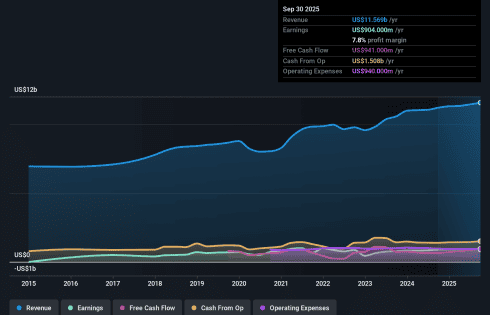

Yum China Holdings (NYSE:YUMC) reported earnings growth of 1.2% over the past year, slightly lower than its five-year annual average of 1.8%. Net profit margins edged down to 7.8% from 8% last year, with analysts forecasting future annual earnings growth of 9.5% and revenue growth of 5.9%, both of which trail broader US market averages. Despite these modest growth rates, investors may find value in Yum China’s lower price-to-earnings ratio of 17.5, which is below both industry and peer group averages. The share price also remains under recent analyst targets and a fair value estimate of $52.59. Although there is a minor concern about dividend sustainability, the company’s overall financials reflect solid profitability and relative value, balanced against tempered growth expectations.

Next, we will compare these headline results with the market narratives followed by the Simply Wall St community to see how perspective and reality match up.

Margin Expansion Backed by Cost Efficiencies

- Analysts estimate Yum China’s profit margins will rise from 8.0% today to 8.7% in three years, reflecting higher operational efficiency even as net profit margins recently slipped to 7.8%.

- According to analysts’ consensus view, cost controls and a greater mix of digital investments are expected to drive this improvement in margin.

- Consensus notes that deepening digital initiatives, such as the expansion of the Super App and AI-driven automation, should improve operational efficiency and help counteract wage and commodity cost pressure.

- At the same time, supply chain improvements and a growing franchise store mix are expected to help mitigate margin headwinds from rising delivery rider costs and competitive pressures.

Delivery Growth Boosts Sales Amid Competitive Pressures

- Delivery now comprises 45% of total sales, expanding the addressable market and supporting same-store sales growth across all major platforms.

- Consensus narrative highlights the opportunity in delivery scale but maintains a cautious tone regarding rising costs and diminishing ticket sizes:

- While a broader delivery presence is expected to sustain top-line momentum, consensus notes that higher delivery and labor costs could put pressure on restaurant-level margins, especially as competition from local quick-service restaurant brands increases.

- Expanding into lower-tier cities carries risk, since average order sizes are inherently smaller in these areas. This requires increased transaction volumes to offset potential revenue dilution.

Discount to Analyst Target Supports Valuation Case

- With the current share price at $43.87, Yum China trades at a 24.4% discount to the analyst price target of $57.99, while also remaining below the DCF fair value of $52.59.

- Analysts’ consensus suggests that this gap reflects both confidence in future earnings growth and tempered caution given below-market growth projections:

- Consensus argues that ongoing digital investments and expansion initiatives support a premium. However, the price-to-earnings multiple of 17.5 remains below industry averages, which is consistent with more modest expected growth rates.

- Analysts emphasize that, for this upside to be realized, revenue must reach $14.0 billion and earnings $1.2 billion by 2028. This would justify a higher future PE of 21.7x compared to today’s valuation.

Analysts see the discounted share price as a window of opportunity, but urge investors to watch for execution on revenue and margin targets.