AMD sees third-quarter sales of up to $1.85 billion, Street expected $1.94 billion

Advanced Micro Devices Inc. shares dropped in the extended session Tuesday after the chip maker reported earnings that met expectations amid tariff constraints, but disclosed a revenue outlook that fell below the Wall Street consensus because of weaker-than-expected console sales.

AMD AMD, +1.16% shares, which had fallen more than 5% after hours, were last down 3%, following a 1.2% rise in the regular session to close at $33.87. In comparison, the S&P 500 index SPX, -0.26% declined 0.3%, the tech-heavy Nasdaq Composite Index COMP, -0.24% slipped 0.2%, and the PHLX Semiconductor Index SOX, -0.26% declined 0.3% in the regular session.

AMD expects third-quarter revenue of $1.75 billion to $1.85 billion, while analysts had forecast sales of $1.94 billion on average, according to FactSet.

“The sequential and year-over-year increases are expected to be driven by rising EPYC, and Radeon product sales, partially offset by lower than expected semicustom sales,” said Devinder Kumar, AMD chief financial offer, on the call. Chips for game consoles fall into AMD’s semicustom sales.

“AMD met expectations for the quarter, but took its forecast down based on softness in the game console market,” Pat Moorhead, principal analyst at Moor Insights and Strategy, said in emailed comments.

“I believe this softness is driven by consumers getting excited for the next-generation consoles from Microsoft MSFT, -0.48% (Scarlett) and Sony (PS5) and delaying purchases,” Moorhead said. “Supporting this, Microsoft and Sony console sales recently were also both down.

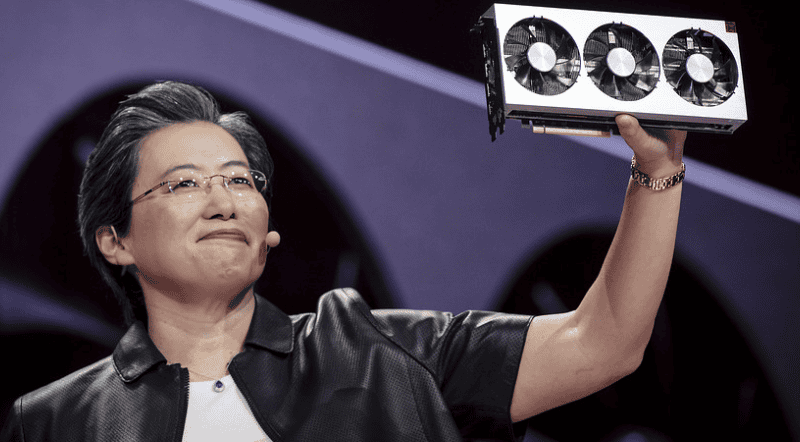

“In the second quarter, we stopped shipping to customers added to the U.S. entities list,” AMD Chief Executive Lisa Su said on the conference call. “While we remain cautious, given the fluidity of the situation, the impact to date has been limited and offset by growing momentum in other parts of our business.”

The company reported second-quarter net income of $35 million, or 3 cents a share, compared with $116 million, or 11 cents a share, in the year-ago period. Adjusted earnings were 8 cents a share. Revenue declined to $1.53 billion from $1.76 billion in the year-ago quarter.

Analysts surveyed by FactSet had forecast earnings of 8 cents a share on revenue of $1.52 billion.