U.S. stock-market bulls will soon find out whether they’re getting ahead of themselves.

The S&P 500 index SPX, -1.65% rose Tuesday to post its highest close in more than two weeks on the eve of the most eagerly awaited Federal Reserve policy decision since the early days of the COVID-19 pandemic.

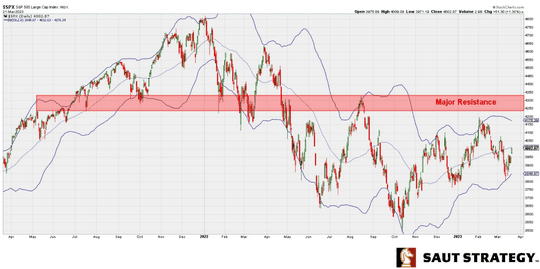

“The market did climb impressively yesterday to produce a new reaction high in the S&P 500. By itself I guess that’s a good sign, though I would have preferred to see such strength come after the Fed meeting and not before,” said technical analyst Andrew Adams in a Wednesday note for Saut Strategy.

“It ups the risk of it being a trap this way if the market decides it doesn’t like what it hears today, but I guess we have to assume the breakout holds until proven otherwise,” he wrote.

The Fed faces one of its toughest decisions in years on Wednesday. Should it push ahead with interest-rate hikes in an effort to continue bringing down inflation that remains well above the central bank’s target, or pause to ease strains on a banking sector facing its worst crisis since 2007-09?

Fed-funds futures show traders have priced in a roughly 86% chance the central bank will deliver a 25-basis-point, or quarter of a percentage point, rise when it concludes its policy meeting at 2 p.m. Eastern

Fed chief Jerome Powell’s news conference and an updated forecast of individual policy makers’ interest rate expectations will be closely watched for clues to the outlook for rates in the months ahead. A signal that the Fed is prepared to pause or possibly cut rates in the future would likely be taken as a positive for equities, Adams and other analysts have said.

The stock market’s premeeting gain “might not matter if the Fed is, indeed, more dovish this afternoon, though it increases the risks if they are not,” he said.

The S&P 500 rose 1.3% on Tuesday to end at 4,002.87, its highest close since March 6. The Dow Jones Industrial Average DJIA, -1.63% gained 1% to finish at 32,560.60, its highest since March 8.

Stocks were in a holding pattern ahead of the Fed announcement, with the S&P 500 up 0.1% and the Dow flat.

Adams said the S&P 500 needs to remain above the 3,950-3,970 zone that previously represented overhead resistance to reinforce the breakout, while a quick pullback below that area would raise questions about the legitimacy of the break.

Leaving room for heightened volatility around the Fed announcement, Adams said he could tolerate a slide toward 3,935 or so.

Holding that level on any immediate dips could leave the market looking to the upside in the days and weeks to come, he said, though the “4300-4400 region still sticks out to me like a sore thumb to be tested, and I would love to see rally take us up there.” (See chart above.)