging from insurance and utilities to railroads and chemicals.

Berkshire’s journey from humble mill to giant conglomerate is incredible. Unfortunately, the Berkshire of today is far too huge to generate the kind of returns that can truly change individual investors’ lives.

It has become “just another” blue-chip stock – and one that some think has come in late or missed the boat entirely on many disruptive technologies.

But there’s one fast-growing company that is in a position to have a profound impact on investor returns. It has learned from companies like Berkshire, incorporating what is arguably Berkshire’s greatest strength – its operating structure…

Where the holding company acts like a giant institutional investor, seeking out operating companies to invest in that can generate the highest ROI…

And letting these subsidiaries operate independently with minimal interference, while the holding company does what it does best – efficiently allocating capital.

But this company has learned from Berkshire’s mistakes – and even improved on its operating model.

What’s this company, you may ask? None other than WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF).

WELL firmly understands that technology is the future, and is committed to fully capitalizing on this wave…

Plus, it is only focused on acquiring companies within the multi-trillion-dollar healthcare sector, which allows it to generate powerful value-boosting synergies among its acquisitions (something that Berkshire does not focus on due to its divergent scope of investments).

And its biggest investor? Multi-billionaire Sir Li Ka-Shing – ranked the 43rd richest person in the world with a networth of $34.6 billion[2] and nicknamed “Superman Li” for his business prowess.

That’s why it could be no exaggeration to say that…

WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) is the “Berkshire Hathaway of Tech-Enabled Healthcare” – and the Company Could Be on the Cusp of a Major Growth Spurt

Much like Berkshire started in the textile business, WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) began as a humble medical clinic operator.

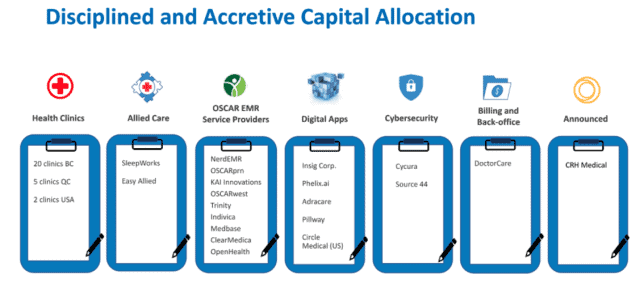

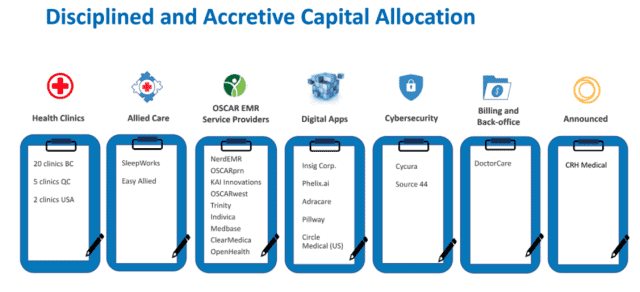

And in just a few short years, it has grown to become a billion-dollar omni-channel company with 7 different healthcare business lines, including health clinics, electronic medical records (EMR), telehealth, digital apps, billing and cybersecurity…

WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) owns 27 primary healthcare clinics in North America – the largest network in BC and the third-largest in Canada…

It operates a multi-national EMR business including its OSCAR Pro EMR asset, which is the third-largest EMR service provider in Canada (a $26.1 billion global market that’s expected to hit $39.4 billion within 5 years[3])…

Its leading Canadian telehealth service conducts thousands of patient visits daily using its software.

All this was done through disciplined and accretive acquisitions, with shareholder dilution always being carefully managed.

And although its stock has shot up by 313% since 2020[4]…

WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) Remains Substantially Undervalued Compared to Its Peers…

Even though…

Its EBITDA already turned positive in the fourth quarter of 2020, with a 53% revenue growth for the year…

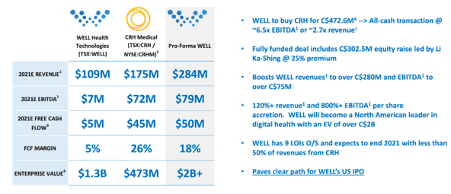

It’s just completed a major acquisition that would add approximately C$175 million in revenues and C$72 million in EBITDA to its earnings…

WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) has 10 signed letters of intent that could add another C$100+ million to its annual revenues by the end of 2021…

And it’s planning a US IPO by the end of the year.

| Company | Symbol | Market Cap (USD)* | Share Price (USD)* | Revenue (USD) | EV/Sales |

| WELL Health | TSX:WELL OTC:WLYYF | $991M | $6.05 | $220M+**[5][6] | 5x |

| Veeva Systems | NYSE:VEEV | $40.8B | $268.29 | $1.1B[7] | 37.1x |

| Teladoc Health | NYSE:TDOC | $29.0B | $188.11 | $1.1B[8] | 26.6x |

| Oak Street Health | NYSE:OSH | $14.1B | $58.57 | $883M[9] | 16.0x |

| American Well | NYSE:AMWL | $4.1B | $17.23 | $245M[10] | 16.7x |

| 1Life Healthcare | NASDAQ:ONEM | $5.8B | $42.49 | $380M[11] | 15.3x |

| Hims and Hers | NYSE:HIMS | $2.3B | $12.29 | $149M[12] | 15.7x |

*Share Price and Market cap taken from Yahoo Finance on April 14, 2021

**This revenue figure is inclusive of the company’s recent (completed) acquisition of CRH Medical, estimated to be on a runrate basis based on consensus estimates.

When compared to others in the industry, WELL’s peer group trades at 10x to 20x revenue multiples, while WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) trades at an EV to sales multiple of just 5x.

This means that although the company is far from being a risky early-stage startup company…

It still has plenty of room to grow, particularly as it continues to ramp up its acquisitions…

Which could place WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) in the perfect risk-reward “sweet spot” for investors…

But this window of opportunity may be closing, as analysts expect its valuations to increase to a range more in line with its peers once the US IPO happens.

8 Reasons WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) Could Be the Healthtech Play of the Future

- Multi-channel Capability: With healthcare clinics, EMR services, telehealth offerings, digital apps, and more, the company is truly multi-channel, multi-service, and omni-channel in nature – able to offer both in-person and digital solutions to patients, healthcare professionals, and clinics. This allows the company to not only benefit from all aspects of the healthcare industry, but also provides defensive diversification qualities.

- Track Record of Accretive Acquisitions: WELL Health (TSX: WELL – OTC: WLYYF) has a solid track record of buying profit-generating companies that can continually add value to its bottom line – all with carefully-controlled shareholder dilution. For instance, due to its acquisition of CRH Health, it is expected to experience 120% accretion to revenue and 800% accretion to EBITDA on a per share basis. However, shareholder dilution was limited to a mere 17%.

- Value-Boosting Synergies Within Business Lines: Post-acquisition, the company also has multiple opportunities to add further value to its acquisitions via internal synergies within its business lines. For example, the company is planning to cross-sell its digital services to CRH Health’s network of over 3,000 Gastroenterologist physicians, which are currently generally digitally underserved.

- Rapid Acquisition and Growth Strategy: Within the first three months of 2021 alone, WELL Health (TSX: WELL – OTC: WLYYF) has already announced six acquisitions – one of which is a major US player. The company also has another 10 signed letters of intent that could add C$100+ million to annual revenues. Further, recent acquisition CRH Medical is itself a proven M&A player with a track record of 32 acquisitions and over 500 active deal targets.

- Strong Investor Base: Multi-billionaire Li Ka-shing is a strategic investor in the company, among other institutional investors such as Manulife, CI Investments, Sentry Investments, Iconiq Capital, Fiera Capital, and the PenderFund Capital. Li Ka-shing and his partner personally led a C$302.5 million equity raise for the CRH Medical acquisition with their own investment of C$100M at an unprecedented 25% premium to market (based on the 5 day VWAP before announcement) – the additional C$202.5M came from the other institutional investors at the same premium.

- Well Funded With a Strong Balance Sheet: WELL Health (TSX: WELL – OTC: WLYYF) boasts C$87 million in cash as at end-2020 – with zero debt. Only recently did the company take on some debt as part of the CRH Medical acquisition. However, even said debt facility was obtained at highly cost-effective rates of between 1.5% to 3.25% depending on leverage ratios.

- Future US IPO Listing: The company’s targeted US IPO in late 2021 will provide an additional cash infusion that it can use to turbocharge its acquisition strategy. Further, analysts also expect a US listing to push the company’s valuation upwards to a level more in line with its peers. WELL is grossly undervalued when compared against US comps.

- Proven Management Team with Skin in the Game: WELL Health’s (TSX: WELL – OTC: WLYYF) management team are all veterans of Tio Networks, a multichannel bill payment processor that was acquired by PayPal for C$304 million in 2017.[13] They’re also all heavily invested in the company, with the CEO personally investing approximately C$6 million in company stock – and never having sold a single share or taken a dollar of cash as salary thus far.

With all these factors in its favor, WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) is…

Well-Positioned to Capitalize on the Massive Digital Transformation Wave Sweeping Through the Healthcare Industry

The health crisis has accelerated digital transformation in all areas, and healthcare is no exception.

For proof of this, look no further than telehealth.

In 2019, research firm Fortune Business Insights[14] estimated the size of the global telehealth market at “only” $61.4 billion…

By 2027, it expects that number to hit $559.5 billion, a compound annual growth rate of over 25%. That’s an astounding growth rate that shows just how big the digital transformation opportunity in healthcare is.

Because although telehealth could soon be worth hundreds of billions, it’s still just one part of the larger digital transformation opportunity…

And WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) is strongly positioned to benefit from all aspects of this opportunity thanks to its multi-pronged approach to healthcare tech.

Beyond that, each new acquisition generates incremental opportunities for its existing subsidiaries, meaning the whole is truly greater than the sum of its parts.

Just like how…

WELL’s (TSX: WELL – OTC: WLYYF) Recent Acquisition of CRH Medical Could Soon Turn the Company into a North American Digital Health Powerhouse

CRH Medical is a major player in the US gastroenterology (GI) market, with 72 GI ambulatory service centers, 411 GI providers, and over 3,200 GI providers trained to use its products and services.

This alone is already enough to generate over C$175 million in annual revenues, with an incredible 26% free cash flow margin.

Yet as investment bank Eight Capital said in a recent research report[15]…

“CRH’s +72 clinic footprint remains digitally underpenetrated, providing a greenfield opportunity for cross-sell. We expect the introduction of a telehealth offering to optimize consumer reach and patient in- and outflow. Plans for the development of a GI-focused app will expand CRH’s reach, increase traffic to clinics, and push product sales.”

In other words, the additional C$175+ million in revenues – not to mention C$72 million in EBITDA and C$45 million in free cash flow – is just the beginning of CRH Medical’s potential…

Because once WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) integrates its digital health offerings with CRH Medical, it could be well on its way toward becoming the next North American digital health powerhouse.

Not to mention that CRH Medical is itself planning to swiftly expand its network and offerings through acquisitions (it has 500 active deal targets in its pipeline)…

Meaning the cross-sell synergies will have a powerful multiplier effect even years down the line.

The best part? All this was done with only a 17% shareholder dilution for Well Health’s (TSX: WELL – OTC: WLYYF) shareholders.

It’s all thanks to the support of the company’s strong investor base, who were all too happy to put in their money at a 25% market premium (investors in this round included every member of its board and most of its management team, including the CEO and CFO of the company)…

Because they realized that the CRH Medical acquisition puts WELL Health in a great position for a US listing…

A powerful catalyst that is widely expected to drive its valuations up toward the ranges offered by its peers.

But while much focus has been (rightfully) given toward the company’s CRH Medical acquisition…

WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) Has Been Steadily Conquering the Digital Healthcare Industry, One Acquisition at a Time

WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) is a diversified healthtech conglomerate that is rapidly making inroads in all aspects of digital health…

Just look at all of its businesses that it already has:

Like the $26.1 billion EMR market, an industry that is quickly growing as clinics scramble to digitize…

Because EMR is the “enterprise backbone” of a clinic, a system that manages everything from the backend database to the frontend point of sale…

Meaning clinics are unlikely to be able to remain competitive in the modern healthcare market for long without an EMR system.

WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) is already the third-largest player in Canada for EMR…

Its main EMR offering – OSCAR Pro – is also open source, giving it greater versatility compared to its competitors. It has been a market share taker in Canada because of its strong interoperability with a large community of third-party app developers.

The company is also quickly adding to its EMR business line with other acquisitions, such as IntraHealth, an enterprise class EMR vendor with customers in Canada, Australia and New Zealand.

Meanwhile, it’s also transitioning clinics owned by newly-acquired subsidiaries over to its EMR platform – showing just how easily the company can generate internal synergies.

Another example is its acquisition of Silicon Valley – and Y Combinator-backed – company Circle Medical.

WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) completed a majority stake investment in Circle Medical in November 2020.

Yet in the past four months, Circle Medical’s revenues have nearly doubled…

This highlights Well Health’s (TSX: WELL – OTC: WLYYF) specialty – strategically allocating capital to undervalued companies that are usually on the cusp of greater growth, which makes the company…

A Fast-Growing, Diversified, and Undervalued Healthtech Play With Multiple Catalysts on the Horizon

Investors looking to invest in the digital transformation that is happening in the trillion-dollar healthcare industry face a common dilemma…

The industry is so vast, with so many different sub-sectors (both B2B and B2C) that they may not even know where to start.

Even if they did know about the various sub-sectors, they would need to invest in many different companies to have a truly holistic and diversified exposure…

Or, they could choose to invest in the large multi-billion dollar health conglomerates – where most of the major returns have already been snatched up years ago by early investors.

WELL Health Technologies Corp. (TSX:WELL) could be the answer to that dilemma…

It offers investors:

- Diversified exposure to the entire tech-enabled healthcare market with a single investment…

- Strong near-term growth opportunities thanks to multiple catalysts on the horizon – such as its expansion into the US from its CRH Medical acquisition plus its planned US IPO, as well as its 10 pending signed LOIs…

- Long-term value from disciplined and accretive acquisitions that also benefit from internal synergies…

All at a price that analysts consider substantially undervalued.

So, instead of spending all that time and effort untangling the complex web that is healthtech, just to find a company that may or may not pan out…

Why not look at a company whose sole specialty is finding undervalued profit-generating companies across the entire healthtech spectrum, and then consolidating and modernizing them to create even more value?

In other words, why not let WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) do the work for you?

There’s a reason the company was recognized as a TSX Venture 50 company for three years in a row[16]…

Plus, its management team’s track record speaks for itself.

WELL Health Technologies Corp.’s (TSX: WELL – OTC: WLYYF) Has a Management Team Consisting of Nothing but Proven Veterans

Hamed Shahbazi – Chairman & CEO

With over 20 years as a technology-focused operator, Shahbazi has a razor-sharp understanding of the intricacies of identifying opportunities and generating value in the sector. He was the founder of TIO Networks, originally a kiosk solution provider before Shahbazi transitioned it into a multichannel payment solution provider specializing in bill payments and other financial services. As a result, the company was acquired by PayPal in 2017 for C$304 million.

Shahbazi has extensive experience in strategic mergers, acquisitions, and divestitures, both as an operator and board member, with more than a dozen successful transactions. He is also the Lead Independent Director for mediatech company BBTV Corp, as well as the owner and operator of Impactreneur Capital Corp, which has over a dozen investments in leading digital content, ehealth, insurtech, and other technology inspired companies.

Dr. Michael Frankel – Chief Medical Officer

Dr. Frankel has 29 years of experience as a general practitioner in the Lower Mainland, giving him a wealth of experience in the medical industry. But more than just being a doctor, Dr. Frankel is also a healthcare investor and businessman, owning and operating a portfolio of successful primary healthcare facilities. This gives him a deep understanding of what healthcare facilities are lacking and how they can be improved – a crucial piece of WELL Health’s (TSX:WELL) strategy.

Eva Fong, FCCA, CPA, CGA – Chief Financial Officer

As the VP in charge of corporate strategy and M&A at TIO Networks, Fong intimately understands the full lifecycle of M&A transactions, from prospecting to integration and regulatory compliance management.

Her 25 years of experience includes Fortune 500 public company management, M&A, corporate strategy development, risk and compliance, and finance and business shared services programs. She’s held senior leadership positions in various high-tech sectors including PayPal, TIO Networks, SAP, and 360networks, where she led business units and built best-in-class corporate culture.

Amir Javidan – Chief Operations Officer

In his over 15 years of experience as a technology and operations executive, Javidan has been involved in two successful exits. Most recently, he was the SVP of Operations for TIO Networks, overseeing its C$304 million buyout by PayPal. Before that, he was at Avigilon, an integrated cloud and AI-powered solutions company, where he helped scale the business from a “stealth mode” startup to a public company worth over C$1 billion. He also helped take its revenue to over C$100M in five years.

RECAP: 10 Reasons Investors Should Seriously Consider Adding WELL Health Technologies Corp. (TSX: WELL – OTC: WLYYF) to Their Portfolios

- It is a multi-channel, multi-product healthtech conglomerate that has the capability to benefit from multiple areas of the industry

- A proven track record of accretive acquisitions of profit-generating businesses – all with carefully controlled dilution

- Internal synergies from cross-selling can further boost the value of its acquisitions

- Rapid acquisition and growth strategy gives it strong potential in a lucrative industry

- Significantly undervalued compared to its peers; for example, its peer group trades at 10x to 20x revenue multiples, while WELL trades at 5x EV to Sales multiple.

- Planned US IPO listing is widely expected to bring its valuations to a range more in line with its peers

- Strong investor base including multi-billionaire Li Ka Shing plus other institutional investors, all of whom have shown willingness to pump in capital to support acquisitions

- Proven management team with skin in the game that have executed successful M&As and exits

- Multiple business lines within the healthtech industry provides defensiveness plus a hybrid physical-virtual competitive moat

- Already a significant player within multiple lucrative business lines (such as EMR and telehealth) but with plenty of room to grow remaining

SOURCES:

[1] https://finance.yahoo.com/quote/BRK-A?p=BRK-A&.tsrc=fin-srch (15 Apr 2021)

[2] https://www.forbes.com/profile/li-ka-shing/?sh=38d286ff523f

[3] https://www.pharmiweb.com/press-release/2020-12-15/electronic-medical-records-emr-market-2020-size-and-growth-factors-study-and-estimate-4medica-a

[4] https://finance.yahoo.com/quote/WELL.TO?p=WELL.TO&.tsrc=fin-srch (from Jan 1 2020 to Apr 15 2021)

[5] https://www.newswire.ca/news-releases/well-health-achieves-record-revenue-and-positive-adjusted-ebitda-in-q4-2020-driven-by-400-yoy-growth-of-software-and-services-revenue-861878058.html

[6] https://www.newswire.ca/news-releases/crh-medical-corporation-announces-2020-fourth-quarter-and-year-end-results-825729519.html

[7] https://ir.veeva.com/investors/news-and-events/latest-news/press-release-details/2020/Veeva-Announces-Fiscal-2020-Fourth-Quarter-and-Fiscal-Year-2020-Results/default.aspx

[8] https://www.mobihealthnews.com/news/teladoc-health-outlines-year-knockout-growth-q4-2020-earnings-call

[9] https://www.businesswire.com/news/home/20210309005989/en/Oak-Street-Health-Reports-Fourth-Quarter-2020-Financial-Results

[10] https://www.fool.com/earnings/call-transcripts/2021/03/25/american-well-corporation-amwl-q4-2020-earnings-ca/

[11] https://www.globenewswire.com/news-release/2021/02/25/2182928/0/en/One-Medical-Announces-Results-for-Fourth-Quarter-and-Full-Year-2020.html

[12] https://www.businesswire.com/news/home/20210318005928/en/Hims-Hers-Health-Inc.-Reports-Fourth-Quarter-and-Full-Year-2020-Financial-Results

[13] https://www.businesswire.com/news/home/20170718005456/en/PayPal-Completes-Acquisition-of-TIO-Networks

[14] https://www.fortunebusinessinsights.com/industry-reports/telehealth-market-101065

[15] Title “WELL accelerates scale in NA with CRH; US IPO on deck”, dated Feb 18, 2021

[16] https://www.well.company/for-investors/news-releases/well-health-recognized-as-a-tsx-venture-50–company-for-the-third-year-in-a-row

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Equity Insider is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for WELL Health Technologies Corp. advertising and digital media from Market Jar Media Inc. There may be 3rd parties who may have shares of WELL Health Technologies Corp., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ does not own any shares of WELL Health Technologies Corp. MIQ will not buy or sell shares of WELL Health Technologies Corp. for a minimum of 72 hours from the publication date on this website (May 5, 2021), but reserve the right to buy and sell, and will buy and sell shares of WELL Health Technologies Corp. at any time thereafter without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, and we own shares of the mentioned company that we will sell, and we also reserve the right to buy shares of the company in the open market, or through further private placements and/or investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

This Healthcare Juggernaut Is Ready For Take Off

There are two types of healthcare companies that stand out as the biggest potential winners of 2021: companies that are able to produce a widely used vaccine or treatment for certain virus’, and resilient firms that held tough through the worst of 2020 and can benefit from a gradual return to normalcy.

Healthcare technology, commonly referred to as “healthtech,” refers to the use of technologies developed for the purpose of improving any and all aspects of the healthcare system. From telehealth to robotic-assisted surgery, our guide will walk you through what it is and how it’s being used.

Healthcare technology refers to any IT tools or software designed to boost hospital and administrative productivity, give new insights into medicines and treatments, or improve the overall quality of care provided. Today’s healthcare industry is a $2 trillion behemoth at a crossroads. Currently being weighed down by crushing costs and red tape, the industry is looking for ways to improve in nearly every imaginable area. That’s where healthtech comes in. Tech-infused tools are being integrated into every step of our healthcare experience to counteract two key trouble spots: quality and efficiency.

The way we purchase healthcare is becoming more accessible to a wider group of people through the insurance technology industry, sometimes called “insurtech.” Patient waiting times are declining and hospitals are more efficiently staffed thanks to artificial intelligence and predictive analytics. Even surgical procedures and recovery times are being reduced thanks to ultra-precise robots that assist in surgeries and make some procedures less evasive.

This is a very broad sector that can go in many directions, for more information on this sector please enter your email address in the box provided on this page and we will be more than happy to let you know when more information becomes available.

Protected: Digital Health Giant in the Making: Highly Strategic and Disciplined M&A Driving Dramatic Growth and Profitability for This Healthtech Juggernaut

Upcoming $3 Trillion Spending Bill Set to Cause Copper Mining Boom

US Economic Advisers are pushing a massive spending package, with a giant infrastructure plan that should blast copper demand into orbit.

Under the moniker of “Build Back Better”, economic advisers for the current US administration are championing a sweeping $3 trillion package to boost the economy, beginning with a massive infrastructure plan.

Once news of the new planned US spending hit the market, demand for metals rose. There was one critical metal in particular that seriously took off hitting a nearly 10 year high… COPPER.[1]

We believe we’ve identified a company that’s perfectly positioned to capitalize on the days ahead, with a pair of enviable properties in a country about to see a major MINING BOOM.

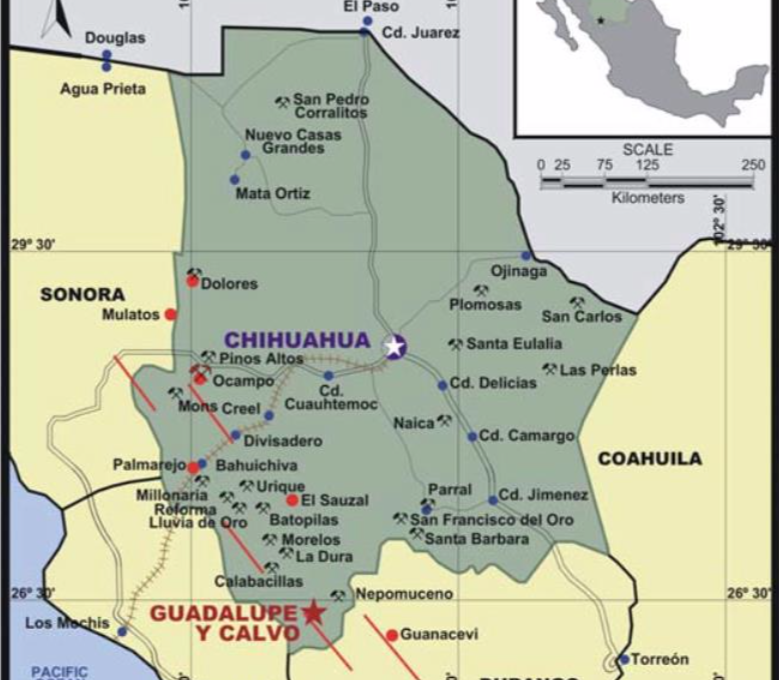

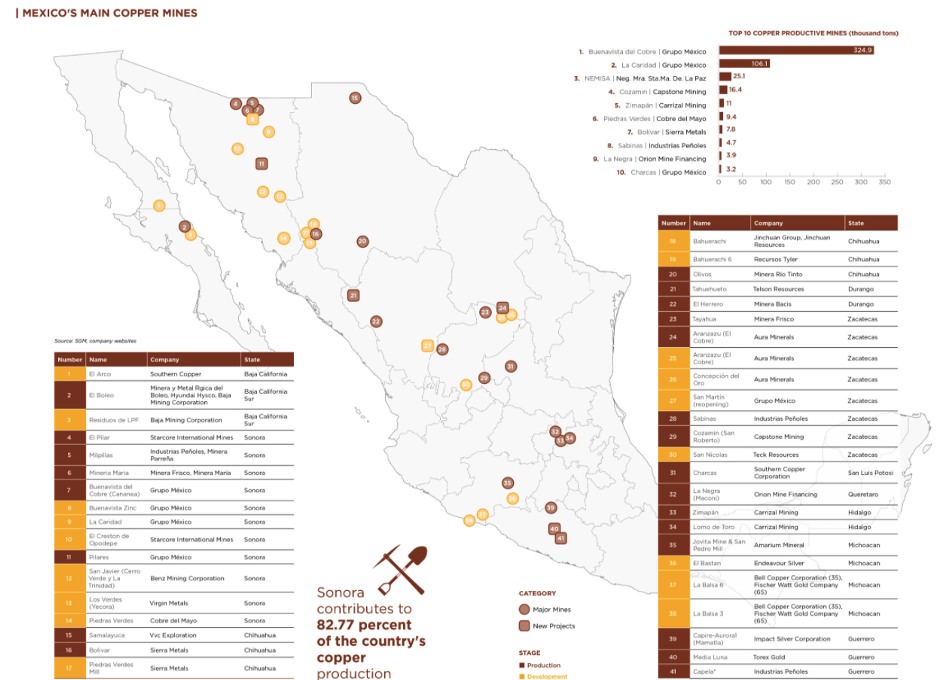

Emerging copper & gold mining developer Ridgestone Mining Inc. (OTC:RIGMF, TSXV:RMI) is poised for a breakout in TWO of Mexico’s top producing mining districts—including the country’s top producing copper region, Sonora.

Mexico’s mining output has already rebounded above pre-pandemic levels, despite ongoing challenges presented by the global health crisis.[2]

But will it be enough?

There’s a SERIOUS global shortage of copper on the horizon—a gap projected to reach 10 million tons in the next decade.[3]

Goldman Sachs has warned of this historic shortage, stating: “the market now on the cusp of the tightest phase in what we expect to be the largest deficit in a decade.”[4]

Among the top producers of copper in the world is Peru, where their central bank just cut projections, due to COVID-related challenges to production.[5] Neighboring Chile is ramping up what it can, with BHP’s Spence Mine expected to hit peak production later this year.[6]

And don’t think that those massive supplies in Chile and Peru will be headed towards the USA to meet this infrastructure boom. Most of those large, copper-loaded ships are headed for Chinese ports.[7]

It’s beginning to look like North American demand will need to be met by North American supply.

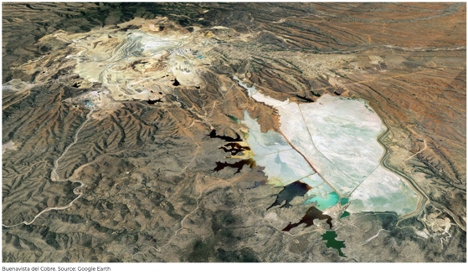

Much more will be expected out of one of the largest copper mines in the world by reserve, Buenavista (aka Cananea) Mine.

Currently the 5th largest copper mine in the world[8], the Buenavista Mine is located in Sonora State. It’s owned and operated by Group Mexico, which trades in the USA under the name Southern Copper Corporation (NYSE:SCCO).

It’s also one of the oldest open-pit mines in North America. The importance of the Buenavista Mine is heightened for Southern Copper, especially because the company recently had to cancel its Tia Maria copper project in southern Peru because of “anti-mining terrorism” in the area.[9]

So the focus back on Mexico appears to be even more warranted than before.

Among the Top 10 producing mines in Mexico, 6 are located within the mining districts of either Chihuahua or Sonora.

Ridgestone Mining Inc. (OTC:RIGMF, TSXV:RMI) has established its properties within both of those districts, they’re surrounded by bigger players that will (as will we) be paying very close attention to their developments in the months to come.

In 2021, Ridgestone Mining Inc. (OTC:RIGMF, TSXV:RMI) is looking to advance both its copper-gold Rebeico project and gold-silver Guadalupe y Calvo projects.

After successfully closing TWO over-subscribed private placements, raising $2.32 million earlier this year, Ridgestone Mining is well capitalized and good to go.

We expect BIG results from a still-very-small company, which is primed for a growth spurt in 2021…

5 Key Highlights Pointing at Ridgestone Mining as a Perfect Mining Opportunity in Mexico

- TWO high-grade mining projects located within Mexico’s prolific Sierra Madre gold belt

- Exploration-stage Rebeico copper-gold project in Sonora

- Resource-stage Guadalupe y Calvo gold-silver project in Chihuahua

- Rebeico copper-gold project encompasses 3,459 hectares of private land with numerous artisanal gold and copper workings.

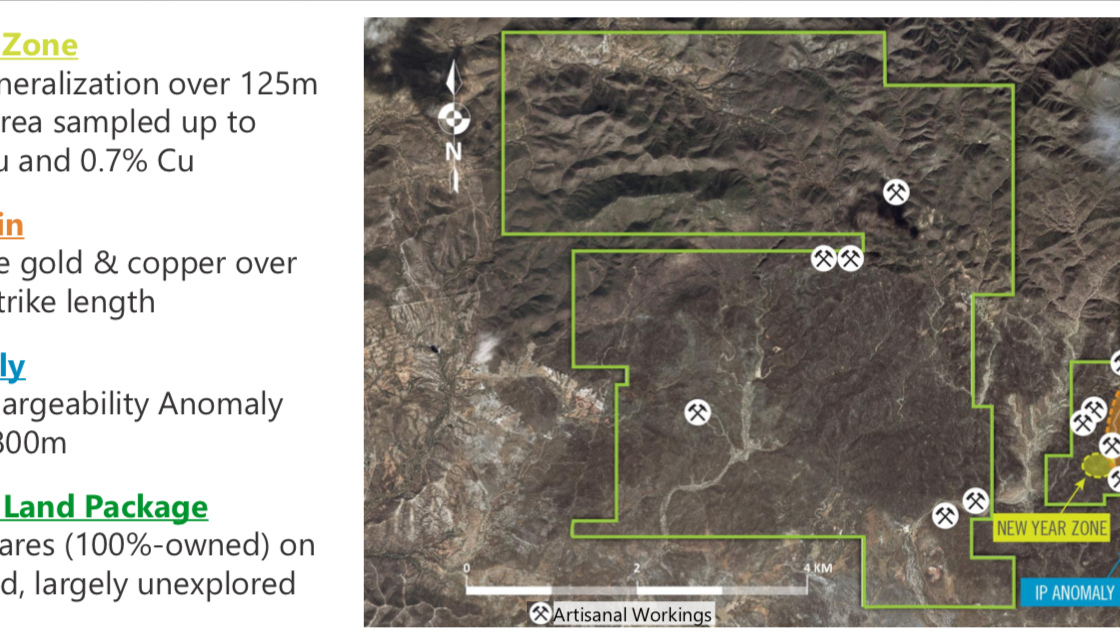

- Multiple mineralized zones identified: the Alaska Vein, the New Year Zone, the IP Anomaly, and a number of historic mines including the El Cobre copper mine.

- Past exploration highlights include:

- Alaska Vein

- 1.5 metres grading 1.2% copper plus 36.1 g/t gold

- 1.0 metre grading 5.95% copper plus 17.70 g/t gold

- New Year Zone

- 16.25 metres grading 1.79% copper plus 2.13 g/t gold

- Waste Dumps (from surface waste dumps/waste material from mining in the 1960s)

- 111 samples with an average grade of 0.8% copper plus 2.5 g/t gold

- El Cobre Mine (underground mine operated during the 1960s, samples taken from waste material)

- Samples grading over 2.4% copper

- IP Anomaly

- A potential copper-gold porphyry highlighted by a target spanning 1,400 metres by 800 metres

- Alaska Vein

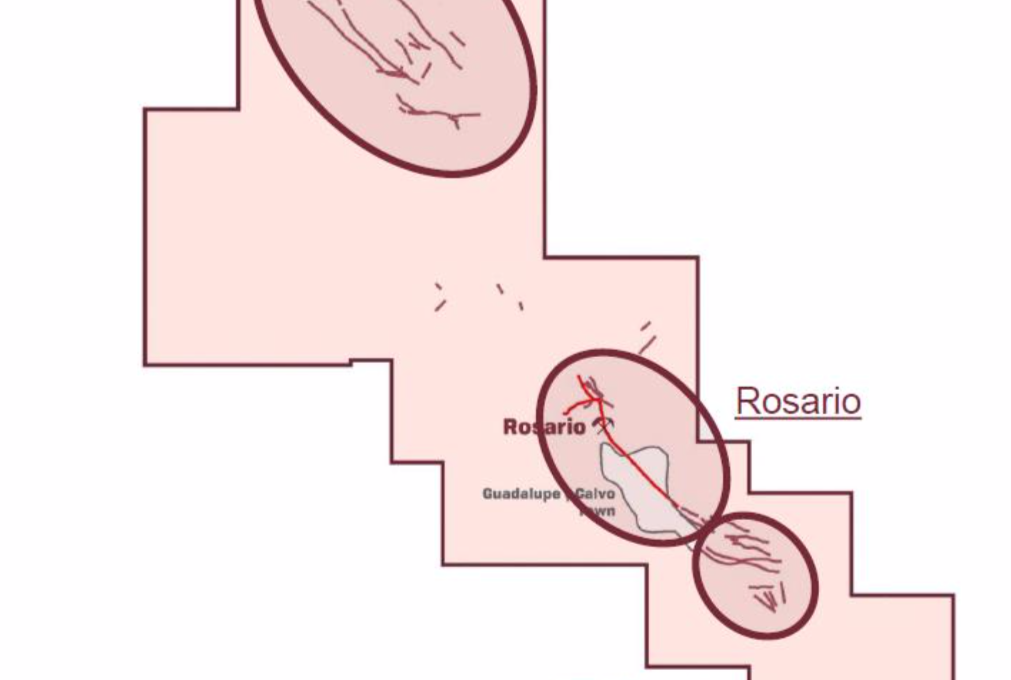

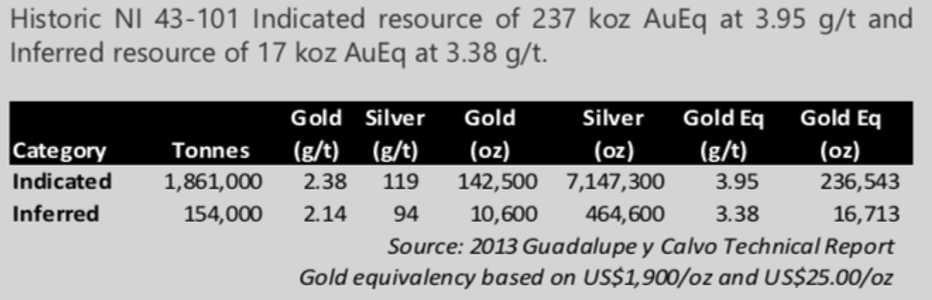

- Guadalupe y Calvo (GyC) gold-silver project is located within a mining district with historic production of over 2 million ounces of gold and 28 million ounces of silver.

- Mineralization is characterized by low-sulfidation epithermal veins with multiple vein structures identified over a 3km strike.

- GyC hosts a historical estimate NI 43-101 Indicated resource of 237,000 oz AuEq at a grade of 3.95 g/t AuEq and Inferred resource of 17,000 oz AuEq.

- Resource remains open for expansion along strike and at depth.

- Proven management team with a track record of discovery and monetization in Sonora State.

- Past successes include:

- Sale of the largest moly deposit in Mexico for $195 million

- Discovery of three gold deposits and one copper deposit which have become significant mines (two of which are still active in Sonora)

- Past successes include:

Copper-Gold Asset: Rebeico Project

Rebeico is located 115km east of Hermosillo, a main operations support hub for the Sonora mining district.

Comprised of 16 concessions totaling 3,459 hectares on private land(no ejido), the Rebeico is accessible by highway and a network of all-weather roads.

Infrastructure is great, as there are grid electrical power lines within 6.5 km of the property.

Historic exploration on the property focused on the Alaska Vein and New Year Zone.

Alaska Vein drilling highlights included:

- 1.2% Cu and 36.1 g/t Au over 1.5 m

- 2.4% Cu and 8.3 g/t Au over 3.25 m

- Including 5.95% Cu and 17.7 g/t Au over 1 m

- 2.8% Cu and 8.7 g/t Au over 2m

New Year Zone drilling highlights includes:

- 1.79% Cu and 2.13 g/t Au over 16.25m

- 0.54% Cu over 29.15 m

On top of the two primary zones are additional prospective signs of copper potential. These include samples from historic mines, and waste by-products.

Waste Dumps (waste material from mining in the 1960’s) data includes:

- 111 samples with an average grade of 2.5 g/t gold plus 0.8% copper from surface waste dumps (waste material from mining in the 1960’s)

El Cobre Mine (historic mine that operated into the 1960s) data includes:

- Waste material grading over 2.4% copper

IP Anomaly:

- Potential copper-gold porphyry highlighted by a target spanning 1,400 metres by 800 metres

Case Study 1: Southern Copper’s Buenavista Mine

Roughly 125 miles separate RMI’s Rebeico Project and Southern Copper’s Buenavista mine, which are both along the same trend in the prolific Sonora Mining district.

The Buenavista Mine is the oldest operating copper mine in North America, dating back to 1899.

In 2019, the mine produced 965 million pounds (Mlbs) of copper, which accounted for approximately 44% of the company’s total production for that year. The mine also produces silver and molybdenum as by-products. The contained copper at the mine is estimated to be 22.1Mt.[10]

According to the CFO of Southern Copper Corp., Raul Jacob, the company wants to almost double output by 2028, and possibly become the world’s largest producer.[11]

Jacob stated: “If this [copper] price level holds, we should see announcements of new projects coming in the market.”

It’s important to note that in order for Southern Copper to get there, the company has stated it will look at acquisition opportunities that come along, with asset quality being a top priority.

Given that the Rebeico Project is in the same mining district, and comes with full control given the private ownership of the rights, this could potentially make Ridgestone Mining a serious candidate in the years to come, with a very healthy valuation due to a better price environment.

“We feel comfortable in Latin America and very comfortable and positive about copper,” Jacob added, in an interview with Mining.com.

Between March 2020 and March 2021, shares of Southern Copper Corporation (NYSE:SCCO) has seen its shares rise from $26.57 on March 24, 2020 to a high of $81.53 in February 2021—for a rise of +200% in one year.

Gold-Silver Asset: Guadalupe y Calvo (GyC) Project

Located in the town of Guadalupe y Calvo, in SW Chihuahua State (~300km south of Chihuahua City) with excellent road access and strong local infrastructure.

Comprised of 2,750 hectares of contiguous claims covering numerous historical workings, including the Rosario Mine.

Dating back to the 1930s, the Rosario Mine produced over 2 million ounces of gold, and 28 million ounces of silver.

Due to water-handling capabilities of the time, this historic production was limited… NOT because of the mineralization.

That means, that with today’s technology, it’s game on to get this project back up and running!

Management recognized this, as there are EXCELLENT near-term opportunities for resource growth in place, through additional drilling—Mineralization remains OPEN along strike and at depth.

Already there’s been significant exploration (over 200 drill holes) done in the past by companies that are now part of Goldcorp, Aurico Gold, and Endeavour Silver totaling over 50,000 metres.

Included within those drilling results were 4.1 g/t Au and 281 g/t Ag over 2.5 metres with NUMEROUS targets identified for follow-up exploration.

The Northwest striking Rosario fault complex is the project’s main structural feature, with a total width of the mineralized zone up to 80 metres.

Underground historic mining had widths of high-grade gold-silver mineralization up to 10 metres.

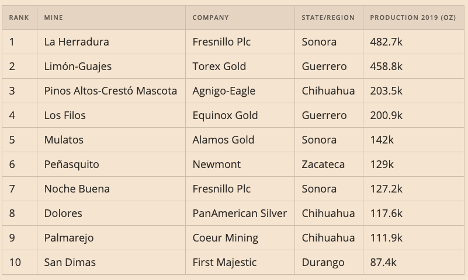

Case Study 2: Coeur Mining’s Palmajero Mine

Ridgestone Mining’s (OTC:RIGMF, TSXV:RMI) y Calvo Project is located near the city of the same name, which is just over 100 miles along trend to the southeast of the Palmajero Mine, owned and operated by Coeur Mining, Inc. (NYSE:CDE).

The property consists of a land position that totals approximately 27,233 hectares.

In 2020, the mine produced 6.3 million ounces of silver and 110,608 ounces of gold.

The Palmarejo silver-gold complex consists of:

- the Palmarejo mine and processing facility;

- the Guadalupe underground mine, located about 8 kilometers southeast of the Palmarejo mine;

- the Independencia underground mine, located approximately 800 meters northeast of the Guadalupe underground mine;

- other nearby deposits and exploration targets.

Between March 2020 and March 2021, shares of Coeur Mining, Inc. (NYSE:CDE) has seen its shares rise from $2.88 on March 18, 2020 to a high of $11.14 in February 2021—for a rise of 287% within one year.

Peer Groups in the Mexico Mining World

Ridgestone Mining Inc. (OTC:RIGMF, TSXV:RMI) is surrounded by successful mining operations in both the Chihuahua (GyC) and Sonora (Rebeico) regions.

Together, these regions are both within the Sierra Madre corridor, which has been known for its mineral endowment for a very long time.

This is one of the most mining friendly regions of the country.[12]

In particular, the Sonora region is Mexico’s most active mining region for both copper and gold[13]—Sonora contributes to 82.77% of the country’s copper production.[14]

The output and copper extracted from Sonora, in particular, is considered top notch quality, which is why the demand for this metal in the area is growing on a daily basis.[15]

Beyond the copper production, according to Mexico´s Mining Chamber CAMIMEX, more than half (6) of Mexico´s ten largest operational gold mines are in those two regions.

| Company | Symbol | Share Price Today | Mkt Cap | State/Region |

| Ridgestone Mining Inc. | OTC:RIGMF TSXV:RMI | $0.165 | $12.44M | Chihuahua / Sonora |

| Fresnillo PLC | OTC:FNLPF | $13.25 | $9.63B | Sonora |

| Southern Copper | NYSE:SCCO | $67.48 | $52.17B | Sonora |

| Starcore International Mines | OTC:SHVLF TSX:SAM | $0.21 | $10.1M | Sonora |

| Minera Frisco | OTC:MSNFY | $0.49 | $1.67B | Sonora |

| Sierra Metals Inc. | NYSE:SMTS TSX:SMT | $3.06 | $500M | Chihuahua |

| Agnico Eagle Mines Limited | NYSE:AEM TSX:AEM | $60.46 | $14.66B | Chihuahua |

| Alamos Gold Inc. | NYSE:AGI TSX:AGI | $8.18 | $3.21B | Sonora |

| First Majestic Silver Corp. | NYSE:AG TSX:FR | $17 | $3.77B | Sonora/Durango |

| Argonaut Gold Inc. | OTC:ARNGF TSX:AR | $1.76 | $541.3M | Sonora |

* All price in USD

** Latest share price taken from Yahoo! Finance on April 13, 2021

Ridgestone Mining’s Management Team

Before it had even acquired its properties, perhaps the #1 asset that Ridgestone Mining had in place was its leadership team. Each member brings a proven track record of discovery and monetization, with expertise specific to Sonora State.

Past successes include the sale of the largest moly deposit in Mexico for $195 million, and the discovery of three gold deposits that have gone on to become significant mines—two of which are still active in Sonora to this day.

Among the talented team, here are some members we felt were necessary to highlight:

CEO & Director – Jonathan George

George is a geologist and mining entrepreneur with over 35 years of experience in exploration, development and financing. Previously President, CEO and co-founder of Creston Moly. Successfully raised $40 million in equity to acquire, develop, and de-risk the El Creston project before selling it to Mercator Minerals for $195 million. Other notable highlights include President and CEO of ESO Uranium, the predecessor to Alpha Minerals which was acquired by Fission Uranium for $185 million.

CFO & Director – Erwin Wong

Wong has over 26 years of experience having served in senior management and board level positions for numerous Chinese and Canadian based enterprises, both public and private, which were involved in various sectors including transport, real estate, mining, life sciences and investment banking. He had also founded a corporate advisory firm which assisted a number of companies with the complexities of initial public offerings, corporate governance and regulatory compliance in various jurisdictions. Erwin Wong is a Chartered Accountant and holds a Bachelor of Commerce from the University of British Columbia.

VP Exploration – Noris Del Bel Belluz

Belluz has over 35 years of experience in operations, exploration, geology and technical evaluations of both underground and open pit mines. Most recently, he was Operations Manager & Acting General Manager for Nevsun Resource’s Bisha mine, which was acquired for $1.8 billion by Zijin Mining Group Co. Previously, he was Manager of Mine Geology for Eldorado Gold’s China operations and with Freeport-McMoRan as Manager of Mine Geology at the Grasberg mine in Indonesia which included a key role in the discovery of the Kucing Liar skarn deposit. Belluz’s technical experience also includes holding senior roles with Stantec Engineering and Wardrop Engineering, overseeing various technical studies from NI 43-101 resource estimates to feasibility studies and detailed engineering. He holds a Bachelor of Science Degree in Geology from the University of Toronto and is a Qualified Person (QP) under NI 43-101.

Advisor – Dr. Andrew J. Ramcharan

Dr. Ramcharan has over 20 years’ experience in operations, project evaluation, mergers and acquisitions, corporate development, project finance and investor relations. Mr. Ramcharan has worked for a number of companies including IAMGOLD Corporation, Sprott Resources and Resource Capital Funds. He holds a Master’s and Ph.D Degree in Mining and Minerals Economics. Andrew is a Registered Member of The Society for Mining, Metallurgy and Exploration (SME) in USA, Licensed Professional Engineer in Ontario, Canada and Fellow of The Australasian Institute of Mining and Metallurgy. A graduate of the Colorado School of Mines, University of Leoben, and Harvard University’s Continuing Education program.

SOURCES:

[1] https://www.reuters.com/article/global-metals-idUSL1N2LA0K9

[2] https://www.bnamericas.com/en/news/mexico-mining-output-rebounds-to-pre-pandemic-levels

[3] https://news.metal.com/newscontent/101425386/Supply-falls-short-of-demand-A-global-shortage-of-10-million-tons-of-copper-in-the-next-decade/

[4] https://oilprice.com/Metals/Commodities/Goldman-Sachs-Historic-Copper-Shortage-Loom-As-Prices-Rocket.html

[5] https://www.mining.com/web/peru-central-bank-cuts-growth-forecast-for-2021-sees-tailwinds-from-rising-copper-price/

[6] https://cn.reuters.com/article/chile-copper-bhp-idCNL1N2KM001

[7] https://www.bloomberg.com/news/articles/2021-02-26/copper-crunch-is-set-to-ease-as-more-concentrate-heads-to-china

[8] https://www.kitco.com/news/2021-03-18/The-world-s-top-10-largest-copper-mines-in-2020-report.html

[9] http://www.laht.com/article.asp?CategoryId=14095&ArticleId=2381146

[10] https://www.nsenergybusiness.com/projects/buenavista-copper-mine-expansion/

[11] https://www.mining.com/web/copper-to-stay-tight-on-long-path-to-new-supply-top-miner-says/

[12] https://gambusinoprospector.com/mineral-resources-in-mexico/mining-regions/

[13] https://www.lexology.com/library/detail.aspx?g=e4db032c-8d2e-4360-a9c8-df86b0f6be59

[14] https://mexicobusiness.news/sites/default/files/2019-10/Map-Copper-mines_110-111.jpg

[15] https://electroheatinduction.com/copper-mined-mexico/

DISCLAIMER:

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Equity Insider is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Ridgestone Mining Inc. advertising and digital media from the company directly (“the Company”). There may be 3rd parties who may have shares of Ridgestone Mining Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Ridgestone Mining Inc. which were purchased as a part of a private placement. MIQ will not buy or sell shares of Ridgestone Mining Inc. for a minimum of 72 hours from the publication date on this website March 31, 2021, but reserve the right to buy and sell, and will buy and sell shares of Ridgestone Mining Inc. at any time thereafter without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, and we own shares of the mentioned company that we will sell, and we also reserve the right to buy shares of the company in the open market, or through further private placements and/or investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

Upcoming 3 Trillion Spending Bill Set To Cause Copper Mining Boom

Gold gets plenty of attention, but the outlook for base metals like copper is also positive in 2021. RBC Capital Markets analysts raised their 2021 average price estimate from $3.25 to $3.50 a pound due to higher consumption estimates. They expect copper consumption to be higher this year due to indicators that the economy is strengthening.

In a recent report, analyst Sam Crittenden and his team said the backdrop for copper remains positive this year, while low inventories support higher prices. However, they expect the supply response throughout the year to be gradual from both mines and scrap. These factors could moderate the copper price.

Copper equities also remain well-positioned in 2021, and the RBC analysts are starting to see multiple expansion as investors become more interested in the sector.

They note that North American base metals stocks have traded at an average EV/EBITDA multiple of 5.8 times over the last decade. On the other hand, the TSX index trades at a multiple of 9.2 times. Currently, North American base metals stocks are trading at a multiple of 6.9 times, while the TSX is at a multiple of 12 times.

We are following a few promising copper companies, for more information please enter your email in the box provided.

Thank you

Protected: The Smart Investor’s Way to Add PPE and Tech Solutions to Your Portfolio

Deregulation Is About To Make This Gaming Stock Go Crazy

Playgon Games Inc. (TSX.V:DEAL / OTC: PLGNF) is Targeting the Fastest Growing Segment of the Online Casino Gaming Market

Over the last year, we’ve seen not only the utter decimation of revenues and activity within the doors of land-based casinos, but also a mass exodus of players towards online gaming to fulfil their desires.

People are still playing their favourite casino games… except now they no longer need to be in the casino to do it.

According to Martin Calesund, CEO of the +$22B company Evolution Gaming:

“(The) online evolution has just started.”

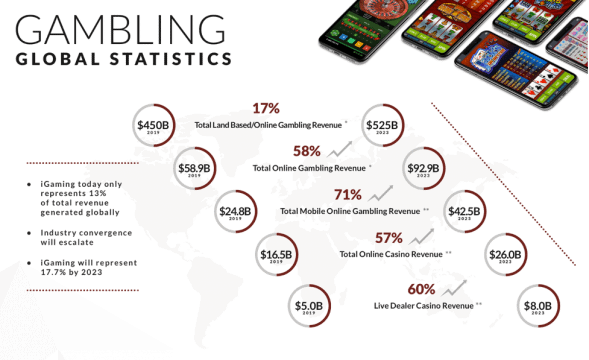

According to recent industry metrics, the global online gambling market is expected to reach more than US$92.9 billion in 2023—nearly double the ~US$52.9 billion it is currently. [1]

Back in June of 2020 (when the global health crisis was still in its earlier stages), Calesund added to this thought, boldly stating:

“In the future to come, I think 50-70% of casino will be online.” [2]

The shift has been swift and very significant, as online gambling thrived and land-based casinos struggled mightily through 2020 to today. Mobile gaming made significant strides in 2020, notching $79.5 billion, and accounting for a whopping 71% of all app revenues on both the Google Play and Apple App Store combined. [3]

In Atlantic City, all but one casino (which we’ll get to in a second), lost significant revenue. The biggest dropoff came for Harrah’s, which declined 46.8% over the year. [4]

Resorts, Caesars, Tropicana, Borgata, Hard Rock, and Ocean… ALL saw their revenues drop by double-digit percentages.

The one casino that emerged from the bunch was Golden Nugget—it saw its revenues increase nearly 10% over their 2019 numbers.

How did Golden Nugget beat the odds?

The answer is right there in the full name of the stock is Golden Nugget Online Gaming (NASDAQ:GNOG).

That’s right… Golden Nugget is focused on online casino and sports betting.

It wasn’t just in Atlantic City that the company took wins. When they released their Q3 earnings in late October, they showed that their Net revenue was up 92% year-over-year (YoY) to $25.9 million, while Operating income was also increased 92% YoY to $8.2 million.

Since prior to the COVID-19 lockdowns taking full effect, GNOG stock has gone from a low of $9.26 per share to a high of $26.24 in late December—a rise of 183% in just over 9 months. Market researchers have pegged the global online gambling market to grow from $53.7 billion in 2019 to +$95 billion by the end of 2025 at a CAGR of 13.2%. [5]

The industry can no longer afford to deny that Evolution Gaming’s Martin Calesund is right.

The online evolution has begun!

We’ve identified the best equipped provider of a proprietary market-ready and device-agnostic platform that’s perfectly designed to facilitate the transition of these massive casinos into the online age…

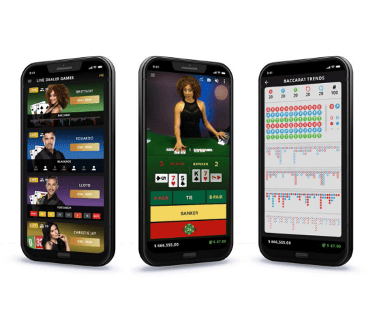

One that’s succeeded in developing not only one of the fastest, most-convenient ways to play, but has done so with the World’s ONLY Live-Dealer mobile app gaming experience with LIVE video streaming of their dealers from a studio in Las Vegas.

Meet Playgon Games Inc. (TSX.V:DEAL / OTC: PLGNF) an innovator focused on developing digital content for the iGaming market, through a mobile-first philosophy with live dealer technology.

Platinum Profile: Playgon Games Inc. (TSX.V:DEAL / OTC: PLGNF)

Playgon provides a multi-tenant gateway that allows online operators the ability to offer their customers innovative iGaming software solutions.

What makes Playgon’s platform most unique for players is its design and feel.

CEO Darcy Krogh recently stated: “We are bringing a very unique mobile live dealer product to the market. We anticipate our business will scale quickly once we receive the final approvals to service our customers.”

Not only does the company provide the World’s ONLY Live Dealer mobile-app experience, but it does so vertically, meaning that players can comfortably play one-handed.

It’s also VERY fast. As a core feature of the design the software was geared towards speed as an integral part of the extremely popular table games of baccarat, roulette and blackjack (NOTE: More on the game of baccarat below).

Through the Playgon platform, hands can be played extremely fast, with up to 8 tables playing at once on one screen.

AN ALLURING BUSINESS MODEL

Playgon’s current software platform involves Live Dealer Casino and E-Table games which through a seamless integration at the operator level allows customer access without having to share or compromise any sensitive customer data.

And the business model is ideal for garnering more and more clients to onboard the software.

This turnkey solution is FREE to incorporate into an established casino’s offerings. Playgon has very wisely made this available, with the upside coming through revenue percentages of player loss on every game played.

As players bounce between casino operators, they are still playing re-skinned Playgon games. By providing the software, Playgon spends next to nothing on marketing, while capitalizing on the upside from newly acquired players.

As a true business to business (B2B) digital content provider, Playgon’s products are ideal turn-key solutions for online casinos, sportsbook operators, land-based operators, media groups, and big database companies.

Its cutting-edge technology and operational best practices make Playgon the best possible partner for online casinos looking to the future. Playgon also employs a global strategy, uniquely positioning it to take advantage of the sizable market in Europe and Asia.

BOOSTING BACCARAT’S BANKROLL POTENTIAL

While the popularity of baccarat continues to grow in the west, it’s common knowledge within the industry that James Bond’s favourite card game is the most profitable casino card game on the planet. This is because in Asian markets, players mostly stay away from slot machines, while VIP baccarat accounts for roughly 70% of casino revenue shares, followed by mass-market baccarat. [6]

Today’s casino gaming market is steadily growing in Asia, with industry experts in the region estimating the Asian live casino market to be 10x the size of its European counterpart.

Playgon’s team knows this, and has wisely designed itself towards this trend— and has developed a way to unlock baccarat’s enormous potential—having the game played online.

Why? Because in a traditional casino setting, games such as Baccarat and Roulette are not scalable because they can only serve a fixed number of players at a time.

In contrast, the majority of games can support a limitless number of players betting at the same time, while bearing none of the other overhead costs a traditional casino would have to bear (i.e. free drinks to players, casino maintenance expense, etc.).

Under Playgon’s business model, the Live Dealer salary becomes a fixed cost which can be leveraged across hundreds of potential concurrent players instead of just a few players at a traditional casino table.

Given the speed at which hands of baccarat are played is already a significant bonus to casino profitability. Now when the hands are dealt, bets are handled, payouts are paid and all other actions are done electronically. It’s fast, smooth, and profitable.

With their ability to maintain a whopping 8 tables on one screen at the same time, brick-and-mortar casinos just can’t compete with the speed of play of the Playgon Games Inc. (TSX.V:DEAL / OTC: PLGNF) baccarat experience.

And baccarat is a game that’s VERY familiar to those within the company. Playgon Interactive Founder, Guido Ganschow wrote the first live dealer software used in Asia—leading software sales to over 200 different casinos, many of which still use the software today.

LIVE DEALER GAMING—LIVE FROM VEGASTM!

Playgon Games Inc. (TSX.V:DEAL / OTC: PLGNF) is looking to capitalize on the Live Dealer Casino market, which represented 30% of the total online casino gaming market in 2019—or $5 billion. [7]

The company’sscalability results in a far more attractive business model than any land-based casino can offer. By integrating augmented reality, tactically adjusting bonuses and payouts, and optimizing player- dealer communication, Playgon’s offering is more immersive than the experience at a brick & mortar casino.

The platform’s Live Casino offering brings the brick & mortar casino experience to a user’s phone, computer, or other streaming device. Contrary to typical digital casino games which feature no physical human interaction, Live Casino is 100% focused on seamless interaction between gamblers playing from all over the world.

Live Casino is the fastest growing segment within online casino, with an annual growth rate of 32% between 2014 and 2018 and is expected to reach $8 billion by 2023. [8]

Mobile online gaming continues to be a key factor in the development of the global iGaming market. Currently, over 70% of Live Dealer casino revenues stem from mobile devices.

Playgon’s Live Dealers are streamed live from a studio in Las Vegas—click here for an example video

Players can interact in real time with the dealers and other players in real time 24 hours a day, 7 days a week—all complimented by augmented reality that further enhances the experience.

And, due to the overwhelmingly positive feedback from Operators, Playgon has already increased the size of their Live from Vegas studio and doubled their table capacity.

Playgon is taking live-dealer casino games to the next level, bringing cutting-edge handheld features and functionality to the mobile generation of gambling enthusiasts who have long been demanding a world-class gambling experience on their phone.

THE PLAYGON ADVANTAGE

Playgon has centralized its offerings to be as convenient and comfortable as possible to play.

Its advantages are unique, including

One Touch + One handed play.

Currently over 70% of Live Dealer casino revenues stem from mobile devices. Based on analytics provided by ScientiaMobile.com [9], Playgon has determined its focus solely on a Portrait-first orientation of its platforms.

Mobile users predominantly prefer this orientation by significant numbers:

- iOS = 97%

- Android = 89%

In fact, according to ScientiaMobile, only 22% of people flip their smartphone from portrait to landscape orientation.

HD Streaming

The Playgon experience is driven by High Definition content from a streaming studio Live from Las Vegas—delivering the user a truly live feel and presence.

Mobile First Approach

Most legacy technology is developed for desktop and not for mobile, making it inefficient for user interface (UI) and user experience (UX).

Playgon’s platform has been designed with a mobile first approach in mind. This focus enhances player UI and UX.

But despite having portrait-orientated mobile as its flagship offering, Playgon’s platforms entail Progressive Web App (PWA) technology, that’s device agnostic, and designed to handle every type of user, every browser, and play on every device.

It’s this portability that works to Playgon’s advantage, in particular when it comes to the potential for white labeling the service to work in conjunction with competitors; Operators don’t need to displace other providers to integrate Playgon’s Live Dealer games.

Playgon offers proprietary technology, which is cloud based and built for robustness, scalability, speed of play, to derive the maximum bets per hour that equates to more revenue. Ultimately, the platform and games are designed to attract the most sought-after player; the discerning, higher-value, returning player to maximize life time value.

Management & Board with Exceptional Experience

Darcy Krogh – President, Chief Executive Officer & Director of Playgon Games Inc

Involved the space for 21 years, Krogh began in iGaming by co-founding Chartwell Technology in 1999, a publicly traded technology company specializing in the development of games, gaming systems, and entertainment content focused in Europe. He served as a Director and was a key member of the management team, staying on after the company was sold to Amaya in 2011 for CAD$25 million. He served as VP Business Development with Amaya until July 2015 where he assisted with the divestiture of its B2B asset portfolio for $150m to Nyx Gaming Group. In April 2016 he exited NYX Gaming to start up a new venture, Playgon Games Inc.

Guido Ganschow – President & Director of Playgon Interactive

Playgon Interactive Founder Ganschow has created real-time Live-Dealer platforms for 12+ years, having served as Co-Founder and Creative Director for a Macau Casino Consortium, and successfully creating and establishing Live Dealer platform businesses in Asia and Europe between 2008 and 2014. In 2016 he started Playgon Interactive with a mandate to develop a next generation live dealer product for real money and social applications. Over his career, Ganschow has executed commercial partnerships, sales, and integration of the Live-Dealer solutions with major global gaming brands including Ho Gaming Group, Chartwell Technology and Amaya Gaming Group.

James Penturn – Executive Chairman of the Board

Penturn has decades of experience providing strategic advice and leadership to management teams of knowledge based businesses to successfully market and sell their services, to structure and syndicate investments, and to raise equity and debt instruments. He is the President of SpectraLegal Limited in the United Kingdom, a specialist provider of funding solutions for law firms. He is also a member of the strategic advisory committee of Generation Three Family Partners, an international multifamily office that he co-founded. He has been a director of several Canadian publicly listed companies where he sat on executive, audit, governance and compensation committees. Penturn has over 30 years’ experience in merchant banking, real property and strategic advisory services as both a principal and agent.

Steve Baker – Chief Operating Officer

Baker is the former VP Operations for Shaw Communications and has been involved in a number of major growth products including video streaming and home entertainment. He has helped the company grow sales revenue from $300 million to $2.8 billion. He’s also overseen new product rollouts and M&A activities.

7 Key Highlights to Remember for Playgon Games Inc. (TSX.V:DEAL / OTC: PLGNF)

- Fully Developed Platform ready to launch with multiple tier-1 operators

- Mobile Driven Strategy drastically improves user experience relative to competitors’ desktop-first approach

- Diversified Risk through leveraging technology across real money and social gaming markets

- Live Dealer is the fastest-growing vertical within the online casino business

- Global Industry Growth in iGaming has been projected to increase at a yearly CAGR between 10-15%

- Experienced Management team in technology and iGaming industries

- Industry Convergence terrestrial gaming industry’s movement to digital has been super-charged with the recent global health crisis.

[1] https://www.msn.com/en-us/money/topstocks/golden-nugget-online-gaming-stock-may-see-2420-before-2440/ar-BB1d0pEu

[2] https://www.gamblinginsider.com/news/9366/evolution-gaming-ceo-50-70-of-casino-revenue-will-be-online-in-the-future

[3] https://www.tweaktown.com/news/77100/mobile-gaming-made-79-5-billion-in-2020-71-of-total-app-revenues/index.html

[4] https://journalstar.com/news/national/a-record-year-for-nj-sports-betting-casinos-not-so-much/article_498a2a09-3e72-53ae-9a39-931c99dcc9ca.html

[5] https://www.globenewswire.com/news-release/2020/04/13/2015187/0/en/The-Global-Online-Gambling-Market-is-expected-to-grow-from-USD-53-686-56-Million-in-2019-to-USD-95-023-13-Million-by-the-end-of-2025-at-a-Compound-Annual-Growth-Rate-CAGR-of-9-98.html

[6] https://www.quora.com/Which-game-does-a-casino-generate-the-most-revenue-from-in-terms-of-quarterly-or-annual-revenue-Im-not-asking-about-odds-per-game-I-have-heard-the-answer-is-slots?share=1

[7] Source: H2 Gaming Consultants (https://h2gc.com)

[8] Source: H2 Gaming Consultants (https://h2gc.com)

[9] https://www.scientiamobile.com/

DISCLAIMER:

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Equity Insider is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Playgon Games Inc. advertising and digital media from the company directly. There may be 3rd parties who may have shares of Playgon Games Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Playgon Games Inc. which were purchased in the open market. MIQ will not buy or sell shares of Playgon Games Inc. for a minimum of 72 hours from the publication date on this website February 5, 2021, but reserve the right to buy and sell, and will buy and sell shares of Playgon Games Inc. at any time thereafter without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, and we own shares of the mentioned company that we will sell commencing immediately, and we also reserve the right to buy shares of the company in the open market, or through private placements and/or other investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

Protected: This Under-The-Radar Biotech Stock’s Latest Move Could Be 2021’s Best Play

Red-Hot Battery Technology Space Poised for Great Disruption with New AI-Based Tech

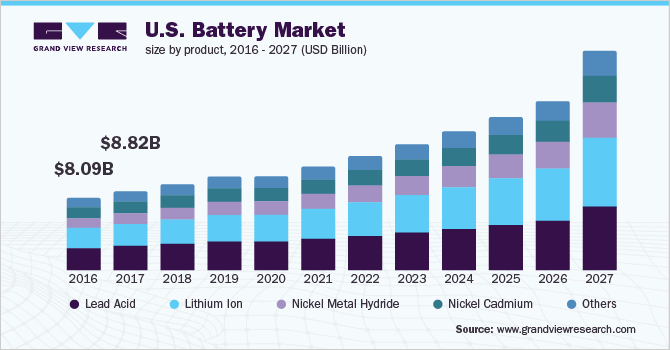

The global battery market size was valued at USD 108.4 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 14.1% from 2020 to 2027. The market growth is attributed to high demand from the automotive application. The automotive application includes rechargeable batteries used in non-rechargeable batteries and electric vehicles. The increasing popularity of consumer electronics on a global scale is projected to result in the usage of the lithium-ion battery as a product type over the forecast period. High demand for portable electronics, including LCD displays, smartphones, tablets, and wearable devices such as fitness bands, is boosting the market growth. The market is expected to observe substantial growth on account of technological advancements in terms of enhanced efficiency, cost-effectiveness, and product innovation. Strict emission norms by the government authorities of developed countries, such as the United States and the United Kingdom, coupled with growing attention towards fuel efficiency, are expected to drive battery demand.

.

The U.S. battery market size was valued at USD 10.49 billion in 2019. The U.S. government has been cheering stakeholders for both renewable industry and Electric Vehicles (EVs), resulting in an improved demand for battery energy storage systems (BESS), mainly led by Li-ion batteries. The adoption of EVs is rising at a high rate across the country. The U.S. is one of the leading countries in global electric vehicle sales, along with other countries such as Canada, which has already begun transforming its transportation infrastructure for electric vehicles.

Decreasing fossil fuel reserves, along with promising government initiatives and high CO2 emissions, are expected to propel market growth in the next few years. Key non-rechargeable batteries are extensively used in children’s toys, light beacons, remote controls, watches, and electronic keys. These are expected to observe a loss of stake to rechargeable batteries on account of efficiency and enhanced lifespan.

Developing markets of Africa and the Asia Pacific are expected to boost battery demand in electric bicycle applications and storage applications such as the leveling of load in renewable sources of energy like the wind and solar. Growing aircraft and automobile manufacturing in developing nations of APAC, including China and India, is expected to provide enormous potential for market growth.

Growing technological advancements in battery technologies have amplified the usage of various battery-operated equipment across the world. Hybrid Electric Vehicles (HEV) are equipped with the countless features that consume a significant amount of battery power. These features include a GPS navigation system, power windows, display that give information about the battery charge level, and air-conditioning systems.