Wall Street Bets a Rally in Riskiest Stocks Has Staying Power

US small-cap stocks are having something of a moment — and Wall Street doesn’t expect it to end any time soon.

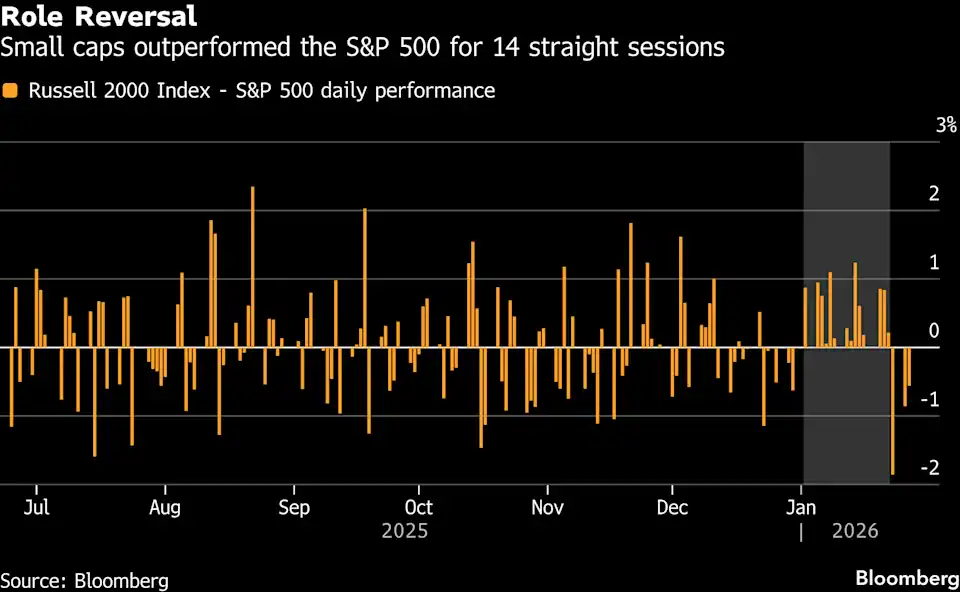

The Russell 2000 Index, home to some of the riskiest stocks in the market because of their strong ties to the business and credit cycles, just ended the longest run of beating large caps since 1996.

While that’s impressive, prior periods that approached such levels of outperformance have failed to persist. Not to worry, strategists say. They’ve grown optimistic on small caps as a way to play a broadening out of the bull run for stocks that’s been powered by Big Tech.

The bet is predicated on expectations for faster earnings growth, owing to a combination of falling interest rates and economic growth. Deregulation, tight credit spreads and more interest rate cuts should also provide tailwinds for these high-beta stocks.

“This channel of strong enough growth – but not too strong – and lower or declining rates are two big macro forces that can push small caps higher,” said Sebastien Page, chief investment officer at T Rowe Price, which manages nearly $1.8 trillion. “We think this can continue for six months.”

Page acknowledges the peril in going long small caps. The group beat the S&P 500 for the first 14 trading days of this year. The streak ended Friday and small caps have trailed the 500-member index since then.

“It’s been a value trap. It’s looked cheap, it’s looked attractive and it has performed a little bit over a couple weeks, and then it’s just been a trap,” Page said.

Still, Page remains broadly overweight small caps, expecting the group to benefit from an economy that is growing while interest rates are still projected to fall.

He’s far from alone, investors and strategists expect the current slump to end and the group to trounce larger-cap peers once again.

“We could see a bit more of a pullback, but then expect small caps to resume their leadership,” Jonathan Krinsky, chief market technician at BTIG LLC, said in a Monday research note.

“Small caps have a macro and fundamental tailwind,” said Dennis DeBusschere, president and chief market strategist at 22V Research. “If AI proves to be a productivity booster, that should benefit most of the companies starting at lower profitability base, like small and mid-cap stocks.”

DeBusschere recommends investors go long regional banks, transportation stocks except for airlines and the consumer discretionary sector.

Investors are also betting that fiscal stimulus, including from tax reforms passed last year, will provide the group a boost in fiscal 2026, given their exposure to the US economy.

“They’re the most American equities you can own,” said Peter Roy, small-cap portfolio manager at Argent Capital. The group derives more of its revenues domestically than their larger cap peers and should benefit from an “accelerating and potentially broadening US economy.”

One risk is that as larger investors rotate into the small-cap space, there is potential for even larger swings in the names given their relative low liquidity. That could mean long-term investors will have to endure heightened volatility.

Traders should plan accordingly, according to Michael Dickson, head of research and quantitative strategies at Horizon Investments LLC. “This relative volatility is going to be more of a norm than an anomaly,” he said by phone.

Mega-cap names like Apple Inc., Alphabet Inc. and Nvidia Corp. each have larger market capitalizations than the entirety of the Russell 2000, whose cumulative market value is $3.6 trillion. Goldman Sachs recently flagged the potential for liquidity to provide a snag as investors rotate out of larger cap names and partially into the small cap space.

Still, many investors see the small caps as a cheap and long-neglected corner of the market currently enjoying multiple tailwinds.

“It’s an under-owned area of the market,” said Horizon’s Dickson. “Valuations are lower for a reason, because of the risk associated with small cap stocks, but it’s a very attractive entry point.”