Why some are accusing Trump of manipulating stock markets

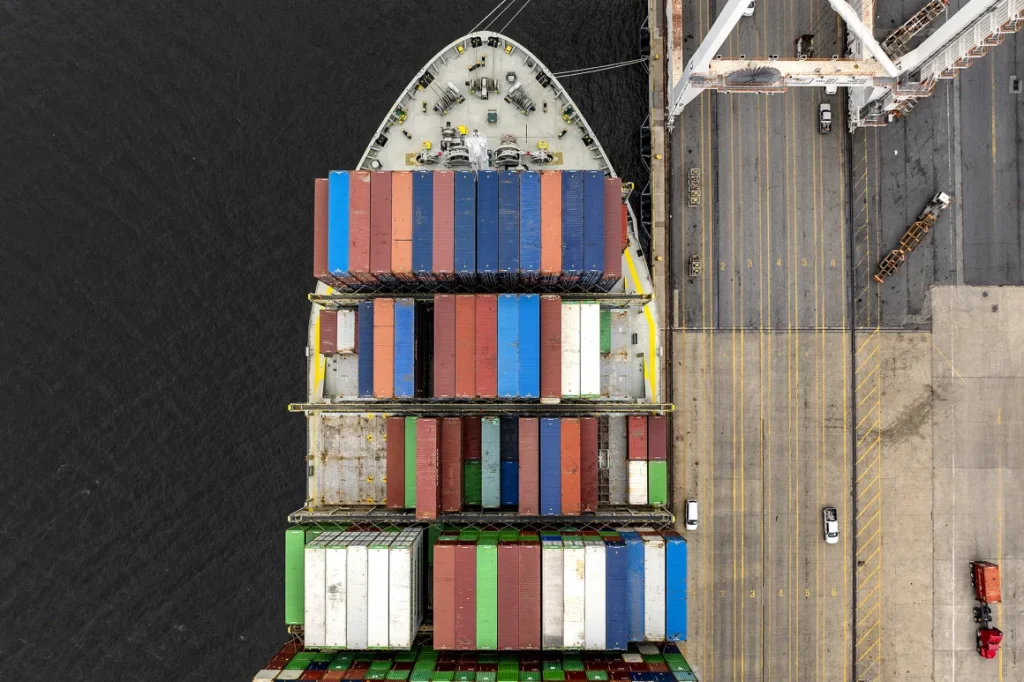

Chinese companies that sell to US customers on Amazon are reportedly preparing to raise prices or quit the US market because of tariffs imposed by President Trump. Amazon CEO Andy Jassy has meanwhile confirmed that he expects the cost of tariffs to be passed on to US buyers.

Reuters talked to several individual sellers and a Chinese trade association that represents over 3,000 Amazon sellers for an article published today. “It’ll be very hard for anyone to survive in the US market” because “the entire cost structure gets entirely overwhelmed” by the tariffs, Reuters was told by Wang Xin, who leads the Shenzhen Cross-Border E-Commerce Association. Xin also “not[ed] the tariffs could also lead to customs delays and higher logistics costs.”

Trump increased tariffs on China imports to 125 percent yesterday even as he announced a 90-day pause on tariff hikes affecting other countries. The total tariffs are 145 percent because the newly raised tariff “comes on top of a 20 percent fentanyl-related tariff that Trump previously imposed on China,” CNBC wrote today.

It’s no surprise that tariffs of this size would have a big impact on Chinese sellers, who have been courted by Amazon for years and are a source of cheap products for US buyers (though those products are often of poor quality).

Amazon declined to comment about the tariffs’ impact on Chinese sellers when contacted by Ars today. But Jassy told CNBC that he expects sellers to pass the cost of tariffs on to consumers.

“I’m guessing that sellers will pass that cost on… depending on which country you’re in, you don’t have 50 percent extra margin that you can play with so I think they’ll try and pass the cost on,” Jassy said.

Jassy said Amazon is “doing everything we can to try and keep prices the way they’ve been for customers, as low as possible.” Amazon has already “done some strategic forward inventory buys to get as many items as make sense for customers at lower prices,” and may renegotiate some deals, he said.

Reuters spoke to five Chinese sellers, writing that “three said they would look to raise prices for their exports to the US, while two planned to leave the market entirely.”

Dave Fong sells products “from schoolbags to Bluetooth speakers” and has already raised prices in the US by up to 30 percent, the article said. “For us and anyone else, you can’t rely on the US market, that’s quite clear,” Fong told Reuters. “We have to reduce investment, and put more resources into regions like Europe, Canada, Mexico, and the rest of the world.”

Products already shipped to Amazon fulfillment centers in the US soften the blow temporarily, but Shenzhen-based seller Brian Miller “anticipated he and other sellers would need to raise prices steeply when current inventories run out in one or two months.”

“Building blocks for children that sell on Amazon for $20 that cost his company $3 to produce would now cost $7 including the tariff. Maintaining margins would require raising the price by at least 20 percent, and prices for higher-cost toys might see 50 percent increases, he said,” according to Reuters. Miller said that if the tariffs aren’t changed, “manufacturing that serves the US will have to be transferred to other countries like Vietnam or Mexico.”

Bloomberg reported yesterday that Amazon “canceled orders for multiple products made in China and other Asian countries.”

Mortgage rates headed higher by most measures this week after President Trump’s tariff plans sparked fresh inflation fears and led to widespread market volatility.

Average 30-year mortgage rates were 6.92% on Thursday, according to Mortgage News Daily, up 29 basis points from a week earlier. Zillow has them at 6.84%, even after Trump paused tariffs on most countries.

Last week’s tariff announcement shattered several weeks of relative stability for mortgage rates. Rates initially fell, following Treasury yields lower, as investors feared a potential recession.

But what looked like a potential bright spot amid a broad stock market sell-off was short-lived. Ten-year Treasury yields, which closely track mortgage rates, swung wildly, then began marching higher this week amid concerns that the tariffs could usher in stagflation and hamper long-term foreign demand for US bonds.

“The economic situation is rapidly evolving,” Kara Ng, senior economist for Zillow Home Loans, said in a statement. “It’s hard to predict the direction of mortgage rates with any conviction.”

Trump said he was watching the bond market before he announced 90-day relief from higher tariffs for most countries on Wednesday.

“The bond market right now is beautiful,” he said Wednesday. “I saw last night where people were getting a little queasy.”

Ten-year Treasury yields fell somewhat after the higher tariffs were paused, but they remain elevated. They’re about 4.34% now, up from around 4.16% before “Liberation Day.”

Illustrating just how volatile rates were this week, Freddie Mac’s weekly mortgage rate survey, which runs through Wednesday, was an outlier, pinning the average 30-year mortgage rate at 6.62%, down slightly from 6.64% a week earlier. Fifteen-year mortgage rates remained flat at 5.82%.

Tim Stafford, a mortgage broker at Edge Home Finance, said that on a normal bad day for mortgage rates, he might receive two intraday updates from lenders notifying him that their rates were moving higher. On Monday, one large company sent him three.

He’s telling buyers who are comfortable with their monthly mortgage payments to lock in their rates despite the uncertainty. One recent client didn’t take this advice on Friday when rates were falling, only to call back on Monday during the upswing.

“I think in the long term, rates are going to come down,” Stafford said. “But you just don’t know where they’re going to be right now, so if it works for you now, I would lock.”

Mortgage applications jumped last week, helped by buyers and refinancers who managed to take advantage of the brief dip in rates. Applications to purchase a home rose 9% from a week earlier, according to the Mortgage Bankers Association, while refinancing applications surged 35%.

NEW YORK, April 10 (Reuters) – Wall Street stocks tumbled on Thursday on mounting worries over the economic impact of U.S. President Donald Trump’s multi-front tariff war.

All three major U.S. stock indexes suffered steep losses, forfeiting much of the previous session’s gains as growing concerns over the escalating Washington-Beijing trade face-off dampened optimism over upbeat economic data and U.S.-Europe trade negotiations.

After Trump announced a 90-day tariff reprieve on Wednesday, the S&P 500 surged 9.5%, the largest one-day percentage jump since October 2008. The tech-heavy Nasdaq soared 12.2%, notching its second-biggest daily gain on record.

Russell Investments remains focused on sectors in which AI adoption has been ramping up, including industrials, healthcare, and consumer goods. As per the firm, companies that leverage AI for productivity improvements remain well-placed to gain a lasting competitive edge and provide healthy returns. Therefore, skilled active managers are required to look for such companies, primarily those that are in less-covered segments of the market.

With respect to real assets, Russell Investments sees attractive investment opportunities in real estate and infrastructure, mainly sectors that can benefit from the stabilization of long-term interest rates and favorable relative valuations in comparison to other growth assets. The application of AI in real estate, like data centers and healthcare facilities, continues to emerge as a critical growth area. Furthermore, the infrastructure investments continue to gain momentum from energy utilities and pipeline exposures, given the US administration’s emphasis on expanding LNG (liquified natural gas) production.

The firm also believes that an early focus on deregulation and tax cuts would likely be well-received by equity investors. Overall, an expected US soft landing, together with anticipated policy moderation on trade and immigration, creates specific opportunities for well-positioned portfolios, says Russell Investments.

We sifted through the holdings of iShares Core S&P 500 ETF and shortlisted the companies that have 10-year revenue growth of over ~10%. Next, we selected stocks that were the most popular among elite hedge funds. We have ranked the stocks in ascending order of hedge fund sentiment.

A technician working at a magnified microscope, developing a new integrated circuit.

10-year Revenue Growth: ~26.5%

Number of Hedge Fund Holders: 161

Broadcom Inc. (NASDAQ:AVGO) is engaged in the designing, developing, and supplying of various semiconductor devices. Morningstar believes that the company’s primary valuation drivers revolve around the growth of its AI chip business as well as its capability to extract growth and operating leverage from VMware. The firm also expects continued inorganic growth over the long term. It expects high AI sales to fuel supernormal growth for Broadcom Inc. (NASDAQ:AVGO) over the next 5 years.

Broadcom Inc. (NASDAQ:AVGO)’s strength in both chips and software enables it to earn terrific accounting and economic profits, and Morningstar believes that its competitive positioning will continue to allow it to do so for the upcoming 20 years. As per the firm, Broadcom Inc. (NASDAQ:AVGO) will focus on healthy cash generation. Over the long term, Morningstar expects that the emphasis will be on improving its dividend and bolting on more acquisitions, which can help drive its cash flow. The company is expected to be a significant beneficiary of rising AI spending, which can spur strong growth for its networking semiconductor sales.

Carillon Tower Advisers, an investment management company, released its Q4 2024 investor letter. Here is what the fund said:

“Broadcom Inc. (NASDAQ:AVGO) had a strong quarter, mostly from the two days that followed its earnings release announcing a significant expansion in the addressable market for its custom AI silicon offerings. As a leader in data center connectivity and custom silicon, the company is now considered to be one of the biggest beneficiaries from the growth in AI spending.”

Overall, AVGO ranks 6th on our list of best stocks for 15 years. While we acknowledge the potential of AVGO as an investment, our conviction lies in the belief that some deeply undervalued AI stocks hold greater promise for delivering higher returns, and doing so within a shorter time frame. There is an AI stock that went up since the beginning of 2025, while popular AI stocks lost around 25%. If you are looking for a deeply undervalued AI stock that is more promising than AVGO but that trades at less than 5 times its earnings, check out our report about this cheapest AI stock.