How actual ‘fake news’ caused a market whiplash

It’s eaten with almost every meal, used to make sushi, made into sweets, fermented into alcohol and offered to the spirits at religious ceremonies.

Rice is everywhere in the diet of Japan – there are at least six ways in Japanese to describe the grain, from unhusked to ready to eat. It’s so popular that McDonald’s there added a burger bun made of rice to its menu.

But being so reliant on the staple leaves the country – the world’s fourth-biggest economy – vulnerable to the slightest supply glitch.

In recent years, a combination of bad weather, heatwaves and the threats of typhoons and earthquakes have sparked bouts of panic-buying in the nation of 124 million people.

The average price of a 60-kilogram bag rose to around $160 last year – up 55 per cent compared to two years ago, according to government figures.

The situation has become so dire that the government announced in February that it would release 210,000 tons of rice – more than a fifth of what it holds in its contingency reserve – for auction. The first bags of the reserve rice have now gone on sale in supermarkets.

The government built its rice reserve in 1995, two years after an unexpected cool summer crippled rice harvests forcing it to import overseas grains.

It dipped into the store following the 2011 earthquake and tsunami in which 20,000 people died or went missing, and again following the deadly Kumamoto earthquake in 2016.

Other countries across Asia where rice is a staple, such as India, Vietnam and Thailand also hold rice stockpiles to shield their populations against shortages and price rises – which can spill into politics, like a recent surge in egg prices in the United States.

China also has a strategic reserve of the country’s favorite meat, pork, to deal with emergencies and stabilize prices when necessary.

In Japan, the first batch of 150,000 tons of rice went under the hammer last month, according to the Ministry of Agriculture, Forestry and Fisheries.

“Prices now are exceptionally high,” Agriculture, Forestry and Fisheries Minister Taku Eto said ahead of the auction.

“But I urge everyone not to worry,” he added, saying that he expected the injection of rice into the market would mean prices “eventually come down.”

Eto also attributed the recent price hikes to a supply chain issue, saying that there was sufficient rice in the system, only that it has failed to reach the shelves in supermarkets, without specifying why.

On Wednesday, Trial Holdings, which runs a chain of discounted supermarkets in the southern island of Kyushu, confirmed to CNN that the first batch of auctioned rice has hit the shelves at some of their stores.

But, in a country that is particular about its rice – with various prefectures competing against one another for the title of best rice in the country – some said they would rather sit this batch out, skeptical of the grain’s quality.

“I do not intend to buy it because I have heard that it is old rice. I am still very particular about rice,” housewife Emi Uchibori, 69, told CNN.

Uchibori said she stocked up on supplies in early March after reading about prices going up and hoped what she had would last until prices ease.

“But it doesn’t look like it will go back to its original price,” she said.

Yuko Takiguchi, 53, a part time worker, said she would pass on the auctioned rice unless it became significantly cheaper.

She said she wouldn’t mind forking out more for quality rice as the price of flour had also gone up, driving up costs for other staples such as bread, udon and pasta.

“I prefer rice as a staple food since it is more filling. Also, since I have school-age children, rice is essential for their lunch boxes,” she said.

For an overwhelming majority of retired workers, Social Security is more than just a monthly check. It represents a financial lifeline that they’d struggle to make do without.

Since 2002, national pollster Gallup has surveyed retirees annually to determine how reliant they are on the Social Security income they receive. During this 23-year period, 80% to 90% of retirees have responded that Social Security represents a “major” or “minor” source of income. Long story short, it’s a payout that provides a financial foundation for retired workers.

Taking into account how critical Social Security checks are for our nation’s aging workforce, no announcement has more gravity to the program’s 52 million retired workers than the annual cost-of-living adjustment (COLA) reveal. While early estimates point to the 2026 COLA climbing, there’s an unpleasant catch that comes with this forecast.

Social Security’s COLA is the tool the Social Security Administration (SSA) uses to fight back against a loss of buying power for beneficiaries.

For example, if a large basket of commonly purchased goods and services increases in price by 2.5% from one year to the next, Social Security benefits would also need to climb by 2.5% to ensure that retirees can still purchase the same amount of these goods and services. Social Security’s COLA is the mechanism responsible for attempting to match payouts with the effects of inflation (rising prices).

For the first 35 years that the SSA oversaw payouts, there was no rhyme or reason to COLAs. No adjustments were made during the entirety of the 1940s, which led to Congress passing the largest-ever cost-of-living adjustment of 77% in 1950. Only 11 COLAs were administered from 1940 through 1974, and they were all arbitrarily assigned by special sessions of Congress.

Beginning in 1975, the Consumer Price Index for Wage Earners and Clerical Workers (CPI-W) became the inflationary index used to calculate COLAs on an annual basis. The CPI-W sports more than 200 different spending categories, all of which have their own respective percentage weightings. These weightings are the key to whittling down the CPI-W to a single figure at the end of each month.

However, only CPI-W readings from July through September (i.e., the third quarter) factor into the COLA calculation. If the average CPI-W reading from the third quarter of the current year is higher than the comparable period of the prior year, inflation has occurred and beneficiaries will receive a raise.

When the prevailing rate of inflation shot higher four years ago, so did Social Security’s COLAs. U.S. Inflation Rate data by YCharts.

Cost-of-living adjustments have been something of a mixed bag for retirees over the last 16 years. The 2010s were a period of anemic raises, with deflation (falling prices) resulting in no COLA being passed along in 2010, 2011 and 2016 and the smallest positive COLA in history (0.3%) being registered in 2017.

This was followed by a big uptick in annual raises this decade. A historic 26% year-over-year increase in U.S. money supply, courtesy of fiscal stimulus during the height of the COVID-19 pandemic, sent the prevailing rate of inflation soaring to a peak of 9.1%. The result was a 5.9% COLA in 2022, a 41-year-high 8.7% COLA in 2023, a 3.2% COLA in 2024, and a 2.5% COLA this year. For context, the average annual cost-of-living adjustment since 2010 is 2.3%.

Social Security’s 52 million retired workers are hoping for an encore that will lead to a fifth-consecutive year with an above-average raise — and they just might get it.

Following the release of the January inflation report by the U.S. Bureau of Labor Statistics (BLS), nonpartisan senior advocacy group The Senior Citizens League (TSCL) updated its outlook for Social Security’s 2026 COLA. After forecasting a 2.1% increase following the December inflation report, TSCL’s policy advisors are now looking for a 2.3% boost next year.

In January, the average retired-worker benefit check totaled $1,978.77. This means TSCL’s updated COLA forecast implies a monthly increase of $45.51 in retired-worker benefits for 2026. It would also firmly lift the average payout to retired workers above the psychological $2,000-per-month mark.

Although we’re still four months away from the first month that actually counts toward the COLA calculation, TSCL’s rising forecast bodes well, at least nominally, for retirees’ pockets.

According to the January inflation report from the BLS, the Consumer Price Index for All Urban Consumers (CPI-U), a similar inflationary measure to the CPI-W, rose by 3% over a 12-month stretch. This 3% year-over-year increase marks the fastest rate of inflation since August 2023 and explains why TSCL updated its 2026 COLA forecast.

But this headline figure only tells part of the story — and that’s the problem.

Retirees and working-age Americans spend their money differently. Whereas people in their 20s are likelier to spend a higher percentage of their monthly budget on things like apparel and education, seniors spend more than the typical working-age American on shelter expenses and medical care service costs.

In the January inflation report, the trailing-12-month inflation rate for shelter and medical care services (per the CPI-U) clocked in at 4.4% and 2.7%, respectively. Although shelter inflation has come down a bit in recent months, a significant uptick in mortgage rates has brought existing home sales to a crawl and afforded landlords exceptional rental pricing power. In other words, there’s not much of a catalyst to weigh down shelter inflation much beyond where it is now.

The issue for retired-worker beneficiaries is that their most important expenses are continually rising at a faster pace than the Social Security COLA they’re receiving. Even with TSCL forecasting a 2.3% COLA for 2026, shelter expenses are climbing at nearly twice this rate. If the 2026 COLA fails to surpass the prevailing inflation rate for shelter and medical care services, there’s a very high probability of retirees losing buying power.

Truth be told, Social Security income has been losing purchasing power for more than a decade. A TSCL analysis released in July 2024 estimates a 20% loss of buying power for seniors since 2010.

Unless the 2026 COLA forecast notably increases and the prevailing inflation rate for shelter/medical care services declines, retirees will be facing another year in which the purchasing power of a Social Security dollar withers.

As broad tariffs announced by President Donald Trump sent global markets into a tailspin, the world’s 500 richest people saw their combined wealth plunge by $208 billion on Thursday, Bloomberg reported.

The drop turned out to be the fourth-largest one-day decline in the Bloomberg Billionaires Index’s 13-year history, and the largest since the height of the Covid-19 pandemic.

With an average decline of 3.3%, more than half of those tracked by Bloomberg’s wealth index saw their fortunes tumble.

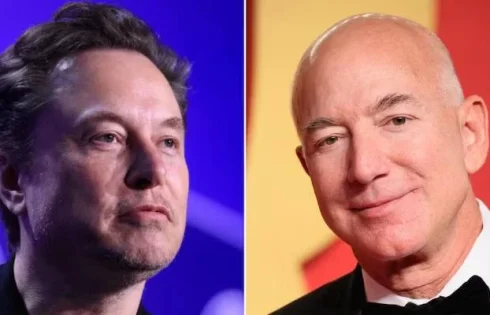

US billionaires were among the hardest hit, with Meta’s Mark Zuckerberg and Amazon’s Jeff Bezos leading the way.

Additionally, Carlos Slim, Mexico’s richest man, was among a small group of billionaires outside the US who escaped the tariffs’ impact.

Pushing Slim’s net worth up by about 4% to $85.5 billion, the Mexican Bolsa rose 0.5% after the country was excluded from the White House’s list of reciprocal tariff targets.

Following are some of the day’s biggest losers:

Mark Zuckerberg: With the social media company’s 9% slide costing its chief executive officer $17.9 billion, or around 9% of his wealth, the Meta founder was biggest loser in dollar terms.

Jeff Bezos: Costing the tech giant’s founder $15.9 billion in personal wealth, Amazon shares plunged 9% Thursday, their biggest drop since April 2022. The stock of company is down more than 25% from its February peak.

Elon Musk: As lagging deliveries and Musk’s controversial role as Trump’s efficiency czar have hammered the electric-vehicle manufacturer’s stock, the Tesla CEO has lost $110 billion so far this year — including $11 billion on Thursday.

US stock futures plunged Sunday evening, setting up Wall Street for another bruising day on Monday as markets braced for more fallout from President Trump’s fast-moving tariff policy.

Futures tied to the S&P 500 (ES=F) plummeted over 3%, while those on the tech-heavy Nasdaq (NQ=F) lost 4%. Dow Jones Industrial Average futures (YM=F) sank 2.5%, or around 1,000 points. Oil prices also dropped more than 3%, tumbling below $60 per barrel for the first time since 2021.

Wall Street is coming off its worst week since the advent of the pandemic, shedding over $5 trillion in value as Trump’s plans to impose heavy tariffs on all US trading partners led to a sell-off of epic proportions. The Nasdaq Composite (^IXIC) entered into a bear market on Friday, more than 20% off its most recent highs, while the S&P 500 (^GSPC) moved closer to that threshold. The Dow (^DJI) closed in correction territory.

Trump has shown little sign of wavering in the face of Wall Street’s panic and international reactions. China already announced retaliatory tariffs, and the EU is readying countermeasures. The US’s new baseline 10% duties on most trading partners went into effect over the weekend, and the additional tariffs that Trump announced on so-called “bad actors” are set to be enacted beginning on Wednesday.

Administration officials defended Trump’s plans during appearances on Sunday talk shows. Treasury Secretary Scott Bessent rejected the assertion that the tariffs could send the US economy into recession. JPMorgan on Friday became the first big US bank to project a recession later this year, as forecasters have in just days scrambled projections of a solid growth trajectory for the US economy.

Bessent, along with top economic adviser Kevin Hassett, claimed that more than 50 countries have reached out to begin negotiations, raising questions about logistical challenges with the tariffs set to go in place this week. Commerce Secretary Howard Lutnick said the tariffs would “definitely going to stay in place for days and weeks.”

Trump, for his part, showed no signs of backing down, saying late Sunday that markets may have to “take medicine.” He added that he was not intentionally trying to crash equities.