3D Systems Co. (NYSE:DDD – Get Rating) gapped up prior to trading on Tuesday following insider buying activity. The stock had previously closed at $10.25, but opened at $10.46. 3D Systems shares last traded at $10.02, with a volume of 16,597 shares traded. Specifically, EVP Andrew Martin Johnson sold 4,000 shares of the stock in a transaction that occurred on Tuesday, March 1st. The stock was sold at an average price of $20.00, for a total transaction of $80,000.00. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, CEO Jeffrey A. Graves purchased 10,141 shares of the firm’s stock in a transaction that occurred on Thursday, May 19th. The shares were bought at an average price of $10.50 per share, for a total transaction of $106,480.50. Following the acquisition, the chief executive officer now directly owns 577,158 shares in the company, valued at approximately $6,060,159. The disclosure for this purchase can be found here. Insiders have sold a total of 19,838 shares of company stock valued at $328,804 over the last quarter. Corporate insiders own 3.45% of the company’s stock.

Several analysts recently weighed in on DDD shares. Craig Hallum decreased their price target on 3D Systems from $18.00 to $10.00 in a report on Wednesday, May 11th. Bank of America reduced their target price on 3D Systems from $23.00 to $12.00 in a research note on Tuesday, May 10th. Lake Street Capital reduced their target price on 3D Systems from $36.00 to $29.00 and set a “buy” rating on the stock in a research note on Tuesday, March 1st. B. Riley reduced their target price on 3D Systems from $24.00 to $22.00 and set a “neutral” rating on the stock in a research note on Tuesday, March 1st. Finally, JPMorgan Chase & Co. reduced their target price on 3D Systems from $22.00 to $18.00 and set an “underweight” rating on the stock in a research note on Tuesday, March 1st. Four equities research analysts have rated the stock with a sell rating, three have issued a hold rating and one has assigned a buy rating to the company’s stock. According to MarketBeat.com, the company has an average rating of “Hold” and an average target price of $20.43.

The company has a current ratio of 6.57, a quick ratio of 5.90 and a debt-to-equity ratio of 0.54. The business has a 50-day moving average price of $13.64 and a 200-day moving average price of $17.85. The firm has a market cap of $1.32 billion, a P/E ratio of 5.13 and a beta of 1.38.

3D Systems (NYSE:DDD – Get Rating) last posted its quarterly earnings results on Monday, May 9th. The 3D printing company reported ($0.18) earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of ($0.10) by ($0.08). 3D Systems had a negative return on equity of 5.29% and a net margin of 41.50%. The firm had revenue of $133.00 million for the quarter, compared to the consensus estimate of $132.67 million. During the same period in the previous year, the company posted $0.10 EPS. 3D Systems’s quarterly revenue was down 9.0% compared to the same quarter last year. On average, equities analysts anticipate that 3D Systems Co. will post -0.35 earnings per share for the current fiscal year.

Institutional investors and hedge funds have recently bought and sold shares of the company. Sumitomo Mitsui Trust Holdings Inc. boosted its position in 3D Systems by 83.6% during the fourth quarter. Sumitomo Mitsui Trust Holdings Inc. now owns 3,651,342 shares of the 3D printing company’s stock valued at $78,650,000 after purchasing an additional 1,662,200 shares in the last quarter. Dimensional Fund Advisors LP boosted its position in 3D Systems by 1.5% during the fourth quarter. Dimensional Fund Advisors LP now owns 1,536,609 shares of the 3D printing company’s stock valued at $33,099,000 after purchasing an additional 21,966 shares in the last quarter. Mitsubishi UFJ Kokusai Asset Management Co. Ltd. boosted its position in 3D Systems by 30.3% during the fourth quarter. Mitsubishi UFJ Kokusai Asset Management Co. Ltd. now owns 277,109 shares of the 3D printing company’s stock valued at $6,130,000 after purchasing an additional 64,376 shares in the last quarter. Commonwealth Equity Services LLC boosted its position in 3D Systems by 137.6% during the fourth quarter. Commonwealth Equity Services LLC now owns 41,428 shares of the 3D printing company’s stock valued at $892,000 after purchasing an additional 23,991 shares in the last quarter. Finally, Royal Bank of Canada boosted its position in 3D Systems by 3.9% during the third quarter. Royal Bank of Canada now owns 168,850 shares of the 3D printing company’s stock valued at $4,654,000 after purchasing an additional 6,408 shares in the last quarter. 69.13% of the stock is currently owned by institutional investors and hedge funds.

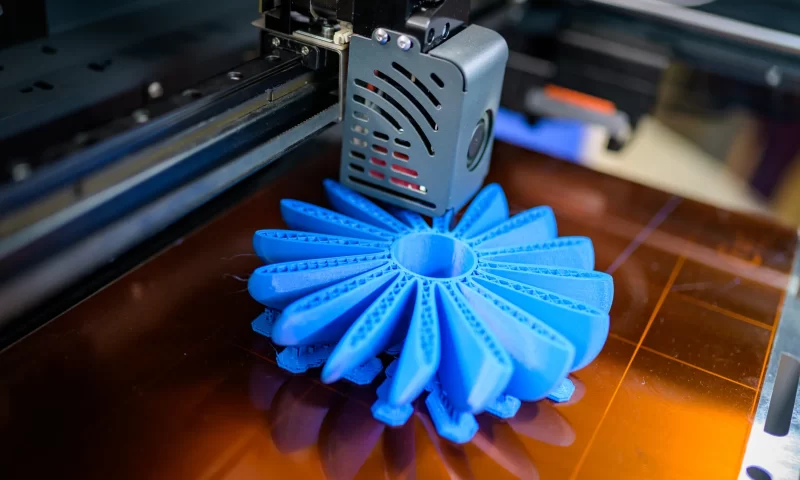

About 3D Systems (NYSE:DDD)

3D Systems Corporation, through its subsidiaries, provides 3D printing and digital manufacturing solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company offers 3D printers, such as stereolithography, selective laser sintering, direct metal printing, multi jet printing, color jet printing, and extrusion and SLA based bioprinting that transform digital data input generated by 3D design software, computer aided design (CAD) software, or other 3D design tools into printed parts.