S&P 500 ekes out a gain Friday, snaps four-week losing run: Live updates

DoorDash, the popular gig economy food delivery service, has announced that it will be partnering with Klarna, the financing service, to offer consumers the option to buy delivery and then pay for it later. That’s right, you can now finance a pizza.

Buying now and paying later has long been a feature of American consumer life when it comes to pricey goods like cars or homes, and few Americans could ever afford to pay for those goods entirely in cash. But while it makes for funny memes to imagine being hit up by a debt collector for a Chipotle payment, the truth is that the American economy is increasingly resembling a dystopian film directed by Bong Joon Ho, the famed Korean filmmaker behind the Oscar-winning Parasite and the new Mickey 17.

Those movies showed us the lengths people would go to escape from debt, whether it was turning your family into conmen or signing up for a mission in outer space that guarantees you will live and die repeatedly until the end of your days.

For Americans, debt is now everywhere, even on the holidays. One survey released in November 2024 found that nearly half of Americans were still paying off debt from the previous year’s holiday spending. “Six in 10 people with credit card debt have had it for at least a year. That’s up 10 percentage points from three years ago,” Bankrate analyst Tedd Rossman explained at the time.

It would be easy to blame this all on people’s lack of individual responsibility. Indeed, financial literacy isn’t a strong suit for a lot of Americans. But as debt invades every aspect of our lives, is it really that Americans have just suddenly become much more irresponsible and unable to live within their means?

There’s an old Chinese proverb that says that our ancestors plant the trees so that we can sit in the shade. The seeds of the debt economy have been laid everywhere, from colleges and universities portraying their outrageous tuition and fees as an “investment” Americans should be willing to go deeply into debt for to the ubiquitous credit card commercials they’re greeted with any time you sit down to watch television.

Our society is telling us that living outside your means is no problem, and we’re listening. But over time we may also see a counterculture start to take root. Financial gurus like Dave Ramsey are building a fanbase based on preaching a philosophy of keeping people out of debt. One issue some Democrats and Republicans have found common ground on is capping credit card interest rates (although any such bill faces long odds in Congress). The absurdity of the DoorDash-Klarna venture is self-evident to many Americans.

Americans are increasingly living in a society that not only expects them to go deep into debt but encourages them to be trapped in their own personal debtor’s jail. A prison break still might be possible, but the recent DoorDash-Klarna agreement is a truly dystopian move.

Accenture (NYSE:ACN) recently declared a substantial 15% increase in its quarterly dividend to $1.48 per share, alongside reporting robust second-quarter earnings with sales rising to $16.7 billion and net income increasing year-over-year. Despite these positive developments, the company’s shares registered a 5.1% drop over the last week. This decline comes amid a broader market recovering from losses, as the S&P 500 attempts to break a four-week losing streak and economic uncertainties persist. Accenture’s stock performance may reflect investor caution as market trends adjust, despite its strong financial reporting and shareholder-focused initiatives.

Accenture’s shares have shown a total return of 89.08% over the past five years, reflecting consistent growth and investment initiatives. The last five years have seen Accenture significantly expand its AI capabilities through investments like the AI Refinery platform and a dedicated AI workforce. Additionally, strategic acquisitions totaling US$242 million in the latest quarter underline its focus on digital transformation services, enhancing both market share and operational efficiency.

Furthermore, a strong focus on returning value to shareholders is evident through its comprehensive share buyback program, with over 514 million shares repurchased for US$43 billion since 2001. Earnings growth, partly driven by robust client partnerships such as those with Verizon Business and HPE, contrasts with uneven geographic performance and competitive pricing pressures. This backdrop of strategic investment and financial performance has positioned Accenture as a prominent player in its industry, despite the company’s underperformance against both the US market and IT industry over the past year.

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the long term shareholders of Envista Holdings Corporation (NYSE:NVST) have had an unfortunate run in the last three years. So they might be feeling emotional about the 66% share price collapse, in that time. And over the last year the share price fell 21%, so we doubt many shareholders are delighted. Unfortunately the share price momentum is still quite negative, with prices down 24% in thirty days.

The recent uptick of 3.9% could be a positive sign of things to come, so let’s take a look at historical fundamentals.

To quote Buffett, ‘Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace…’ One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Envista Holdings has made a profit in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn’t reliably profitable. Other metrics might give us a better handle on how its value is changing over time.

With revenue flat over three years, it seems unlikely that the share price is reflecting the top line. We’re not entirely sure why the share price is dropped, but it does seem likely investors have become less optimistic about the business.

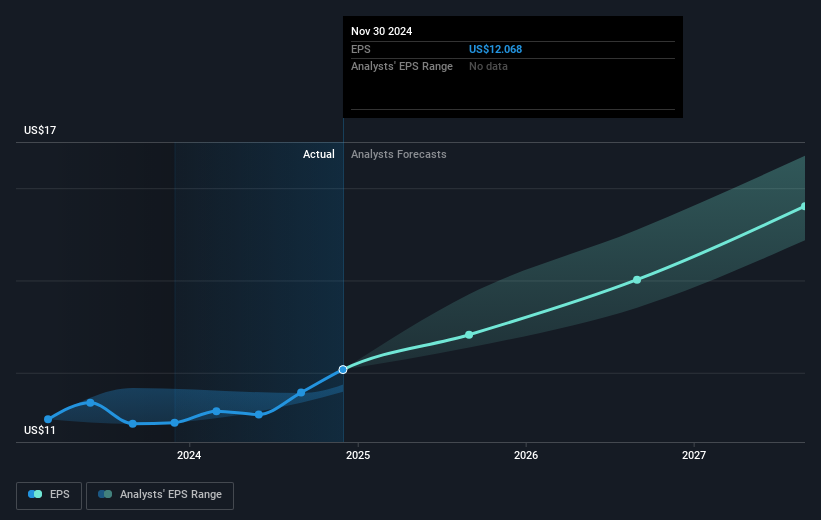

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Envista Holdings will earn in the future (free profit forecasts).

Investors in Envista Holdings had a tough year, with a total loss of 21%, against a market gain of about 9.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 1.7% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Envista Holdings is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.