With Lithium Demand Set to Double by 2030 and Drastically Outpacing New Supply, Lithium South Development (TSXV:LIS) (OTC:LISMF) is Poised with a World-Class Project and Potentially Sector Disrupting Technology to Lead the Way to a Sustainable ‘Gold Rush’ in Argentina

While lithium prices reach new highs, the lithium sector is battling a multi-front war against a wave of challenges: logistical, geopolitical, and environmental.

Analysts are sounding the alarm that while by 2030, lithium demand is set to reach 2.4 million tonnes LCE. [1] It’s not hard to believe in such a jump, as lithium consumption has already nearly quadrupled since 2010.[2]

Given that the worldwide supply of lithium is expected to hit 600,000 tonnes of LCE in 2022,[3] that means we have 6 years to quadruple our production to meet demand.

But getting there is proving to be a monumental task, especially with mounting environmental, geopolitical and technological challenges.[4]

Analysts estimate this will require at least US$42 billion in new investment to accomplish this feat.[5] By 2028, the global lithium market is expected to reach US$8.2 billion.[6]

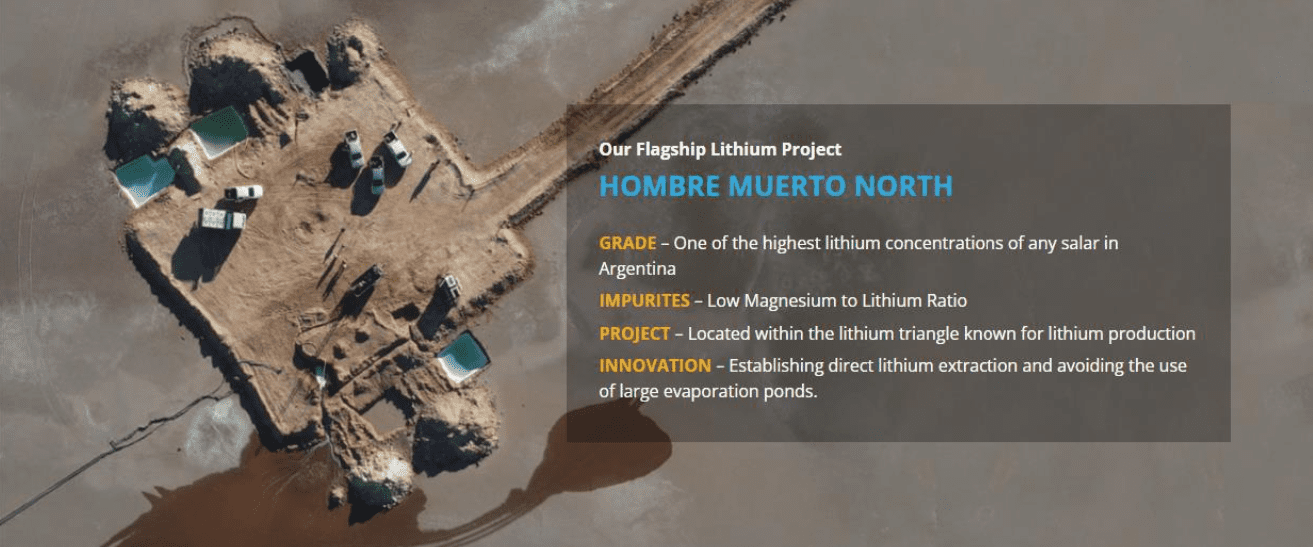

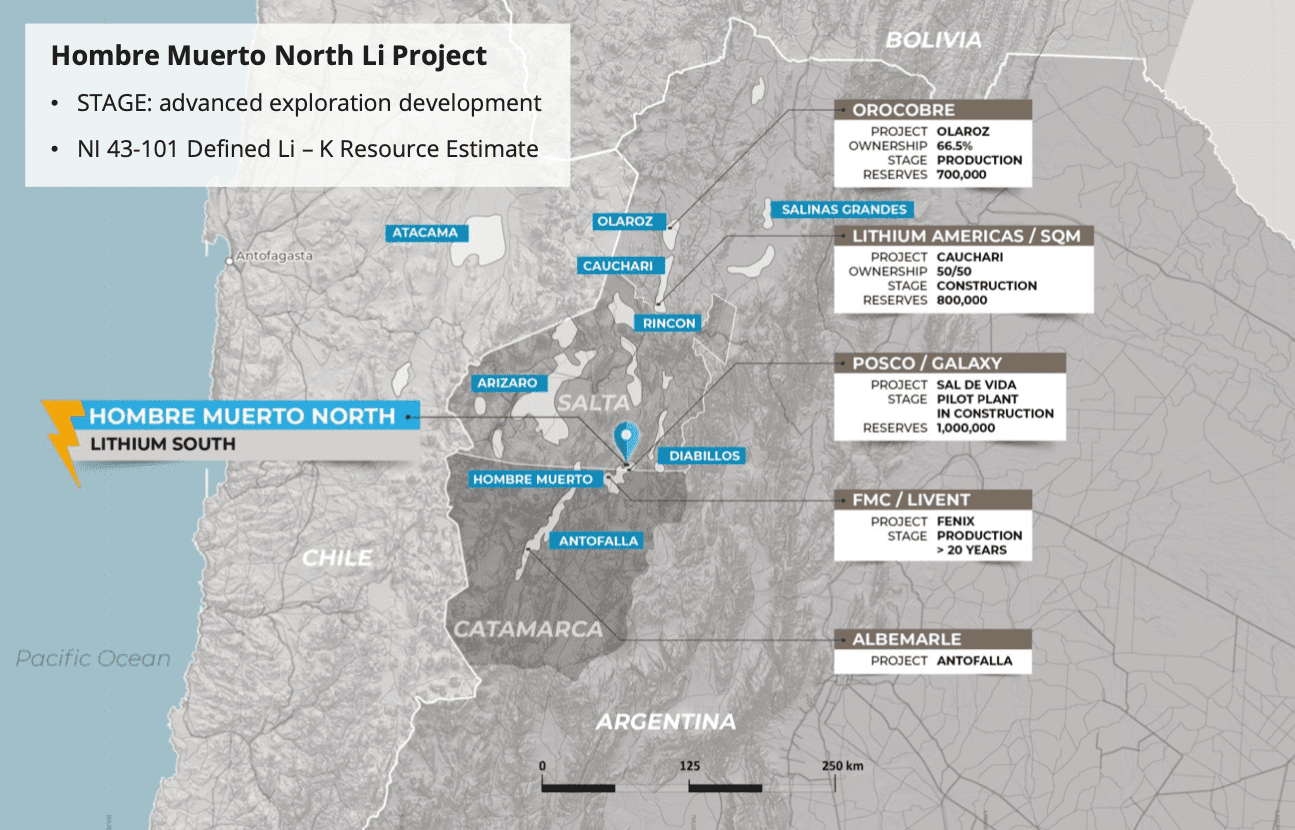

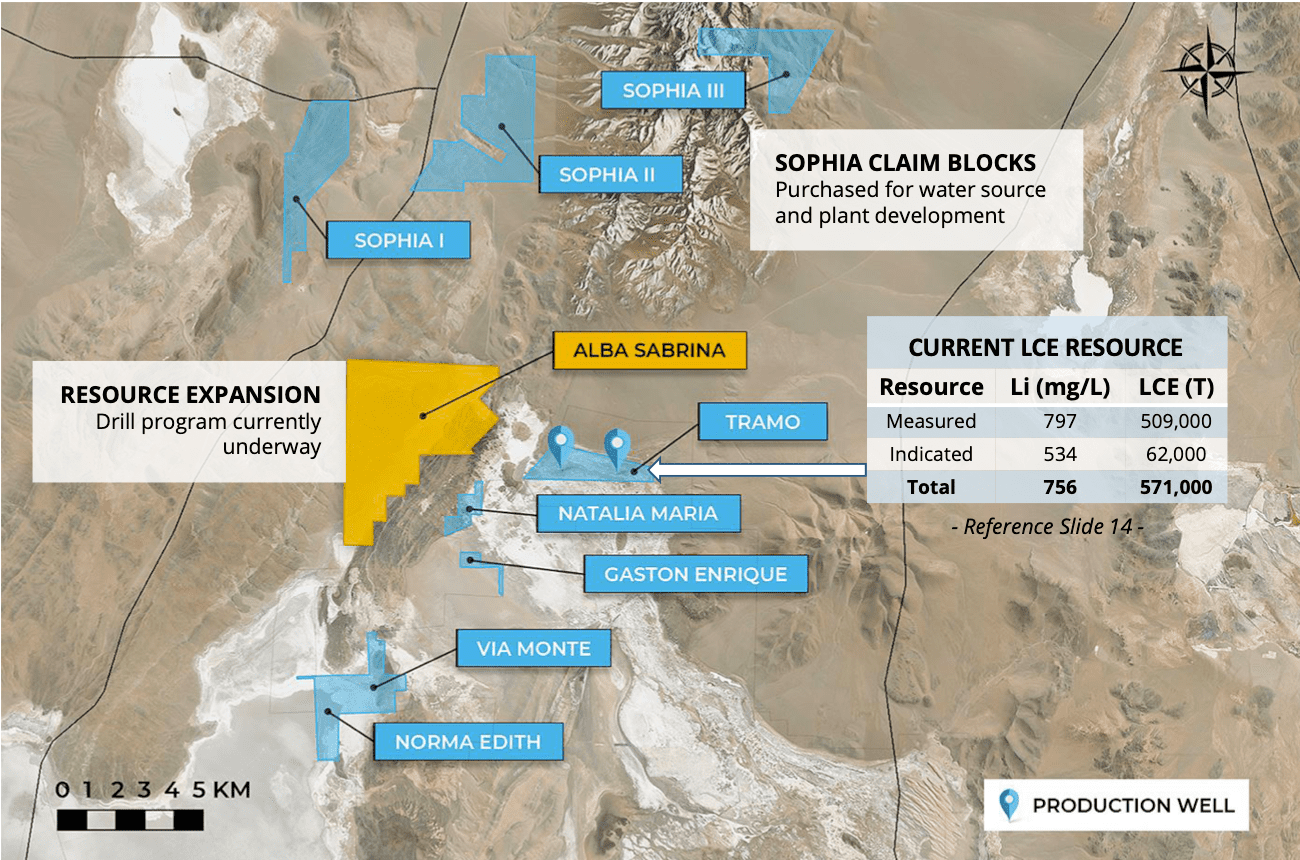

Located next to two major lithium operations in the renowned Lithium Triangle, Lithium South Development (TSXV:LIS) (OTC:LISMF) is actively drilling to expand the M&I Resource of its world-class HMN Li project that’s at the center of a global race to prove the validity of the game-changing ESG-friendly lithium extraction process that the world has been waiting for.

RECENT NEWS HEADLINES:

- First Hole HMN Li Project, Argentina Second Drill Rig on Site

- Second Drill Rig Added to HMN Lithium Project, Argentina

- High Grade Lithium Discovery at Alba Sabrina Claim Block

- Lithium South Retains Groundwater Insight for Resource Calculation

Lithium South Development in 60 Seconds

- Advanced exploration stage lithium company with a world-class project in the mining friendly Salta Province, Argentina—within the world-famous Lithium Triangle

- Great Real Estate of the project that’s adjacent to production from Livent and surrounded by a near-production project owned by Korean giant POSCO.

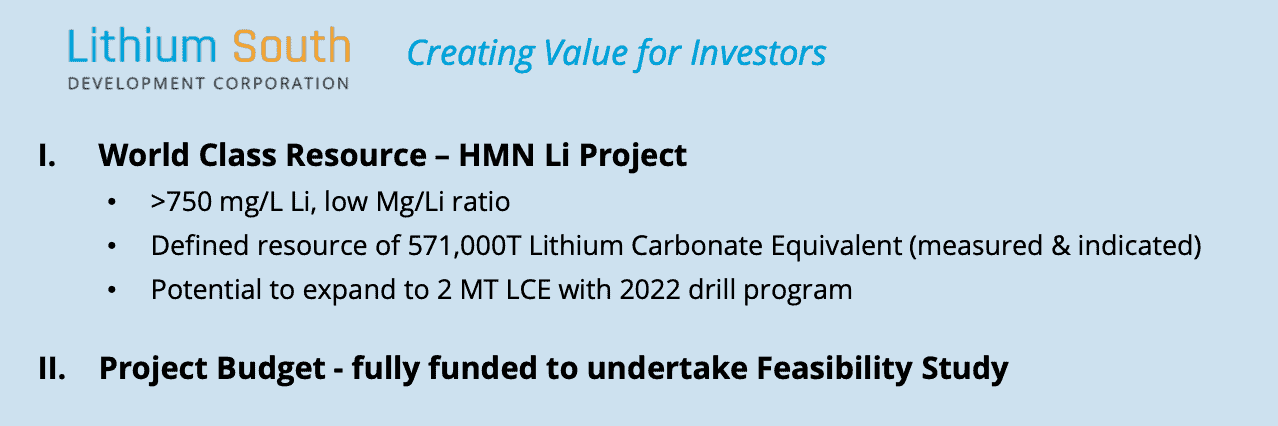

- High Quality Brine Resource with an M&I Resource of 570,000 tonnes of LCE, a projected mine life of 30 years, from high lithium brine with 756 mg/L lithium.

- Solid PEA Numbers calculated in early 2019 indicated robust economics with a NPV (8% discount) of US$217 million, that carries a CAPEX of only US$98 million.

- HOWEVER those numbers were calculated in 2019, before lithium prices went on a huge run, rising more than 13-fold in just the last two years.[7]

- ESG-Friendly, Game-Changing Technology is being tested by three different entities in three different countries with brines sampled from the flagship asset, which to-date have returned extremely promising results (99% lithium recovery).

- Staged & Work Completed with a promising 2022 drill campaign underway designed for resource expansion, that’s already returned high lithium brine results. An Environmental Impact Report has already been completed, and nearby claims have been acquired to secure additional water sources and a location for a future plant and processing facilities.

- Qualified, Proven Team with extremely strong technical lithium experience that includes minds that were integral to the development of some of the region’s most prominent lithium production operations.

The Need for Clean(er) Lithium

Before we get to the core of the Lithium South Development (TSXV:LIS) (OTC:LISMF) story, we need to look at the most exciting technological race that’s taking the lithium sector by storm, and how LIS fits into it.

A new report from The Nature Conservancy (TNC) and UCLA recently outlined the need for prioritizing the least impactful methods of lithium extraction to protect the environment and communities.[8]

The questions being raised by TNC are important for markets, because of their reputation for input on assessing the worthiness of companies and “Investing in Nature” in this ESG-focused era.[9]

Voices are growing louder, calling for the methods we use to produce lithium to radically change.

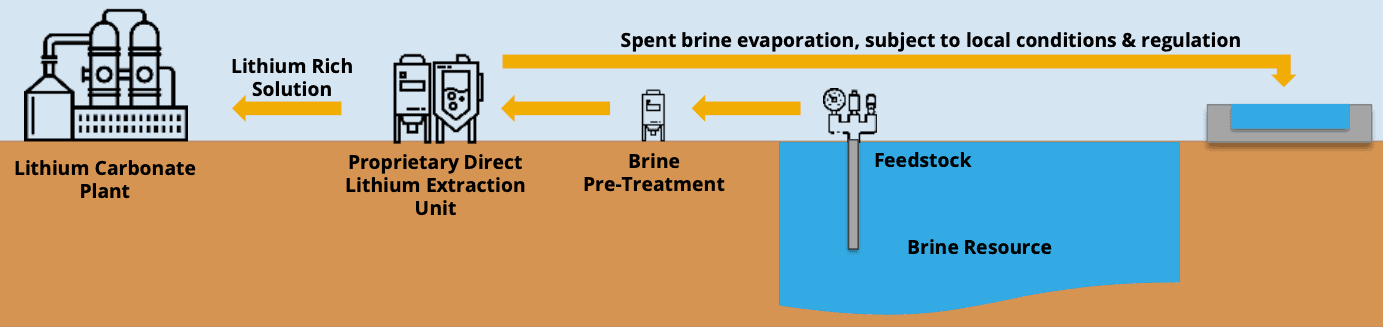

A new lithium technology is drawing heavy investment from major players, such as mining giant Rio Tinto, automaker General Motors, and even the U.S. Energy Department, called direct lithium extraction (DLE).[10]

“[DLE is] such a game changer. There’s huge opportunities.” – U.S. Energy Secretary Jennifer Granholm[11]

Time Magazine recently pointed its readers towards a lithium race in Argentina that could deliver the country a “Sustainable Gold Rush”.[12]

Direct Lithium Extraction (DLE): The Answer?

Embedded within the Time Magazine report was a focus on the work of privately-owned, California-based start-up Lilac Solutions, which in 2021 raised $150 million from investors including Lowercarbon Capital and T. Rowe Price.[13]

This is where Lithium South Development’s (TSXV:LIS) (OTC:LISMF) HMN Li Project begins to shine.

In April 2021, Lilac and Lithium South generated huge optimism, announcing how Lilac’s patented Ion Exchange (IX) technology recovered 99% of the lithium from a synthetic sample of the HMN Li Project brine—identical in chemical composition to that contained within the project’s NI 43-101 Preliminary Economic Assessment (PEA).[14]

But it doesn’t stop there. Lithium South is working with two other groups (not just Lilac) to test the validity of DLE on the HMN Li project, including with Florida-based Eon Minerals Inc.[15] with its in Argentina and with Chemphys and their lab facilities in China.[16]

Using Chemphys’ XFP-Lithium DLE process, test work delivered 80% lithium recovery, which is a near doubling of lithium recovery rates from conventional evaporation extraction.[17]

These results from the DLE testing has been blowing conventional methods out of the water (even though Lithium South is prudently also testing conventional evaporation as a potential method to produce from HMN Li)[18].

How Does Lithium South Development (TSXV:LIS) (OTC:LISMF) Stack Up With Its Neighbors?

Lithium South Development’s (TSXV:LIS) (OTC:LISMF) HMN Li Project is in great company, and surrounded by several major projects.

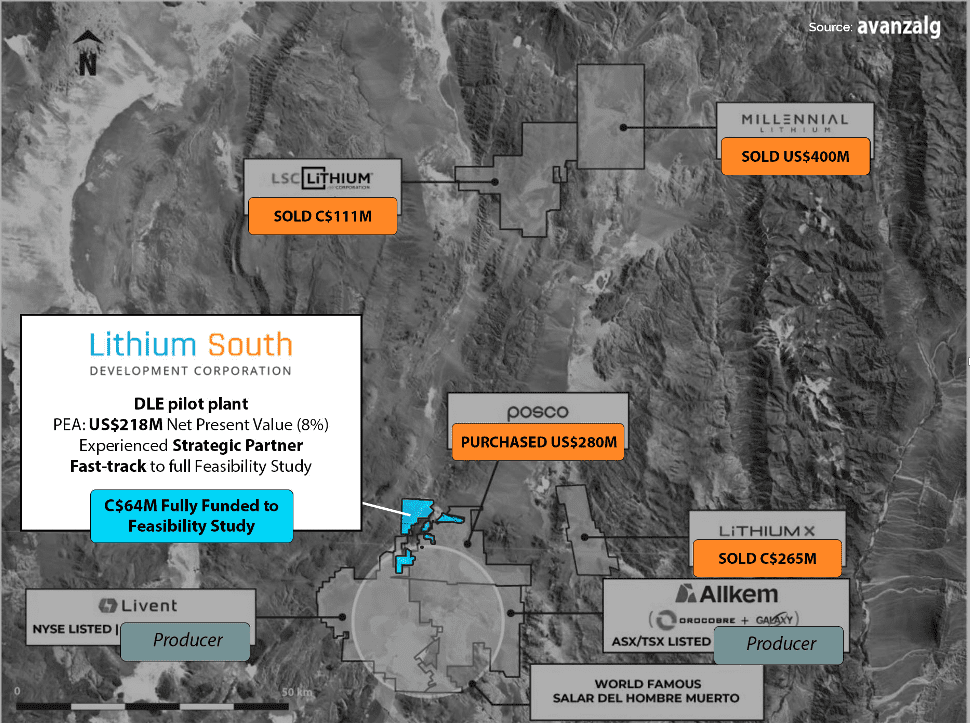

The HMN Li already has moved forward with a DLE Pilot Plant on deck, a 2019 PEA that gave the project a US$218 million NPV (8%), and with C$64 million on hand, LIS is fully funded to fast-track towards a Feasibility Study.

Where the smart investor will now pay close attention is towards where the company is now, where it’s going, and how it will get there.

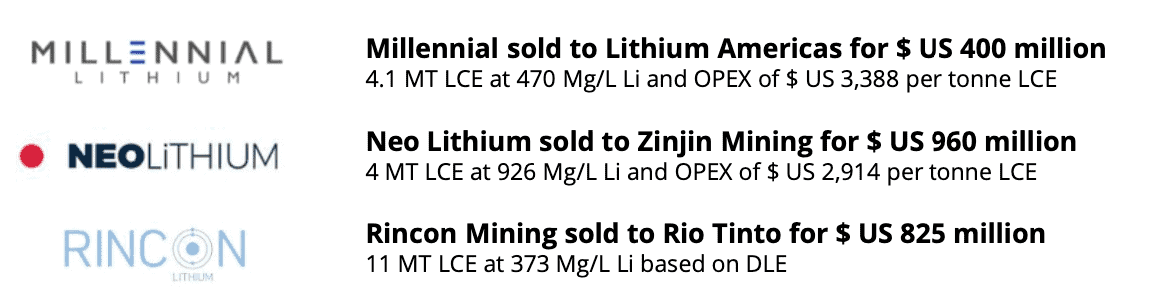

If it doesn’t take the project all the way to production on its own, it’s surrounded by stories of major takeout target successes.

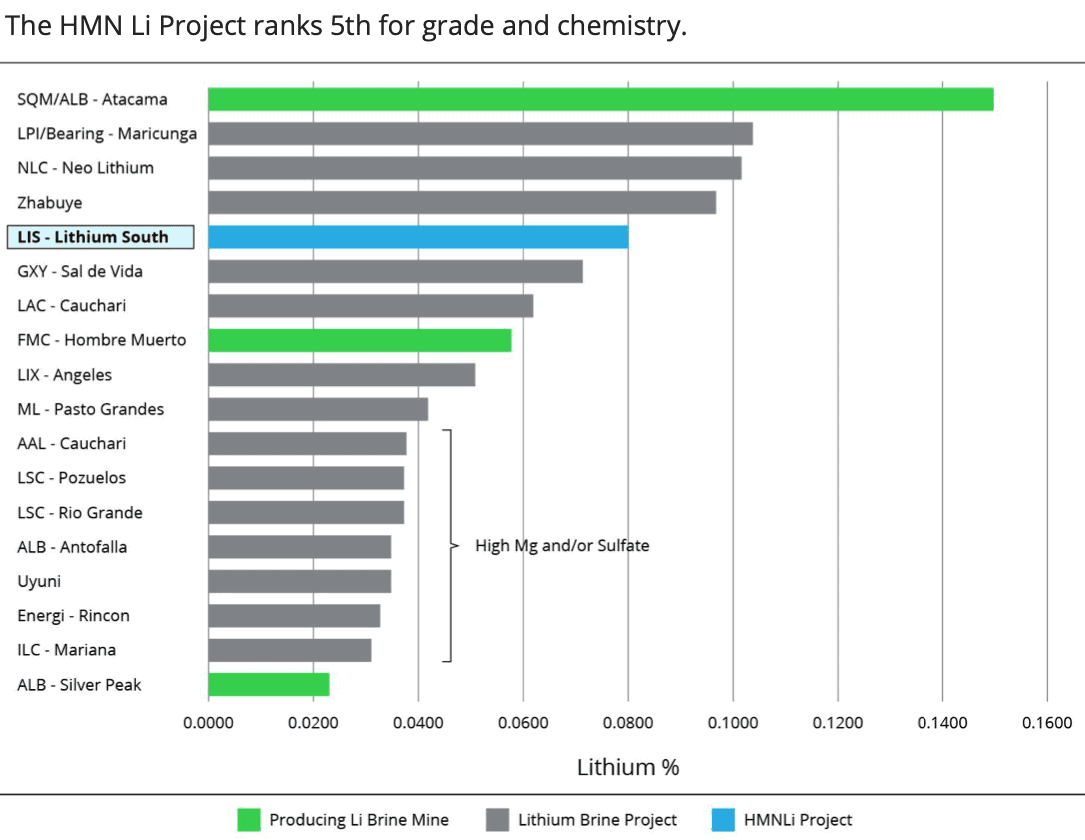

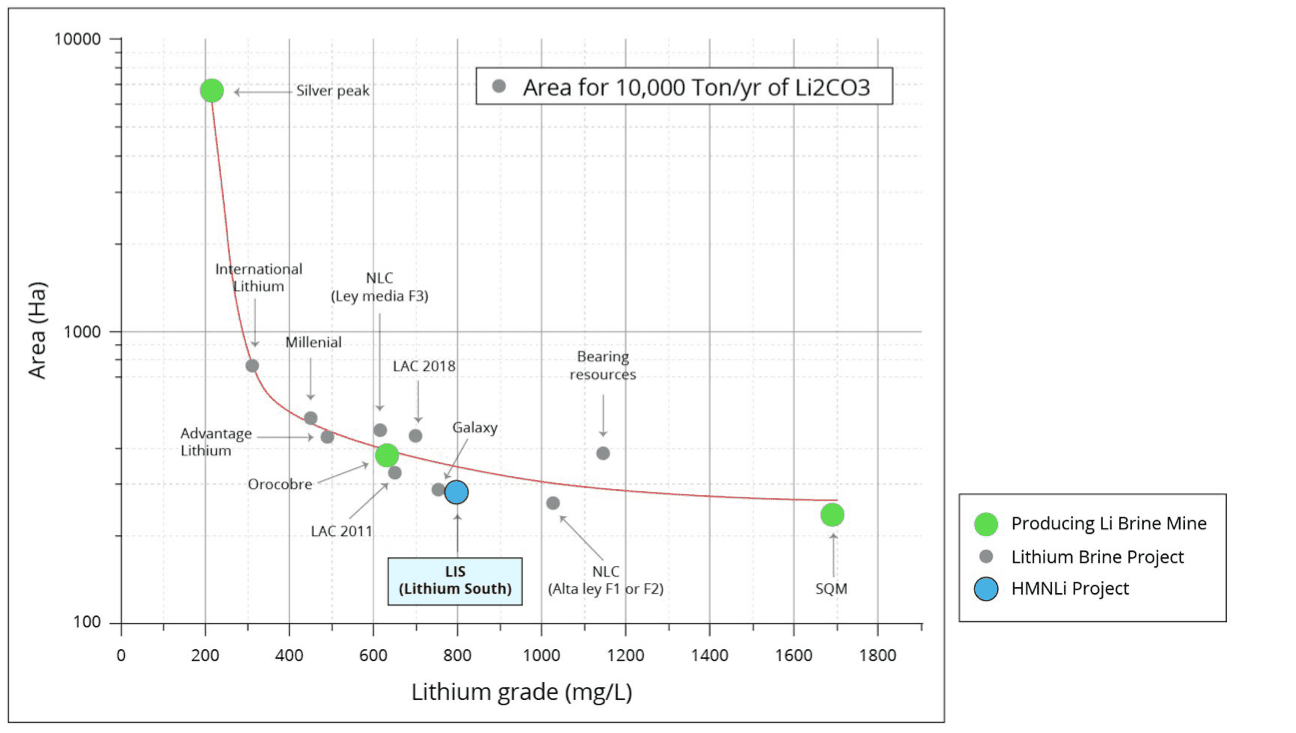

According to the company’s calculations, the HMN Li Project is near the top tier in terms of grade and chemistry, meaning it not only has a high grade of lithium that’s ahead of several other big players and their massive projects, but also that it comes with a favourably low magnesium to lithium ratio.

With a M&I Resource of 571,000 T of LCE, the current drilling program is designed to further expand the resource.

And so far the results have looked VERY good.

Recently the company announced a high-grade lithium discovery at its Alba Sabrina claim, with lithium values ranging from 732-772 mg/L lithium[19]—very much on pace with the previous resource’s grades and far above the cut-off grade of 500 mg/L lithium.

Because the drilling campaign’s results are starting to hit the company’s news flow, this is where the smart investor would take notice and not want to be left on the outside looking in as the case for an expanded resource becomes much stronger.

As of August 12, 2022, some might say that Lithium South Development’s (TSXV:LIS) (OTC:LISMF) stock value is an absolute BARGAIN… given that the company’s market cap is less than US$40M, and nearby projects acquired were sold for upwards of 9 digits.

The relevance of Lithium South’s high lithium grades cannot be overstated.

Even if we’re looking at conventional brine evaporation ponds, lithium grade is directly related to the size of the ponds. These sizes of ponds account for nearly 50% of the CAPEX of a brine project.

Meaning, the higher the grade, the lower the CAPEX.

Where does Lithium South’s HMN Li stack up amongst its peers?

Now factor in the potential injection of the DLE factor, and the economics start looking even more enticing.

As we’ve seen above, Lilac delivered 99% lithium recovery, while Chemphys delivered 80% lithium recovery, which was DOUBLE that of conventional evaporation tests on the property.

Which means, if one of the three DLE methods ends up winning out, the potential for Lithium South and its flagship asset skyrockets.

Instead of taking 18 months or more to produce lithium through evaporation, Lithium South could potentially produce it within HOURS. Instead of recovering only ~40% of the overall lithium available, DLE could provide as high as 80% or more!

And the potential for losses due to weather goes down to ZERO. Meaning, the project further de-risks itself, should DLE prove itself to be a viable commercial method of producing lithium.

Strong Leadership Team

In order to properly assess and work with a potentially game-changing technology in one of the world’s top lithium production regions, the HMN Li project requires capable hands… Thankfully, Lithium South Development (TSXV:LIS) (OTC:LISMF) is in VERY capable hands.

LIS’s leadership team includes:

Adrian F. C. Hobkirk – President and CEO: Hobkirk has 32 years of experience in the mining and venture capital industry, including extensive experience working in Argentina. He is the co-discoverer of the Dublin Gulch Gold Deposit (Yukon) and the Yarnell Gold Mine (Arizona). He’s explored for precious metals around the world and is currently developing the 1.5-million-ounce AuCuEq Groete Gold Copper Project in Guyana. Hobkirk is the founder of Lithium South Development Corp., having acquired the HMN Lithium Project and managed its development to date.

Christopher P. Cherry – CFO and Director: Cherry has over 20 years of corporate accounting and audit experience. Formerly an auditor with KPMG, he has extensive corporate experience and has held senior-level positions for several public mining companies. Cherry is a certified general accountant and a chartered accountant.

Yi Hua Dai, PhD – Director: Yi Hua (PhD) founded Chemphys in 1998 to focus on battery quality and high purity lithium processing. He’s a certified Technical and Economic Expert of Sichuan Province and China Non-ferrous Metals Industry Association Expert. He has a proven record of leading the development of lithium manufacturing techniques with 24 patents valid and under application.

Alison Dai – Director: Dai has 9 years of experience in the lithium industry and is responsible for business development and is a director for Chengdu Chemphys Chemical Industry Co., Ltd. In her role at Chemphys, Dai has been involved in developing strategic partnerships, international markets and procurement. Prior to joining Chemphys, Dai was an investment banking analyst at J.P. Morgan Australia in the mining and metals team.

Fernando E. Villarroel – VP & Director Project Development: Villarroel has 12 years of experience in the mining industry in Argentina with a focus on Lithium process development. From 2009 to 2013 he worked with Lithium Americas Corp. (Minera Exar S.A.) as Project Manager which included construction management and commissioning of the initial pilot evaporation facilities and laboratory at the Cauchari Olaroz Lithium Project. He has also acted as a consultant to Neo Lithium and International Lithium Inc. He holds a degree in Industrial Engineering and has specialized training in Data Modeling & Analysis for Business and Engineering from M.I.T.

Marcela Casini – Senior Geologist and Hydrogeologist: Casini has a distinguished career in the lithium exploration and development industry in Argentina, having worked for Rio Tinto as a field geologist exploring salars in the Puna region, as well as on the Minera Exar lithium brine project, a joint venture with Lithium Americas Corp. and Ganfeng Lithium Co, leading the exploration that led the project to the feasibility 2012. From 2019 to 2021 she was responsible for the strategy and development of the production well field, supporting a projected 40,000 tonne per year lithium operation. She’s also has consulted to PepinNini Minerals regarding the exploration and development of lithium resources at the Rincon and Pular salar since 2016.

Vijay Mehta, PhD. – Technical Consultant and Qualified Person: A recognized expert in lithium mining and processing, Dr. Mehta (PhD) brings almost five decades of experience to LIS. His experience includes evaluating the technological and economic feasibility of lithium brine projects around the world. He was the Product and Process Technology Development Leader of FMC Corporation for 30 years and was one of the founding developers of FMC’s lithium plant at the Hombre Muerto Salar, Argentina, which has been in production since 1998. He holds 12 lithium related U.S. patents and has published over 50 technology reports and ten academic papers.

7 Reasons to Put Lithium South Development (TSXV:LIS) (OTC:LISMF) on Your Must-Watch List

1 The Timing: The lithium market is exploding, with prices skyrocketing over the last two years, and demand expected to more than double by the end of the decade. Meanwhile, analysts are predicting what could be a catastrophic shortfall of lithium supplies in the next few years, unless lithium miners can increase their production to four times its current levels.

2 Advanced Exploration Stage Project with Great Real Estate: The HMLi Project is located within the mining friendly Salta Province, Argentina, adjacent to a producing Livent property, and surrounded by a near-producing project owned by Korean giant POSCO.

3 High Quality Brine Resource: The project comes with high lithium brine (756 mg/L), with a low magnesium to lithium ratio (2.6:1), and a M&I Resource of 0.57 Mt LCE, and a projected mine life of 30 years.

4 Solid PEA Numbers: So far, the PEA done on the project indicates robust economics, with a NPV (8% discount) of US$217 million, that carries a CAPEX of only US$98 million. However, those numbers were calculated in 2019, prior to lithium’s surge to its current LCE market prices that greatly dwarf those previous figures.

5 Proprietary, ESG-Friendly Technology: Direct Lithium Extraction (DLE) is on the cutting edge of becoming one of the industry’s biggest game changers. It allows for potentially double the lithium recovery without large evaporation ponds. It takes hours, not years, and creates a much smaller environmental footprint, which would appease local communities in ways that conventional production has yet to. Lithium South is evaluating three different unique DLE technologies, as well as the potential for conventional production as a benchmark.

6 Qualified Proven Team: Extremely strong technical lithium experience, with an office and laboratory located nearby in Salta, Argentina, backed by world-renowned technical consultant and qualified person Vijay Mehda, along with senior geologist/hydrologist Marcela Casini.

7 Staged & Work Completed: Two production wells have already been drilled and cased. An Environmental Impact Report is currently underway. TEM survey results confirm further resource expansion potential. The company has aggressively acquired nearby claims to secure water sources and a location of future plant and processing facilities.

Now that you’ve digested the fruits of our research, it’s time to follow up with some research of your own.

NOW IS THE PERFECT TIME for smart investors to seriously follow the rapidly Lithium South Development (TSXV:LIS) (OTC:LISMF) story.

LIS is actively working to expand its already impressive resource in one of the world’s most sought after lithium jurisdictions, and is at the forefront of proving the viability of potentially industry changing DLE technology.

So, do your own due diligence, and don’t forget to click here to sign up for the Lithium South’s newsletter to make sure you don’t miss out on any news and milestones along the way to becoming the next darling of the lithium sector.

USA News Group

Editorial Staff

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Equity Insider is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Lithium South Development Corporation advertising and digital media from the company directly. There may be 3rd parties who may have shares of Lithium South Development Corporation, and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Lithium South Development Corporation which were purchased in the open market, and reserve the right to buy and sell, and will buy and sell shares Lithium South Development Corporation at any time without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, we currently own shares of Lithium South Development Corporation and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

SOURCES CITED:

[1] https://www.mining.com/global-lithium-production-hits-record-high-on-electric-vehicle-demand/

[2] https://elements.visualcapitalist.com/lithium-consumption-has-nearly-quadrupled-since-2010/

[3] https://www.benchmarkminerals.com/membership/analysis-lithium-industry-needs-42-billion-to-meet-2030-demand/

[4] https://www.sciencedirect.com/science/article/abs/pii/S0959652621011732

[5] https://www.benchmarkminerals.com/membership/analysis-lithium-industry-needs-42-billion-to-meet-2030-demand/

[6] https://www.globenewswire.com/en/news-release/2022/03/11/2401706/29442/en/Global-Lithium-Market-Expected-to-Reach-8-2-Billion-by-2028-Grand-View-Research-Inc.html

[7] https://www.mining-technology.com/analysis/lithium-price-challenges/

[8] https://www.nature.org/en-us/newsroom/ca-lithium-extraction/

[9] https://www.nature.org/content/dam/tnc/nature/en/documents/TNC-INVESTING-IN-NATURE_Report_01.pdf

[10] https://www.reuters.com/business/sustainable-business/new-lithium-technology-can-help-world-go-green-if-it-works-2022-04-07/

[11] https://www.reuters.com/business/sustainable-business/new-lithium-technology-can-help-world-go-green-if-it-works-2022-04-07/

[12] https://time.com/6200372/lithium-mining-technology-argentina-gold/

[13] https://www.cnbc.com/2021/09/22/lilac-raised-150-million-for-sustainable-lithium-extraction-tech.html

[14] https://www.lithiumsouth.com/posts/lilac-solutions-achieves-99-lithium-recovery-with-ion-exchange-process/

[15] https://www.lithiumsouth.com/posts/eon-minerals-inc-to-evaluate-hmn-brine-using-direct-lithium-extraction-technology/

[16] https://www.prnewswire.com/news-releases/lithium-south-development-corporation-doubling-of-lithium-recovery-from-brine-with-chemphys-process-301248906.html

[17] https://www.lithiumsouth.com/posts/doubling-of-lithium-recovery-from-brine-with-chemphys-process/

[18] https://www.lithiumsouth.com/posts/evaporation-test-work-underway-at-hmn-li-project/

[19] https://www.lithiumsouth.com/posts/high-grade-lithium-discovery-at-alba-sabrina-claim-block/