Weekly Market Review – July 11, 2020

Stock Markets

Stocks finished modestly higher last week, led by technology and long-term growth stocks. The nonmanufacturing Purchasing Managers’ Index, a measure of business conditions, posted its biggest monthly gain and moved back into expansion, adding to the string of positive economic surprises. However, as new COVID-19 cases rise and several states slow down or roll back reopening measures, the economic recovery is likely to start losing some momentum. Uncertainty around the path of the virus and the political outcome of the U.S. elections will likely linger over the coming months, but low interest rates and monetary and fiscal stimulus should help sustain the economic recovery later this year and into 2021.

US Economy

With 50% of 2020 in the books, the outlook for the second has things that change, but as many that remain the same. Analysts believe some of this year’s prevailing conditions will persist, while some facets of the investment environment are likely to change as we progress through the remainder of the year.

Financial goals stretch beyond this calendar year, so investment decisions should be guided by a longer-term strategy, not simply the next several months. At the same time, disciplined portfolio positioning and periodic adjustments can help keep investors on track toward ther goals as we navigate the remainder of this historic year. Analysts expect the second half of 2020 will be governed by:

COVID – which will remain in the driver’s seat.

Low interest rates – which are likely to linger on.

Policy-support – will remain wide open aiding the markets.

Metals and Mining

Gold breached US$1,800 an ounce on Wednesday, trending as high as US$1,814. A weakening US dollar and a retreat from risk sentiment helped the yellow metal hit its highest value since 2011. The broader precious metals space benefited from the rally, with all constituents positioned to end the week in the green.

After climbing 9.7 percent during Q2, gold is on track for a fifth straight week of gains. Since July 1, it has added 2.4 percent to its value. The yellow metal has not been in the US$1,800 range since mid-September 2011. Silver was also able to rise this session, increasing by roughly 2.2 percent. While the white metal’s fundamentals differ from those of gold, safe haven demand has worked in its favor. Diminished industrial demand has weighed on silver, and the lifting of lockdowns and factory restarts have yet to propel the metal to its previous levels. Silver is still well off its all-time high of nearly US$50 per ounce, even as its sister metal inches higher. Platinum rose above US$850 per ounce this week. The move marked the first time since May that the metal had surpassed that threshold. But the ascent was short-lived, with the catalyst metal falling to US$814 at midday on Thursday. A recent report from the World Platinum Investment Council showcases Germany’s decarbonization goals. The group expects the use of fuel cell electric vehicles (FCEVs), which require platinum, to be a key component in the German strategy. Palladium made a large leap this session, jumping to US$1,934 per ounce on Thursday. The 4 percent surge over one day was later reversed when the metal pulled back to US$1,880. Now back above US$1,900, palladium has climbed 5.5 percent since Monday.

The first full week of July was positive for base metals as well. Copper started the period at US$6,112 per tonne and was up 3 percent by the end of week. Supply and demand chains continue to be impacted for the red metal, which could justify a move to US$7,000, according to one market watcher. A modest gain was also seen in the zinc space as prices steadily moved up. But a week of positive price action was still not enough to pull the metal to its pre-COVID-19 high of US$2,466 per tonne. Nickel saw a 1.3 percent increase this period, marking a year-to-date high for the metal. Now at the US$13,400 per tonne level, nickel remains far from its one year high of US$18,620. A rally in lead prices pushed the metal above US$1,800 this week. Five days of steady gains helped push lead back to its pre-pandemic price, and a 2 percent uptick allowed the base metal to end the week trading at US$1,817.50 per tonne.

Energy and Oil

Oil posted a price correction on Thursday on fears of the rising coronavirus numbers in the U.S., something that the IEA warned about in its latest Oil Market Report out Friday. In early trading, prices firmed up, with WTI holding onto $40 per barrel. The IEA hiked its demand forecast for 2020 but also warned that the spreading coronavirus in the U.S. poses downside risks. The agency said demand could be 400,000 bpd higher than previously thought this year due to a rapid bounce back in many economies around the world, particularly in China and India. Also, oil supply fell by 2 mb/d in June, further tightening the market. Investment in U.S. offshore wind could soon match total investment levels in offshore oil and gas. A new study from Wood Mackenzie projects offshore wind investment could reach $78 billion this decade, compared to $82 billion for offshore oil and gas. In the decade ending in 2010, wind saw virtually nothing while offshore oil and gas received $154 billion. On the legal front, the U.S. Supreme Court ruled that a large swathe of Oklahoma remains in control of Native American tribes. The decision raises questions about whether oil and gas sites will no longer fall under the control of Oklahoma regulators, instead potentially reverting to federal control with tribes as beneficiaries. Natural gas spot prices rose at most locations this. The Henry Hub spot price rose from $1.48 per million British thermal units (MMBtu) last week to $1.58/MMBtu this week. At the New York Mercantile Exchange (Nymex), the price of the July 2020 contract decreased 4¢, from $1.638/MMBtu last week to $1.597/MMBtu this week. The price of the 12-month strip averaging July 2020 through June 2021 futures contracts declined 8¢/MMBtu to $2.286/MMBtu.

World Markets

European shares ended the week little changed, depressed by renewed concerns about a resurgence of coronavirus cases. Although the pan-European STOXX Europe 600 Index was flat, major European market indexes were mixed. Germany’s DAX Index rose 0.22%, but France’s CAC 40 Index eased 1.38%, while Italy’s FTSE MIB Index declined 1.12%, and the UK’s FTSE 100 Index fell 1.19%.

Core eurozone bond yields fell on the week as a surge of coronavirus cases in the U.S. ignited fresh fears of a second wave, pushing investors to core assets. Peripheral eurozone bond yields fell overall after a mixed week. Cautious optimism about an economic recovery lifted yields at first, but reignited coronavirus fears caused them to retrace.

In Chinaa, a bullish editorial in the China Securities Journal on Monday set in motion a risk-on rally for the rest of the week that sent the benchmark Shanghai Composite Index to a two-year high. By Friday, the large-cap CSI 300 Index and Shanghai Composite Index rallied 7.5% and 7.3%, respectively. In China’s fixed income market, domestic bonds sold off and yields rose. The yield on China’s 10-year bond rose 20 basis points to end the week at 3.13% amid growing optimism about the economy and strong momentum in stocks.

China’s June consumer price inflation rose 2.5%, in line with expectations. However, headline inflation is expected to decline in future readings as food price inflation continues to ebb on lower pork prices. A food basket tracked by China Reality Research fell to a 16-month low and an annual rise of 9%, down from 10.6% in May. More noteworthy was the continued decline in factory gate prices, which fell for the fifth straight month in annual terms. The producer price index fell 3.0% in June from a year earlier, underscoring the threat of deflation due to the coronavirus-induced demand shock, though it exceeded the consensus forecast and the prior month’s 3.7% drop.

The Week Ahead

The second-quarter earnings season kicks off on Monday, with 8% of S&P 500 companies reporting earnings throughout the week. Important economic data being released include inflation on Tuesday, retail sales on Thursday, and housing starts on Friday.

Key Topics to Watch

- Federal budget

- NFIB small-business index

- Consumer price index

- Core CPI

- Empire state index

- Import price index

- Industrial production

- Capacity utilization

- Initial jobless claims

- Continuing jobless claims

- Retail sales

- Retail sales ex-autos

- Philly Fed index

- NAHB home builders’ index

- Business inventories

- Housing starts (SAAR)

- Building permits (SAAR)

- Consumer sentiment index (flash)

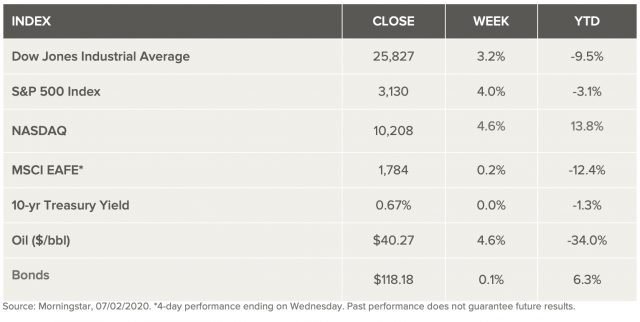

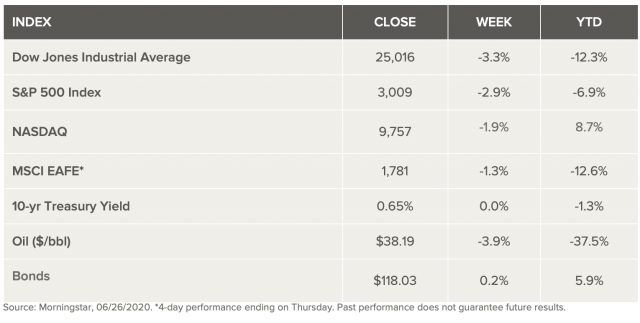

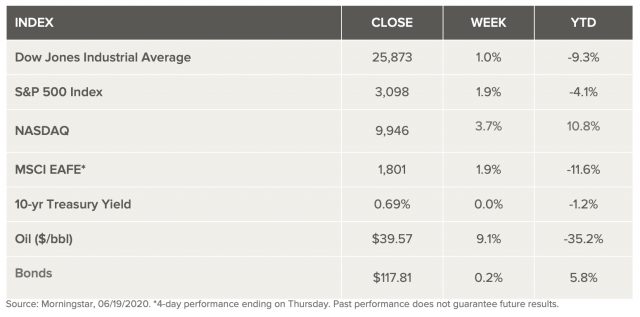

Markets Index Wrap Up