All the political factors are correlated,’ investor says

It’s the natural instinct of seasoned investors to ignore politics, as the vast majority of Washington grandstanding is just that — talk that will do little to change the fundamentals of corporate profits and stock valuations.

But such impulses could be less prudent in a year when the stock market has been driven almost entirely by monetary policy and the seemingly daily twists in U.S.-China trade negotiations. As Willie Delwiche, market strategist at R.W. Baird told MarketWatch: “The lesson of the past year is that talk matters, maybe even more than action.”

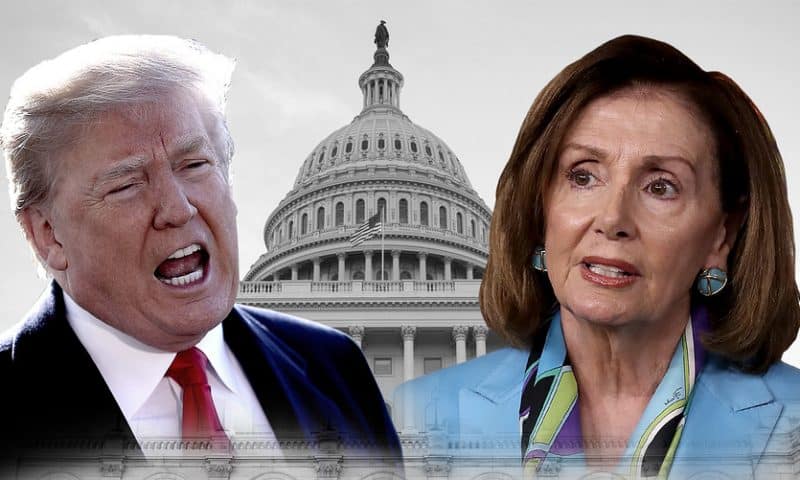

Speaker Nancy Pelosi on Sept. 25 said the House would move ahead with an official impeachment effort, prompted by the whistleblower controversy. The question on the minds of Wall Street strategists and investors revolve around how the allegations — that President Donald Trump had encouraged Ukrainian officials to produce damaging information about Democratic presidential hopeful Joe Biden — and the proceedings around impeachment affect a range of market-driving factors in the weeks and months ahead.

Correlation

“All the political factors are correlated, and when you push on one factor it changes the probable outcomes of other factors,” Jay Hatfield, co-founder and portfolio manager at Infrastructure Capital Management, told MarketWatch.

Major stock indexes logged a second straight weekly decline, but most of the pressure was attributed to developments on the trade front. On Friday, equities turned lower after a news report said the White House was weighing a proposal to curb U.S. portfolio flows into China. The Dow Jones Industrial Average DJIA, -0.26% saw a 0.4% fall for the week, while the S&P 500 SPX, -0.53% declined 1%. The Nasdaq Composite COMP, -1.13% posted a 2.2% weekly drop.

One important consideration aside from the potential political danger for the president, is the possibility that the focus on Ukraine damages Biden’s prospects in a very competitive race for the Democratic presidential nomination.

Trump, during a July phone call, asked Ukrainian President Volodymyr Zelensky to “look into” Biden’s efforts to remove Ukraine’s top prosecutor in 2016, when he was vice president. Trump surrogates have argued that this is an example of corruption on Biden’s part, because Biden’s son Hunter sat on the board of Ukraine’s largest private gas company, Burisma Holdings, which had been investigated for corruption in 2014.

But according to a report by Bloomberg, the investigation into Burisma was shelved long before Biden attempted to have the prosecutor removed. Biden said his efforts were aimed at increasing corruption oversight rather than helping Burisma avoid it.

Warren rising

Nevertheless, the imbroglio likely won’t help Biden’s chances in coming primary contests. The main beneficiary of a setback would appear to be Massachusetts Senator Elizabeth Warren, who is gaining in the polls to the point where she is arguably the front-runner.

“Warren rising in the polls is arguably more important than impeachment,” Hatfield said.

“She’s the most anti-corporate candidate we’ve had since World War II, and maybe ever. I would argue markets have been resilient in the face of” rising odds of a Warren nomination, given the volatility he believes her election could trigger, he added.

Other analysts see the impeachment proceedings as a potential catalyst for developments in U.S.-China trade relations. Investors have been given reason to hopeand to despair that greater certainty on tariffs and trade policy will soon be delivered by the Trump administration, but Brent Schutte, chief investment strategist at Northwestern Mutual Wealth Management, told MarketWatch that the increased political pressure on the president makes a deal more likely.

“The president will want to shift the narrative to a trade deal,” he said. “When push comes to shove, he wants to put points on the board for the 2020 election, and the biggest point he can put up is a deal with China.”

Gridlock

The latest escalation of hostilities between congressional Democrats and the Trump administration could also imperil other important legislation. “We will need to monitor for whether further polarization in Washington could have a knock-on effect on bipartisan cooperation over budget issues or infrastructure spending,” wrote Michael Ryan, chief investment officer for Americas at UBS, in a Thursday note.

Threats of another shutdown loom, as Congress has only been able to approve stopgap spending measuresthat avoid hot-button issues like funding for an extension of the southern U.S. border wall, while passage of a renegotiated North American free-trade agreement could also be put in doubt as the impeachment inquiry takes center stage.

Week ahead

Along with the many political variables for investors to consider, the coming week will feature some key economic reports, including the closely watched ISM manufacturing index on Tuesday, along with data on August construction spending.

On Thursday, ISM will issue its reading of the services sector, while the government will issue new estimates of factory orders for August and new applications for jobless benefits for the week ended Sept. 28.

Wednesday will bring Automatic Data Processing Inc.’s ADP, -1.74% report on private sector job growth, ahead of Friday’s all-important nonfarm payrolls report, where investors will get an updated snapshot of the U.S. labor sector and wage growth. Any cracks in this picture could create more volatility, given the importance of a strong U.S. consumer to the longevity of the current economic expansion.

In corporate news, McCormick & Co. Inc. MKC, -2.37% is expected to deliver an earnings report before the start of trade on Tuesday, while Stitch Fix Inc. SFIX, -1.77% will release results after the close. Bed Bath and Beyond Inc. BBBY, +0.92% will report Wednesday along with home builder Lennar Corp. LEN, -1.53%.

On Thursday, investors will receive financial results from Constellation Brands Inc. STZ, -0.03%, Costco Wholesale Corp. COST, -0.80% and PepsiCo Inc. PEP, -0.09%