Issued on behalf of Magma Silver Corp.

Giants Walked Away From the Mountain. Magma Silver (TSXV: MGMA) is Going Back to Collect All the Silver and Gold They Foolishly Left Behind.

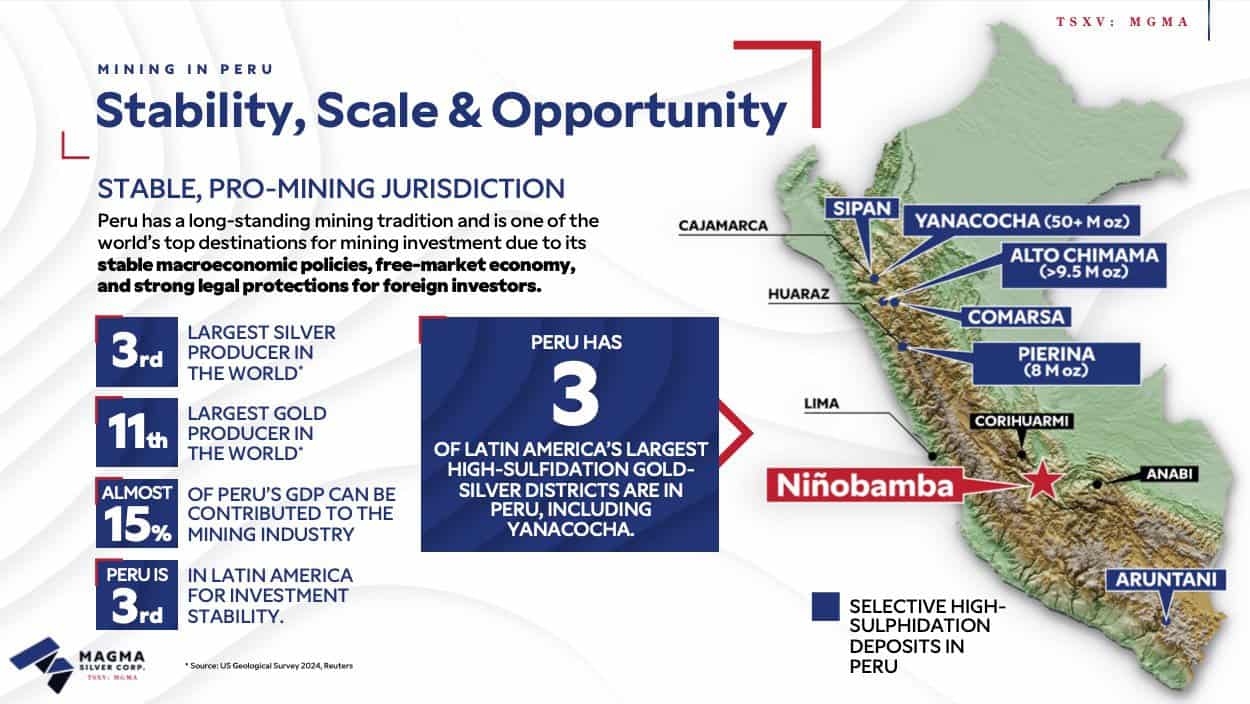

In the rugged hills of southern Peru, a gold-rich system once caught the attention of Newmont, AngloGold, and other global majors.

They drilled it, mapped it, and left behind tens of millions of dollars in exploration.

Not because the grades weren’t there. But because it wasn’t big enough — for them.

Today, that very same system is under new ownership. And this time, it doesn’t have to be a multi billion-dollar mine to move the needle.

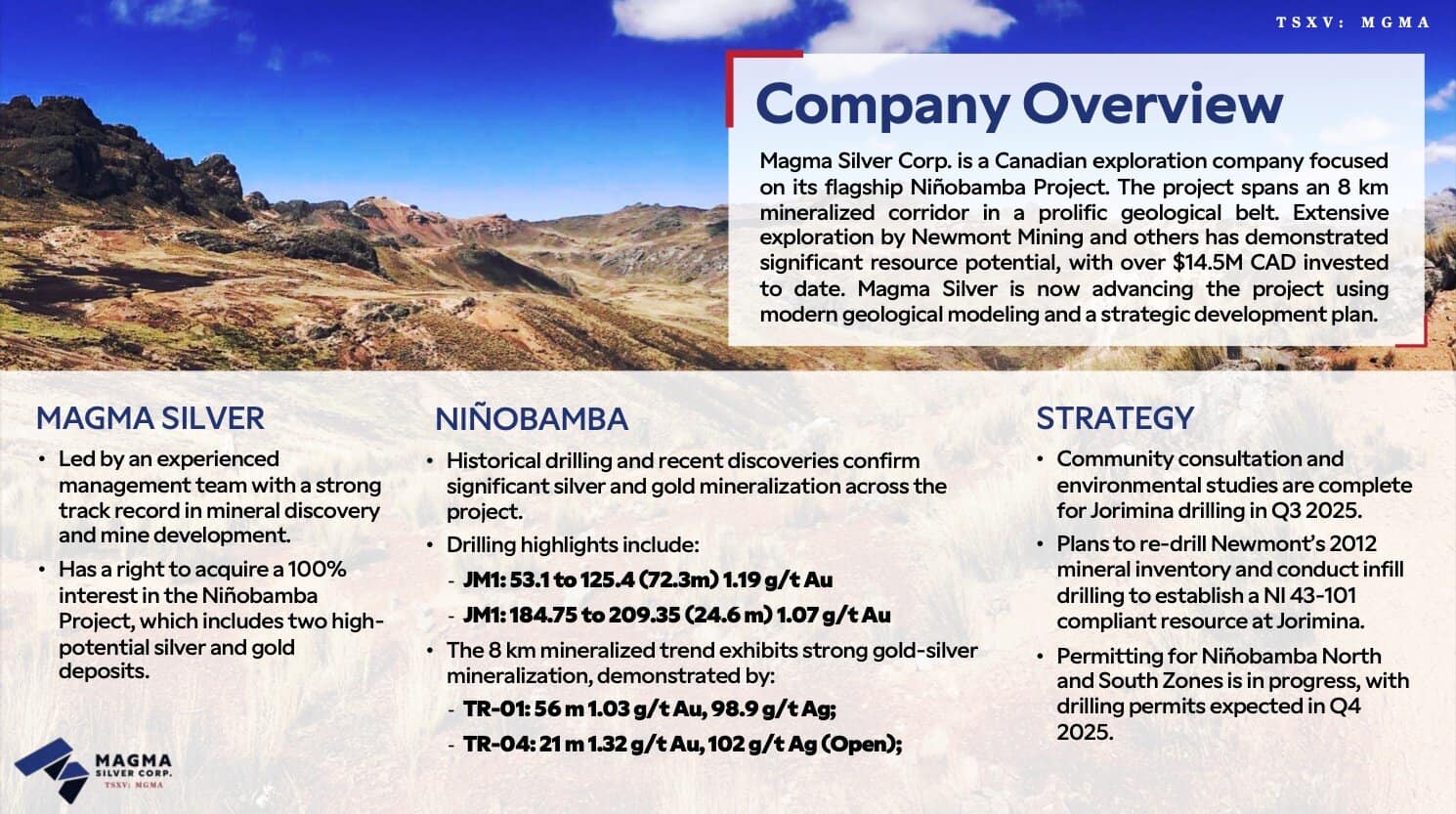

Magma Silver (TSXV: MGMA) has stepped into a rare position: a junior explorer with 100% control of a high-sulfidation gold-silver system backed by over $14.5M in legacy drilling, trenching, and modeling — and most of the benefit still ahead of it.

Why is that significant right now?

Because we’re entering a different kind of market. In a world where:

- Silver is facing structural supply deficits year after year,

- Gold just broke all-time highs with central banks buying faster than ever,

- And majors are scrambling to backfill reserves depleted over the last decade…

… projects like Niñobamba — with scale, surface access, and modern upside — are starting to matter again.

Magma isn’t starting from scratch. It’s picking up where the majors left off, with new eyes, modern modeling, and a market that finally sees the value in ounces closer to surface.

Why Invest?

Here’s what sets Magma Silver (TSXV: MGMA) apart in today’s precious metals landscape:

When Juniors Take Over Where Majors Left Off

After all, Magma isn’t the first junior to inherit a legacy project from a major.

It’s just the next one — and that might be the whole point.

Because if the last gold cycle taught us anything, it’s this:

Some of the biggest winners weren’t those who made grassroots discoveries from scratch…

They were the juniors who picked up where majors left off — at a fraction of the cost — and took forgotten assets to new heights.

Let’s look at three examples that show what that can look like in practice.

Case Study 1: Skeena Resources — “What One Major Missed”

In December 2017, Skeena Resources announced it had secured an option to acquire the famed Eskay Creek project from Barrick Gold.[1]

That same day, strategic investors participated in a private placement at $0.80 CAD (~$0.62 USD) per share, reflecting insider conviction that the story was just beginning.

But the broader market didn’t buy it — not yet.

By February 2019, Skeena Resources had slumped to a closing price of just $0.78 USD, showing how little value was being assigned to the opportunity at the time.[2]

Over the next several years, that all changed.

As Skeena Resources advanced Eskay Creek with modern open-pit modeling and step-out drilling, the market began to reprice the asset.

By May 6, 2025, the stock closed at $13.10 USD — a return of more than 16x from the 2019 low, and over 21x from its original financing.[3]

Not through grassroots discovery.

But through re-activation of a forgotten giant.

And even Skeena didn’t start with over $14 million already sunk into drilling and modeling — a starting point that Magma Silver (TSXV: MGMA) already holds.

Case Study 2: Rupert Resources — “From Overlooked Option to Major European Discovery”

In March 2016, Rupert Resources announced a six-month option to acquire the past-producing Pahtavaara gold mine in Finnish Lapland.[4]

That day, the stock closed at just $0.07 USD, reflecting the market’s assumption that this was a legacy asset with limited upside.

Over the next few years, Rupert explored quietly. Then, in 2020, it drilled Ikkari.

What followed were some of the most impressive intercepts in modern European gold exploration[5]:

- 158m of 4.3g/t Au

- 141m of 3.9g/t Au

- 52m of 7.5g/t Au

By November 19, 2020, the stock hit $5.49 USD, representing a return of over 78x from its 2016 low.[6]

And it wasn’t a fluke. In March 2022, it topped $5 again[7] after additional hits (110m of 5.1g/t and 154m of 3.1g/t)[8] and a major financing injection by Agnico Eagle. [9]

Like Magma Silver (TSXV: MGMA), Rupert didn’t chase dreams. It made good on what was already there — and uncovered a new district in the process.

Case Study 3: Soma Gold Corp. — “The Producer Nobody Saw Coming”

On March 19, 2020, Para Resources (now Soma Gold) announced a deal to consolidate its Colombian mining assets.[10] That same day, the stock closed at just $0.05 USD.[11]

Just months later, it surged to nearly $0.50[12] on the back of debt restructuring, rising gold prices, and insider-led optimism.[13]

By November 2020, Soma had posted its first quarterly profit — $11.1M revenue, $3.5M EBITDA, and clean books. [14]

And it kept climbing.

By May 2025, the company posted record Q1 results[15]:

- $27.9 million in revenue

- $3.2 million in net income

- $13.5 million in adjusted EBITDA

It didn’t get there by hype.

It got there by delivering.

Magma Silver (TSXV: MGMA) may still be early in the story — but if history is any guide, the transition from forgotten to functional can happen fast.

The Magma Opportunity — A Rare Shot at a High-Grade Silver-Gold System in Peru

If Skeena reactivated a legendary past producer, Rupert unearthed a new district, and Soma rebuilt a dormant mine into a profit machine…

Magma Silver (TSXV: MGMA) is attempting something equally rare — and potentially just as rewarding.

At the heart of the story is the Niñobamba Project, located in the prolific silver-gold belt of southern Peru, a region that hosts some of the world’s most lucrative epithermal systems.

But what sets Niñobamba apart is what previous operators left behind: extensive high-grade silver and gold intercepts that were never followed up with systematic drilling.

Historic highlights include:

- 130m of 1.5g/t gold from surface

- 56m of 1.3g/t gold with 98g/t silver

- And multiple narrow intercepts of over 1kg/t silver-equivalent

These are not just numbers — they’re the kind of intercepts that suggest near-surface oxide potential and deeper high-grade feeder systems.

Yet for over a decade, the project sat idle. Poor timing. Weak markets. And fractured ownership.

Now, Magma Silver (TSXV: MGMA) for the first time has unified the property under a clean, 100%-owned structure and is preparing to drill a project that’s barely been scratched beyond 100 meters.

It’s not just about proving up a historical zone.

It’s about testing a large-scale geological system that appears to remain wide open — with mineralization along a 6km corridor, and multiple targets yet to be drilled.

A technical report is underway, and a fully funded drill program is expected to begin in the near term.

This is the phase where undervalued juniors can re-rate quickly.

And where investors who understand the setup — like with Skeena, Rupert, and Soma — have historically seen the greatest upside.

Magma Silver (TSXV: MGMA) is now in that window.

Right before the drill turns.

Right before the story changes.

The Right Team for the Right Project

Much like the companies profiled above, Magma Silver (TSXV: MGMA) isn’t led by hype merchants. It’s steered by operators.

Backed by a board with deep capital markets experience and local expertise in Latin America, Magma’s leadership brings the mix of technical, financial, and jurisdictional competence that has defined many of the best turnaround and reactivation stories in recent mining cycles.

Top 5 Highlights – Magma Silver (MGMA.V)

- District-scale potential in a Tier 1 silver jurisdiction

Magma controls 100% of the 41 km² Niñobamba Project in Peru’s prolific silver belt — a region that hosts multiple world-class operations including Pan American’s Huaron and Morococha - Modern reinterpretation of a forgotten system

Historic drilling showed near-surface mineralization, but new interpretations suggest the bulk of the silver may sit deeper — offering a fresh path to discovery using modern geophysics and targeting. - Backed by veterans with deep roots in Latin American exploration and TSX-listed resource plays

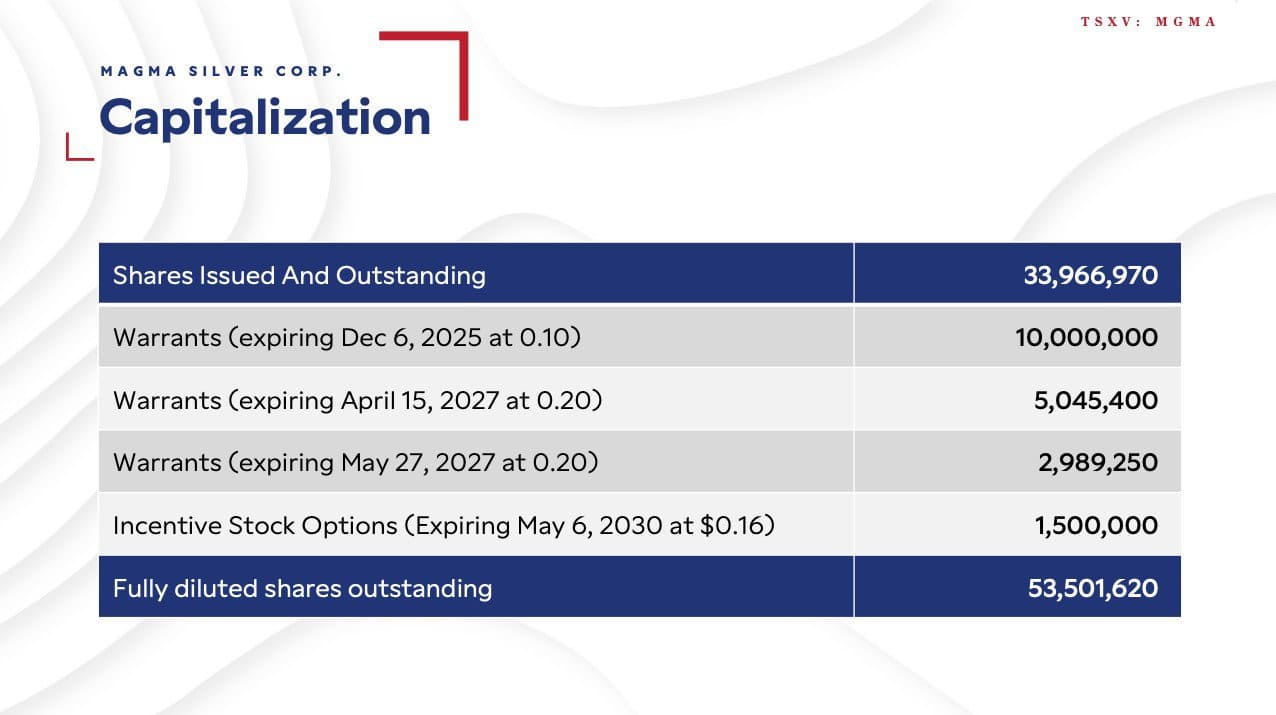

Magma’s leadership and technical team bring decades of combined experience advancing gold and silver projects in Peru and across the Americas — with a proven track record in exploration, permitting, and public markets. Their network spans institutional finance, grassroots discovery, and NI 43-101 compliance, providing the strategic and operational footing to advance Niñobamba with discipline and scale. - Tight structure and early-stage valuation

With under 34M shares outstanding and a modest enterprise value, Magma remains one of the few Peru-focused juniors offering genuine scale without a bloated cap table. - Active 2025 campaign underway

Mapping, sampling, and geophysical work are already in motion to identify priority targets — with plans advancing toward a drill program designed to validate the new structural thesis.

Magma Silver isn’t chasing old stories. It’s writing a new one.

With drills expected to turn soon at Niñobamba, a proven technical lead at the helm, and a structure built for breakout potential — this could be one of the most asymmetric setups in the silver space today.

The majors are watching Peru again. You should be too.

Visit www.magmasilver.com to sign up for updates and stay informed.

Editorial Staff

Equity Insider

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Equity Insider is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). This content is being distributed for Baystreet.ca media Corp, who has been paid a fee for an advertising contract with Magma Silver Corp. MIQ has not been paid a fee for Magma Silver Corp. advertising or digital media, but the owner/operators of MIQ also co-owns Baystreet.ca Media Corp. (“BAY”) There may also be 3rd parties who may have shares of Magma Silver Corp. and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ/BAY does not own any shares of Magma Silver Corp. but reserve the right to buy and sell, and will buy and sell shares of Magma Silver Corp. at any time without any further notice commencing immediately and ongoing. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material, including this article, which is disseminated by MIQ on behalf of BAY has been approved by Magma Silver Corp.; this is a paid advertisement, we currently do not own any shares of Magma Silver Corp. but will likely buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

SOURCES CITED:

[1] https://skeenagoldsilver.com/news-release/skeena-secures-option-to-acquire-eskay-creek-announces-strategic-investment-from-barrick/

[2] https://finance.yahoo.com/quote/SKE/history/?period1=1012919400&period2=1748629178

[3] https://finance.yahoo.com/quote/SKE/history/?period1=1012919400&period2=1748629178

[4] https://rupertresources.com/march-15-2016-rupert-announced-on-march-15-2016-that-it-has-signed-a-six-month-option-agreement-to-acquire-the-pahtavaara-gold-mine-in-lapland-finland/

[5] https://rupertresources.com/new-drilling-reported-from-ikkari-including-4-3g-t-gold-over-158m-from-152m-3-9g-t-gold-over-141m-from-239m-and-7-5g-t-gold-over-52m/

[6] https://finance.yahoo.com/quote/RUPRF/history/?period1=1014733800&period2=1748631685

[7] https://finance.yahoo.com/quote/RUPRF/history/?period1=1014733800&period2=1748631685

[8] https://rupertresources.com/drilling-results-from-ikkari-and-heina-south/

[9] https://rupertresources.com/exercise-by-agnico-eagle-mines-of-warrants-for-net-proceeds-of-11-5million/

[10] https://www.sedarplus.ca/csa-party/records/document.html?id=80cfb9c26280745449ba77bbb2f367a82f901341c93c52bd893fb459239ded63

[11] https://finance.yahoo.com/quote/SMAGF/history/?period1=1470144600&period2=1748634328

[12] https://finance.yahoo.com/quote/SMAGF/history/?period1=1470144600&period2=1748634328

[13] https://www.sedarplus.ca/csa-party/records/document.html?id=2c636e732ff7f6d85c558a37bd13c19f7868b6bfba019414f971ac225337c4dd

[14] https://somagoldcorp.com/2020/soma-reports-first-quarterly-net-profit/

[15] https://somagoldcorp.com/2025/soma-reports-first-quarter-financial-results-and-operating-highlights-2/