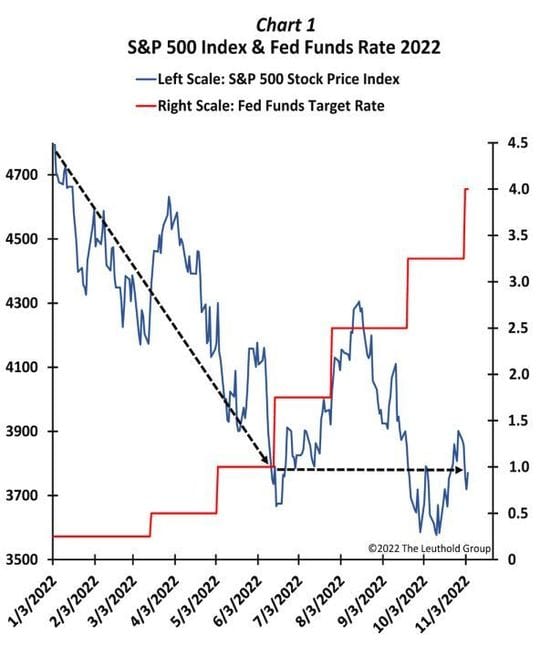

The S&P 500 SPX, +0.96% is trading at roughly the same level from five months ago, which could mean U.S. stocks are poised to keep on rallying after their stellar performance in October, according to Jim Paulsen, chief investment strategist at the Leuthold Group.

With less than two months left in the year, Paulsen said it’s notable that stocks are trading at roughly the same levels from early June, considering the steady drumbeat of “bad news” that investors have endured during the intervening months.

Some examples cited by Paulsen include the most aggressive Federal Reserve interest-rate hikes in decades, along with an increasingly inverted Treasury yield curve and disappointing third-quarter earnings from Amazon.com Inc. AMZN, -0.49%, Meta Platforms Inc. META, +6.53% and other megacap technology names that once led the market higher.

While many economists are worried about the U.S. economy sliding into a recession next year, the outlook outside North America is even more dire, Paulsen pointed out. An energy crisis has roiled the European economy as the war in Ukraine has dragged on. In China, President Xi Jinping’s “COVID zero” policy has sapped growth.

Yet U.S. stocks have taken all this in stride, bouncing back after briefly tumbling to their lowest levels since late 2020 last month. As of Monday, the S&P 500 was trading more than 5% off intraday lows reached on Oct. 13.

That stocks are essentially flat during the period cited by Paulsen doesn’t mean the market hasn’t been volatile. Conversely, realized volatility has been conspicuously elevated since the start of 2022.

Since Jan. 1, the S&P 500 has risen or fallen by 2% or more during 42 trading sessions, according to Dow Jones Market Data. That’s compared with an average of 11.4 such moves per year over the last decade.

But according to Paulsen, the fact that stocks haven’t been more volatile is worth celebrating.

“Somehow, someway, despite chronic and seemingly debilitating news over the last five months, the S&P 500 is 5.5% above its bear market low and ‘flat’ for the last ‘five’ months,” Paulsen said.

“Perhaps the stock market is just one more punch away from dropping to the mat and not answering the 10-count. Or maybe, despite a flurry of punches, the stock market’s resilience implies it may yet surface as a winner.”

To be sure, U.S. stocks have fallen sharply since the start of the year, with the energy sector a notable exception.

The S&P 500 rose 0.7% on Monday, leaving it down 20.3% since the start of the year. The Dow Jones Industrial Average DJIA, +1.31% rose more than 400 points on Monday, shaving its year-to-date loss to just 9.6%, compared with a drop of more than 20% at the lows in September.

The Nasdaq Composite COMP, +0.85% has lagged, with a year-to-date loss of 32.6%, although it too was trading higher on Monday.

Big tech may be having a brutal year, but cyclical sectors like industrials, energy and materials, as well as small-cap stocks like the constituents of the Russell 2000 RUT, have helped to pick up the slack. This bodes well for the market’s performance in the months ahead, Paulsen said.