The dynamic pushed up Wall Street’s ‘fear gauge’ last week, even as stocks climbed

Once again, option traders have been giving in to the “fear of missing out” and chasing the stock-market rally higher.

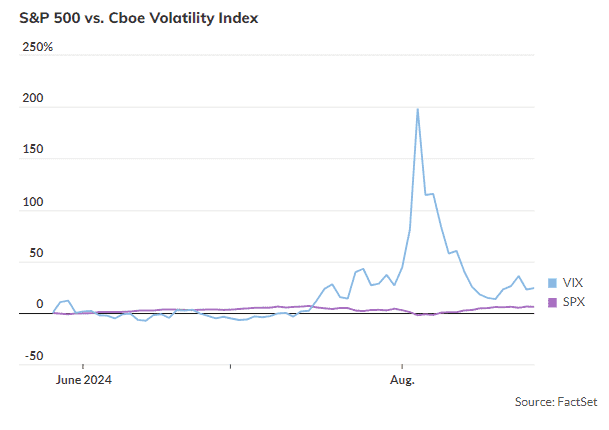

This was evident last week as both the S&P 500 index and the Cboe Volatility Index rose in tandem, a dynamic that a senior Cboe strategist described as “unusual” in a report shared with MarketWatch.

Typically, the VIX moves in the opposite direction of the S&P 500, since implied volatility in stocks — what the VIX was designed to measure — tends to climb more quickly when markets have been falling. But this isn’t always the case. Ultimately, the level of the VIX ends up determined by trading activity in S&P 500 options.

When demand for riskier out-of-the-money options rises, the VIX climbs as well. Last week, its incremental rise was a sign that options traders were piling into “out-of-the-money” calls and puts ahead of Federal Reserve Chair Jerome Powell’s speech at Jackson Hole, Wyo. on Friday, according to Cboe.

In options parlance, an out-of-the money call has a strike price that sits above where the market currently trades. An out-of-the-money put has the opposite relationship.

Nomura strategist Charlie McElligott on Monday also highlighted the divergence as evidence that investors were once again piling into an “upside grab” in equity index options.

Now that stocks have nearly recovered all of their losses from a selloff that reached its nadir earlier this month, sophisticated investors who decided to sit out the initial recovery have been facing pressure to pile into bullish options as they once again chase the rally higher. McElligott earlier this year highlighted a similar pattern.

To be sure, investors didn’t limit themselves to risky options tied to the S&P 500. Demand for out-of-the-money index options tied to the Russell 2000 and Nasdaq-100 was also elevated last week, according to Cboe.

Stocks finished mixed on Monday, although the Dow Jones Industrial Average DJIA 0.16% tallied a fresh record close. The S&P 500 SPX -0.32% fell by 17.77 points, or 0.3%, to 5,616.84, while the Russell 2000 RUT -0.04% fell by 0.78 points, or less than 0.1%, to 2,217.92.

The Nasdaq Composite COMP-0.85% fell by 152.03 points, or 0.9%, to 17,725.76. The Dow gained 65.44 points, or 0.2%, to 41,240.52, a new record close.