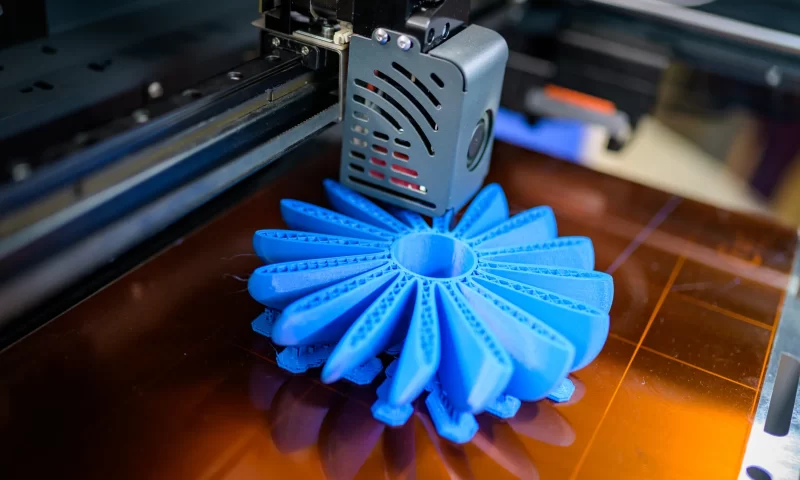

3D Systems Co. (NYSE:DDD – Get Rating) gapped up prior to trading on Tuesday following insider buying activity. The stock had previously closed at $10.25, but opened at $10.46. 3D Systems shares last traded at $10.02, with a volume of 16,597 shares traded. Specifically, EVP Andrew Martin Johnson sold 4,000 shares of the stock in a transaction that occurred on Tuesday, March 1st. The stock was sold at an average price of $20.00, for a total transaction of $80,000.00. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, CEO Jeffrey A. Graves purchased 10,141 shares of the firm’s stock in a transaction that occurred on Thursday, May 19th. The shares were bought at an average price of $10.50 per share, for a total transaction of $106,480.50. Following the acquisition, the chief executive officer now directly owns 577,158 shares in the company, valued at approximately $6,060,159. The disclosure for this purchase can be found here. Insiders have sold a total of 19,838 shares of company stock valued at $328,804 over the last quarter. Corporate insiders own 3.45% of the company’s stock.