DocuSign, Inc. (NASDAQ:DOCU – Get Free Report) shares shot up 6.4% during trading on Tuesday . The company traded as high as $96.90 and last traded at $98.21. 455,777 shares changed hands during trading, a decline of 77% from the average session volume of 1,968,344 shares. The stock had previously closed at $92.26.

Analysts Set New Price Targets

DOCU has been the subject of a number of research analyst reports. Wells Fargo & Company raised their price target on DocuSign from $50.00 to $70.00 and gave the stock an “underweight” rating in a research note on Friday, December 6th. Robert W. Baird lifted their target price on DocuSign from $59.00 to $100.00 and gave the stock a “neutral” rating in a research report on Friday, December 6th. Jefferies Financial Group upped their price target on shares of DocuSign from $80.00 to $95.00 and gave the stock a “buy” rating in a report on Tuesday, December 3rd. JPMorgan Chase & Co. lifted their price objective on shares of DocuSign from $50.00 to $70.00 and gave the company an “underweight” rating in a report on Tuesday, December 3rd. Finally, JMP Securities restated a “market outperform” rating and issued a $124.00 target price on shares of DocuSign in a research note on Tuesday, January 7th. Three equities research analysts have rated the stock with a sell rating, seven have issued a hold rating and three have assigned a buy rating to the company’s stock. According to MarketBeat, the stock has an average rating of “Hold” and a consensus price target of $92.45.

DocuSign Stock Performance

The business has a 50 day moving average of $90.04 and a two-hundred day moving average of $71.96. The stock has a market capitalization of $19.77 billion, a PE ratio of 20.17, a PEG ratio of 8.30 and a beta of 0.88.

Insider Transactions at DocuSign

In other DocuSign news, Director Teresa Briggs sold 534 shares of the firm’s stock in a transaction dated Monday, December 16th. The stock was sold at an average price of $94.60, for a total value of $50,516.40. Following the completion of the sale, the director now owns 7,736 shares of the company’s stock, valued at approximately $731,825.60. This trade represents a 6.46 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CEO Allan C. Thygesen sold 7,763 shares of the company’s stock in a transaction dated Monday, December 2nd. The shares were sold at an average price of $80.54, for a total transaction of $625,232.02. Following the transaction, the chief executive officer now owns 100,062 shares in the company, valued at approximately $8,058,993.48. This trade represents a 7.20 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 693,537 shares of company stock valued at $66,575,817 in the last 90 days. Insiders own 1.66% of the company’s stock.

Institutional Trading of DocuSign

A number of institutional investors have recently bought and sold shares of DOCU. Avior Wealth Management LLC raised its holdings in shares of DocuSign by 36.5% in the fourth quarter. Avior Wealth Management LLC now owns 542 shares of the company’s stock worth $49,000 after buying an additional 145 shares during the last quarter. Linden Thomas Advisory Services LLC increased its position in shares of DocuSign by 1.1% in the 4th quarter. Linden Thomas Advisory Services LLC now owns 13,540 shares of the company’s stock valued at $1,218,000 after acquiring an additional 149 shares during the period. J.W. Cole Advisors Inc. raised its stake in DocuSign by 2.0% in the 3rd quarter. J.W. Cole Advisors Inc. now owns 7,946 shares of the company’s stock worth $493,000 after acquiring an additional 155 shares during the last quarter. Resonant Capital Advisors LLC lifted its position in DocuSign by 0.9% during the 3rd quarter. Resonant Capital Advisors LLC now owns 17,516 shares of the company’s stock worth $1,088,000 after acquiring an additional 157 shares during the period. Finally, Optimist Retirement Group LLC lifted its position in DocuSign by 3.8% during the 3rd quarter. Optimist Retirement Group LLC now owns 4,416 shares of the company’s stock worth $274,000 after acquiring an additional 161 shares during the period. 77.64% of the stock is currently owned by institutional investors and hedge funds.

About DocuSign

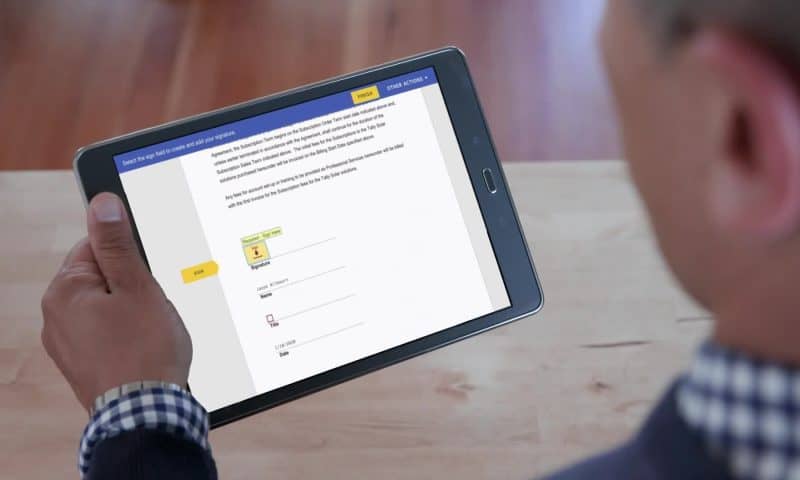

DocuSign, Inc provides electronic signature solution in the United States and internationally. The company provides e-signature solution that enables sending and signing of agreements on various devices; Contract Lifecycle Management (CLM), which automates workflows across the entire agreement process; Document Generation streamlines the process of generating new, custom agreements; and Gen for Salesforce, which allows sales representatives to automatically generate agreements with a few clicks from within Salesforce.