CRH (NYSE:CRH) is back in focus after the company reported fresh share repurchases under its ongoing US$300 million buyback programme, alongside increased holdings from large institutional investors in recent regulatory filings.

At a share price of US$122.41, CRH has had a modest 90 day share price return of 3.39%, while its 1 year total shareholder return of 24.97% and very large 3 and 5 year total shareholder returns point to momentum that, for now, still leans positive despite recent softer 30 day share price performance.

If CRH’s buybacks and institutional interest have you thinking about where else capital and insider confidence might be lining up, this could be a good time to broaden your search with fast growing stocks with high insider ownership.

With CRH trading at US$122.41 against an average analyst price target of about US$140, and with both buybacks and long term returns in focus, you might ask yourself: is there still upside here, or has the market already priced in future growth?

Most Popular Narrative: 12.6% Undervalued

CRH’s most followed narrative pegs fair value at about $140, compared with the last close of $122.41, and builds that gap on specific growth and profitability assumptions.

Want to see what kind of revenue runway and margin profile are baked into that valuation, and how profit multiples are expected to evolve over time? The full narrative lays out a detailed earnings path, share count assumptions, and the discount rate that ties it all back to today’s $140 fair value mark.

However, you also have to weigh the reliance on public infrastructure funding, as well as the execution and integration risks that come with CRH’s acquisitive growth approach.

Another View Using Current Earnings

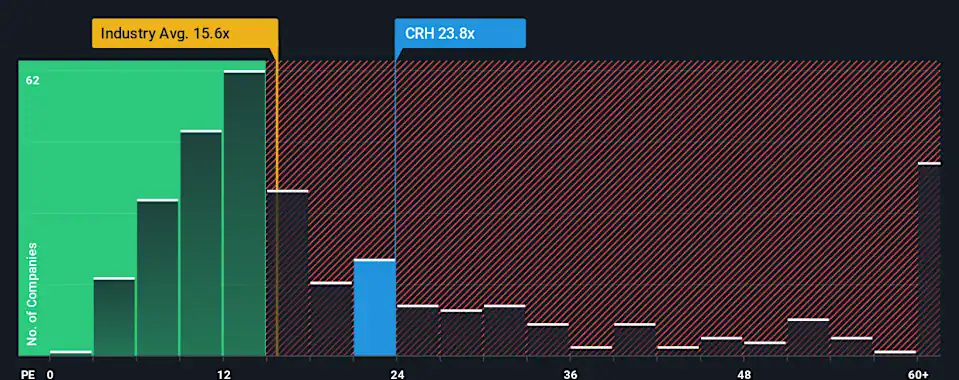

The narrative fair value of about $140 rests on long term growth assumptions, but today the market is already paying a P/E of 24.1x for CRH, which is higher than the global Basic Materials industry at 15.4x and below peers at 27.3x. Our fair ratio sits at 27x, so how much room do you think is left for error?

Build Your Own CRH Narrative

If you interpret the numbers differently or prefer to rely on your own analysis, you can test your assumptions and build a full CRH story in minutes by starting with Do it your way.

A great starting point for your CRH research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.