Rivian Automotive, Inc. (RIVN Quick QuoteRIVN – Free Report) is slated to release third-quarter 2023 results on Nov 7, after market close. The Zacks Consensus Estimate for the to-be-reported quarter’s loss per share and revenues is pegged at $1.36 and $1.36 billion, respectively.

For the third quarter, the consensus estimate for RIVN’s loss per share has narrowed by 5 cents in the past 30 days. Its bottom-line estimates imply a rise of 13.4% from the year-ago reported numbers.

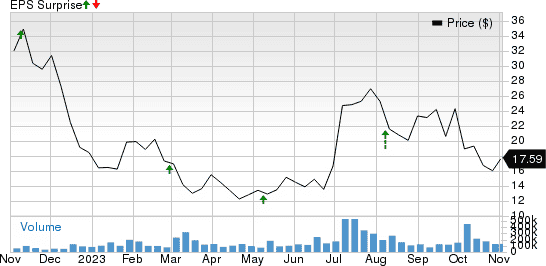

The Zacks Consensus Estimate for its quarterly revenues suggests a year-over-year increase of 154.6%. Over the trailing four quarters, RIVN surpassed earnings estimates in all of the trailing four quarters, the average surprise being 15.2%. This is depicted in the graph below:

Rivian Automotive, Inc. Price and EPS Surprise

Q2 Highlights

In second-quarter 2023, RIVN’s adjusted loss per share of $1.08 was narrower than the consensus mark of a loss of $1.41. The bottom line also narrowed from the year-ago loss of $1.89 per share. Total revenues came in at $1.12 billion, outpacing the consensus mark of $1 billion and improving from $364 million generated in the second quarter of 2022.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for the electric vehicle maker for the quarter to be reported. A combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here, as elaborated below.

Earnings ESP: RIVN has an Earnings ESP of -1.78%. This is because the Most Accurate Estimate for loss is 2 cents wider than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Factors at Play

In the third quarter of 2023, Rivian produced and delivered 16,304 and 15,564 vehicles, respectively, up from 7,363 and 6,584 vehicles, respectively, recorded in the third quarter of 2022. Higher deliveries are likely to have boosted revenues in the to-be-reported quarter. The company reduced guidance for capital expenditures to $1,700 million from the previous guidance of $2,000 million. The trimmed projection for expenses is likely to buoy Rivian’s third-quarter result.

However, in the last reported quarter, Rivian’s cost of revenues increased to $1,533 million, up from $1,068 million reported in the corresponding quarter of 2022. Cost of revenues is likely to have flared up in the to-be-reported quarter as well, thereby limiting margins. Notably, Rivian has not been able to generate income. Rising costs and net losses are likely to have adversely impacted Rivian’s third-quarter results.