Evercore’s (EVR Quick QuoteEVR – Free Report) shares slumped 3.5% following the release of its third-quarter 2023 results. Quarterly adjusted earnings per share of $1.30 missed the Zacks Consensus Estimate of $1.31 by a penny. Also, the bottom line was down from the prior-year quarter’s $2.20.

A decline in net revenues of the Investment Banking & Equities segment hampered the overall top line. Amid a challenging environment, the company saw a decline in assets under management (AUM). However, the rise in Investment Management segment revenues offered some support.

Net income available to common shareholders (GAAP basis) was $52.1 million, down from $82.4 million reported in the year-ago quarter.

Revenues Decline & Expenses Rise

In third-quarter 2023, net revenues of $574.4 million surpassed the Zacks Consensus Estimate of $565.9 million. However, the top line decreased 1.2% year over year. A decline in advisory fees, as well as commissions and related revenues mainly led to the fall.

Total expenses increased 10.5% to $493.4 million. This was mainly due to a rise in almost all the components of total expenses, except professional fees and depreciation and amortization costs.

Adjusted compensation ratio was 68%, up from the prior-year quarter’s 61%.

Adjusted operating margin was 14.4%, down from the prior-year quarter’s 23.4%.

Quarterly Segmental Performance (Adjusted Basis)

Investment Banking & Equities: Net revenues declined 1.5% year over year to $557 million. Also, operating income decreased 41% to $77.6 million.

Investment Management: Net revenues were $19.1 million, up 5.9% from the prior-year quarter’s reading. Operating income was $5.1 million, up nearly 1% from the year-ago quarter. AUM was $11.27 billion as of Sep 30, 2023, up 12.9% from the year-earlier quarter.

Balance Sheet Position

As of Sep 30, 2023, cash and cash equivalents were $492.6 million, and investment securities and certificates of deposit were $1.1 billion. Moreover, current assets exceeded current liabilities by $1.6 billion as of the same date.

Capital Distribution Activities

In third-quarter 2023, Evercore repurchased 3 million shares at an average price of $128.97 per share.

Our Viewpoint

The company’s financial performance in the third quarter seems disappointing as revenues declined. Nonetheless, amid a challenging macroeconomic backdrop for deal-making, EVR’s initiatives to boost its client base in advisory solutions and expand geographically are impressive strategic moves.

Also, with strong liquidity, the company’s efforts to enhance shareholders’ value through steady capital distribution activities seem sustainable.

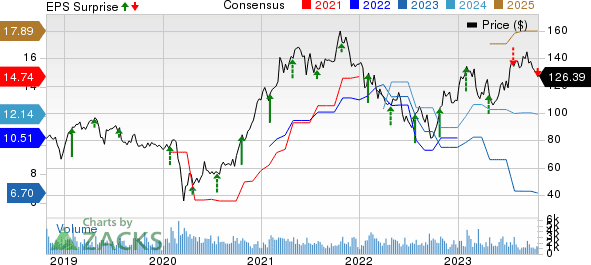

Evercore Inc Price, Consensus and EPS Surprise