Dollar Tree says it’s winning over higher-income shoppers and may offset tariffs with price hikes

Robinhood is getting closer to becoming a full-fledged financial service. On Wednesday, the company announced a wholly online banking platform that will offer checking and savings accounts to Robinhood Gold subscribers when it launches this fall.

The platform, called Robinhood Banking, will let users access their accounts, as well as send and receive money through the Robinhood Credit Card app. It even attempts to make up for not having a physical location by having physical cash “delivered on-demand right to your doorstep.” There still aren’t many details about how this will work, but Robinhood says “coverage varies based on geographic location.”

Robinhood Banking promises a 4 percent annual percentage yield (APY) and FDIC insurance of up to $2.5 million on accounts. The company notes that since it’s not an FDIC-insured bank, it’s offering “pass-through” insurance provided by FDIC member Coastal Community Bank. Pass-through insurance involves insuring people’s funds by holding them “at an FDIC-insured bank through a third party,” according to the FDIC.

The service will offer individual and joint banking accounts at launch, along with options to create children’s accounts. Deepak Rao, Robinhood Money’s general manager and vice president, says the platform is designed to “solve many of the challenges presented by legacy banks.”

In addition to a bank account, Robinhood is launching a new wealth management platform called Robinhood Strategies. It will offer access to a mix of single stocks and exchange-traded funds (ETFs), which “are actively managed to provide access to more opportunities.” The funds have a 0.25 percent annual management fee, with a yearly cap of $250 for Robinhood Gold members.

Robinhood Strategies is available to Robinhood Gold members today, but it’s coming to all customers next month. Robinhood Gold is the company’s $5 per month (or $50 per year) subscription program that offers features like margin investing and larger instant deposits.

Later this year, Robinhood also plans to launch an AI-powered investment tool called Cortex for Gold subscribers. It will provide analyses and insights about the current market, such as why a particular stock is going up or down, as well as which stocks to consider trading.

Over the years, Robinhood has transformed itself from a simple investing app into an all-in-one hub for users’ finances. The company launched a credit card in 2024 as part of efforts to encourage people to keep their money within the widening Robinhood ecosystem, where they’ll now be able to store and withdraw cash to make investments on the app, too.

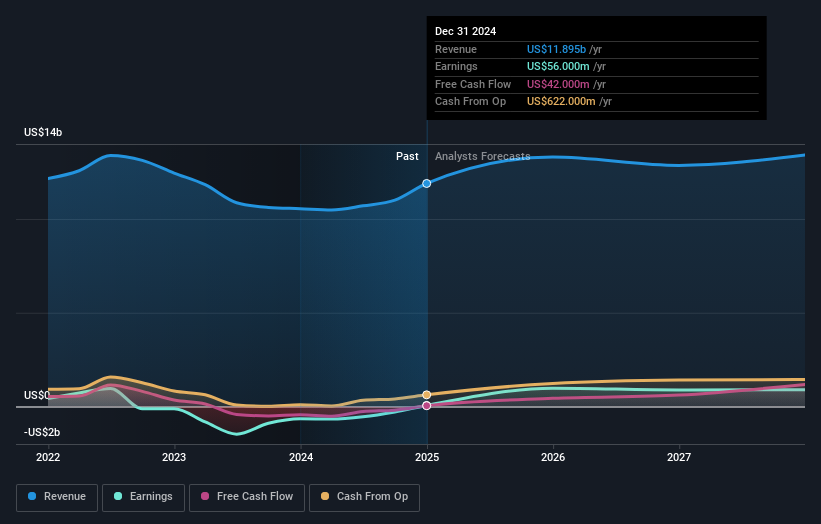

Carvana experienced a notable event last week with its inclusion in the FTSE All-World Index, a development that likely contributed to the company’s strong share price performance, moving up 15% over the week. This event signals increased recognition and visibility in the investment world, and potentially enhances investor interest, especially among institutional players. In the context of broader market trends, where the S&P 500 and Nasdaq were slightly higher, Carvana’s index recognition stands out amid a generally recovering market sentiment, bolstered by optimism around potential changes to tariff impositions and ongoing economic recovery efforts.

The last five years have seen Carvana deliver a total shareholder return of 307.85%, indicating strong performance in the market. Key developments have likely played a role in this trajectory. The integration of ADESA mega sites has expanded Carvana’s reconditioning capacity, potentially driving revenue growth by increasing the volume of cars processed and sold. Additionally, the adoption of artificial intelligence to enhance operational efficiency may contribute to higher revenues and improved margins.

Business expansions, such as launching same-day vehicle delivery in several cities, have likely improved distribution logistics and customer reach. Furthermore, a favorable debt restructuring that reduced total debt by over $1.33 billion and lowered cash interest expenses has been instrumental in enhancing financial stability. Over the past year, Carvana outperformed the US Specialty Retail industry and the broader market, reflecting its ability to capitalize on these strategic initiatives effectively.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10bn in marketcap – there is still time to get in early.

If you want to know who really controls Alcoa Corporation (NYSE:AA), then you’ll have to look at the makeup of its share registry. We can see that institutions own the lion’s share in the company with 76% ownership. Put another way, the group faces the maximum upside potential (or downside risk).

Institutional investors was the group most impacted after the company’s market cap fell to US$8.8b last week. Still, the 6.2% one-year gains may have helped mitigate their overall losses. We would assume however, that they would be on the lookout for weakness in the future.

Let’s delve deeper into each type of owner of Alcoa, beginning with the chart below.

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

As you can see, institutional investors have a fair amount of stake in Alcoa. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Alcoa, (below). Of course, keep in mind that there are other factors to consider, too.

Institutional investors own over 50% of the company, so together than can probably strongly influence board decisions. We note that hedge funds don’t have a meaningful investment in Alcoa. Looking at our data, we can see that the largest shareholder is The Vanguard Group, Inc. with 10% of shares outstanding. With 9.5% and 6.4% of the shares outstanding respectively, BlackRock, Inc. and Eagle Capital Management LLC are the second and third largest shareholders.

A closer look at our ownership figures suggests that the top 15 shareholders have a combined ownership of 51% implying that no single shareholder has a majority.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock’s expected performance. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that Alcoa Corporation insiders own under 1% of the company. It is a very large company, so it would be surprising to see insiders own a large proportion of the company. Though their holding amounts to less than 1%, we can see that board members collectively own US$67m worth of shares (at current prices). It is always good to see at least some insider ownership, but it might be worth checking if those insiders have been selling.

The general public– including retail investors — own 23% stake in the company, and hence can’t easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

It’s always worth thinking about the different groups who own shares in a company. But to understand Alcoa better, we need to consider many other factors. Like risks, for instance. Every company has them, and we’ve spotted 2 warning signs for Alcoa (of which 1 can’t be ignored!) you should know about.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.