Israel Holds Rates as Bank Waits for War Inflation to Slow

Israel kept interest rates on hold for a ninth straight meeting, with the central bank waiting for war-induced inflation to slow before starting an easing cycle.

The Bank of Israel held its base rate at 4.5%, according to a statement on Monday, a decision in line with all analysts in a Bloomberg survey.

“In view of the continuing war, the Monetary Committee’s policy is focused on stabilizing markets and reducing uncertainty, alongside price stability and supporting economic activity,” the central bank said in a statement following the decision.

Guidance was unchanged from previous months. “The interest-rate path will be determined in accordance with the convergence of inflation to its target, continued stability in the financial markets, economic activity, and fiscal policy,” the central bank said.

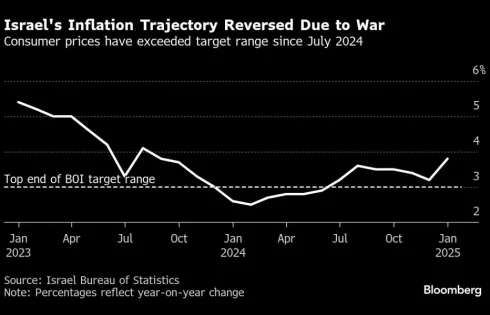

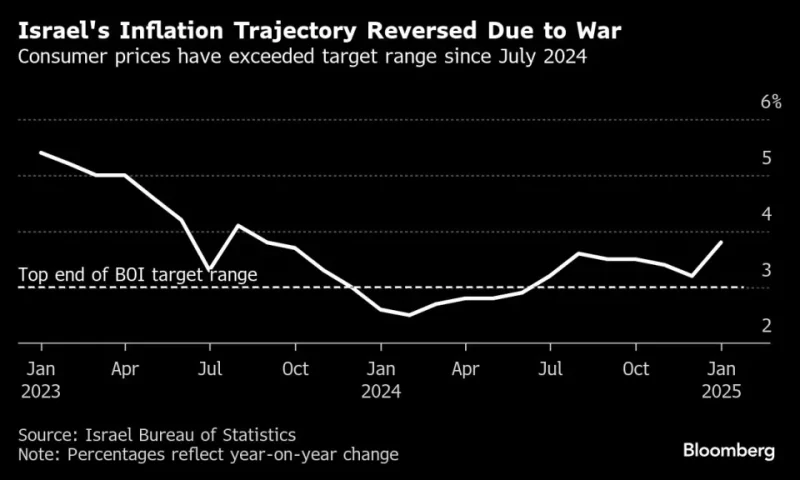

Israel’s economy is starting to recover from the strain of conflicts with Iranian-backed militant groups, after ceasefires in Gaza and in Lebanon. Yet annual inflation is running at 3.8%, above the country’s official target of 1% to 3%. That’s mainly due to a hike in value-added tax aimed at funding Israel’s higher defense needs and in electricity and water costs.

Citigroup Inc. said ahead of Monday’s rates decision that Governor Amir Yaron may start cutting rates by May, provided inflation decelerates and risk premiums related to Israel’s conflict remain under control.

The central bank noted that, according to forecasters’ projections, inflation should fall below 3% in the second half of the year, and that 12-month expectations are within the target range.

“In contrast to the situation in the US, inflation expectations in Israel are low, and the fiscal situation also looks better,” Bank Hapoalim, one of Israel’s two largest lenders, said in a note to clients last week.

Bringing inflation down is seen as one of the last major obstacles to monetary easing, with Israeli assets, including the shekel and the country’s credit-default swaps, having largely stabilized on the back of the truces from late last year.

The Israeli shekel is up 1.8% against the dollar in 2025, roughly in line with other so-called expanded-major currencies tracked by Bloomberg.

But there’s no guarantee the ceasefires will hold, particularly in Gaza. The initial stage of that pause ends this coming weekend, and there’s been little indication yet that terms on an extension will be agreed.

Another cause for uncertainty is the 2025 budget, which is meant to be passed by the end of March. There’s a chance it could be derailed by members of Prime Minister Benjamin Netanyahu’s coalition over domestic political disputes.

Lower borrowing costs could help boost Israel’s $550 billion economy. Gross domestic product rose 1% last year, the lowest in over two decades, excluding the Covid-19 pandemic. That was mainly due to a slump in investments, exports and private consumption, which offset an increase in defense-related expenditure.

Donald Trump’s election helped turbocharge an already surging bull market in the U.S., sending stocks and cryptocurrencies to record highs.

Donald Trump’s election helped turbocharge an already surging bull market in the U.S., sending stocks and cryptocurrencies to record highs.

The Nasdaq Composite fell more than 1% on Monday, with big technology stocks creating the biggest drag as investors worried about demand for technology supporting artificial intelligence while they waited for results from market heavyweight Nvidia.

The S&P 500 closed slightly lower, marking its third straight day of declines, while the Dow managed to eke out a tiny gain. It was also Nasdaq’s third consecutive loss and its fourth daily drop of more than 1% so far in February.

Investors were concerned about future demand for Nvidia’s (NVDA.O), opens new tab pricey AI chips as they awaited its quarterly results on Wednesday. Worries about hefty spending on the technology have mounted since low-cost AI models from China’s DeepSeek rattled the industry in January.

Adding to uncertainty, a TD Cowen analyst note published late on Friday reported that Microsoft Corp (MSFT.O), opens new tab has scrapped leases for sizeable data center capacity in the U.S., suggesting a potential oversupply of AI infrastructure.

Microsoft said its plan to invest over $80 billion in AI and cloud capacity this fiscal year was intact but that it “may strategically pace or adjust” infrastructure in some areas.

“Markets are already jittery and looking for a reason to take profits,” said Gene Goldman, chief investment officer at Cetera Investment Management, noting that any question about AI is seen as a reason to take profits since the technology has driven market growth for the last few years.

Along with worries about tariffs and inflation, investors are getting more anxious about economic growth after last week’s batch of weak economic data and a disappointing forecast from Walmart (WMT.N), opens new tab.

“Volatility is being driven by market uncertainty about whether we’re facing a growth scare or an inflation scare,” said Goldman.

The Dow Jones Industrial Average (.DJI), opens new tab rose 33.19 points, or 0.08%, to 43,461.21, the S&P 500 (.SPX), opens new tab lost 29.88 points, or 0.50%, to 5,983.25 and the Nasdaq (.IXIC), opens new tab lost 237.08 points, or 1.21%, to 19,286.93.

The more defensive healthcare index (.SPXHC), opens new tab led percentage gains, closing up 0.75% while technology (.SPLRCT), opens new tab was the biggest laggard, ending down 1.43%.

Nvidia was the S&P 500’s biggest index point drag, ending the session down 3.1%, and it was followed by chip maker Broadcom Inc (AVGO.O), opens new tab, down 4.9%, Amazon.com (AMZN.O), opens new tab, down 1.8%. Microsoft shares ended down 1%.

The tech sector’s biggest percentage decliner with, a 10.5% drop, was another popular AI stock, Palantir Technologies (PLTR.O), opens new tab.

“The dominance of the AI tech trade has run its course, not that these companies aren’t great stocks. We’re headed for a major digestion phase,” said Peter Boockvar, CIO at Bleakley Financial Group.

On the data front, the Personal Consumption Expenditure index – the Federal Reserve’s preferred inflation gauge – is expected on Friday and could help markets gauge the timing of the central bank’s first rate cut this year.

Interest rate futures indicate trader expectations that the Fed will leave borrowing costs unchanged until June, according to CME Group’s FedWatch, opens new tab tool.

In individual stocks, Apple (AAPL.O), opens new tab finished up 0.7% after the iPhone maker unveiled plans to spend $500 billion in U.S. investments in the next four years, including setting up a factory in Texas for AI servers.

Berkshire Hathaway (BRKa.N), opens new tab, shares hit record highs in early trading, after Warren Buffett’s conglomerate reported a record annual profit and its class B shares ended up more than 4%.

Nike (NKE.N), opens new tab finished up 4.9% after Jefferies raised its rating to “buy” from “hold”.

Declining issues outnumbered advancers by a 1.25-to-1 ratio on the NYSE where there were 90 new highs and 134 new lows.

On the Nasdaq, 1,518 stocks rose and 2,888 fell as declining issues outnumbered advancers by a 1.9-to-1 ratio. The S&P 500 posted 28 new 52-week highs and 8 new lows while the Nasdaq recorded 40 new highs and 232 new lows.

On U.S. exchanges about 15.32 billion shares changed hands compared with the 15.34 billion average for the last 20 sessions.

The Nasdaq Composite fell more than 1% on Monday, with big technology stocks creating the biggest drag as investors worried about demand for technology supporting artificial intelligence while they waited for results from market heavyweight Nvidia.

The S&P 500 closed slightly lower, marking its third straight day of declines, while the Dow managed to eke out a tiny gain. It was also Nasdaq’s third consecutive loss and its fourth daily drop of more than 1% so far in February.

Investors were concerned about future demand for Nvidia’s (NVDA.O), opens new tab pricey AI chips as they awaited its quarterly results on Wednesday. Worries about hefty spending on the technology have mounted since low-cost AI models from China’s DeepSeek rattled the industry in January.

Adding to uncertainty, a TD Cowen analyst note published late on Friday reported that Microsoft Corp (MSFT.O), opens new tab has scrapped leases for sizeable data center capacity in the U.S., suggesting a potential oversupply of AI infrastructure.

Microsoft said its plan to invest over $80 billion in AI and cloud capacity this fiscal year was intact but that it “may strategically pace or adjust” infrastructure in some areas.

“Markets are already jittery and looking for a reason to take profits,” said Gene Goldman, chief investment officer at Cetera Investment Management, noting that any question about AI is seen as a reason to take profits since the technology has driven market growth for the last few years.

Along with worries about tariffs and inflation, investors are getting more anxious about economic growth after last week’s batch of weak economic data and a disappointing forecast from Walmart (WMT.N), opens new tab.

“Volatility is being driven by market uncertainty about whether we’re facing a growth scare or an inflation scare,” said Goldman.

The Dow Jones Industrial Average (.DJI), opens new tab rose 33.19 points, or 0.08%, to 43,461.21, the S&P 500 (.SPX), opens new tab lost 29.88 points, or 0.50%, to 5,983.25 and the Nasdaq (.IXIC), opens new tab lost 237.08 points, or 1.21%, to 19,286.93.

The more defensive healthcare index (.SPXHC), opens new tab led percentage gains, closing up 0.75% while technology (.SPLRCT), opens new tab was the biggest laggard, ending down 1.43%.

Nvidia was the S&P 500’s biggest index point drag, ending the session down 3.1%, and it was followed by chip maker Broadcom Inc (AVGO.O), opens new tab, down 4.9%, Amazon.com (AMZN.O), opens new tab, down 1.8%. Microsoft shares ended down 1%.

The tech sector’s biggest percentage decliner with, a 10.5% drop, was another popular AI stock, Palantir Technologies (PLTR.O), opens new tab.

“The dominance of the AI tech trade has run its course, not that these companies aren’t great stocks. We’re headed for a major digestion phase,” said Peter Boockvar, CIO at Bleakley Financial Group.

On the data front, the Personal Consumption Expenditure index – the Federal Reserve’s preferred inflation gauge – is expected on Friday and could help markets gauge the timing of the central bank’s first rate cut this year.

Interest rate futures indicate trader expectations that the Fed will leave borrowing costs unchanged until June, according to CME Group’s FedWatch, opens new tab tool.

In individual stocks, Apple (AAPL.O), opens new tab finished up 0.7% after the iPhone maker unveiled plans to spend $500 billion in U.S. investments in the next four years, including setting up a factory in Texas for AI servers.

Berkshire Hathaway (BRKa.N), opens new tab, shares hit record highs in early trading, after Warren Buffett’s conglomerate reported a record annual profit and its class B shares ended up more than 4%.

Nike (NKE.N), opens new tab finished up 4.9% after Jefferies raised its rating to “buy” from “hold”.

Declining issues outnumbered advancers by a 1.25-to-1 ratio on the NYSE where there were 90 new highs and 134 new lows.

On the Nasdaq, 1,518 stocks rose and 2,888 fell as declining issues outnumbered advancers by a 1.9-to-1 ratio. The S&P 500 posted 28 new 52-week highs and 8 new lows while the Nasdaq recorded 40 new highs and 232 new lows.

On U.S. exchanges about 15.32 billion shares changed hands compared with the 15.34 billion average for the last 20 sessions.

The Starbucks drink menu is getting an overhaul next week. The coffee chain will remove some of its less popular hot, cold and blended drinks starting March 4 in an effort to speed up service and lighten the load on baristas.

Big orders with complicated modifications have made it difficult for baristas to keep up, leading to dissatisfied customers and a decline in company sales, Bloomberg reported.

“As part of our plan to get back to Starbucks, we’re simplifying our menu to focus on fewer, more popular items, executed with excellence,” Starbucks told Today.com. “This will make way for innovation, help reduce wait times, improve quality and consistency, and align with our core identity as a coffee company.”

The decision is part of chief executive officer Brian Niccol’s overall goal to streamline company operations. In a letter to employees Monday, Niccol announced there will be layoffs for 1,100 global corporate employees. The layoffs won’t impact store baristas. “Our intent is to operate more efficiently, increase accountability, reduce complexity and drive better integration,” Niccol said in the letter.

The Starbucks drink menu is getting an overhaul next week. The coffee chain will remove some of its less popular hot, cold and blended drinks starting March 4 in an effort to speed up service and lighten the load on baristas.

Big orders with complicated modifications have made it difficult for baristas to keep up, leading to dissatisfied customers and a decline in company sales, Bloomberg reported.

“As part of our plan to get back to Starbucks, we’re simplifying our menu to focus on fewer, more popular items, executed with excellence,” Starbucks told Today.com. “This will make way for innovation, help reduce wait times, improve quality and consistency, and align with our core identity as a coffee company.”

The decision is part of chief executive officer Brian Niccol’s overall goal to streamline company operations. In a letter to employees Monday, Niccol announced there will be layoffs for 1,100 global corporate employees. The layoffs won’t impact store baristas. “Our intent is to operate more efficiently, increase accountability, reduce complexity and drive better integration,” Niccol said in the letter.

Wall Street is gearing up for Nvidia’s (NVDA) fourth quarter earnings results to come out this Wednesday, February 26. However, not all expert investors are so bullish on the semiconductor manufacturer.

The Bahnsen Group CIO David Bahnsen sits down with Catalysts hosts Seana Smith and Madison Mills along with Yahoo Finance executive editor Brian Sozzi to present why he is bearish on the chip giant, weighing in on Nvidia’s valuation and growth expectations.

“If you compare its earnings multiple to some of the other AI companies, let alone other Mag Seven and, of course, other S&P names, it’s at an incredible premium. Now, I agree it’s earned it, I agree it’s deserved it and generated the order flow,” Bahnsen explains.

“But one of the key things that was said… it’s just simply untrue that it’s a monopoly. Nobody in their right mind thinks Nvidia is a monopoly. There’s tons of competition, but all the earnings multiple estimates are based on them never having competition.

Wall Street is gearing up for Nvidia’s (NVDA) fourth quarter earnings results to come out this Wednesday, February 26. However, not all expert investors are so bullish on the semiconductor manufacturer.

The Bahnsen Group CIO David Bahnsen sits down with Catalysts hosts Seana Smith and Madison Mills along with Yahoo Finance executive editor Brian Sozzi to present why he is bearish on the chip giant, weighing in on Nvidia’s valuation and growth expectations.

“If you compare its earnings multiple to some of the other AI companies, let alone other Mag Seven and, of course, other S&P names, it’s at an incredible premium. Now, I agree it’s earned it, I agree it’s deserved it and generated the order flow,” Bahnsen explains.

“But one of the key things that was said… it’s just simply untrue that it’s a monopoly. Nobody in their right mind thinks Nvidia is a monopoly. There’s tons of competition, but all the earnings multiple estimates are based on them never having competition.