Investors say it’s time to take Trump seriously as markets recoil

Data out Monday showed activity in the manufacturing sector slowed in February while costs increased and employment contracted, as President Donald Trump’s tariff policies weighed on the sector.

The Institute for Supply Management’s manufacturing PMI registered a reading of 50.3 in February, down from January’s 50.9 reading and below the 50.7 economists had expected. Readings above 50 for this index indicate an expansion in activity, while readings below 50 indicate a contraction.

Meanwhile, the prices paid index surged to a reading of 62.4, up from 54.9 the month prior and its highest level since July 2022, reflecting company costs continuing to increase. The employment index fell into contraction with a reading of 47.6 in February, down from 50.3 in January.

All three major stock indexes hit their lows of the day following the release, with the Nasdaq Composite (^IXIC) sliding the furthest, down about 1% before paring back losses.

“Demand eased, production stabilized, and destaffing continued as panelists’ companies experience the first operational shock of the new administration’s tariff policy,” Institute for Supply Management Chair Timothy Fiore wrote in the release. “Prices growth accelerated due to tariffs, causing new order placement backlogs, supplier delivery stoppages and manufacturing inventory impacts.”

Fiore explained in an interview with Yahoo Finance that the surge in the prices paid index was largely due to Trump’s 25% tariffs on steel and aluminum imports.

“The whole story here is really around the tariff issue,” Fiore said, further explaining that the increases in prices lead to lower new orders from businesses and also could impact hiring plans. If Trump’s proposed 25% tariffs on Mexico and Canada are enacted, Fiore said he expects the situation to worsen, with prices continuing to increase and manufacturing activity further weakening.

“If you stay on the path that we’re headed on, I think it’s going to be tough, a tough route [for the US economy],” Fiore said.

ISM’s prices paid index has closely tracked the monthly prints of the Consumer Price Index (CPI) and the Producer Price Index (PPI), per Fiore. This month’s large increase in the prices paid index likely points to an increase in prices for the two inflation measures — CPI and PPI — in February, Fiore said.

Capital Economics North America economist Thomas Ryan wrote in a note to clients on Monday that the ISM data “supports our view that there will be a goods-driven resurgence in core inflation in the second half of the year.”

“The drop back in the ISM manufacturing index and the negative tone of the report will add to fears that the economy has taken a sudden turn for the worse amid the barrage of weaker activity data in recent weeks,” Ryan wrote.

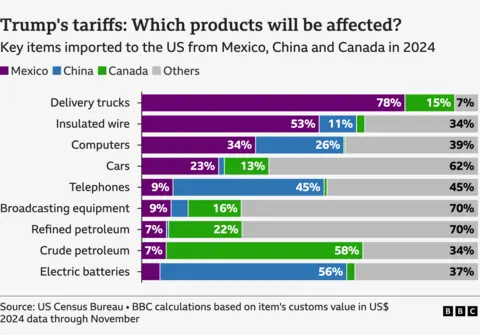

Canada, Mexico and China have vowed to retaliate after tariffs on goods entering the US from their countries came into effect on Tuesday.

US President Donald Trump has imposed 25% tariffs against Canada and Mexico, and 20% tariffs against China.

Stock markets in the US, UK and Asia dipped following the introduction of the taxes amid fears of trade war widening.

Analysts have warned tariffs could push up prices for US households and could also have a knock on effect on consumers across the world, including the UK.

Trump threatened to impose the tariffs, which are a tax added to a product when it enters a country – on Canada, Mexico and China in response to what claims is the unacceptable flow of illegal drugs and illegal immigrants into the US.

But Canadian Prime Minister Justin Trudeau said his country was responsible for less than 1% of fentanyl entering the US and would retaliate with 25% tariffs on $150bn worth of US goods.

China swiftly announced its own counter measures, which include 10-15% tariffs on some US agricultural goods, including wheat, corn, beef and soybeans. Mexico is expected to announce its response later.

The three major stock market indexes in the US sank following the news, while the FTSE 100 index of the UK’s biggest publicly-listed companies opened sharply lower on Tuesday and stock markets in Asia were also down.

Andrew Wilson, from the International Chamber of Commerce, said: “What we’re seeing is the biggest effective increase in US tariffs since the 1940s – with severe economic risks attached to that.”

“The initial market moves are entirely reflective that we’re now entering into a very risky scenario for global trade and for the global economy,” he told BBC Radio 4’s Today programme

He said Yale University had predicted these measures could cost US households in the region of $2,000 in this year alone.

Ella Hoxha, head of fixed income at Newton Investment Management, told the BBC: “In terms of consumers, you’re more likely looking at, certainly over the short term, increases in prices as companies pass some of those prices onto the consumer.”

Chris Torrens, vice president of the British Chamber of Commerce in China, added: “It’s a huge challenge for British business because of the historical links that the UK and the US have. [We are] Seeing what looks like the dismantling of a transatlantic alliance between the US and Europe.

“But, there is a real sense of hope for a stronger UK-China relationship.”

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like On Holding (NYSE:ONON). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Over the last three years, On Holding has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn’t particularly indicative of expected future performance. As a result, we’ll zoom in on growth over the last year, instead. On Holding’s EPS skyrocketed from CHF0.25 to CHF0.39, in just one year; a result that’s bound to bring a smile to shareholders. That’s a commendable gain of 57%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it’s a great way for a company to maintain a competitive advantage in the market. While we note On Holding achieved similar EBIT margins to last year, revenue grew by a solid 26% to CHF2.2b. That’s a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Since On Holding has a market capitalisation of US$15b, we wouldn’t expect insiders to hold a large percentage of shares. But thanks to their investment in the company, it’s pleasing to see that there are still incentives to align their actions with the shareholders. We note that their impressive stake in the company is worth CHF2.9b. That equates to 19% of the company, making insiders powerful and aligned with other shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

If you believe that share price follows earnings per share you should definitely be delving further into On Holding’s strong EPS growth. This EPS growth rate is something the company should be proud of, and so it’s no surprise that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it’s a good stock to follow. Of course, profit growth is one thing but it’s even better if On Holding is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

Although On Holding certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

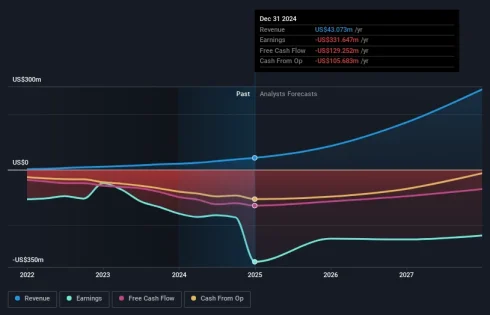

One of the biggest stories of last week was how IonQ, Inc. (NYSE:IONQ) shares plunged 23% in the week since its latest yearly results, closing yesterday at US$24.57. Revenues of US$43m beat expectations by a respectable 4.0%, although statutory losses per share increased. IonQ lost US$1.56, which was 80% more than what the analysts had included in their models. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there’s been a strong change in the company’s prospects, or if it’s business as usual. We’ve gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Following the latest results, IonQ’s five analysts are now forecasting revenues of US$85.4m in 2025. This would be a substantial 98% improvement in revenue compared to the last 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 25% to US$1.15. Before this latest report, the consensus had been expecting revenues of US$83.2m and US$0.95 per share in losses. While this year’s revenue estimates increased, there was also a very substantial increase in loss per share expectations, suggesting the consensus has a bit of a mixed view on the stock.

Spiting the revenue upgrading, the average price target fell 5.5% to US$44.60, clearly signalling that higher forecast losses are a valuation concern. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company’s valuation. There are some variant perceptions on IonQ, with the most bullish analyst valuing it at US$54.00 and the most bearish at US$29.00 per share. This shows there is still a bit of diversity in estimates, but analysts don’t appear to be totally split on the stock as though it might be a success or failure situation.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It’s clear from the latest estimates that IonQ’s rate of growth is expected to accelerate meaningfully, with the forecast 98% annualised revenue growth to the end of 2025 noticeably faster than its historical growth of 67% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 6.7% per year. Factoring in the forecast acceleration in revenue, it’s pretty clear that IonQ is expected to grow much faster than its industry.

The most important thing to note is the forecast of increased losses next year, suggesting all may not be well at IonQ. Happily, they also upgraded their revenue estimates, and are forecasting them to grow faster than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.