Hasbro, Inc. (HAS Quick QuoteHAS – Free Report) reported mixed third-quarter fiscal 2023 results, wherein earnings came in line with the Zacks Consensus Estimate but revenues missed the same. The top line fell short of the consensus estimate after beating it in the preceding two quarters.

Disappointing Consumer Products and Entertainment revenues hurt the company’s top line in the quarter under discussion. Following the results, the stock declined 13% in the pre-market trading session.

Earnings & Revenues

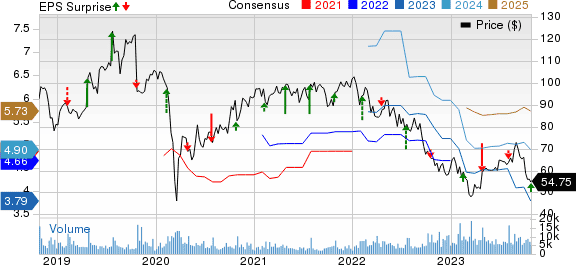

In the fiscal third quarter, HAS reported adjusted earnings per share (EPS) of $1.64, meeting the Zacks Consensus Estimate. In the prior-year quarter, it reported adjusted EPS of $1.42.

Net revenues of $1,503.4 million lagged the Zacks Consensus Estimate of $1,637 million. Moreover, the top line declined 10% year over year.

Brand Performances

In the fiscal third quarter, Franchise Brands reported revenues of $1,011 million, up 8% year over year. The upside was driven by digital and tabletop growth for DUNGEONS & DRAGONS, MAGIC: THE GATHERING, Hasbro Gaming and TRANSFORMERS products. Our estimate was pegged at $926.8 million.

Partner Brands’ revenues dipped 35% year over year to $228.2 million due to license exits and industry softness. We expected the metric to be $334.6 million.

Revenues at Portfolio Brands came in at $170.3 million, falling 19% from the prior-year levels. A reprioritization of investment (to support Franchise Brands) and transitioning select brands to a licensing model added to the negatives. Our projection for the metric was $241.7 million.

Total gaming category revenues rose 23% year over year to $628 million.

Revenues from non-Hasbro Branded Film & TV tumbled 47% year over year to $93.9 million. We anticipated the metric to be $193.4 million.

Segmental Revenues

Hasbro has three reportable operating segments — Consumer Products, Wizards of the Coast and Digital Gaming, and Entertainment.

In the fiscal third quarter, net revenues from Consumer Products decreased 18% year over year to $956.9 million. Adjusted operating margin was 11.2% compared with 12.6% in the prior-year quarter.

The Wizards of the Coast and Digital Gaming segment’s revenues totaled $423.6 million, up 40% from $303.5 million reported in the year-ago quarter. The uptick was driven by a rise in Digital and Licensed Gaming revenues. Adjusted operating margin was 48% compared with 33.7% in the year-ago quarter.

Entertainment’s revenues plunged 42% year over year to $122.9 million. Adjusted operating margin was 6.6% compared with 2.8% in the prior-year quarter.

Operating Highlights

In the fiscal third quarter, HAS’ cost of sales (as percentages of net revenues) came in at 32.9% compared with 35% in the year-earlier quarter. Our forecast for the metric was 32.3%.

Selling, distribution and administration expenses (as percentages of net revenues) reached 23.4% compared with 21.8% in the prior-year quarter.

HAS reported adjusted EBITDA of $401.5 million compared with $345.5 million a year ago. Our envisioned the metric to be $439.4 million.

Balance Sheet

As of Oct 1, 2023, cash and cash equivalents were $185.5 million compared with $551.6 million as of Sep 25, 2022. At the end of the reported quarter, inventories totaled $617.7 million compared with $844.5 million a year ago.

As of Oct 1, 2023, long-term debt was $3,654.6 million compared with $3,725.1 million as of Sep 25, 2022.

The company’s board of directors announced a dividend of 70 cents per common share, payable on Nov 15, to shareholders of record at the close of business as of Nov 1, 2023. In third-quarter fiscal 2023, it paid out cash dividends worth $97 million. Year to date, it has paid $291 million in dividend payments.

2023 Outlook

For fiscal 2023, management now expects revenues to decline 13-15% year over year compared with the prior estimate of 3-6% fall year over year. The company anticipates adjusted operating margin in the range of 13-13.5%. Adjusted EBITDA is suggested in the $900-$950 million band. It now projects operating cash flow in the range of $500-$600 million, down from the earlier estimate of $600-$700 million.

Segment wise, the company forecasts Consumer Products revenues to decline year over year (at cc) in the mid-to-high teens compared with the prior prediction of mid-single digits. In the Wizards of the Coast and Digital Gaming segment, management continues to expect revenues to grow in high-single digits in fiscal 2023.

In fiscal 2023, HAS continues projecting Entertainment revenues to decline 25-30% year over year.