AALBORG, Denmark (AP) — In a warehouse more than 1,500 kilometers (900 miles) from Ukraine’s capital, workers in northern Denmark painstakingly piece together anti-drone devices. Some of the devices will be exported to Kyiv in the hopes of jamming Russian technology on the battlefield, while others will be shipped across Europe in efforts to combat mysterious drone intrusions into NATO’s airspace that have the entire continent on edge.

Two Danish companies whose business was predominantly defense-related now say they have a surge in new clients seeking to use their technology to protect sites like airports, military installations and critical infrastructure, all of which have been targeted by drone flyovers in recent weeks.

Weibel Scientific’s radar drone detection technology was deployed ahead of a key EU summit earlier this year to Copenhagen Airport, where unidentified drone sightings closed the airspace for hours in September. Counter-drone firm MyDefence, from its warehouse in northern Denmark, builds handheld, wearable radio frequency devices that sever the connection between a drone and its pilot to neutralize the threat.

So-called “jamming” is restricted and heavily regulated in the European Union, but widespread on the battlefields of Ukraine and has become so extensive there that Russia and Ukraine have started deploying drones tethered by thin fiber-optic cables that don’t rely on radio frequency signals. Russia also is firing attack drones with extra antenna to foil Ukraine’s jamming efforts.

A spike in drone incursions

Drone warfare exploded following Russia’s full-scale invasion of Ukraine in 2022. Russia has bombarded Ukraine with drone and missile attacks, striking railways, power facilities and cities across the country. Ukraine, in response, has launched daring strikes deep inside Russia using domestically produced drones.

But Europe as a whole is now on high alert after the drone flyovers into NATO’s airspace reached an unprecedented scale in September, prompting European leaders to agree to develop a “drone wall” along their borders to better detect, track and intercept drones violating Europe’s airspace. In November, NATO military officials said a new U.S. anti-drone system was deployed to the alliance’s eastern flank.

Some European officials described the incidents as Moscow testing NATO’s response, which raised questions about how prepared the alliance is against Russia. Key challenges include the ability to detect drones — sometimes mistaken for a bird or plane on radar systems — and take them down cheaply.

The Kremlin has brushed off allegations that Russia is behind some of the unidentified drone flights in Europe.

Andreas Graae, assistant professor at the Royal Danish Defense College, said there is a “huge drive” to rapidly deploy counter-drone systems in Europe amid Russia’s aggression.

“All countries in Europe are struggling to find the right solutions to be prepared for these new drone challenges,” he said. “We don’t have all the things that are needed to actually be good enough to detect drones and have early warning systems.”

Putting ‘machines before people’

Founded in 2013, MyDefence makes devices that can be used to protect airports, government buildings and other critical infrastructure, but chief executive Dan Hermansen called the Russia-Ukraine war a “turning point” for his company.

More than 2,000 units of its wearable “Wingman” detector have been delivered to Ukraine since Russia invaded nearly four years ago.

“For the past couple of years, we’ve heard in Ukraine that they want to put machines before people” to save lives, Hermansen said.

MyDefence last year doubled its earnings to roughly $18.7 million compared to 2023.

Then came the drone flyovers earlier this year. Besides Copenhagen Airport, drones flew over four smaller Danish airports, including two that serve as military bases.

Hermansen said they were an “eye-opener” for many European countries and prompted a surge of interest in their technology. MyDefence went from the vast majority of its business being defense-related to inquiries from officials representing police forces and critical infrastructure.

“Seeing suddenly that drone warfare is not just something that happens in Ukraine or on the eastern flank, but basically is something that we need to take care of in a hybrid warfare threat scenario,” he added.

Radar technology used against drones

On NATO’s eastern flank, Denmark, Poland and Romania are deploying a new weapons system to defend against drones. The American Merops system, which is small enough to fit in the back of a midsize pickup truck, can identify drones and close in on them using artificial intelligence to navigate when satellite and electronic communications are jammed.

The aim is to make the border with Russia so well-armed that Moscow’s forces will be deterred from ever contemplating crossing the line from Norway in the north to Turkey in the south, NATO military officials told The Associated Press.

North of Copenhagen, Weibel Scientific has been making Doppler radar technology since the 1970s. Typically used in tracking radar systems for the aerospace industry, it’s now being applied to drone detection like at Copenhagen Airport.

The technology can determine the velocity of an object, such as a drone, based on the change in wavelength of a signal being bounced back. Then it’s possible to predict the direction the object is moving, Weibel Scientific chief executive Peter Røpke said.

“The Ukraine war, and especially how it has evolved over the last couple of years with drone technology, means this type of product is in high demand,” Røpke said.

Earlier this year, Weibel secured a $76 million deal, which the firm called its “largest order ever.”

The drone flyovers boosted the demand even higher as discussion around the proposed “drone wall” continued. Røpke said his technology could become a “key component” of any future drone shield.

Japanese Finance Minister Satsuki Katayama issued a fresh warning regarding currency movements as the yen weakened toward the key threshold of 155 to the dollar, amid concerns the currency will move closer toward levels where authorities last intervened in markets.

“We’re seeing one-sided, rapid currency moves of late,” Katayama said in response to questions in parliament Wednesday, adding that it can’t be denied that the negative aspects of the weak yen are becoming clearer. “The government is watching for any excessive and disorderly moves with a high sense of urgency.”

Japanese Finance Minister Satsuki Katayama issued a fresh warning regarding currency movements as the yen weakened toward the key threshold of 155 to the dollar, amid concerns the currency will move closer toward levels where authorities last intervened in markets.

“We’re seeing one-sided, rapid currency moves of late,” Katayama said in response to questions in parliament Wednesday, adding that it can’t be denied that the negative aspects of the weak yen are becoming clearer. “The government is watching for any excessive and disorderly moves with a high sense of urgency.”

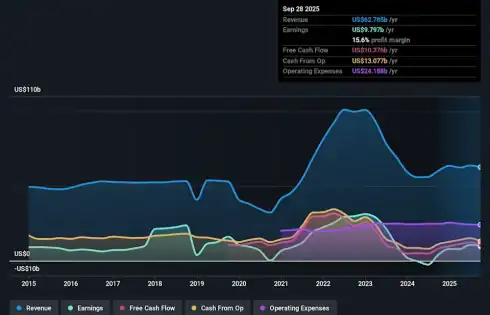

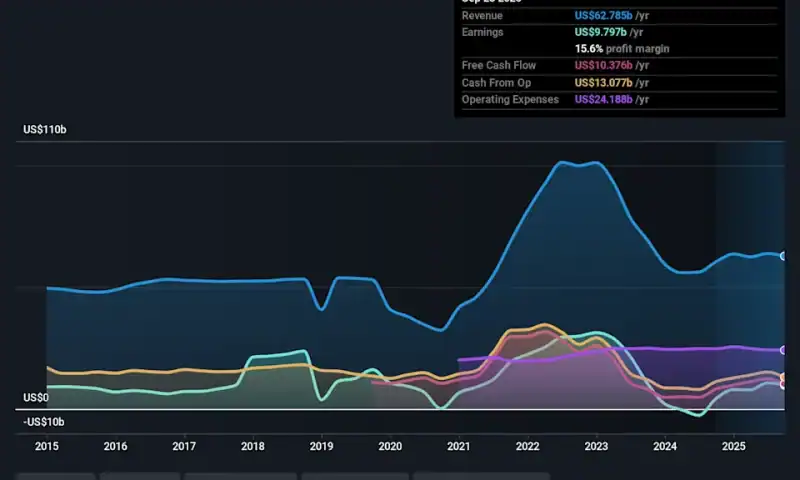

TOKYO (Reuters) -SoftBank’s shares slid as much as 10% on Wednesday after the $5.8 billion sale of its stake in Nvidia highlighted the growing funding demands it faces to bankroll its “all-in” bet on ChatGPT creator OpenAI and other investments.

The conglomerate needs to fund a $22.5 billion follow-on investment in OpenAI, is acquiring chipmaker Ampere in a $6.5 billion deal and has agreed to buy the robotics business of Swiss group ABB for $5.4 billion.

Analyst Mary Pollock at CreditSights estimates SoftBank has committed to at least $41 billion in recent spending on investments and purchases. Its cash position totalled 4.2 trillion yen ($27.86 billion) at the end of September.

SoftBank’s cash needs in the current quarter are “substantial”, Pollock wrote in a note.

“Though SBG’s liquidity position has improved relative to when it issued its hybrids in October, we still estimate it will need to be proactive funding its recent (more than) $41 billion investment spend,” she wrote.

The share drop also comes amid investor concerns about the risk that rapidly rising tech valuations are overextended, even as SoftBank moves to deepen its exposure to the AI sector.

SoftBank said on Tuesday it sold the Nvidia stake and also sold T-Mobile US shares for $9.2 billion between June and September.

SoftBank’s founder and CEO Masayoshi Son, who is known for his risk appetite and aggressive investing style, is bullish on the outlook for artificial intelligence.

“I do not think SoftBank has a negative view on Nvidia,” said Rolf Bulk, analyst at New Street Research.

“The position was large, liquid, and easy to monetise, and likely SoftBank sees even more upside in reallocating capital to OpenAI.”

In June, Son said corporate winners grow stronger over time, scooping up profits, and made a comparison with firms such as Alphabet’s Google and Amazon.

SoftBank’s shares have had a blistering run, more than quadrupling between April and October, but have pared gains in recent days.

On Wednesday, the shares recouped some of their earlier losses and ended the day down 3.46%. Shares in Nvidia and chip designer Arm, which is controlled by SoftBank, fell 3% overnight.

TOKYO (Reuters) -SoftBank’s shares slid as much as 10% on Wednesday after the $5.8 billion sale of its stake in Nvidia highlighted the growing funding demands it faces to bankroll its “all-in” bet on ChatGPT creator OpenAI and other investments.

The conglomerate needs to fund a $22.5 billion follow-on investment in OpenAI, is acquiring chipmaker Ampere in a $6.5 billion deal and has agreed to buy the robotics business of Swiss group ABB for $5.4 billion.

Analyst Mary Pollock at CreditSights estimates SoftBank has committed to at least $41 billion in recent spending on investments and purchases. Its cash position totalled 4.2 trillion yen ($27.86 billion) at the end of September.

SoftBank’s cash needs in the current quarter are “substantial”, Pollock wrote in a note.

“Though SBG’s liquidity position has improved relative to when it issued its hybrids in October, we still estimate it will need to be proactive funding its recent (more than) $41 billion investment spend,” she wrote.

The share drop also comes amid investor concerns about the risk that rapidly rising tech valuations are overextended, even as SoftBank moves to deepen its exposure to the AI sector.

SoftBank said on Tuesday it sold the Nvidia stake and also sold T-Mobile US shares for $9.2 billion between June and September.

SoftBank’s founder and CEO Masayoshi Son, who is known for his risk appetite and aggressive investing style, is bullish on the outlook for artificial intelligence.

“I do not think SoftBank has a negative view on Nvidia,” said Rolf Bulk, analyst at New Street Research.

“The position was large, liquid, and easy to monetise, and likely SoftBank sees even more upside in reallocating capital to OpenAI.”

In June, Son said corporate winners grow stronger over time, scooping up profits, and made a comparison with firms such as Alphabet’s Google and Amazon.

SoftBank’s shares have had a blistering run, more than quadrupling between April and October, but have pared gains in recent days.

On Wednesday, the shares recouped some of their earlier losses and ended the day down 3.46%. Shares in Nvidia and chip designer Arm, which is controlled by SoftBank, fell 3% overnight.