European stocks close at record high, led by defence shares

US employers probably added jobs at a moderate pace in February at a time of federal government layoffs and a consumer spending slowdown.

Payrolls rose by 160,000 in February, a slight improvement from the 143,000 increase a month earlier yet softer than during the final months of 2024, according to the median projection of economists surveyed by Bloomberg. The unemployment rate is seen holding at 4%.

Friday’s report from the Bureau of Labor Statistics will provide an update for Federal Reserve officials about momentum in the labor market that’s been the key support — at least until January — of household spending and the economy. However, rapid policy changes by the Trump administration — including the push by Elon Musk’s Department of Government Efficiency to shrink the federal government and cut spending — risk elevating uncertainty about the outlook.

Listen to the Podcast: Will Elon Musk Trigger a US Government Shutdown?

Fed Chair Jerome Powell is slated to speak at a monetary policy forum Friday afternoon. Policymakers next meet March 18-19 and they’re expected to hold interest rates steady as they gauge the labor market and inflation trends as well as recent government policy shifts.

Other officials speaking in the coming week include Fed governors Adriana Kugler and Christopher Waller, as well as New York Fed President John Williams. Treasury Secretary Scott Bessent is also speaking before the Economic Club of New York.

Treasury Secretary Scott Bessent said Sunday that he’s confident US inflation will slow over the course of the year as two polls signaled that President Donald Trump risks putting off Americans worried about the economy and consumer-price growth with the broad flurry of measures during his first weeks in office.

Recent surveys already show consumers are shedding optimism about business conditions and the job market over the next several months. Figures from the Institute for Supply Management and S&P Global will help show whether manufacturers and service providers are seeing orders and business activity cool as managers assess a growing threat of tariffs.

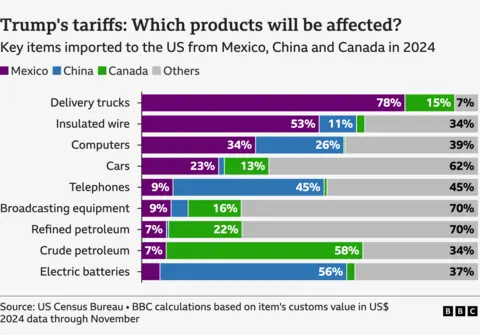

Trump’s administration is planning to enact 25% tariffs on imports from Canada and Mexico on March 4, the same day the president addresses a joint session of Congress and may drop other policy bombshells.

The February jobs report may also include the initial effects of a federal hiring freeze, though thousands of public-service layoffs occurred too late in the month to have a material impact this time around. And while federal jobs account for a small share of overall payrolls, funding cutbacks risk bleeding into the private sector that supports — and is supported by — government-funded programs.

What Bloomberg Economics Says:

“Softening sentiment, a contraction in spending, downward revisions to first-quarter GDP growth expectations – data in the past week have stirred growth fears in the market, challenging the narrative of the US economy’s ‘exceptionalism.’ Data and events in the coming week could turn these flickers of concern into a real fire.”

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou & Chris G. Collins, economists. For preview, click here

In Canada, government officials are expected to continue their push to avert Trump’s planned levies on most Canadian goods.

Among economic data, the international trade report for January may show a continued surge in exports to the US as the loonie weakened and American importers looked to get ahead of potential tariffs. Employment data for February may similarly continue a trend seen the previous month, in which manufacturing jobs boomed, likely due to tariff front-running.

Elsewhere, Chinese manufacturing PMIs, inflation readings from Australia to Switzerland to Mexico and rate cuts at the European Central Bank and in Turkey will be in focus.

Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.

The week kicks off with the latest inflation reading for the euro area, which — following mixed signals from Germany and France — likely slowed to 2.6%. While still clearly above the ECB’s 2% target, the deceleration will be a relief for central bank officials, who on Thursday in Frankfurt are set to deliver another 25 basis point rate cut — the sixth such move since June.

What happens next is less clear, with policymakers led by President Christine Lagarde increasingly torn on how far they should go. New economic forecasts published alongside the rate decision could provide some clarity, though the threat of US tariffs clouds the outlook.

The Danish central bank typically mirrors any ECB move, and so is expected to lower rates as well on Thursday.

Earlier that day, Turkey will probably also cut borrowing costs — encouraged by new inflation data due Monday likely to show a slowdown to 40% in February — while Ukraine is seen hiking rates for a third straight meeting.

In the UK, Bank of England Governor Andrew Bailey will be among ratesetters questioned by the Treasury committee on their decision to lower rates by a quarter point in February.

Beyond central banks, South African data on Tuesday is expected to show gross domestic product expanded 0.9% in the fourth quarter, against a 0.3% contraction in the prior three months, in part due to a rebound in the agricultural industry and strong growth in the retail sector.

Swiss inflation a day later will probably show a reading of just 0.2% for February, the weakest since March 2021. The central bank has warned that inflation readings could drop below zero in some months this year and predicts consumer-price growth to average just 0.3% in 2025 as a whole.

In Germany, factory orders on Friday are expected to show a contraction, reminding politicians hashing out their priorities in forming a new government of the country’s industrial malaise.

The situation in Ukraine will, however, overshadow everything else in the region after a meeting between Trump and Ukrainian counterpart Volodymyr Zelenskiy blew up on Friday, throwing US support into question.

Bloomberg Economics calculates that protecting Ukraine and expanding their own militaries could cost Europe’s major powers an additional $3.1 trillion over the next 10 years.

UK Prime Minister Keir Starmer hosts European leaders on Sunday in London, ahead of an emergency EU summit in Brussels on Thursday.

Whether it’s a dozen eggs or a new car, Americans are having a hard time adjusting to current prices.

Nearly all Americans report experiencing some form of “sticker shock,” regardless of income, according to a recent report by Wells Fargo.

In fact, 90% of adults said they are still surprised by the cost of some goods, such as a bottle of water, a tank of gas, dinner out or concert tickets, and said that the actual costs are between 55% and 200% higher than what they expected depending on the item.

Many Americans are still cutting back on spending, making financial choices and delaying some life plans, the Wells Fargo report also found. The firm polled more than 3,600 consumers in the fall.

“The value of the dollar and what it is providing may not be as predictable anymore,” said Michael Liersch, head of advice and planning at Wells Fargo. As a result, “consumer behaviors are shifting.”

Still, adjusting to a new normal takes time, he added: “Habit formation does take a while. Next year what you can imagine seeing is consumers being a little less surprised or shocked by prices and adapting to the current situation to create that goals-based plan.”

“After years of very high inflation, they are kind of figuring it out,” Wise said. “They’ve adjusted their baseline for what things cost right now.”

But with President Donald Trump’s proposed 25% tariffs on imports from Canada and Mexico set to take effect in March, there is also the possibility that prices will rise even further in the months ahead.

Mexico and Canada tariffs could put pressure on some consumer staples, experts say. That includes already high grocery prices, which are up 28% over the last five years, according to the Bureau of Labor Statistics.

The prospect of tariffs and renewed inflation is weighing heavily on many consumers.

The Conference Board’s consumer confidence index sank in February, notching the largest monthly drop since August 2021. The University of Michigan’s consumer sentiment index similarly found that Americans largely fear that inflation will flare up again.

A recent CreditCards.com survey found that 23% of Americans expect to worsen or go into credit card debt this year, in part because they are making more purchases ahead of higher tariffs.

Consumer savings expert Andrea Woroch recommends setting a spending plan and tracking expenses. That helps you pinpoint wasteful purchases and those where prices are accelerating and take steps to save.

“Write out all your expenses currently from those essentials and the wants, figuring out an average monthly spend for fluctuating categories,” she said. “Once you have it all listed out, you can begin hacking away at unnecessary purchases or at least set goals for reducing in those nonessential categories.”

Identify triggers that lead to impulse purchases to help dodge them in the future, Woroch also said. “If you can’t resist a sale, then unsubscribe from store newsletters and turn off push notifications in deal apps.”

Ultimately, being more in control of your spending will “reduce the stress that comes with worry about how you’re going to afford higher prices,” Woroch said.

It’s easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Edgewell Personal Care Company (NYSE:EPC) shareholders over the last year, as the share price declined 17%. That falls noticeably short of the market return of around 17%. Longer term shareholders haven’t suffered as badly, since the stock is down a comparatively less painful 12% in three years. Shareholders have had an even rougher run lately, with the share price down 17% in the last 90 days. This could be related to the recent financial results – you can catch up on the most recent data by reading our company report.

Now let’s have a look at the company’s fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Unfortunately Edgewell Personal Care reported an EPS drop of 12% for the last year. This reduction in EPS is not as bad as the 17% share price fall. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Edgewell Personal Care’s earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

While the broader market gained around 17% in the last year, Edgewell Personal Care shareholders lost 16% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year’s performance caps off a bad run, with the shareholders facing a total loss of 0.5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We’ve spotted 3 warning signs for Edgewell Personal Care you should be aware of, and 1 of them is significant.

The board of U.S. Physical Therapy, Inc. (NYSE:USPH) has announced that it will be paying its dividend of $0.45 on the 11th of April, an increased payment from last year’s comparable dividend. This will take the dividend yield to an attractive 2.2%, providing a nice boost to shareholder returns.

We like to see robust dividend yields, but that doesn’t matter if the payment isn’t sustainable. Based on the last payment, U.S. Physical Therapy’s profits didn’t cover the dividend, but the company was generating enough cash instead. Given that the dividend is a cash outflow, we think that cash is more important than accounting measures of profit when assessing the dividend, so this is a mitigating factor.

Over the next year, EPS is forecast to expand by 68.4%. If the dividend continues along recent trends, we estimate the payout ratio will be 64%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

The company has a long dividend track record, but it doesn’t look great with cuts in the past. The dividend has gone from an annual total of $0.48 in 2015 to the most recent total annual payment of $1.80. This works out to be a compound annual growth rate (CAGR) of approximately 14% a year over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. U.S. Physical Therapy has seen earnings per share falling at 5.6% per year over the last five years. A modest decline in earnings isn’t great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. Earnings are forecast to grow over the next 12 months and if that happens we could still be a little bit cautious until it becomes a pattern.

Overall, we always like to see the dividend being raised, but we don’t think U.S. Physical Therapy will make a great income stock. The payments haven’t been particularly stable and we don’t see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We don’t think U.S. Physical Therapy is a great stock to add to your portfolio if income is your focus.