Fiserv experienced an 8% increase in its stock price over the past month, potentially buoyed by recent strategic collaborations. Notably, the enhanced partnership with Mastercard aimed at integrating the FIUSD stablecoin aligns with Fiserv’s expansion into digital asset solutions, possibly adding to its market strength. Additionally, arrangements with PayPal and Circle Internet Group to increase stablecoin interoperability might have reinforced investor confidence. The recent market climb of 2% may have supported this upward trend, though Fiserv’s sophisticated technological developments in digital payments could have played a more prominent role in its performance.

The recent developments at Fiserv, including partnerships aimed at integrating the FIUSD stablecoin, position the company to strengthen its digital payment solutions. These initiatives could positively impact future revenue and earnings forecasts by increasing market penetration and expanding service offerings. Over the past three years, Fiserv’s total return, considering share price appreciation and dividends, was 89.94%. This growth context provides a backdrop for its recent one-year performance where it outpaced the US market’s 12.2% return.

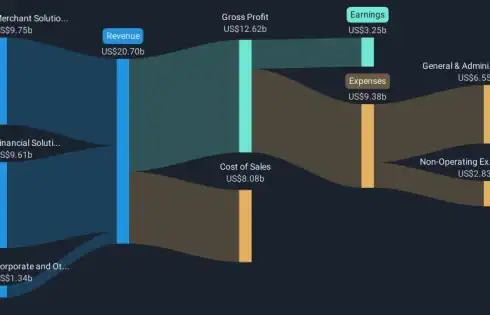

Fiserv’s share price, currently at US$184.95, stands 18.7% below the consensus analyst price target of approximately US$227.42. The potential revenue boost from these collaborations could contribute to realizing these price target expectations, aligning with forecasts for revenue growth from US$20.70 billion to US$24.90 billion by 2028. Despite a Price-to-Earnings Ratio that remains elevated compared to the US Diversified Financial industry average, expected improvements in operational efficiencies and strategic expansion efforts may justify this premium over time.