US employers probably added jobs at a moderate pace in February at a time of federal government layoffs and a consumer spending slowdown.

Payrolls rose by 160,000 in February, a slight improvement from the 143,000 increase a month earlier yet softer than during the final months of 2024, according to the median projection of economists surveyed by Bloomberg. The unemployment rate is seen holding at 4%.

Friday’s report from the Bureau of Labor Statistics will provide an update for Federal Reserve officials about momentum in the labor market that’s been the key support — at least until January — of household spending and the economy. However, rapid policy changes by the Trump administration — including the push by Elon Musk’s Department of Government Efficiency to shrink the federal government and cut spending — risk elevating uncertainty about the outlook.

Listen to the Podcast: Will Elon Musk Trigger a US Government Shutdown?

Fed Chair Jerome Powell is slated to speak at a monetary policy forum Friday afternoon. Policymakers next meet March 18-19 and they’re expected to hold interest rates steady as they gauge the labor market and inflation trends as well as recent government policy shifts.

Other officials speaking in the coming week include Fed governors Adriana Kugler and Christopher Waller, as well as New York Fed President John Williams. Treasury Secretary Scott Bessent is also speaking before the Economic Club of New York.

Treasury Secretary Scott Bessent said Sunday that he’s confident US inflation will slow over the course of the year as two polls signaled that President Donald Trump risks putting off Americans worried about the economy and consumer-price growth with the broad flurry of measures during his first weeks in office.

Recent surveys already show consumers are shedding optimism about business conditions and the job market over the next several months. Figures from the Institute for Supply Management and S&P Global will help show whether manufacturers and service providers are seeing orders and business activity cool as managers assess a growing threat of tariffs.

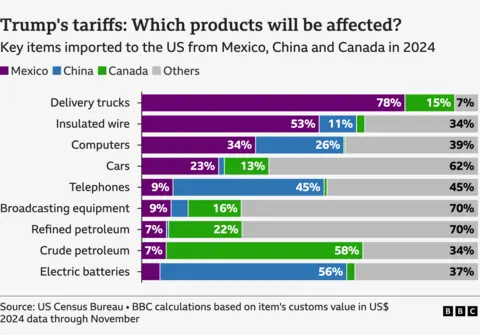

Trump’s administration is planning to enact 25% tariffs on imports from Canada and Mexico on March 4, the same day the president addresses a joint session of Congress and may drop other policy bombshells.

The February jobs report may also include the initial effects of a federal hiring freeze, though thousands of public-service layoffs occurred too late in the month to have a material impact this time around. And while federal jobs account for a small share of overall payrolls, funding cutbacks risk bleeding into the private sector that supports — and is supported by — government-funded programs.

What Bloomberg Economics Says:

“Softening sentiment, a contraction in spending, downward revisions to first-quarter GDP growth expectations – data in the past week have stirred growth fears in the market, challenging the narrative of the US economy’s ‘exceptionalism.’ Data and events in the coming week could turn these flickers of concern into a real fire.”

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou & Chris G. Collins, economists. For preview, click here

In Canada, government officials are expected to continue their push to avert Trump’s planned levies on most Canadian goods.

Among economic data, the international trade report for January may show a continued surge in exports to the US as the loonie weakened and American importers looked to get ahead of potential tariffs. Employment data for February may similarly continue a trend seen the previous month, in which manufacturing jobs boomed, likely due to tariff front-running.

Elsewhere, Chinese manufacturing PMIs, inflation readings from Australia to Switzerland to Mexico and rate cuts at the European Central Bank and in Turkey will be in focus.

Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.

Europe, Middle East, Africa

The week kicks off with the latest inflation reading for the euro area, which — following mixed signals from Germany and France — likely slowed to 2.6%. While still clearly above the ECB’s 2% target, the deceleration will be a relief for central bank officials, who on Thursday in Frankfurt are set to deliver another 25 basis point rate cut — the sixth such move since June.

What happens next is less clear, with policymakers led by President Christine Lagarde increasingly torn on how far they should go. New economic forecasts published alongside the rate decision could provide some clarity, though the threat of US tariffs clouds the outlook.

The Danish central bank typically mirrors any ECB move, and so is expected to lower rates as well on Thursday.

Earlier that day, Turkey will probably also cut borrowing costs — encouraged by new inflation data due Monday likely to show a slowdown to 40% in February — while Ukraine is seen hiking rates for a third straight meeting.

In the UK, Bank of England Governor Andrew Bailey will be among ratesetters questioned by the Treasury committee on their decision to lower rates by a quarter point in February.

Beyond central banks, South African data on Tuesday is expected to show gross domestic product expanded 0.9% in the fourth quarter, against a 0.3% contraction in the prior three months, in part due to a rebound in the agricultural industry and strong growth in the retail sector.

Swiss inflation a day later will probably show a reading of just 0.2% for February, the weakest since March 2021. The central bank has warned that inflation readings could drop below zero in some months this year and predicts consumer-price growth to average just 0.3% in 2025 as a whole.

In Germany, factory orders on Friday are expected to show a contraction, reminding politicians hashing out their priorities in forming a new government of the country’s industrial malaise.

The situation in Ukraine will, however, overshadow everything else in the region after a meeting between Trump and Ukrainian counterpart Volodymyr Zelenskiy blew up on Friday, throwing US support into question.

Bloomberg Economics calculates that protecting Ukraine and expanding their own militaries could cost Europe’s major powers an additional $3.1 trillion over the next 10 years.

UK Prime Minister Keir Starmer hosts European leaders on Sunday in London, ahead of an emergency EU summit in Brussels on Thursday.