S&P 500 books weekly gains

U.S. stocks ended lower, with losses led by the technology-heavy Nasdaq Composite, after an unexpectedly strong surge in January nonfarm payrolls and disappointing earnings from a trio of tech-related corporate heavyweights.

Still, the Nasdaq rose for a fifth straight week, notching its longest weekly winning streak since the week ending Nov. 5, 2021, according to Dow Jones Market Data.

How did stocks trade?

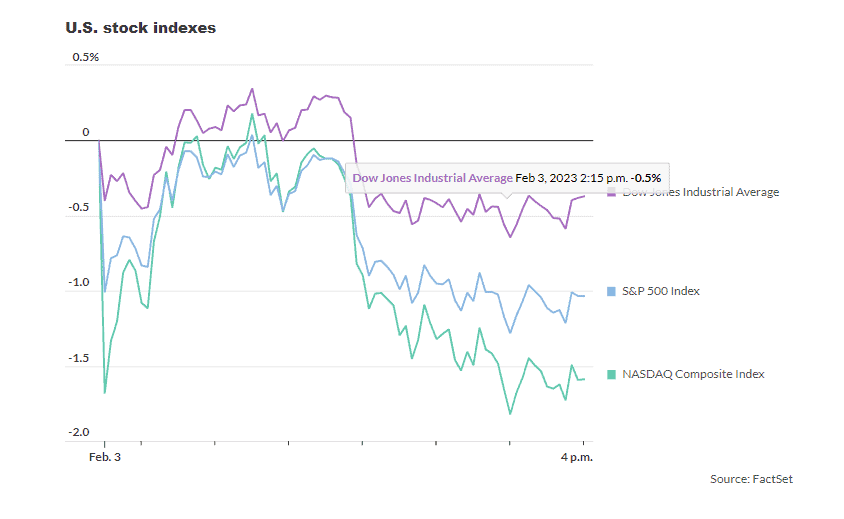

- The Dow Jones Industrial Average DJIA, -0.38% fell 127.93 points, or 0.4%, to close at 33,926.01, after sliding 220 points at its session low.

- The S&P 500 SPX, -1.04% dropped 43.28 points, or 1%, to finish at 4,136.48.

- The Nasdaq Composite COMP, -1.59% shed 193.86 points, or 1.6%, to end at 12,006.95.

For the week, the Dow slipped 0.2%, while the S&P 500 gained 1.6% and the Nasdaq rose 3.3%.

What drove markets?

Stocks prices were volatile on Friday as investors digested a stronger-than-expected jobs report and some disappointing technology sectors earnings.

The U.S. economy added 517,000 jobs in January, far exceeding economist expectations for a rise of 187,000, while the unemployment rate fell to 3.4%, its lowest since 1969. Average hourly earnings rose 0.3%, in line with expectations.

Randy Frederick, managing director of trading and derivatives at Charles Schwab, said by phone Friday that he wasn’t surprised to see stocks dip at the open, as the strong jobs report may have initially worried investors that the Federal Reserve might need to become more aggressive hiking interest rates to cool the economy as it keeps up its fight with high inflation.

“What’s more surprising is how much equities have rebounded since the open,” he said. “There’s such a huge appetite out there to get into this market,” said Frederick. “I’m quite shocked by the amount of momentum that’s out there.”

Randy Frederick, managing director of trading and derivatives at Charles Schwab, said by phone Friday that he wasn’t surprised to see stocks dip at the open, as the strong jobs report may have initially worried investors that the Federal Reserve might need to become more aggressive hiking interest rates to cool the economy as it keeps up its fight with high inflation.

“What’s more surprising is how much equities have rebounded since the open,” he said. “There’s such a huge appetite out there to get into this market,” said Frederick. “I’m quite shocked by the amount of momentum that’s out there.”

While the rebound faded, the technology-heavy Nasdaq Composite still advanced 3.3% this week and has soared 14.7% so far this year, according to FactSet data. And the S&P 500 booked a weekly gain of 1.6% for a rise so far in 2023 of 7.7%.

Meanwhile, fed-funds futures show traders see a 25 basis point interest rate hike by the Fed in March as nearly assured and raised the odds of another 25 basis point rise in May, putting market expectations for the peak in interest rates nearer the Fed’s forecast above 5%.

Although the jobs data may have rattled stock-market investors, some argued that the overall picture points to a more favorable picture for economic growth and inflation.

“The strong jobs report tells me more and more people have burned through their excess savings and going back to work. This is also helping to keep wage increases under control with a modest 0.3% increase,” said Bryce Doty, senior portfolio manager at Sit Fixed Income Associates.

“There is a combination of improving supply and consumer demand falling as savings evaporate. This phenomenon helps explain how the pace of inflation is slowing more quickly than expected,” he said, while arguing the Fed will “continue to misinterpret this process of a normalizing job market and want to punish the economy further.”

In another round of upbeat economic data, the Institute for Supply Management said Friday its services index rebounded to 55.2% in January after falling into contraction territory at the end of last year. Numbers over 50% indicate expansion in the economy.

Meanwhile, the Nasdaq snapped a three-day win streak after heavyweight tech companies reported results that fell short of Wall Street expectations late Thursday.

Shares of Amazon.com Inc. AMZN, -8.43% dropped 8.4% following the e-commerce giant reporting its worst annual loss on record after the least profitable holiday quarter since 2014.

The Federal Trade Commission is preparing a possible antitrust lawsuit against Amazon, the Wall Street Journal reported Friday, citing people familiar with the matter. The suit could challenge many of the tech giant’s business practices as being anticompetitive, the people said.

Alphabet Inc. GOOGL, -2.75% shares slid 2.7% as it reported weaker advertising spending over the holiday quarter, along with a slight miss on revenue and earnings. Apple Inc. AAPL, +2.44% shares bucked the trend, rising 2.4% after its earnings revealed the deepest sales drop in six years.

“The tech stocks, at least the largest ones, have had a mixed quarter. In summary, Tesla, Netflix and Facebook did well, while Microsoft, Apple, Amazon and Google disappointed,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank. “Is this balance enough to keep Nasdaq in a positive trend? It might not be,” Ozkardeskaya said.

Hopes that the Federal Reserve, which increased interest rates by 25 basis points this week, is nearing an end to its monetary policy tightening cycle has been helping to drive tech stocks higher in 2023. Fed Chair Jerome Powell also came across as more dovish than some expected at Wednesday’s news conference.

But others are worried that stocks have climbed too far too fast.

“I don’t really see how we have this sort of pie-in-the-sky, goldilocks” scenario for stocks in a universe of still relatively high inflation, said Patrick McDonough, a portfolio manager at PGIM Quantitative Solutions, in a phone interview Friday. “We’re not going to zero again,” he said of interest rates.

“So why would we continue to see these speculative growth companies that did well in a zero rate environment outperform?,” said McDonough. “I find that very strange.”

Companies in focus

- Shares of Ford Motor Co. F, -7.61% ended 7.6% lower after reporting a $2 billion loss in 2022 and mixed quarterly results.

- Nordstrom Inc. JWN, +24.79% shares surged 24.8% after The Wall Street Journal reported that activist investor, and GameStop chairman, Ryan Cohen has amassed a sizeable stake and is looking to shake up its board.

- Activision Blizzard Inc. ATVI, -2.43% agreed to pay $35 million to settle SEC charges that it failed to maintain disclosure controls related to complaints of workplace misconduct. The video game publisher also settled charges that it violated an SEC whistleblower protection rule, according to an SEC statement released Friday. Shares fell 2.4%.