The U.S. dollar may be losing its appeal as one of the few reliable safe-haven assets in times of economic and geopolitical uncertainty after an 18 month rally, and a further fall by the currency could fuel a 2023 stock-market rally, market analysts said.

But a near-term dollar bounce could pose a test for equity bulls.

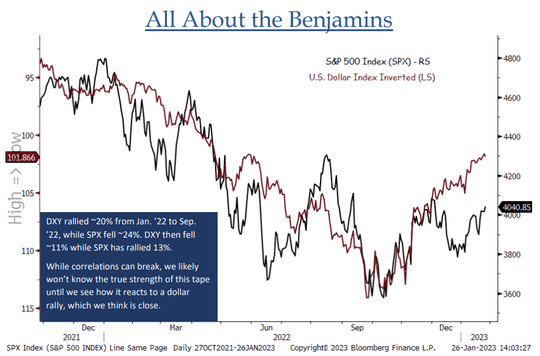

“Over the last 12-14 months there has been a clear inverse correlation between equities and the U.S. dollar…The DXY looks very poised for a countertrend rally here, and we don’t think we can get a true sense of the durability of this rally until we see how stocks react to a rising dollar,” said Jonathan Krinsky, chief market technician of BTIG, in a note last week (see chart below).

The ICE U.S. Dollar Index DXY, 0.10%, a measure of the currency against a basket of six major rivals, jumped 1.2% on Friday after an unexpectedly strong surge in U.S. January nonfarm payrolls which dented the markets’ perception that the end of the Fed’s interest rate increases is near after all.

Stocks fell Friday in the wake of the data, but the Nasdaq Composite COMP, -1.59% still logged its fifth straight weekly advance with a gain of 3.3%, while the S&P 500 SPX, -1.04% held on to a 1.6% weekly gain led by a continued surge for tech-related shares. The Dow Jones Industrial Average DJIA, -0.38% saw a 0.2% weekly fall.

The dollar may have been poised for a bounce. The dollar index fell to a nine-month low on Wednesday after the Federal Reserve, as expected, raised the fed-funds rate by 25 basis points, lifting its policy interest rate for the eighth straight meeting and signaling more than one further rise is still planned. But markets remained at odds with the Fed’s forecast for rates to peak above 5% and stay there, instead pricing in rate cuts before year-end.

While Powell continued to push back against rate-cut expectations and repeated his previous concern about easy financial-market conditions, he also acknowledged for the first time that “the disinflationary process has started.” That was enough for traders to bet the rate-hike cycle is nearing its end, with cuts soon in store.

The dollar surged for most of 2022, with the index jumping 19% in the first nine months of the year and hitting a peak of 114.78 in late-September, as higher interest rates in the U.S. drew in foreign investors. A surging dollar, described as a “wrecking ball,” was blamed in part for a plunge in stocks. The greenback’s gains came as climbing Treasury yields made bonds more attractive relative to other income earning assets.

The dollar’s subsequent overvaluation and market expectations that the Fed would begin scaling back its monetary tightening cycle have been the catalysts behind its pullback, said Larry Adam, chief investment officer at Raymond James.

“The tailwinds supporting the U.S. dollar in 2022 such as Fed hawkishness and favorable yield advantage turned into headwinds as we moved into 2023,” he said.

John Luke Tyner, portfolio manager and fixed-income analyst at Aptus Capital Advisors, said the main reason for the dollar outperforming the rest of the world last year was that the Federal Reserve was leading global central banks in this interest-rate hiking cycle. Now other central banks are playing catch-up.

“Where they’re at in the tightening schedule is behind us, and so as they continue to catch up, it should help strengthen the euro versus the dollar,” Tyner said.

Both the European Central Bank and the Bank of England on Thursday delivered expected half percentage point interest rate hikes in their attempts to wrestle down inflation. While the ECB signaled more hikes would likely follow, the BOE suggested that it might soon pause.

The dollar’s strength has eroded in the past four months, falling 10%, according to Dow Jones Market Data.

“The dollar was probably too overvalued based on ridiculous expectations for the Fed to hike to 6% — where you saw some people getting really giddy in those expectations,” Tyner told MarketWatch on Thursday.

However, while Powell and his colleagues are determined to keep interest rates elevated “for some time,” investors still don’t seem to believe that they will stick with elevated rate hikes in 2023. Traders projected a 52% probability that the rate will peak at 5-5.25% by May or June, followed by almost 50 basis points of cuts by year-end, according to the CME’s FedWatch tool.

As a result, market analysts see the dollar’s as closer to its end and is likely to fall further in 2023 as inflation cools and recession risks decline.

Gene Frieda, global strategist at Pacific Investment Management Company, or Pimco, said the dollar’s yield advantage versus other developed economies will narrow as the Fed moves toward an expected pause in its hiking cycle in the first quarter of 2023.

Frieda and his team said in a note earlier this week that the dollar’s strength in 2022 was aided in part a substantial risk premium imposed on European assets for the tail risk that Russian energy supplies could be cut off, or even worse, a “nuclear event.” A risk premium is the additional return an investor demands for holding riskier assets over risk-free assets.

Frieda acknowledged the possibility that inflation could prove stickier in the U.S. than in other advanced economies, or that monetary policy may tight for an extended period. That would suggest the risk premium in the dollar market could remains sizable, but “these premiums could decline further as shocks recede and evidence builds that last year’s surge in inflation is well and truly improving and abating.”

“We expect the USD will continue to lose its appeal as the safe-haven currency of last resort,” Frieda said.

However, it is not all bad news. A slide in greenback may catalyze rallies in risk assets such as stocks, which have kicked off the new year on a bright note.

As of Friday, the dollar index had dropped more than 10% from Sept. 27, when it hit a two-decade high, while the S&P 500, the large-capitalization index for the stock market, has gained over 11% since.

At the dollar’s 2022 high, the DXY was up 19% for the year, while the S&P 500 had slumped 22%, according to Dow Jones Market Data.

Meanwhile, some analysts warned against using the recent inverse correlation between the dollar and stocks as a reason to jump back into equities other risk assets.

“It could be that investors are taking this announcement from the Fed and their current sentiment to mean that they can go back into riskier assets, but I wouldn’t necessarily say it is a guarantee,” said Shelby McFaddin, senior analyst of Motley Fool Asset Management.

“Certainly we can say correlation, not causation…You could say that it’s an indication, but not that it is the indicator,” McFaddin added.