The main aim of stock picking is to find the market-beating stocks. But in any portfolio, there will be mixed results between individual stocks. So we wouldn’t blame long term Ball Corporation (NYSE:BALL) shareholders for doubting their decision to hold, with the stock down 38% over a half decade. And it’s not just long term holders hurting, because the stock is down 22% in the last year.

With that in mind, it’s worth seeing if the company’s underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

To quote Buffett, ‘Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace…’ One way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and its earnings per share (EPS).

During the unfortunate half decade during which the share price slipped, Ball actually saw its earnings per share (EPS) improve by 14% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

Due to the lack of correlation between the EPS growth and the falling share price, it’s worth taking a look at other metrics to try to understand the share price movement.

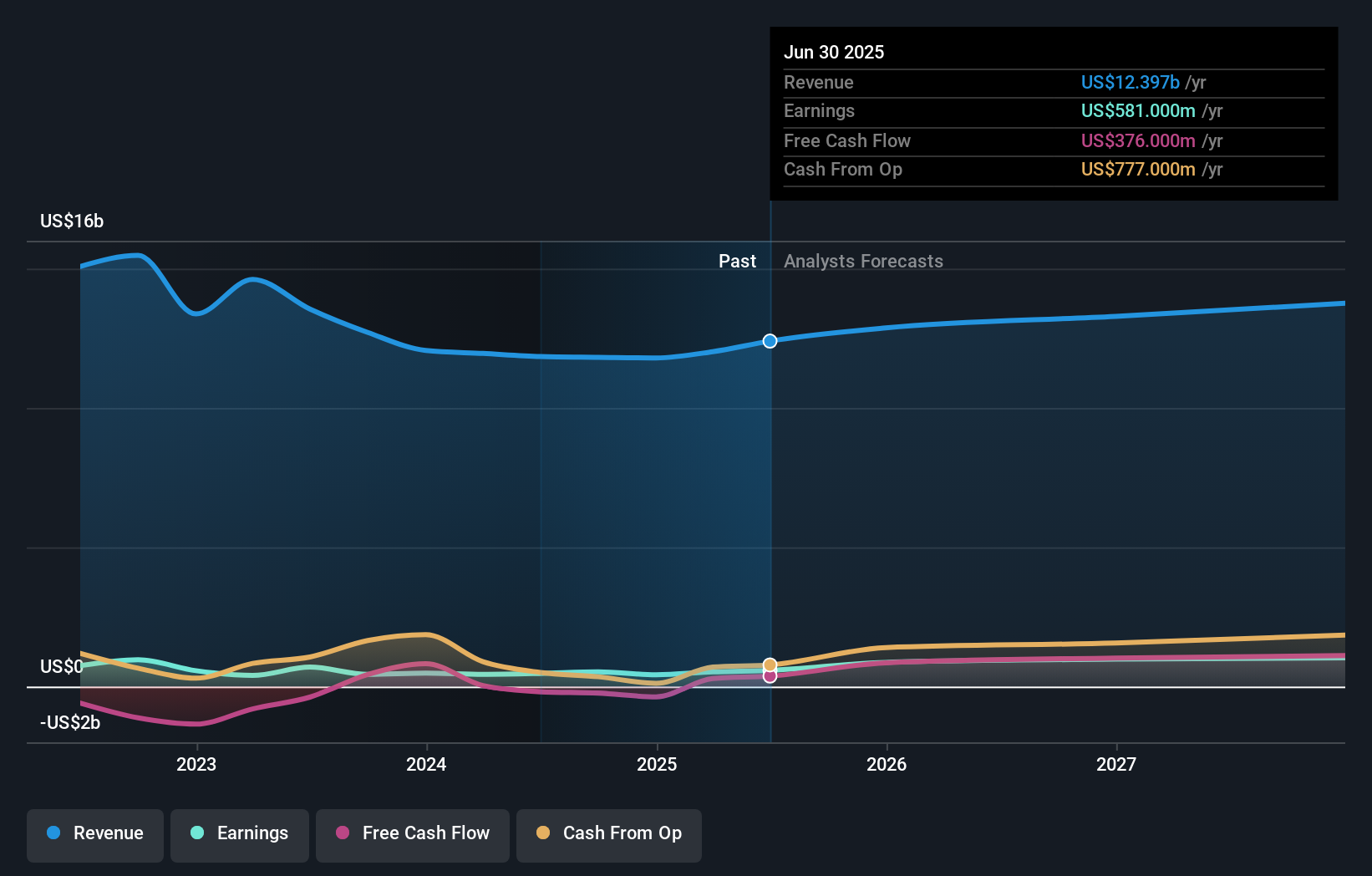

The modest 1.6% dividend yield is unlikely to be guiding the market view of the stock. The revenue fall of 0.5% per year for five years is neither good nor terrible. But if the market expected durable top line growth, then that could explain the share price weakness.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Ball is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Ball stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Ball’s TSR for the last 5 years was -34%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Investors in Ball had a tough year, with a total loss of 21% (including dividends), against a market gain of about 20%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year’s performance caps off a bad run, with the shareholders facing a total loss of 6% per year over five years. We realise that Baron Rothschild has said investors should “buy when there is blood on the streets”, but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 2 warning signs we’ve spotted with Ball (including 1 which is a bit unpleasant) .