Do Visa’s (NYSE:V) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Visa (NYSE:V), which has not only revenues, but also profits. While this doesn’t necessarily speak to whether it’s undervalued, the profitability of the business is enough to warrant some appreciation – especially if its growing.

Visa’s Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you’d expect a company’s share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, Visa has grown EPS by 18% per year, compound, in the last three years. If the company can sustain that sort of growth, we’d expect shareholders to come away satisfied.

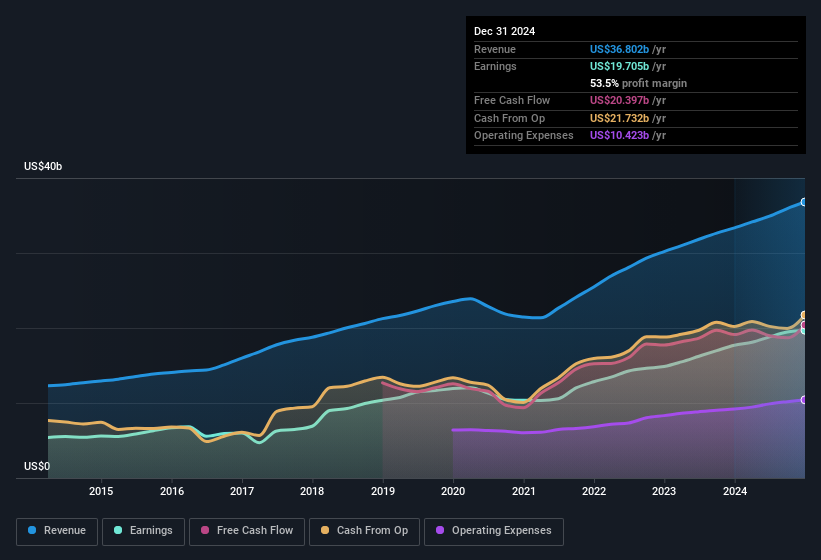

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it’s a great way for a company to maintain a competitive advantage in the market. Visa maintained stable EBIT margins over the last year, all while growing revenue 10% to US$37b. That’s a real positive.

The chart below shows how the company’s bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

View our latest analysis for Visa

Are Visa Insiders Aligned With All Shareholders?

Owing to the size of Visa, we wouldn’t expect insiders to hold a significant proportion of the company. But we do take comfort from the fact that they are investors in the company. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$254m. We note that this amounts to 0.04% of the company, which may be small owing to the sheer size of Visa but it’s still worth mentioning. So despite their percentage holding being low, company management still have plenty of reasons to deliver the best outcomes for investors.

Does Visa Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Visa’s strong EPS growth. This EPS growth rate is something the company should be proud of, and so it’s no surprise that insiders are holding on to a considerable chunk of shares. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. What about risks? Every company has them, and we’ve spotted 1 warning sign for Visa you should know about.

Although Visa certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.