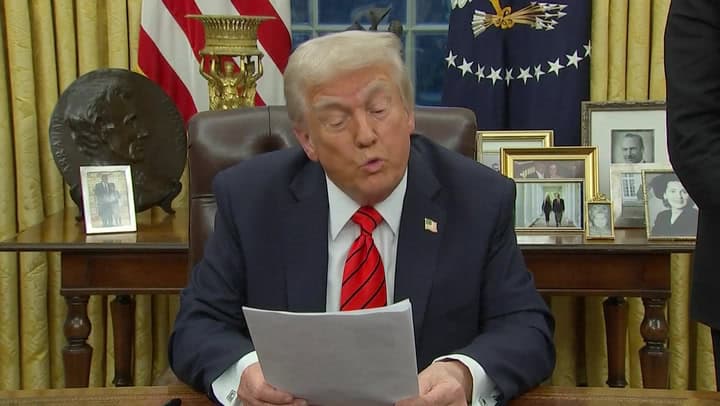

Stocks sank last week as a lack of clarity around President Donald Trump’s tariff plans and what they could mean for the economy’s overall trajectory gripped markets.

For the week, the S&P 500 (^GSPC) fell more than 3%, while the Dow Jones Industrial Average (^DJI) slid more than 2%, or about 1,000 points. The Nasdaq Composite (^IXIC) led the losses, falling almost 3.5%. The Nasdaq has now fallen more than 10% from its last record high in December and is in a correction.

In the week ahead key updates on inflation, with fresh readings on the Producer Price Index (PPI) and Consumer Price Index (CPI), will be in focus as investors look for any clues on how tariffs may impact the path forward for prices. Updates on inflation expectations and consumer sentiment are also on the calendar.

In a quieter week of corporate earnings releases, Oracle (ORCL) and Adobe (ADBE) will highlight the schedule.

Fed isn’t ‘in a hurry’

Friday’s February jobs report came and went with few surprises. The US labor market added 151,000 jobs in the month, just below expectations, while the unemployment rate inched up to 4.1%. Economists largely read the report as better-than-feared, given other signs of economic growth slowing.

Bank of America US economist Shruti Mishra described the report as “mostly a sigh of relief.” Markets continue to price in three interest rate cuts from the Federal Reserve in 2025, per Bloomberg data.

But the looming question for markets remains when the Federal Reserve will actually cut rates again. In a speech on Friday Federal Reserve Chair Jerome Powell said any further rate reductions likely aren’t imminent.

“We do not need to be in a hurry and are well-positioned to wait for greater clarity,” Powell said.

There will be no Fed speak in the week ahead as the central bank enters its blackout period ahead of its next meeting on March 18-19.

Price check

A fresh update on the pace of price increases is slated for release on Wednesday.

Wall Street economists expect February’s CPI to show headline annual inflation of 2.9%, down from the 3% seen in January. Prices are anticipated to rise 0.3% on a month-over-month basis, per economist projections, below the 0.5% increase seen in January.

On a “core” basis, which strips out food and energy prices, CPI is expected to have risen 3.2% over last year in February, below the 3.3% seen in January. Monthly core price increases are anticipated to clock in at 0.3%, below the 0.4% seen the month prior.

Wells Fargo senior economist Sarah House wrote in a note to clients that the February CPI print is only expected to provide an “initial taste” of expected tariff impact on inflation data.

It’s not a ‘recession’ trade yet

The recent market sell-off has been driven by weaker-than-expected economic data and fears of further softness caused by Trump’s tariffs.

Economists at Morgan Stanley, JPMorgan, and Goldman Sachs have all downgraded their GDP forecasts for either the first quarter or the entire year. But what’s notable within those calls is they aren’t actually predicting an outright economic downturn. Instead, at least for now, it looks like more likely that the US economy won’t grow at the robust pace many hoped. Not many economists are actually starting to talk about a recession. For instance, with Goldman Sachs’ forecasting update, the probability of a recession in the next 12 months rose to 20% from 15% the year prior.

Companies aren’t currently fearing recession either. Data from FactSet shows just 13 companies mentioned the word “recession” during S&P 500 earnings calls this quarter. This marked the lowest number of recession mentions since the first quarter of 2018.

This reflects that, for now, the stock market’s repricing of the past few weeks is largely a resetting of expectations in a year many believed would be headlined by outperformance of the US economy.

“I don’t think the economy is turning on a dime in a negative direction,” former Council of Economic Advisors chairman Jason Furman told Yahoo Finance. “But everything on the uncertainty, sentiment, all of that is pushing toward slowing.”