Weekly Market Review – October 26, 2019

Stock Markets

U.S. stocks closed near record highs this week as they rose for the third straight week. The primary driver of market action continues to be earnings. Nearly all third-quarter results coming in so far have been better than expected. The markets got an additional lift as reports that the U.S. and China are close to finalizing sections of the trade deal emerged. The softening of trade rhetoric helped international stocks, which have outperformed U.S. stocks this month. As a marker, both emerging-market and developed-market stocks are off their all-time highs reached in 2007 by about 16%. Analysts suggest that expectations for international markets may be overly pessimistic, creating some opportunities for investors who can think long-term.

U.S. Economy

With the stock market up 20% in 2019 and reaching another all-time high last week, markets are trying to assess the charging bull and its effects on bond interest. It begs the questions, where’s the red flag of warning?

In previous cycles we saw skyrocketing home prices and easy mortgages for borrowers with no income, and prior to that a stock market P/E ratio near 40 times and astronomical stock price gains in dot-coms with no foreseeable profits.

At present, there are no obvious looming excesses or bubbles that demonstrate an imminent threat. However, the prevalence of negative interest rates abroad is a sign worth watching. To predict negative rates red flags, we suggest four key areas:

- Why and where are interest rates negative?

- Will negative rates work?

- Will the U.S. see negative rates?

- What should investors do in this rate environment?

Subzero rates should not drive suboptimal decisions. Although global economies face headwinds, it’s not a time to avoid international diversification of portfolios. Reviewers suggest that negative rates are a sign of extremely pessimistic expectations for international markets which can create an excellent opportunity for long-term investors.

Metals and Mining

Precious metals were up this week as concerns surrounding Brexit and a slow in global economic growth once again pushed prices. Gold rallied on Friday as the Brexit question once again entered murky waters as Prime Minister Boris Johnson demanded a December 12 election and EU ambassadors are left considering the length for an extension to the exit deal. Based on these events, it is unlikely that EU governments will make a Brexit decision this week. That sent investors to seek out the precious metals as a favorite safe haven. Concerns surrounding global economic health and the outcome of the US and China trade deal also helped to support for gold. Data was released Thursday that showed new orders for key US-made capital goods and shipments declined last month. That’s a signal that business investment continues to lose ground as the trade war continues. As of 10:07 a.m. EDT on Friday, gold was trading at US$1,512.80 per ounce. Silver, which had previously taken its own track, followed gold’s lead this week, also making gains of over 1 percent for the week and once again trading over the US$18 per ounce level. Industry insiders believe that silver is primed to make substantial gains. The other precious metals, platinum and palladium were up once again this week. Platinum rose close to 2 percent Friday breaking through the US$900 per ounce level. Palladium was once again on top of the precious metals heap for the week. It hit an all-time high of US$1,785.50 during Thursday’s session. Palladium has rallied all year, gaining 36.5 percent since January.

Energy and Oil

Oil was down at the start of trading on Friday but was poised to close out the week with modest gains thanks to EIA inventory drawdowns and rumors of OPEC+ cuts. Reports are that top U.S. and Chinese trade negotiators have discussed a plan in which China would buy more farm products in exchange for the U.S. removing some tariffs. The outlines of what is a partial deal are important because they would in essence try to move the trading relationship to positions before the trade war erupted, without having to deal with the larger hot button issues of intellectual property. However, there is a lot of ground to cover. President Trump has currently agreed to cancelling the October 15 tariff increase on $250 billion worth of goods, but that’s all. China says that it will offer more purchases, but in return it also wants the tariffs planned for this December totally scrapped. Natural gas spot price movements were mixed this week. Henry Hub spot prices rose from $2.25 per million British thermal units (MMBtu) last week to $2.28/MMBtu this week. At the New York Mercantile Exchange (Nymex), the price of the November 2019 contract decreased 2¢, from $2.303/MMBtu last week to $2.282/MMBtu this week. The price of the 12-month strip averaging November 2019 through October 2020 futures contracts declined 3¢/MMBtu to $2.348/MMBtu.

World Markets

Europe’s equity markets ended mostly higher this week, lifted by the strong start to the 3rd quarter earnings season. Once again it was Brexit uncertainty and U.S.-China trade tensions that helped to slow gains. The pan-European STOXX Europe 600 Index gained 1.5%, while the German DAX and the UK’s FTSE 100 Index both rose more than 2%. The British pound came under pressure this week set against Brexit uncertainty. French President Emmanuel Macron blocked a European Union (EU) attempt to delay Brexit for three months as the sole dissenter at the EU leadership meeting in Brussels. Macron says he wants to allow a Brexit delay until November 30, but other EU governments are willing to postpone Brexit until January 31. That would allow time for a general election which UK Prime Minister Boris Johnson asked to hold on December 12. He will need to secure the backing of two-thirds of Parliament to secure the motion. It will go before the House of Commons on Monday.

Stocks in China stocks also posted a weekly gain, as a string of positive earnings reports and a liquidity injection by the central bank boosted buying. For the week, the benchmark Shanghai Composite Index edged up 0.6%, and the large-cap CSI 300 Index added 0.7%. Decent third-quarter earnings reports from a few significant companies eased worries about corporate earnings weakness. China reported last week that its economy grew a below-forecast 6.0% in the third quarter, marking its slowest growth pace since 1992.

The Week Ahead

The third-quarter earnings season is moving forward as a full one-third of the S&P 500 companies will be reporting earnings through the week. Several significant economic data points will emerge this week including consumer confidence figures, third-quarter GDP growth, and September job reports at weeks end. On Wednesday, the Federal Reserve will render its important rate decision.

Key Topics to Watch

- Advance trade in goods

- Chicago Fed national activity

- Case-Shiller home prices

- Consumer confidence index

- Pending home sales

- Gross domestic product (GDP)

- FOMC announcement

- Weekly jobless claims

- Employment cost index

- Personal income

- Consumer spending

- Core inflation

- Chicago PMI

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

- Markit manufacturing PMI

- ISM manufacturing index

- Construction spending

- Varies Motor vehicle sales

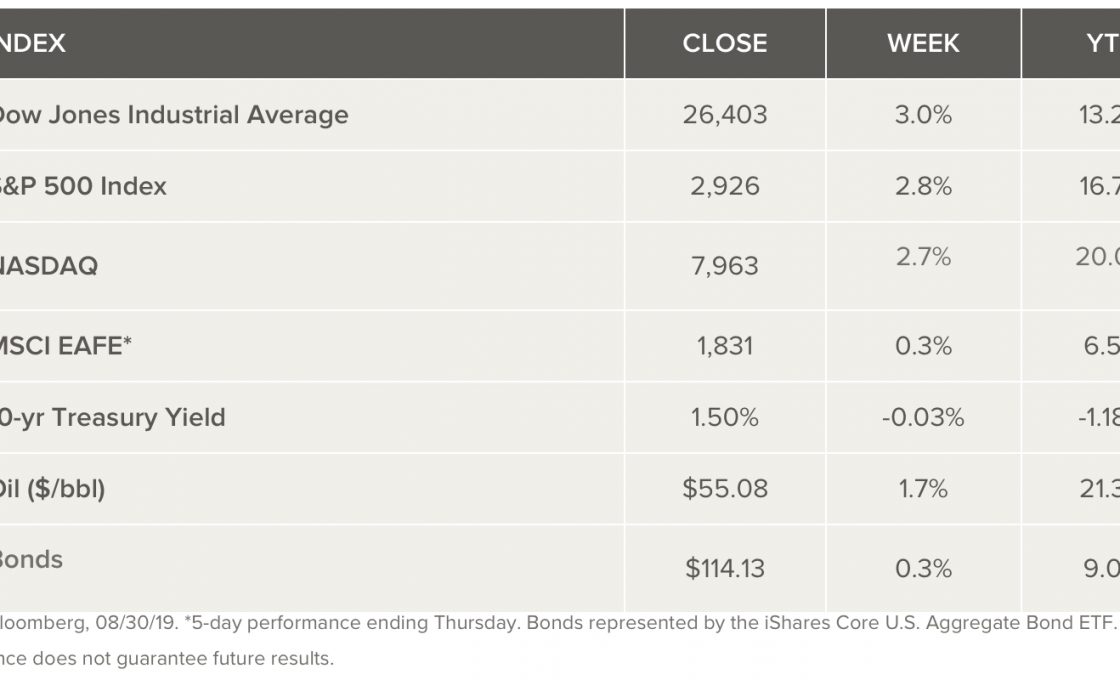

Markets Index Wrap Up