Switch and security strength will be needed as analysts doubt fiscal third-quarter forecast

If Cisco Systems Inc. signals that businesses are failing to splurge on capital spending as the outlook on tariffs and the economy remains murky, it could mean a rough 2019 for the networking giant and spread more fear across the tech spectrum.

When Cisco CSCO, +1.05% reports fiscal second-quarter earnings after the market closes on Wednesday, executives will provide a closely watched forecast from a company that is typically seen as a bellwether for tech and the economy. While investors applauded Cisco after its last earnings report as execs said tariffs from the U.S.-China trade war were not likely to slow growth and that the end of headwinds from memory-chip pricing was in sight, analysts appear less optimistic on enterprise spending seven weeks into 2019.

Instinet analyst Jeffrey Kvaal, who downgraded Cisco to a neutral rating in December and has a $55 price target on the stock, wrote Friday that “2019 data points have further sapped our confidence in sustained strength in both IT and service provider spending,” leaving little room for an uptick.

Piper Jaffray analyst James Fish, who has an overweight rating and a $50 price target on Cisco, voiced concern that Cisco’s fiscal third-quarter outlook may be disappointing.

“Our discussions with partners this quarter suggest that there was some net pull-in of demand related to the tariffs, which took pipeline away from FQ3,” Fish wrote. “Additionally, investors have been much more skeptical in recent weeks around the software transition, as fewer details have been provided by the company.”

“We issue some caution on shares of Cisco into the print given the potential guidance miss,” he warned.

If Cisco’s forecast comes in strong, especially on equipment sales, it could signal that recent fears from chip companies’ forecasts was specific to those companies, not the entire tech ecosystem. Analysts on average currently expect Cisco to report $12.83 billion in the fiscal third quarter that just began.

What to expect

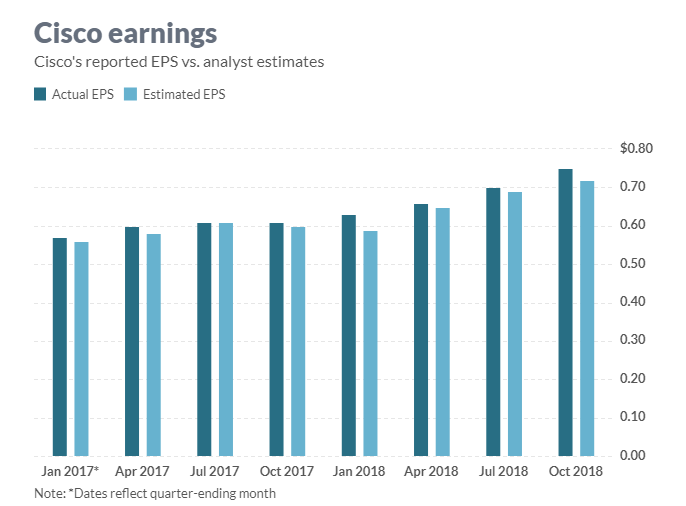

Earnings: Of the 27 analysts surveyed by FactSet, Cisco on average is expected to post adjusted earnings of 72 cents a share for the second quarter. Cisco forecast 71 cents to 73 cents a share. Estimize, a software platform that uses crowdsourcing from hedge-fund executives, brokerages, buy-side analysts and others, calls for earnings of 74 cents a share.

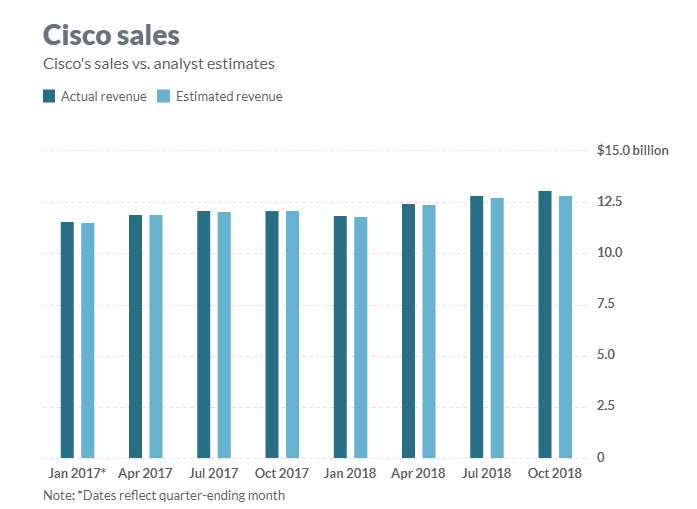

Revenue: Wall Street expects revenue of $12.41 billion from Cisco, according to 25 analysts polled by FactSet. That’s down from $12.52 billion forecast at the beginning of the quarter. Cisco predicted revenue of $12.48 billion to $12.72 billion. Estimize expects revenue of $12.52 billion.

Analysts surveyed by FactSet expect Cisco’s product revenue to rise 5.1% to $9.15 billion. Of that, analysts expect $7.07 billion in infrastructure platform revenue, $1.35 billion in applications revenue, $629.2 million in security revenue and $96.2 million in sales of “other products.” Service revenue is expected to rise 2.1% to $3.25 billion from a year ago.

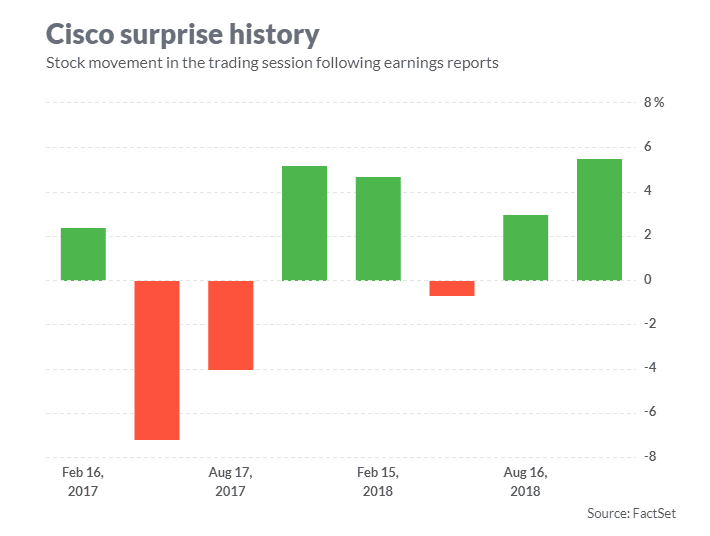

Stock movement: Since Cisco’s earnings report in mid-November, shares have gained 6.5%, while the Dow Jones Industrial Average DJIA, -0.25% which counts Cisco as a component, has advanced 0.1%. Over that time, the S&P 500 indexSPX, +0.07% has gained 0.2%, and the tech-heavy Nasdaq Composite IndexCOMP, +0.14% rose 2.3%.

What analysts are saying

Kvaal was optimistic about Cisco’s Catalyst 9000 switch program, which includes a multiyear software subscription that gives the company a recurring revenue stream, and the growing security business which has been bolstered by the acquisition of Duo Security.

“Cat9K and security strength remain bright spots,” he wrote in a preview.

“The Cat9K has performed ahead of Cisco’s internal expectations and still has a long runway. Security has also maintained three consecutive quarters of robust double-digit growth. The integration of Duo Security’s SaaS-based solutions should further bolster Cisco’s security portfolio.”

Deutsche Bank analyst Vijay Bhagavath is more optimistic about Cisco’s outlook than Kvaal or Fish.

“While the headline optics — i.e. misses or beats to street expectations for top line and EPS — are important report card metrics, the stock trades mainly on the direction and trend line of ‘Product Orders’ and ‘Management Commentary’ on any directional changes in end market and geo demand trends,” wrote Bhagavath, who has a buy rating and a $60 price target on Cisco.

Given this, he expects a “seasonally strong April and July Quarter, and potential for no meaningful downtick in management tone or commentary.”

Bhagavath backed this view noting a “stronger than expected” refresh on the Catalyst 9000 and that a majority of buyers preferred the premium versions of the company’s network software and security features.

Of the 30 analysts who cover Cisco, 22 have buy or overweight ratings and eight have hold ratings, with an average price target of $52.20.