Shopify Inc. (NYSE:SHOP – Get Free Report) TSE: SHOP rose 6.7% during trading on Tuesday . The company traded as high as $68.89 and last traded at $68.48. Approximately 8,674,790 shares were traded during mid-day trading, a decline of 14% from the average daily volume of 10,031,909 shares. The stock had previously closed at $64.21.

Analyst Upgrades and Downgrades

SHOP has been the topic of several recent analyst reports. Needham & Company LLC restated a “hold” rating on shares of Shopify in a research note on Thursday, May 9th. Evercore upgraded shares of Shopify from an “in-line” rating to an “outperform” rating and set a $75.00 price target for the company in a research report on Friday, June 14th. Citigroup raised their target price on Shopify from $95.00 to $96.00 and gave the stock a “buy” rating in a research report on Wednesday, June 26th. Wolfe Research began coverage on shares of Shopify in a report on Tuesday. They issued an “outperform” rating and a $80.00 price objective for the company. Finally, Bank of America upgraded Shopify from a “neutral” rating to a “buy” rating and raised their target price for the stock from $78.00 to $82.00 in a research note on Tuesday. One equities research analyst has rated the stock with a sell rating, fifteen have given a hold rating and twenty-two have assigned a buy rating to the stock. According to data from MarketBeat, the company presently has a consensus rating of “Moderate Buy” and an average target price of $77.44.

Shopify Stock Up 8.6 %

The company has a debt-to-equity ratio of 0.10, a quick ratio of 7.14 and a current ratio of 7.14. The firm has a market capitalization of $89.85 billion, a PE ratio of -402.82, a PEG ratio of 3.24 and a beta of 2.30. The company has a fifty day moving average price of $62.79 and a 200-day moving average price of $72.12.

Shopify (NYSE:SHOP – Get Free Report) TSE: SHOP last announced its earnings results on Wednesday, May 8th. The software maker reported $0.12 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.08 by $0.04. The firm had revenue of $1.86 billion for the quarter, compared to analysts’ expectations of $1.84 billion. Shopify had a negative net margin of 2.82% and a positive return on equity of 7.36%. As a group, analysts expect that Shopify Inc. will post 0.62 earnings per share for the current year.

Institutional Investors Weigh In On Shopify

Institutional investors and hedge funds have recently bought and sold shares of the company. Private Wealth Management Group LLC purchased a new stake in shares of Shopify during the fourth quarter valued at about $26,000. SJS Investment Consulting Inc. lifted its position in Shopify by 59.1% during the fourth quarter. SJS Investment Consulting Inc. now owns 350 shares of the software maker’s stock valued at $27,000 after acquiring an additional 130 shares during the last quarter. DSM Capital Partners LLC acquired a new stake in Shopify in the fourth quarter valued at approximately $28,000. Jones Financial Companies Lllp acquired a new position in shares of Shopify during the fourth quarter worth $28,000. Finally, Your Advocates Ltd. LLP lifted its holdings in shares of Shopify by 4,344.4% during the 4th quarter. Your Advocates Ltd. LLP now owns 400 shares of the software maker’s stock valued at $31,000 after purchasing an additional 391 shares during the last quarter. 69.27% of the stock is owned by institutional investors.

Shopify Company Profile

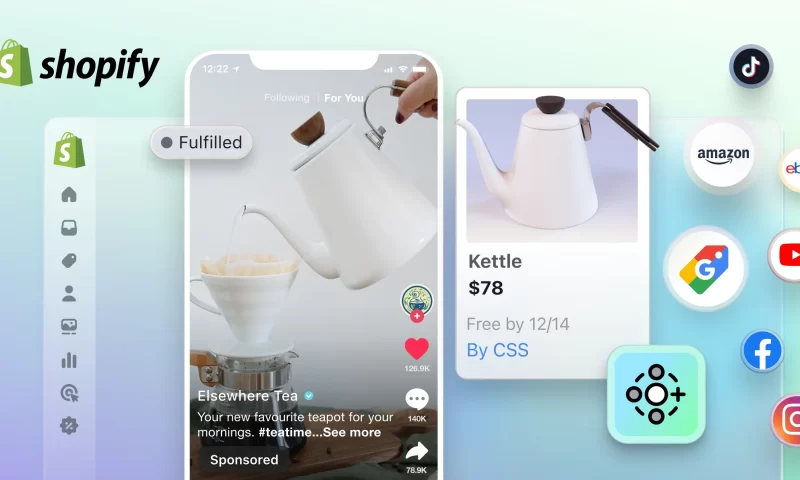

Shopify Inc, a commerce company, provides a commerce platform and services in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, Australia, China, and Latin America. The company’s platform enables merchants to displays, manages, markets, and sells its products through various sales channels, including web and mobile storefronts, physical retail locations, pop-up shops, social media storefronts, native mobile apps, buy buttons, and marketplaces; and enables to manage products and inventory, process orders and payments, fulfill and ship orders, new buyers and build customer relationships, source products, leverage analytics and reporting, manage cash, payments and transactions, and access financing.