Nasdaq logs nine consecutive record closes

Stocks rang in another round of closing records Monday as investors focused on a report that China will cut import tariffs for frozen pork, pharmaceuticals and some high-tech components starting Jan. 1.

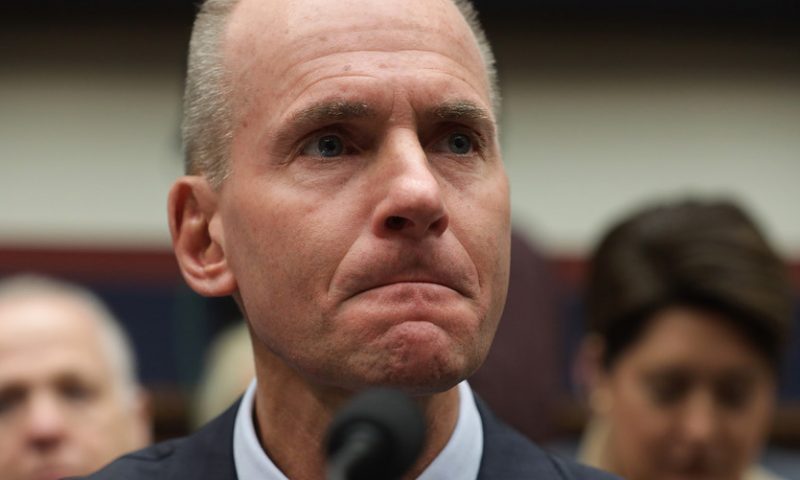

Investors were also eyeing developments at Boeing, after the Dow component announced that president and CEO Dennis Muilenburg has resigned amid controversy surrounding its 737 Max jet.

How did benchmarks perform?

The Dow Jones Industrial Average DJIA, +0.34% rose 96 points, or 0.3%, at 28,551.53 to book its third consecutive record finish, with gains from Boeing Co. delivering the biggest tailwind to the index. The S&P 500 index SPX, +0.09% advanced 3 points, or 0.1%, at 3,224.01, booking its third straight record close. The Nasdaq Composite Index COMP, +0.23% climbed 21 points, or 0.2%, at 8,945.65, recording its ninth uninterrupted record close, its longest such streak since 1998.

The S&P and Nasdaq both hit new intraday highs Monday morning.

Last week, the Dow booked a 1.1% weekly gain, the S&P 500 index returned 1.7% over the period, while the Nasdaq Composite Index climbed 2.2%, marking its largest weekly gain since Aug. 30, according to FactSet data. All three benchmarks produced a second consecutive weekly advance.

What’s driving the market?

The Dow received a boost from Boeing Co. BA, +2.91% shares, which rose 3% Monday on the news that Muilenburg was resigning from the aircraft maker effective immediately. Chief Financial Officer Greg Smith will serve as interim CEO “while Mr. Calhoun exits his non-Boeing commitments,” according to a statement from the company. Current Chairman David L. Calhoun will become president and CEO effective Jan. 13.

The Dow component has significantly underperformed the S&P 500 year-to-date, up just 4.8% versus the large-cap index’s nearly 29% rise, amid the worldwide grounding of its 737 Max airliner, following the crashes of two of those planes in October 2018 and on March 10.

Boeing shares are the most influential of the index’s 30 components.

“It’s a positive for Boeing in that they just needed to move on from somebody who hasn’t dealt with the situation well,” Tom Martin, senior portfolio manager at Globalt, told MarketWatch. “By making that decision, the company acknowledges they are ready to move forward with new emphasis.”

Wall Street’s main stock indexes had been set to gain as the U.S. and China attempt to show signs of cementing a partial trade agreement that could set the stage for a more stable business climate in 2020.

Thus far, China’s cabinet has agreed to lower tariffs for all trading partners on more than 859 types of products to below the rates that most-favored nations enjoy, the Finance Ministry said Monday, according to the Wall Street Journal.

The Journal reported that the lowered import duties will apply to frozen pork, as China aims to shore up its meat supplies amid an outbreak of swine fever. Tariffs on some of the products will fall to zero.

Bloomberg News es timates that the total imports affected could be $389 billion, or about 18% of China’s total imports, based on 2018 import data.

The move is the latest in a sign that Beijing and Washington are near completion of a partial trade agreement that would achieve a lasting detente in a tariff conflict that has persisted for almost two years and has impeded global and domestic economic expansion, economists say.

China’s measures “are a positive indicator for the de-escalation of tensions,” Globalt’s Martin said. “The accumulation of recent news on trade has been generally positive, which may help the market continue to drift higher.”

Trade for Monday kicked off a shortened week of action, with Tuesday representing a half-day session and most global markets closed on Wednesday for Christmas.

Investors parsed data on orders for long-lasting goods in November, which fell 2%, the largest decline since May, driven by a 72.7% decline in orders for defense aircraft and parts. Economists polled by MarketWatch expected a 1% increase. Orders for core capital-expenditure goods, a key measure of business investment, rose 0.1%.

New-home sales in November were at an annual rate of 719,000, a 1.3% increase from the revised October rate of 710,000, but below the 740,000, expected by economists, according to a MarketWatch poll.

What stocks were in focus?

Shares of Apache Corp. APA, +17.29% rallied 17.8% Monday, after the oil-and-gas explorer announced an agreement with French company Total SA FP, +0.24% to acquire a 50% working interest in Block 58 of the offshore Guyana-Suriname basin.

Aurora Cannabis Inc. ACB, -10.67% announced over the weekend that Chief Corporate Officer Cam Battley has left the company. Its shares ended 10.2% lower, contributing to a 59% drop this year.

Online-gambling company DraftKings Inc. said Monday it will become a public company via an acquisition of Diamond Eagle Acquisition Corp. DEAC, +6.59% and SBTech, a gaming technologies firm. The deal is expected to close in the first half of 2020, when the combined company will trade under a new symbol, listed on the Nasdaq. Diamond Eagle shares rose 6.1% Monday.

Shares of Rite Aid Corp. RAD, +6.99% surged 6.8% after James Peters, the pharmacy retailer’s chief operating officer, said its brand of ice cream contributed to the better-than-expected earnings beat in the third quarter.

How did other markets trade?

The yield on the 10-year U.S. Treasury note TMUBMUSD10Y, +0.23% rose 1.8 basis points to 1.934%, its highest close since July 31, according to Tradeweb data.

Oil prices moved higher; West Texas Intermediate Crude for February delivery CLG20, +0.35% ticked up 8 cents, or 0.1% to settle at $60.52 a barrel on the New York Mercantile Exchange. Gold prices also edged higher, with the price of an ounce of gold GCG20, +0.41% rising $7.80, or 0.5%, to settle at a more than six-week high of $1,482.50.

The U.S. dollar DXY, +0.04% was edging lower relative to a basket of its rivals, with the ICE Dollar index, a measure of the buck against six rival currencies, down less than 0.1%.

In Asia overnight, stocks closed mixed; with the China CSI 300 000300, +0.65% losing 1.3%, Japan’s Nikkei 225 NIK, +0.04% gaining less than 0.1% and Hong Kong’s Hang Seng HSI, -0.15% rising 0.1%.

European stocks ended mixed Monday, with the Stoxx Europe 600 SXXP, +0.12% down less than 0.1%. The U.K.’s FTSE 100 index UKX, +0.11% gained 0.5%.