Company is making ‘meaningful progress with mid-market sellers,’ CFO says of merchant business

Square once again saw booming use of its Cash App ecosystem, helping the payments company easily exceed expectations for its first quarter.

Shares of Square SQ, 5.82% rose more than 2% in after-hours trading Thursday.

The company generated net income of $39 million, or 8 cents a share, whereas it posted a net loss of $106 million, or 24 cents a share, in the year-earlier quarter. After adjustments, Square earned 41 cents a share, versus a loss of 2 cents a share a year earlier. The FactSet consensus called for 17 cents a share in adjusted earnings.

Square posted revenue of $5.1 billion in the first quarter, up from $1.38 billion a year ago, fueled by the continued growth of the company’s Cash App, which allows for peer-to-peer trading, bitcoin BTCUSD, 2.58% purchases and stock trading. Analysts tracked by FactSet were expecting $3.34 billion in revenue.

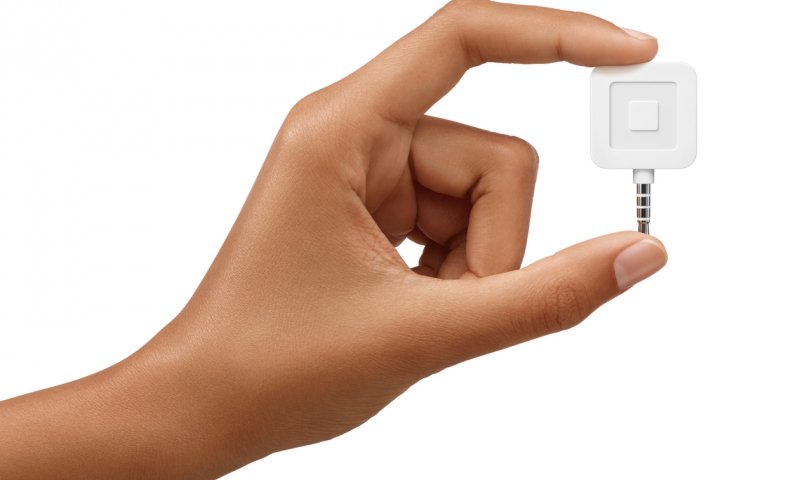

The company saw $960 million in transaction-based revenue, $558 million in subscription and services revenue, $28 million in hardware revenue and $3.5 billion in bitcoin revenue.

While the bitcoin wallet is a big revenue driver for Square, the company only generated $75 million in gross profit from this feature.

The company is also seeing traction with its Cash Card, a debit card that lets users spend the funds in their Cash App wallets. Square saw the number of monthly Cash Card users surpass 10 million in March, while weekly active users nearly doubled on a year-over-year basis, hitting 7 million on average.

Square’s seller gross payment volume rose to $29.8 billion from $24.7 billion a year earlier. The company is making “meaningful progress with mid-market sellers,” Chief Financial Officer Amrita Ahuja said on a call with reporters.

The Cash App continues to benefit from growing inflows into the mobile wallet. Customers added about 55% more funds to the Cash App in March than they did in February, Square disclosed in its shareholder letter.

“A primary driver of Cash App’s gross profit growth has been inflows, or the amount of money our customers pull into Cash App,” the company said in its letter, and one of its goals for the year is to make it easier for customers to do so.

Square is also working on merging its seller and Cash App networks. During the first quarter, Square integrated its loyalty program into the Cash App so that customers who purchase items from a seller using Square’s loyalty feature will be able to open the Cash App to manage their rewards.

“[W]e believe this seamless integration will help bring new customers into Cash App while also deepening the seller-buyer connection,” the company said in its shareholder letter.

During April, Square saw 144% growth in seller GPV relative to a year earlier, or 21% growth relative to two years earlier, a metric the company provided to show a comparison to pre-pandemic times. The company also noted that April gross-profit growth for the Cash App slowed relative to a year earlier, given that the comparable 2020 period benefited from stimulus disbursements.