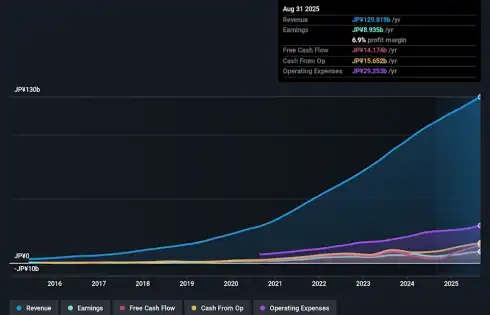

SHIFT (TSE:3697) delivered a net profit margin of 6.9%, up from 4.6% a year ago, and reported earnings growth of 74.3% year-over-year. This growth is well above its five-year average rate of 24.7% per year. The company’s earnings quality remains high, with both revenue and earnings expected to outpace the broader Japanese market, according to forecasts of 15.7% annual revenue growth and 20.5% annual earnings growth. For investors, the story centers around consistent growth, rapidly improving margins, and strong profit expectations. All of this is set against a share price that trades just below its estimated fair value.

Following the headline performance, we will look at how the numbers stack up against the most widely followed market narratives. This will highlight where they fit and where they diverge.

Profit Margin Expansion Leaves Room for More

SHIFT’s net profit margin improved to 6.9%, up from 4.6% last year, signaling a broader boost in profitability beyond just top-line growth.

Strong profit margin gains heavily support the view that SHIFT is riding enterprise digitalization trends, driven by stable contract wins and a growing client base.

Growth Outpaces Industry but Comes at a Premium

While revenue and earnings are forecast to rise 15.7% and 20.5% per year, respectively, SHIFT’s P/E ratio sits at 36.2x versus the Japanese IT industry average of 17.4x and peer average of 23.6x.

What is surprising is that despite commanding more than a 2x premium to the industry average, the company’s robust growth and earnings consistency keep bullish optimism high.

DCF Fair Value Signals Undervaluation Despite Price Premium

The current share price of ¥1227.5 trades below its DCF fair value estimate of ¥1356.07, even as its P/E remains elevated versus the broader industry.

The prevailing market view acknowledges this valuation tension, suggesting that while SHIFT trades at a headline premium, the discounted cash flow approach highlights latent value, especially if growth forecasts hold up.

Next Steps

Don’t just look at this quarter; the real story is in the long-term trend. We’ve done an in-depth analysis on SHIFT’s growth and its valuation to see if today’s price is a bargain. Add the company to your watchlist or portfolio now so you don’t miss the next big move.

See What Else Is Out There

SHIFT’s premium valuation leaves investors with little margin for error if future growth slows or competitors narrow the gap.

Seeking better value for your next investment? Find stocks trading at attractive prices with strong growth prospects by using these 877 undervalued stocks based on cash flows right now.