Weekly Market Review – September 12, 2020

Stock Markets

Stocks declined for the second straight week, as technology stocks experienced their worst pullback since March. There was no single catalyst for the move lower, which left the Nasdaq about 10% below its all-time high reached just six trading days ago. However, broad valuation concerns, skepticism about a compromise on a coronavirus stimulus package before the election, and signs of slowing progress in the labor market all contributed to the negative sentiment. Analysts continue to believe a longer-term recovery is under way, but stocks are likely to enter a more volatile period than the one experienced during the summer months. The path forward could be bumpier and the pace of the recovery slower, and as a result, stocks could start to consolidate some of the recent gains.

US Economy

Last week stocks fell 2.5%, posting their second consecutive week of losses1. We don’t think that last week’s pullback is a sign that the rally has come to an end. But it does highlight the view that we’ve reached a bumpier stage in the economic recovery, prompting occasional downward swings in stocks even as the overall rally continues. Despite the unprecedented, unpredictable and unruly path of the COVID-19 pandemic, we’ve observed a pattern to the economic recovery to date that analysts believe can be defined by three distinct stages:

Stage 1: A severe recession

Stage 2: A sharp early rebound

Stage 3: A slow recovery back to pre-pandemic levels.

Because the economic fundamentals supporting the rally are likely to be less vigorous as we move from Stage 2 of the recovery to Stage 3, analysts expect occasional pullbacks in the equity rally. Maintaining diversification across asset classes, sectors and geographies can help investors reduce the impact of temporary downward swings on long-term portfolio performance within the broader market climb. Despite the bumpier growth path ahead, focusing on achieving financial goals over time rather than on short-lived market moves can help make the economic journey from recession to recovery a smoother ride for investors.

Metals and Mining

Gold remained in the green on Friday after seeing some volatility late in the week. A strengthening US dollar pulled the yellow metal back late in the session, although fears of a prolonged economic recovery continued to benefit the precious metals. The base metals weren’t as lucky, spending most of the second week of September trending lower. Gold was on track to end the week higher after spending the last half of August moving lower. The currency metal started the week at US$1,929.70 per ounce before volatility brought it to US$1,913. A subsequent rally drove the value of the yellow metal to US$1,962.80, a three-week high. Silver also moved higher this week despite experiencing some headwinds mid-session. Its price fell to US$26.04 per ounce on Tuesday and had surged past US$27 by Thursday. After testing the US$29 threshold in August, the white metal has held below US$28. The platinum price climbed 3 percent this session, reversing a steady decline that started in mid-August. After dropping to US$600 per ounce in March, platinum has added 32 percent to its value and is approaching its year-to-date high of US$1,022, set on January 17. On Friday, platinum was selling for US$932.50. While the other precious metals experienced a price slump in mid-August, palladium’s story was the opposite. The automotive metal steadily ticked higher through the first week of September before facing some resistance. Palladium started the session at US$2,197 per ounce, before slipping to US$2,135. By Friday morning, palladium was moving for US$2,208.

Copper felt pressure this session, but even though it ended the week 1 percent lower, the base metal has surpassed its January high of US$6,300 per tonne. After hitting a year-to-date high of US$2,554 on September 1, the zinc price has been on the retreat. The steady run-up that the metal saw in July and August has now consolidated after resistance set in. That said, the price pressure may be temporary as mine supply is still being impacted and seasonal slumps are starting to dissipate, which may set the stage for new price highs. Zinc was selling for US$2,383 on Friday. Nickel also marked its year-to-date high in early September, when its price hit US$15,660. Analysts at Fastmarkets note that the metal’s late-summer bump was likely the result of Tesla (NASDAQ:TSLA) CEO Elon Musk calling for more nickel mining. Lead took a drastic dip this week — the metal opened at US$1,961.50 per tonne and had shed 5.2 percent by the end of week. Despite the dramatic slump, lead values are still holding at their pre-pandemic levels after falling to US$1,578 in May. Friday saw the lead price sitting at US$1,859.

Energy and Oil

Oil prices edged up just a bit during midday trading on Friday, with Brent climbing back above $40 per barrel. Sentiment remains more pessimistic than in previous weeks. Low prices are hitting OPEC+ members, just as they began ramping up production. Should OPEC stay on course with the cuts, hoping that demand recovery picks up next year, enduring low-for-longer oil prices that crush OPEC budgets? Should they cut deeper? ExxonMobil suspended work on a third floating production, storage and offloading vessel in Guyana. The company awaits approval from the government of Guyana for its Payara project. Natural gas spot prices fell at most locations this week. The Henry Hub spot price remained flat at $2.19 per million British thermal units (MMBtu). At the New York Mercantile Exchange, the price of the October 2020 contract decreased 8¢, from $2.486/MMBtu last week to $2.406/MMBtu this week. The price of the 12-month strip averaging October 2020 through September 2021 futures contracts declined 1¢/MMBtu to $2.964/MMBtu.

World Markets

Stocks in Europe rose on the continuing economic recovery, shaking off disappointment that the European Central Bank (ECB) did not announce additional stimulus, as well as renewed fears of a hard Brexit. In local currency terms, the pan-European STOXX Europe 600 Index ended the week 1.67% higher. Germany’s Xetra DAX Index rose 2.80%, France’s CAC 40 added 1.39%, and Italy’s FTSE MIB advanced 2.21%. The UK’s FTSE 100 Index gained 4.02%, which benefited from weakness in the British pound. UK stocks tend to gain when the pound falls because many companies in the index are multinationals that generate meaningful overseas revenues.

Mainland Chinese A-shares shed roughly 3.0%, taking their cue from the U.S. sell-off. In addition to the U.S. tech stock downturn, news that the Trump administration was considering adding Semiconductor Manufacturing International Corporation (SMIC), China’s top chip foundry, to a list of U.S.-sanctioned companies dealt a blow to investor sentiment. Shares of many Chinese technology companies fell on the news, reflecting SMIC’s importance as a key semiconductor supplier to the domestic market and the company’s close ties to Beijing and the defense industry.

The yield on China’s 10-year sovereign bond was unchanged. The tone of China’s fixed income market remained firm: Term spreads have narrowed since June, as have the spreads between bonds with the same maturity but different credit ratings. Most analysts expect domestic liquidity conditions will improve in September, providing a positive backdrop to the bond market. The yuan rose 1.7% against the U.S. dollar.

The Week Ahead

Economic data being released include industrial production on Tuesday, retail sales along with the Federal Reserve interest rate decision on Wednesday, and consumer sentiment on Friday.

Key Topics to Watch

- Empire State index

- Import price index

- Industrial production index

- Capacity utilization rate

- Real median household income

- Poverty rate (supplemental rate)

- Uninsured rate (health insurance)

- Retail sales

- Retail sales excluding autos

- NAHB homebuilders’ index

- Business inventories

- Federal Reserve meeting announcement

- Federal Reserve Chair Jerome Powell press conference

- Initial jobless claims (state program, SA)

- Initial jobless claims (total, NSA)

- Continuing jobless claims (state program, SA)

- Continuing jobless claims (total, NSA)

- Housing starts

- Building permits

- Philly Fed manufacturing index

- Current account deficit

- UMich consumer sentiment index (preliminary)

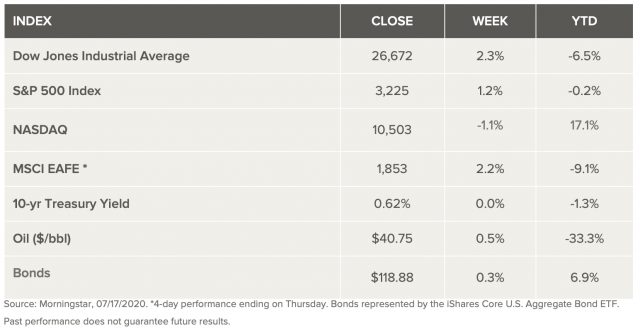

Markets Index Wrap Up