(Bloomberg) — Asian stocks followed US equities lower as continual shifts in US President Donald Trump’s approach to tariffs on trade partners whipped up market uncertainty and dented confidence in the economic outlook.

Shares in Australia and Japan tumbled more than 1.5% each while a gauge of Chinese stocks in Hong Kong gained to the highest level since November 2021. An index of the dollar fell for a fifth session, its longest losing streak in almost a year. Bitcoin fell as details of a US strategic reserve underwhelmed.

Traders pointed to uncertainty over Trump’s tariffs. US stocks failed to stage a rebound even after a decision by Trump to delay levies on Mexican and Canadian goods covered by the North American trade deal, underscoring the fragile appetite for risk. Financial markets have whipsawed this week as investors deal with geopolitical uncertainty and conflicting signals from the US about the levies.

“Confusion reigns around the Trump Administration policy agenda,” said Chris Weston, head of research for Pepperstone Group. “While there are few signs of panic, funds and fast-money accounts cut equity risk.”

Wall Street strategists have been debating whether the Trump administration would be swayed on its tariff plans by a decline in equities. The thinking being that Trump will ditch policies if the stock market — which he touts as a report card — drops and rattles investors. Various firms even mapped out how much pain Trump could tolerate in the S&P 500 Index before retreating. That index level became known as “the Trump put,” in reference to a put option.

So far, Trump has given little indication he’ll change course. The president downplayed the reaction to the latest developments, saying “I’m not even looking at the market.” That followed his comments to Congress earlier this week that levies will cause “a little disturbance, but we’re OK with that. It won’t be much.”

Get the Markets Daily newsletter to learn what’s moving stocks, bonds, currencies and commodities

On Thursday, Trump delayed levies on goods covered by the North American trade deal from the two countries until April 2. Later comments from Treasury Secretary Scott Bessent all but confirmed tariffs will be coming. Bessent rejected the idea that tariff hikes will ignite a new wave of inflation, and suggested that the Federal Reserve ought to view them as having a one-time impact.

European stocks have advanced almost 10% this year, as rate cuts and Germany’s plan to raise defense spending boost the market. Meanwhile, a gauge of Chinese stocks listed in Hong Kong has surged almost 23% so far this year on optimism over the nation’s artificial-intelligence adoption drive and expected stimulus from Beijing.

Bitcoin fell after details of a US cryptocurrency reserve emerged and indicated the government will use digital assets forfeited as part of criminal or civil proceedings.

US equity-index futures rose Friday after US chipmaker Broadcom Inc.’s upbeat revenue forecast reassured investors that spending on artificial-intelligence computing remained ongoing, pushing its shares around 13% higher in after-market trading.

The post-hours rally spread to tech companies that were among the hardest hit on Thursday. Nvidia Corp. and Marvell Technology Inc., which plunged during the main session as its outlook disappointed investors, rose after the closing bell.

Treasuries were slightly higher Friday after a muted session on Thursday. The Mexican peso and the Canadian dollar rose on news of the potential tariff reprieve. Australian and New Zealand yields fell early Friday.

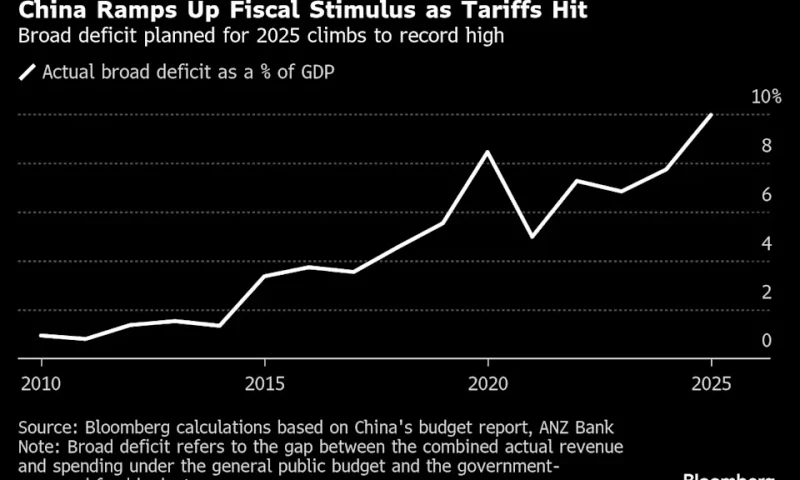

In Asia, China’s central government has ample fiscal policy tools and space to respond to possible domestic and external challenges, Finance Minister Lan Fo’an said Thursday on the sidelines of the annual legislative session. The People’s Bank of China will implement a moderately loose monetary policy, Governor Pan Gongsheng said, repeating an earlier pledge to cut interest rates and lower the reserve requirement ratio for lenders at “an appropriate time.”

China’s exports reached a record so far this year as higher US tariffs, and the threat of more to come, drove frontloading of shipments.

Upcoming US nonfarm payrolls data on Friday may help traders identify the path ahead for interest rates, as they grapple with the impact of rocky geopolitics, the impact of tariffs on global growth and the outlook for inflation.

Friday’s report from the Bureau of Labor Statistics will provide an update for Fed officials about momentum in the labor market that’s been the key support — at least until January — of household spending and the economy.

Fed Chair Jerome Powell is slated to speak at a monetary policy forum Friday afternoon. Policymakers next meet March 18-19 and they’re expected to hold interest rates steady as they gauge the labor market and inflation trends as well as recent government policy shifts.

Meanwhile, Fed Reserve Governor Christopher Waller said he wouldn’t support lowering interest rates in March, but sees room to cut two, or possibly three, times this year.

“If the labor market, everything, seems to be holding, then you can just kind of keep an eye on inflation,” Waller said Thursday at the Wall Street Journal CFO Network Summit. “If you think it’s moving back towards target, you can start lowering rates. I wouldn’t say at the next meeting, but could certainly see going forward.”

In commodities, oil was on track for the biggest weekly decline since October while gold was on track for a gain as traders sought havens.

Key events this week:

-

Eurozone GDP, Friday

-

US jobs report, Friday

-

Fed Chair Jerome Powell gives keynote speech at an event in New York hosted by University of Chicago Booth School of Business, Friday

-

Fed’s John Williams, Michelle Bowman and Adriana Kugler speak, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.3% as of 1:19 p.m. Tokyo time

-

Japan’s Topix fell 1.5%

-

Australia’s S&P/ASX 200 fell 1.8%

-

Hong Kong’s Hang Seng rose 0.6%

-

The Shanghai Composite was little changed

-

Euro Stoxx 50 futures fell 0.7%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro rose 0.2% to $1.0808

-

The Japanese yen rose 0.3% to 147.57 per dollar

-

The offshore yuan was little changed at 7.2443 per dollar

Cryptocurrencies

-

Bitcoin fell 2.9% to $87,240.54

-

Ether fell 2.8% to $2,150.98

Bonds

-

The yield on 10-year Treasuries declined three basis points to 4.25%

-

Japan’s 10-year yield was little changed at 1.510%

-

Australia’s 10-year yield declined eight basis points to 4.40%

Commodities

-

West Texas Intermediate crude was little changed

-

Spot gold fell 0.2% to $2,905.89 an ounce

This story was produced with the assistance of Bloomberg Automation.