Fluor Corporation (FLR Quick QuoteFLR – Free Report) reported stellar results for third-quarter 2023, wherein earnings and revenues surpassed the Zacks Consensus Estimate and increased from the previous year, given solid demand for its engineering and construction solutions.

Given the company’s positive advances on large Energy Solutions projects and continued progress on projects in our legacy portfolio, Fluor lifted its expectations for 2023.

The company’s shares spiked more than 6% on Nov 3 in the pre-market trading session post the earnings release.

Inside the Headlines

Fluor reported adjusted earnings per share (EPS) of $1.02, which handily beat the consensus estimate of 55 cents by 85.5%. The reported figure increased significantly from 7 cents a year ago.

Quarterly revenues of $3,963 million topped the consensus mark of $3,841 million by 3.2%. The reported figure increased 9.7% from the year-ago level. The upside was primarily attributable to strong contributions from the Urban Solutions and Mission Solutions segments.

Overall, the company’s segment profit came in at $276 million, reflecting an increase from $31 million a year ago. The segment margin of 7% expanded from 0.9% in the year-ago period. Adjusted EBITDA for the reported period was $216 million, up from $30 million in the prior-year period.

Fluor’s total new awards for the quarter came in at $4,976 million compared with $9,743 million in the year-ago period. The consolidated backlog at the third-quarter end was $26 billion, slightly down from $26.05 billion at 2022-end.

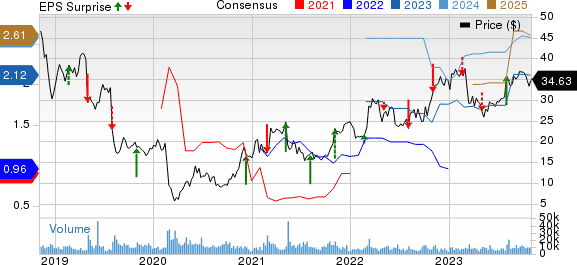

Fluor Corporation Price, Consensus and EPS Surprise

Segmental Discussion

The Energy Solutions segment’s revenues declined 2.4% year over year to $1,553 million in the third quarter. The segment margin expanded 770 basis points (bps) to 11.4% from a year ago. New awards came in at $3,252 million in the quarter, down from $3,574 million in the third quarter of 2022. The backlog at the quarter-end was $9.2 billion compared with $9.13 billion at 2022-end.

Revenues in the Urban Solutions segment totaled $1,431 million, up 32% on a year-over-year basis. The segment margin came in at 4.6% in the quarter against the negative 4.6% a year ago. New awards came in at $1,033 million for the quarter, up from $933 million a year ago. The backlog at the quarter-end was $11.05 billion, up from $10.3 billion at 2022-end.

Revenues in the Mission Solutions segment totaled $655 million, up 2.5% on a year-over-year basis. The segment margin improved 130 bps to 5.8% from the previous year. It booked new awards worth $345 million, down from $4,874 million a year ago. The backlog at the quarter-end was $4.56 billion compared with $5.67 billion at 2022-end.

The Other segment, which comprises NuScale, generated revenues of $324 million for the third quarter, up 9.1% from the year-ago period. The segment generated a loss of $5 million versus $7 million loss a year ago. It booked new awards worth $346 million, down from the year-ago level of $362 million. The backlog at the quarter-end was $1,231 million compared with $979 million at 2022-end.

Guidance Raised

For 2023, Fluor now expects adjusted EPS in the range of $2.50-$2.70, up from $2.00-$2.30 of prior projection. It now expects adjusted EBITDA to be approximately $600 million versus earlier expectations of $500-$600 million. The consensus mark for adjusted EPS is currently pegged at $2.12.

For 2026, it still anticipates adjusted EPS of $3.10-$3.60 and adjusted EBITDA in the range of $800-950 million.