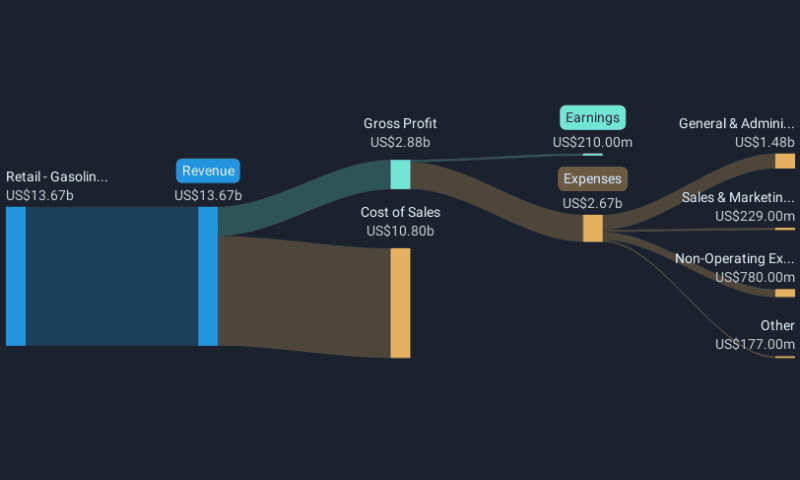

Carvana (NYSE:CVNA) recently announced its fourth quarter and full year earnings, showing significant growth in sales and a return to profitability with a net income of $79 million after a previous loss. However, the net income for the full year was $210 million, a decline from the previous year’s $450 million, which may have influenced investor sentiment. Alongside these financial results, Carvana’s filing of a shelf registration for $660 million in Class A Common Stock might have raised concerns about future share dilution among shareholders. These company-specific developments occurred against a backdrop of mixed market performance, as the broader U.S. stock market experienced fluctuations amid tariff announcements and tech stock volatility. The overall market dip of 3.6% over the past month was mirrored by Carvana’s share price decreasing by 3.93%, reflecting broader market uncertainties and company-specific challenges during this period.

Carvana’s shares delivered a remarkable total return of 208.24% over the last year. During this period, the company’s stock outperformed both the US market, which saw a 16.9% return, and the specialty retail industry, which achieved a 9.1% return. Several key events contributed to this performance. In July 2024, Carvana expanded its market reach by offering same-day vehicle delivery services in regions such as Las Vegas, Houston, and Kansas City. This strategic expansion helped cater to a broader customer base, potentially enhancing revenue streams.

Moreover, the company’s integration into the Russell 1000 Index on July 1, 2024, may have positively influenced investor perceptions, attracting more institutional attention. Earnings announcements throughout the year, including a swing to profitability with a US$79 million net income in Q4 2024, further strengthened investor confidence. However, the filing of a shelf registration in February 2025 for US$660 million in common stock hinted at potential future dilution, possibly tempering enthusiasm among some investors.